1/ $MSTR $TSLA

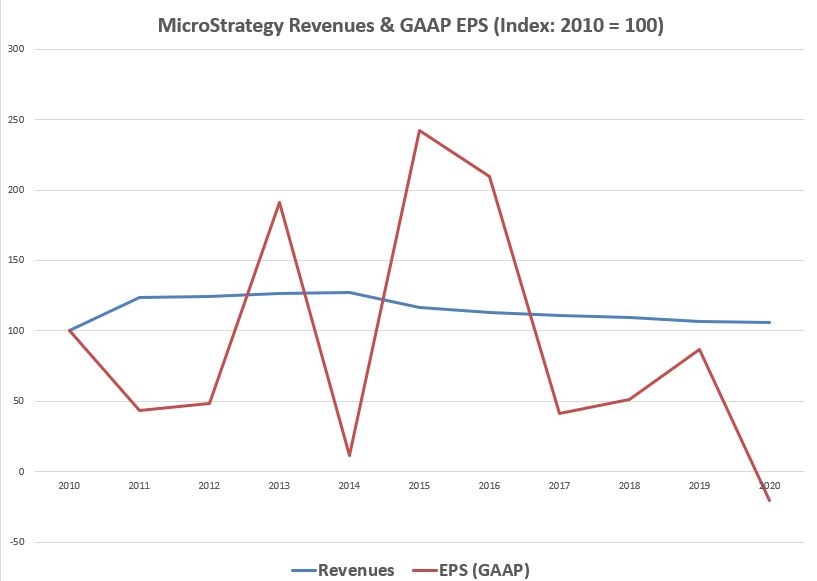

$MSTR is a zombie dotcom fraud w/ crap earnings (chart).

It's lit now b/c it bought tons of Bitcoin & just issued a $600m CB to buy more.

$BTC/equity ratio: 640%. Post financing: 733%.

$MSTR history seems like what $TSLA, PwC & SEC are undergoing these days.

$MSTR is a zombie dotcom fraud w/ crap earnings (chart).

It's lit now b/c it bought tons of Bitcoin & just issued a $600m CB to buy more.

$BTC/equity ratio: 640%. Post financing: 733%.

$MSTR history seems like what $TSLA, PwC & SEC are undergoing these days.

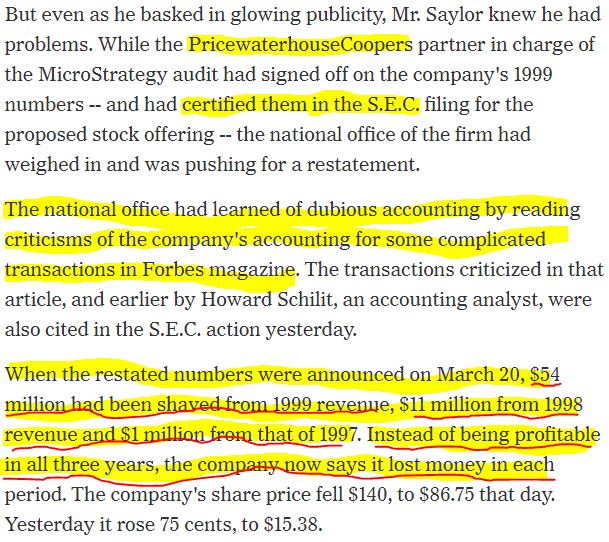

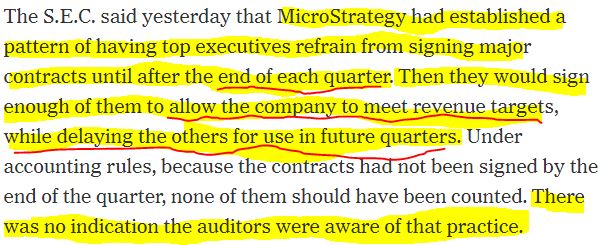

2/ $MSTR CEO @michael_saylor settled for fraud in 2000.

-He overstated sales & covered losses

-PwC OK'd it

-SEC allowed no admission of guilt for an $8.7m penalty

$MSTR plunged by 98% from its 3/00 peak.

Saylor is a star now only b/c $BTC is up 3x since he got $MSTR to buy it.

-He overstated sales & covered losses

-PwC OK'd it

-SEC allowed no admission of guilt for an $8.7m penalty

$MSTR plunged by 98% from its 3/00 peak.

Saylor is a star now only b/c $BTC is up 3x since he got $MSTR to buy it.

3/ Are there similarities between $MSTR & $TSLA? A few.

@elonmusk publicly pined for $BTC on Twitter last Dec (LEFT) & Saylor replied w/ an offer to advise him on how to buy it (RIGHT).

On Feb-8th, $TSLA's 10K was released saying it owned $1.5bn of $BTC "from Jan'21".

@elonmusk publicly pined for $BTC on Twitter last Dec (LEFT) & Saylor replied w/ an offer to advise him on how to buy it (RIGHT).

On Feb-8th, $TSLA's 10K was released saying it owned $1.5bn of $BTC "from Jan'21".

4/ And the accounting tactics. They seem oddly familiar.

$TSLA has bloated current accounts & murky P&L disclosures.

It likely does this through booking >60% of its sales in the last month of each quarter.

$MSTR committed fraud by doing similar things in the dotcom days.

$TSLA has bloated current accounts & murky P&L disclosures.

It likely does this through booking >60% of its sales in the last month of each quarter.

$MSTR committed fraud by doing similar things in the dotcom days.

5/ I often wonder how PwC can handle all of the "complex" accounting going on at $TSLA.

PwC handled it well back in the late 90s w/ $MSTR. Media became noisy. New rules enforced by the SEC. And that's when PwC's partners did the right thing: they thought about their future.

PwC handled it well back in the late 90s w/ $MSTR. Media became noisy. New rules enforced by the SEC. And that's when PwC's partners did the right thing: they thought about their future.

END/: @elonmusk followed @michael_saylor in capital allocation tactics by punting Bitcoin.

Both own ~20% stakes in their companies

Both used public offerings to buy Bitcoin

Both likely did this to veil fading fundamentals

$TSLAQ

H/T: @MemberSee https://www.nytimes.com/2000/12/15/business/microstrategy-chairman-accused-of-fraud-by-sec.html#:~:text=Michael%20J.&text=Saylor%20and%20two%20other%20MicroStrategy,two%20other%20officials%2C%20Sanjeev%20K

Both own ~20% stakes in their companies

Both used public offerings to buy Bitcoin

Both likely did this to veil fading fundamentals

$TSLAQ

H/T: @MemberSee https://www.nytimes.com/2000/12/15/business/microstrategy-chairman-accused-of-fraud-by-sec.html#:~:text=Michael%20J.&text=Saylor%20and%20two%20other%20MicroStrategy,two%20other%20officials%2C%20Sanjeev%20K

Read on Twitter

Read on Twitter