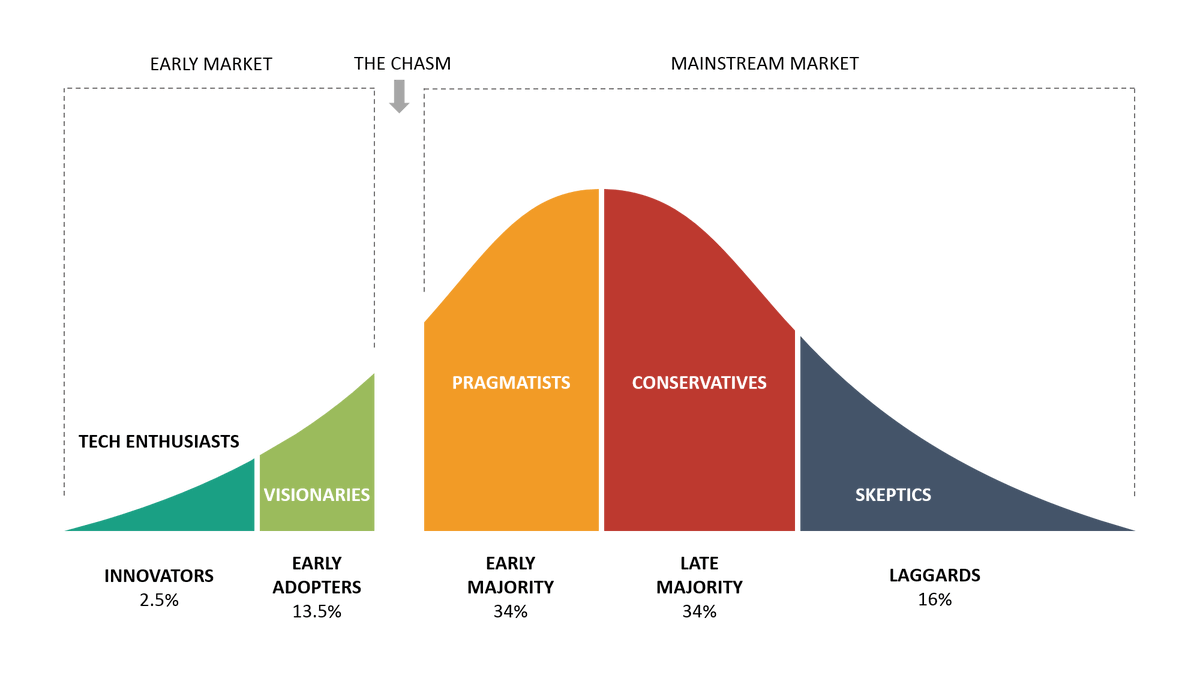

Saffron Finance ($SFI) is a tranched fixed yield product that is positioned to enable DeFi to cross the chasm from the early adopter phase to the mainstream adoption phase.

A thread on why I think $SFI is the next blue chip

A thread on why I think $SFI is the next blue chip

Distribution of capital in DeFi doesn't yet mirror that of tradfi. To enable retail/institutional access to DeFi’s competitive returns, a more diverse set of permissionless primitives, accessed through software that abstracts away complexity will have to be constructed.

DeFi has seen a Cambrian explosion of protocols enabling access to overcollateralized crypto backed loans paying juicy variable rates, but less attention has been focused on the areas of fixed rate lending and derivatives.

Some facts:

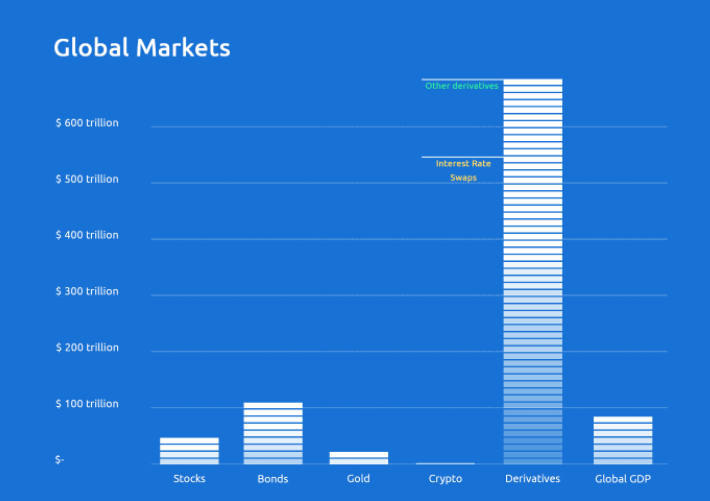

The global credit market is 3x larger than the global equities market and 88% of corporate and mortgage debt is represented in fixed terms.

The global credit market is 3x larger than the global equities market and 88% of corporate and mortgage debt is represented in fixed terms.

The total fixed income market represents about a $128.3T market globally and derivatives of underlying credit represent a market that is potentially 5-10x larger than the underlying credit market.

