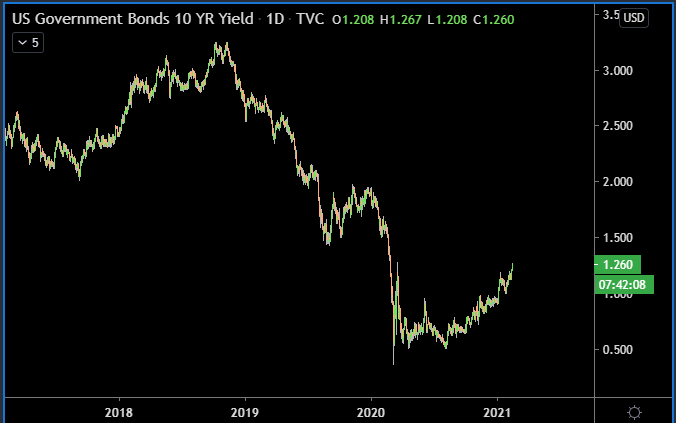

Biggest thing to watch in the macro world is the 10 year treasury yield. All else equal, rising yields crush basically all risk asset prices, and imo, the single biggest reason for the boom in all risk assets in the last 3 years is lower yields. Is this time different? Maybe. /1

2/ "all else equal" was doing a lot of work in my claim above. We also don't have much historical economic data to work with, since quantitative easing is fundamentally new (in which central banks directly buys treasuries and drives down yields).

3/ Investors care about "real yields" (aka nominal yields - inflation). In a free market, real yields would always be meaningfully positive, since investors would never make a loan or take on risk with an expectation of loss.

4/ However, we don't have a free market. Central banks have directly driven down nominal yields, producing a world where most sovereign debt provides negative real yield. Investors do flee these negative sovereign debt yields at the margin, and that's part of what's behind the

5/ epic stock market rally (and rallies in just about everything else). Now, inflation expectations are starting to creep up, and investors have recently been fleeing sovereign debt and bonds. The Fed could again step in to lower yields, but that only works as long as

6/ disinflationary forces are so powerful that they counter the central bank inflationary pressures. Until now, they have been. Productivity gains from technology have produced disinflation to mostly offset the inflationary monetary policy.

7/ but now, most economists are forecasting rising inflation. Economists say there's near zero "slack" in the economy, more money printing and stimulus will probably directly produce non-trivial inflation.

8/ This is the setup that can potentially (and slowly) lead to severe inflation and currency debasement. Investors flee sovereign debt driving up yields - this makes servicing debt more costly to governments and depresses the economy, so the government responds with

9/ more money printing and stimulus, and you get a vicious cycle. The rising yields depress risk assets, but the inflationary concerns are somewhat bullish for most risk assets, leading to a tug of war. Hard to predict the outcome of that war.

10/ In the 1970s for example, the S&P 500 averaged a <6% annual return amidst high inflation, but even worse, real returns were substantially negative. Basically, you were better off holding equities than cash, but a basket of equities lost purchasing power over the decade.

11/ I don't have much of an opinion on how this will play out over the next decade, but my base case is something very roughly comparable. Risk assets probably continue appreciating (with greater volatility) in dollar terms, but real returns likely to be lackluster at best.

12/ what does that mean for cryptocurrency? I expect this to be a growing narrative in both directions. We'll hear that BTC is booming over inflation expectations and then a week later hear that it crashed..because of rising inflation expectations (causing higher nominal yields)

Read on Twitter

Read on Twitter