You do not view this as bearish for $BTC.

It is consolidation. A battle between the two market forces.

When we do break, piggyback on to the winning side.

Supply wins = Short to $41k

Demand wins = Long it to $60k+

Last upside breaks on these structures went 13 - 20% higher.

It is consolidation. A battle between the two market forces.

When we do break, piggyback on to the winning side.

Supply wins = Short to $41k

Demand wins = Long it to $60k+

Last upside breaks on these structures went 13 - 20% higher.

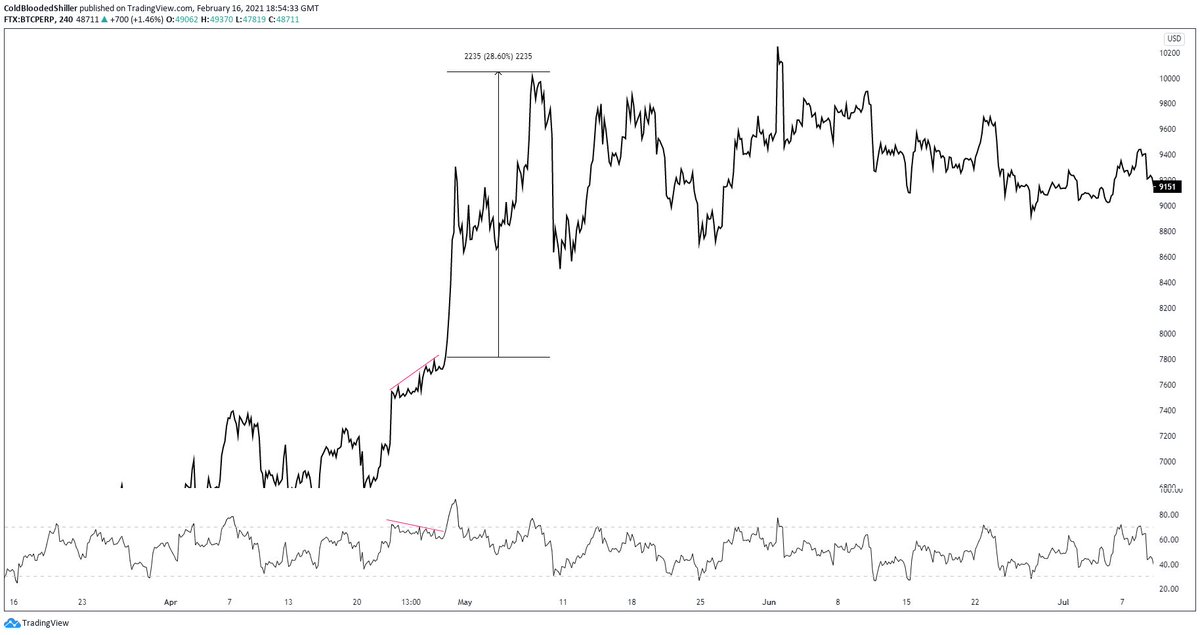

I'll take my trading strategy and utilise it here to piggyback onto @TylerDurden's excellent tweet with some additional examples with RSI. https://twitter.com/TylerDurden/status/1361715664239616002?s=20

We've seen a number of these consolidations easily identifiable for me by "fake" divergences.

They're not really fake but they are there to cause you to second guess.

Here's one at $13k.

Note the similarities to now.

They're not really fake but they are there to cause you to second guess.

Here's one at $13k.

Note the similarities to now.

The reason RSI acts in this way is because we could simply be cooling off and momentum is dropping as a result of the more relaxed PA.

It does not automatically mean it's a bearish div.

In a bull market I hope I've conditioned you enough to ignore the majority of these you see

It does not automatically mean it's a bearish div.

In a bull market I hope I've conditioned you enough to ignore the majority of these you see

Another example with the same process, RSI displaying a fake divergence (cool off) before moving higher.

Strong uptrending markets can cause RSI to look like this but there is no weakness behind it. It's simply consolidation that's causing the divergences to appear.

Of course there is another side that says we do break down.

Of course there is another side that says we do break down.

This demonstrates the importance of not trading based on your emotions.

Right now, I'm open to both sides, I have a trigger for both sides, I just need to see what the next move is.

Don't subscribe to a bias, accept both outcomes and plan accordingly.

Right now, I'm open to both sides, I have a trigger for both sides, I just need to see what the next move is.

Don't subscribe to a bias, accept both outcomes and plan accordingly.

Read on Twitter

Read on Twitter