Positioning

Wave #1 of DeFi attracted early adopters that are by their nature have a high risk tolerance, but most mainstream investors will not find these risks to be palatable.

That's where @saffronfinance_ comes in, allowing users to segregate risks into slices or tranches

Wave #1 of DeFi attracted early adopters that are by their nature have a high risk tolerance, but most mainstream investors will not find these risks to be palatable.

That's where @saffronfinance_ comes in, allowing users to segregate risks into slices or tranches

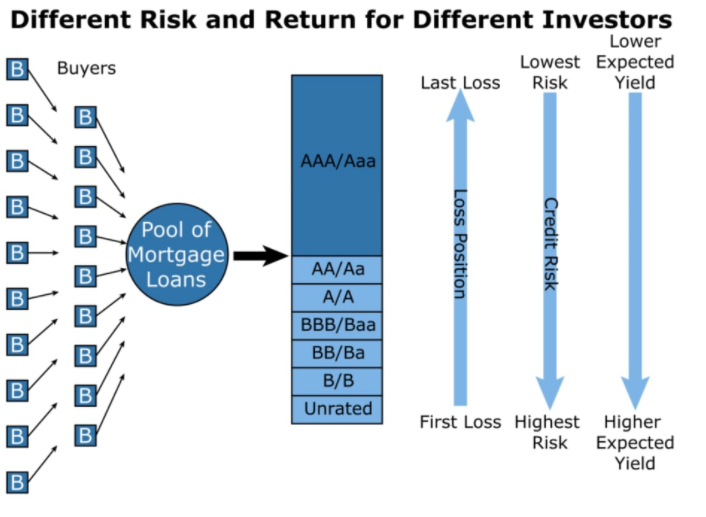

At a very high level, securitization is simply the merging or pooling of financial assets into interest-bearing securities and tranching is the slicing up of those securities into buckets to be sold according to their unique risks, maturities etc.

Saffron acts as a peer to peer risk exchange (risk escrow) made up of 2 main tranches.

AA - The senior tranche - insured by junior tranche against platform failures, liquidity crises etc

A - Supplies cover for AA in exchange for higher yields if no coverable event occurs.

AA - The senior tranche - insured by junior tranche against platform failures, liquidity crises etc

A - Supplies cover for AA in exchange for higher yields if no coverable event occurs.

The protocol launched by first enabling Dai liquidity mining on Compound over two week periods called “Epochs”. Assuming no coverable event occurs, super senior tranche is paid back first when liquidity is removed before the yield enhanced A tranche.

Unlike other insurance products that have to be added a-la-carte to secure a transaction, Saffron embeds the insurance right into the protocol interaction itself. No need for a 3rd party underwriter. Opens up to potential to eat into the insurance market.

$SFI Attributes:

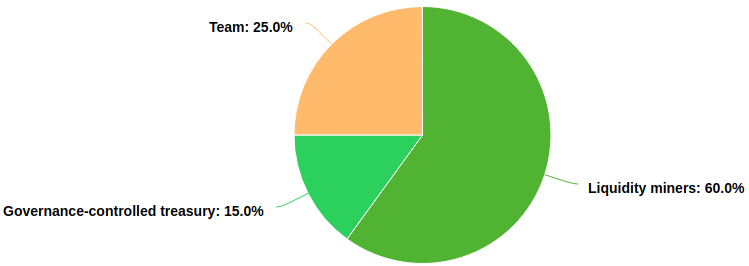

-ERC-20 capped at 100,000 SFI

-40k tokens rewarded for epoch 1, halved each epoch -through (including) epoch 7.

-Epoch 8 and on will be 200 tokens until rewards cut and V2 moves to fees only.

-ERC-20 capped at 100,000 SFI

-40k tokens rewarded for epoch 1, halved each epoch -through (including) epoch 7.

-Epoch 8 and on will be 200 tokens until rewards cut and V2 moves to fees only.

$SFI Utility:

- $SFI is needed to enter high yield pool to stake as insurance for senior tranche.

- Governance

- Fees - V2 after farming ends

- @psykeeper_ has hinted at possibilities in Web3 - how to incentivize other front ends, incentivize data storage (ex the graph) etc.

- $SFI is needed to enter high yield pool to stake as insurance for senior tranche.

- Governance

- Fees - V2 after farming ends

- @psykeeper_ has hinted at possibilities in Web3 - how to incentivize other front ends, incentivize data storage (ex the graph) etc.

V2:

-Lower gas

-Epoch system changes to rollover system

-More asset tranches

-Potential for programmable tranches created by users based on the risk parameters they want

“I really see Saffron as an entirely peer to peer risk matching engine” - @psykeeper_

-Lower gas

-Epoch system changes to rollover system

-More asset tranches

-Potential for programmable tranches created by users based on the risk parameters they want

“I really see Saffron as an entirely peer to peer risk matching engine” - @psykeeper_

Fundraising:

Currently raising 1.5-1.7m of VC money - @psykeeper_ mentioned on @Delphi_Digital podcast that he has worked with his current team for a long time and will use the money to bring them on full time and hopefully make some key hires.

