1/

The best long-term investments benefit from the tailwind of MULTIPLE EXPANSION.

In this thread, we'll take a look at how the honorable “100 baggerdom” can be achieved, using well-known companies as examples.

Best served with a nice cup of tea...

The best long-term investments benefit from the tailwind of MULTIPLE EXPANSION.

In this thread, we'll take a look at how the honorable “100 baggerdom” can be achieved, using well-known companies as examples.

Best served with a nice cup of tea...

2/

One of the most inspiring books I’ve recently read is Chris Mayer’s ( @chriswmayer) 100 Baggers: https://www.amazon.com/100-Baggers-Stocks-100-1/dp/1621291650.

The book concludes that greatest results on the stock market are fueled by “twin engines” of growth and multiple expansion.

One of the most inspiring books I’ve recently read is Chris Mayer’s ( @chriswmayer) 100 Baggers: https://www.amazon.com/100-Baggers-Stocks-100-1/dp/1621291650.

The book concludes that greatest results on the stock market are fueled by “twin engines” of growth and multiple expansion.

3/

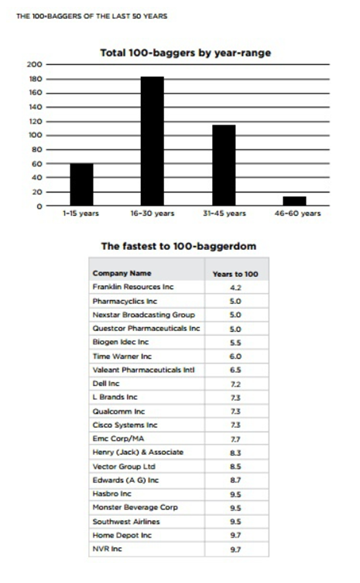

According to the book:

i) most companies take 16-30 yrs to reach the honor

ii) have at the beginning median sales of $170 MUSD

iii) ...and market cap of $500 MUSD

So better focus on smaller companies at the expense of huge ones.

A list of some fastest 100 baggers:

According to the book:

i) most companies take 16-30 yrs to reach the honor

ii) have at the beginning median sales of $170 MUSD

iii) ...and market cap of $500 MUSD

So better focus on smaller companies at the expense of huge ones.

A list of some fastest 100 baggers:

4/

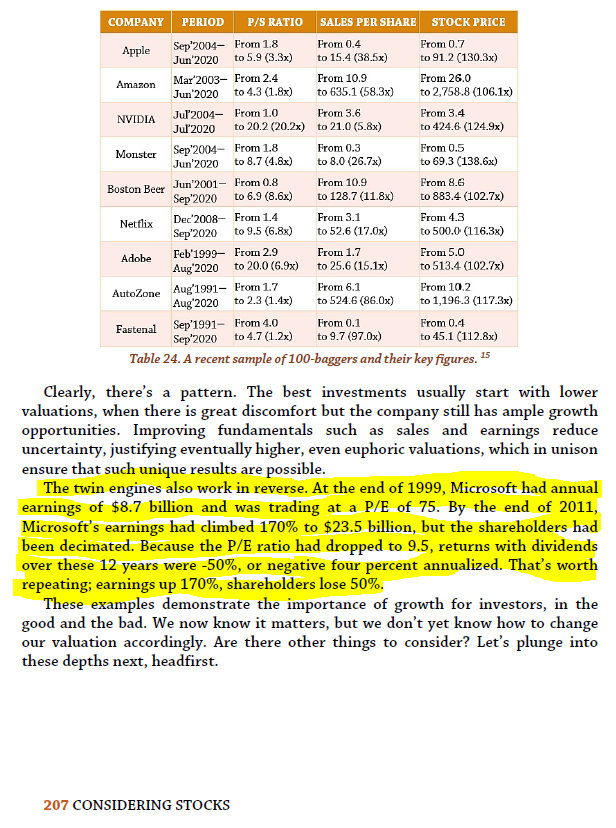

Here’s another take at 100 baggers’ twin engines from “Considering Stocks” (2020). We can see that the best investments usually start with lower valuations.

