(1/n) $CSU.TO deep-dive finally done - check it out. TLDR; I don’t think the market is giving them full value for the VMS M&A opportunity, and zero value for CSU 2.0 (new initiatives). An excellent business at a great price, with a world-class capital allocator at the helm.

(2/n) They’ve perfected decentralized M&A that’s scalable: proprietary data sets, quantitative framework that reduces subjectivity, and education process to produce the next gen of allocators. What enables them to do 100 small acquisitions/year, can enable them to do 200/year

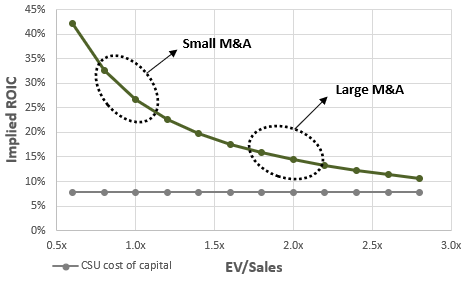

(3/n) To compliment small VMS M&A, they are also pursuing large VMS M&A. Even if ROIC is much lower on large M&A, it will still be higher than their cost of capital. Accretion will still be significant. Better than a return to shareholders

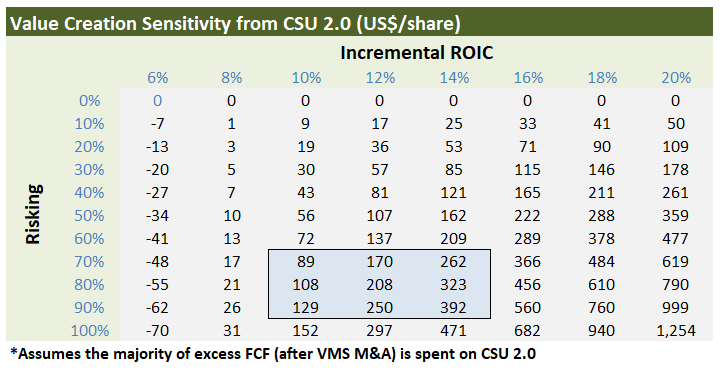

(4/n) Similarly, CSU 2.0 (new initiatives) > return to shareholders if incremental ROIC exceeds 7.5-8.0%. Hard not taking the over with Mark driving the bus. The base rate for ROIC in the broader technology GICS is mid-teens. The value of this real option is meaningful.

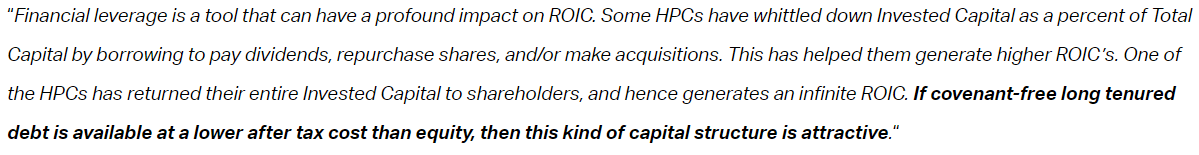

(5/n) In time, CSU will use the balance sheet (currently negative ND/EBITDA). If not to grow to return cash to shareholders. A great lever to pull “eventually”. Mark changed his mind on special dividends – he’ll change his mind about this too. The seed is planted. His own words:

(6/6) I’m bound to be wrong about some part of this thesis. If you disagree with something, let me know! All assumptions can be found in the model on my blog.

Read on Twitter

Read on Twitter