Currently raising 1.5-1.7m of VC money - @psykeeper_ mentioned on @Delphi_Digital podcast that he has worked with his current team for a long time and will use the money to bring them on full time and hopefully make some key hires.

Composability:

Psy emphasized the fact that the system is built to integrate with other protocols and has a desire to work and integrate with as many teams as needed to provide value to end users. Potential to become an essential Defi primitive.

Psy emphasized the fact that the system is built to integrate with other protocols and has a desire to work and integrate with as many teams as needed to provide value to end users. Potential to become an essential Defi primitive.

Opportunities:

1. Integrations in the pipeline, New pools for individual Protocols/Tokens

@Privatechad_ makes a great point that new tranches formed through partnerships are inherently positive sum not zero sum. https://twitter.com/Privatechad_/status/1356309353159131136?s=20

1. Integrations in the pipeline, New pools for individual Protocols/Tokens

@Privatechad_ makes a great point that new tranches formed through partnerships are inherently positive sum not zero sum. https://twitter.com/Privatechad_/status/1356309353159131136?s=20

Opportunities:

2. Multi Asset tranches or "meta" pools - Distributes risk across multiple protocols reducing the collateral required of juniors to cover. https://twitter.com/benjaminsimon97/status/1360294833777233920?s=20

2. Multi Asset tranches or "meta" pools - Distributes risk across multiple protocols reducing the collateral required of juniors to cover. https://twitter.com/benjaminsimon97/status/1360294833777233920?s=20

Opportunities: Better UX

While done digitally, most transactions occur in inefficient OTC markets between broker dealers + institutions. Opening up 24/7 access to permissionless fixed income markets could enable a massive transition of wealth out of tradfi.

While done digitally, most transactions occur in inefficient OTC markets between broker dealers + institutions. Opening up 24/7 access to permissionless fixed income markets could enable a massive transition of wealth out of tradfi.

Barbell investing strategy - As I mentioned in @RariCapital thread, as it's unclear whether a lot of value will sink to the protocol layer or rise to the aggregation layer, heavy bets at each end can reduce your fragility to uncertainty. https://twitter.com/HighCoinviction/status/1359669121869377537?s=20

Opinion:

- More risk configurations = larger set of users that see DeFi as a palatable investment space

- New integrations, meta pools open up alpha opps

- Better 24/7 permissionless user experience vs. using OTC + broker dealers

- Opp to eat into insurance market

- More risk configurations = larger set of users that see DeFi as a palatable investment space

- New integrations, meta pools open up alpha opps

- Better 24/7 permissionless user experience vs. using OTC + broker dealers

- Opp to eat into insurance market

Concerns:

Concentrated counter-party risk: With Comp as only liquidity mining opportunity currently, a coverable event would trigger seniors to sell off junior's staked $SFI. What would that do to the value of $SFI? What about the tail risk of Dai losing its peg?

Concentrated counter-party risk: With Comp as only liquidity mining opportunity currently, a coverable event would trigger seniors to sell off junior's staked $SFI. What would that do to the value of $SFI? What about the tail risk of Dai losing its peg?

Concerns:

25% team rewards with only a 1 year lock up seems rich. I worry about long terms incentives given the fact that the "institutions are here" meme is unlikely to be realized during that time frame.

25% team rewards with only a 1 year lock up seems rich. I worry about long terms incentives given the fact that the "institutions are here" meme is unlikely to be realized during that time frame.

Disclosure: I own $SFI

Additional Resources:

@benjaminsimon97 Has two great threads. Check him out.

https://twitter.com/benjaminsimon97/status/1360294808607219713?s=20

@Privatechad_ has a great thread as well

https://twitter.com/Privatechad_/status/1356309323354398720?s=20

Pulled a lot of figures from @rahul_rai121 's piece

https://messari.io/article/fixed-income-protocols-the-next-wave-of-defi-innovation

@HighCoinviction ' thread

@benjaminsimon97 Has two great threads. Check him out.

https://twitter.com/benjaminsimon97/status/1360294808607219713?s=20

@Privatechad_ has a great thread as well

https://twitter.com/Privatechad_/status/1356309323354398720?s=20

Pulled a lot of figures from @rahul_rai121 's piece

https://messari.io/article/fixed-income-protocols-the-next-wave-of-defi-innovation

@HighCoinviction ' thread

Also still trying to pick this apart https://twitter.com/jai_bhavnani/status/1360135950613966848?s=20

This is my second attempt at doing an analysis of a crypto asset. Lmk where I can improve or areas that I can add in the future. Check out my thread on $rgt @RariCapital if you enjoyed this thread  https://twitter.com/patfitzgerald01/status/1360082980589490177?s=20

https://twitter.com/patfitzgerald01/status/1360082980589490177?s=20

https://twitter.com/patfitzgerald01/status/1360082980589490177?s=20

https://twitter.com/patfitzgerald01/status/1360082980589490177?s=20

Read on Twitter

Read on Twitter