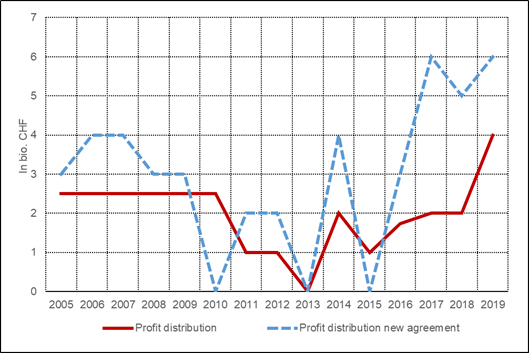

1/ What does the agreement on the distribution of @SNB_BNS profits imply for the size and volatility of distributions? This note aims at providing some answers applying the new rule to past data https://github.com/dankaufmann/snb_profits/blob/main/SNBProfits_Kaufmann_16-02-2021.pdf @SNB_Observatory @DirkNiepelt @LeinSarahMarit

2/ The key take aways are: 1) The profit distribution will likely increase in the coming years. 2) Annual fluctuations of profit distributions will likely increase which may hamper budgetary planning. @Marius_Brulhart @MarcBruetsch @maximebotteron @MarkusDiemMeier @MarkoNikolay

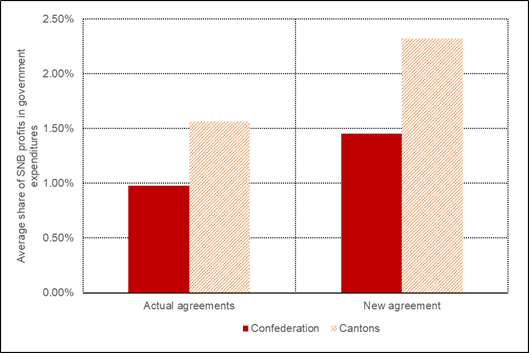

3/ 3) Profit distributions will likely be lower (higher) during economic recessions (booms). 4) Although the #SNB’s profit distributions take center stage in public discussions, its its role in financing total government expenditures is relatively modest. @reb_stuart @fabiocanetg

4/ 5) Because Cantons have less favorable access to capital markets than the Confederation, and because SNB profits play a larger role in financing Cantonal expenditures, annual fluctuations of profit distributions may hamper their budgetary planning more. @ronaldindergand

END/ This is very preliminary and work in progress. Comments and suggestions are very welcome. I will post updates of the note here: https://github.com/dankaufmann/snb_profits and on my blog #macroéCHo http://macro-echo.blogspot.com/

Read on Twitter

Read on Twitter