A big day for the lithium-ion battery recycling industry. Through a #SPAC merger with $PDAC the Canadian startup @li_cycle will go public and become listed on the #NYSE. If the deal goes through it will provide Li-Cycle with $566M in cash to execute their business plan.

The amount is unparalleled in the battery recycling space. While we have seen several Chinese and Korean companies investing in the $100 million range and significant amounts in companies like Redwood and Northvolt this is a completely new level.

So is the pre-money valuation of $975 million, representing a combined company pro forma equity value of $1.67 billion (almost the same amount Geely once paid for Volvo Cars)

Not bad for a company which in 2020 had revenues just north of $900,000.

Not bad for a company which in 2020 had revenues just north of $900,000.

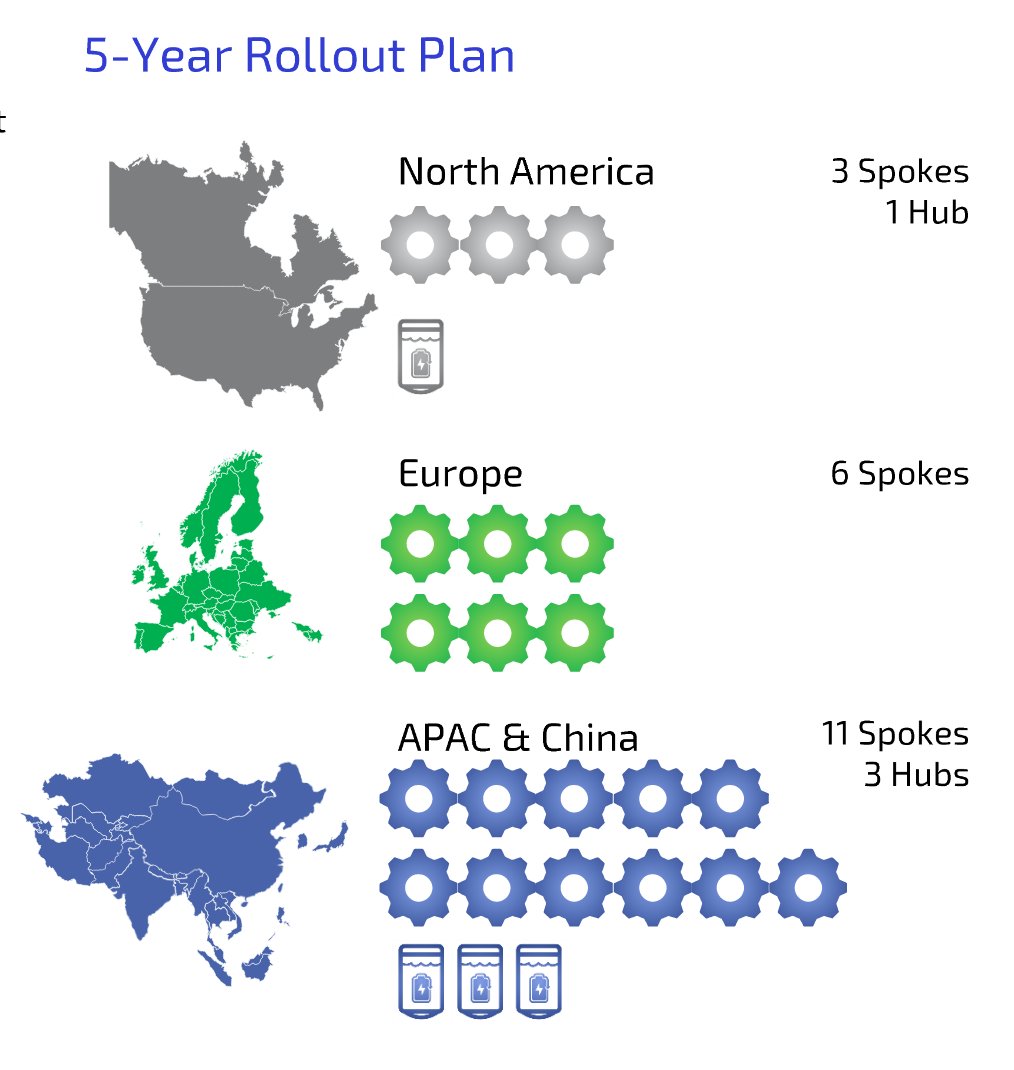

The goals are ambitious. Cumulative EBITDA 2021-2025 is projected to $985M. At that point Li-Cycle will operate 4 material processing plants with a combined capacity of 240,000 tonnes of which 3 in Asia and one in the US. That's twice the size of today's market leader.

Based on the company's expansion plans twice as much material will be sourced in Europe compared to North America and yet twice as much in Asia Pacific as in Europe. From an availability standpoint that seems very reasonable. Still, Li-Cycle is not exactly alone in these markets.

Unlike battery production which theoretically can offer almost unlimited seats by the table in a rapidly growing market, recyclers can only source what's available to recycle. If volumes are not high enough we get what the Chinese call 僧多粥少 – Many monks, little porridge.

In China this has affected both volumes and margins.

Because in recycling, where the end product is commodities the profit is not generated when materials are sold but when they are purchased and processed.

Then 3 things come in handy: batteries, alternatives – and cash.

Because in recycling, where the end product is commodities the profit is not generated when materials are sold but when they are purchased and processed.

Then 3 things come in handy: batteries, alternatives – and cash.

Batteries go the highest bidder. And the highest bidder is the one that create most value. Usually by reuse.

Battery material companies with their own recycling have alternatives being able to use virgin materials instead. Simple math.

But cash enables you to do what you want.

Battery material companies with their own recycling have alternatives being able to use virgin materials instead. Simple math.

But cash enables you to do what you want.

This will obviously give Li-Cycle a very strong position. Because with their war chest they will be a very tough competitor to fight. Something that might pave the way to dominance just when this market really takes off.

I have been following @li_cycle from their early years and I have seen an entrepreneurial and professional company that has been proving its business bit by bit. From development of technology to commercial roll out. With this super injection they might rise to the top. Congrats!

But actually we should congratulate the entire value chain. Because if this goes through an unprecedented amount of funds will be invested in the LIB EOL market which will benefit not only Li-Cycle but also OEMs, collectors, tech providers – and potentially even competitors.

Read on Twitter

Read on Twitter