As Howard Marks says: “A hugely profitable investment that doesn’t begin with discomfort is usually an oxymoron.”

Here’s another take at 100 baggers’ twin engines from “Considering Stocks” (2020). We can see that the best investments usually start with lower valuations.

As Howard Marks says: “A hugely profitable investment that doesn’t begin with discomfort is usually an oxymoron.”

5/

To turn this adage around, the worst investments start with great comfort (read: expanded multiples).

As is captured here, twin engines work both ways. MULTIPLE CONTRACTION can destroy the returns even when holding the best companies in the world.

It takes no prisoners.

To turn this adage around, the worst investments start with great comfort (read: expanded multiples).

As is captured here, twin engines work both ways. MULTIPLE CONTRACTION can destroy the returns even when holding the best companies in the world.

It takes no prisoners.

6/

E.g. $AMZN, $MSFT, $NVDA, and $GOOGL have all been fantastic stocks.

However, there’s been extended 5-10yr periods when they have basically done nothing for the shareholders – thanks to multiple contraction from high initial levels.

These are some serious waiting times.

E.g. $AMZN, $MSFT, $NVDA, and $GOOGL have all been fantastic stocks.

However, there’s been extended 5-10yr periods when they have basically done nothing for the shareholders – thanks to multiple contraction from high initial levels.

These are some serious waiting times.

7/

Another way to look at multiple contraction:

Since its 1997 IPO, whenever Amazon has been trading for P/S multiple above 14, you have ALWAYS had the possibility to get your shares back for less.

Another way to look at multiple contraction:

Since its 1997 IPO, whenever Amazon has been trading for P/S multiple above 14, you have ALWAYS had the possibility to get your shares back for less.

8/

And that’s freaking Amazon (growing at +800% annually in the 1990s with TAM in trillions). Mostly likely our favorites at P/S 40 are not.

It seems that in euphoric markets, everyone forgets the odds and becomes a successful venture capitalist. https://twitter.com/hkeskiva/status/1352896410392387584?s=20

And that’s freaking Amazon (growing at +800% annually in the 1990s with TAM in trillions). Mostly likely our favorites at P/S 40 are not.

It seems that in euphoric markets, everyone forgets the odds and becomes a successful venture capitalist. https://twitter.com/hkeskiva/status/1352896410392387584?s=20

9/

So we should heed the words from the recent "Something of value" memo by @HowardMarksBook

(i) not to overestimate the odds for future success without competition, and

(ii) not to underestimate high valuation’s ability to eat future returns

https://www.oaktreecapital.com/docs/default-source/memos/something-of-value.pdf

So we should heed the words from the recent "Something of value" memo by @HowardMarksBook

(i) not to overestimate the odds for future success without competition, and

(ii) not to underestimate high valuation’s ability to eat future returns

https://www.oaktreecapital.com/docs/default-source/memos/something-of-value.pdf

10/

As everything in the current market environment seems to be going “up, up, up!

”, it’s sometimes good to take the memory lane to study the not-so-exhilarating history of stocks.

”, it’s sometimes good to take the memory lane to study the not-so-exhilarating history of stocks.

At least I find it very helpful for the process - I hope you do too.

As everything in the current market environment seems to be going “up, up, up!

”, it’s sometimes good to take the memory lane to study the not-so-exhilarating history of stocks.

”, it’s sometimes good to take the memory lane to study the not-so-exhilarating history of stocks.At least I find it very helpful for the process - I hope you do too.

11/

That's multiple expansion and 100 baggers in a nutshell!

For high-quality threads in the business domain, follow at least @johnauthers (also: great newsletter) and @FocusedCompound (also: great podcast).

Thank you very much for your kind attention!

That's multiple expansion and 100 baggers in a nutshell!

For high-quality threads in the business domain, follow at least @johnauthers (also: great newsletter) and @FocusedCompound (also: great podcast).

Thank you very much for your kind attention!

Read on Twitter

Read on Twitter