Your thinking about #Zimbabwe equities may be wrong

[Thread]

[Thread]

Let’s start with the basics: the goal of any investment is to maximise return while minimizing risk (Investments 101 stuff), yet ¾ of the conversation around Zim equities focus on return only – rookie move!

Thinks of risk as anxiety that your investment causes you. Better yet, think about risk as the impulsive need to check stock prices because of uncertainty! We measure this by something called ‘standard deviation’ – how much stock return move around the average.

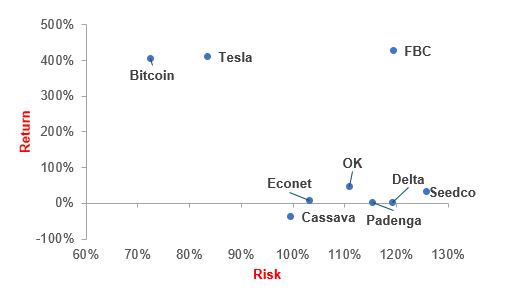

The chart below plots the 1-year return (X-axis) of some of the biggest counters on the ZSE, against the 1-year risk (Y-axis). The numbers are us US$ terms. I also included Bitcoin and Tesla for comparative purposes.

As you can see, the likes of #FBC has given you some pretty solid gains but that has come at a cost of high volatility. #Bitcoin  and #TSLA would have given you a similar return at lower volatility.

and #TSLA would have given you a similar return at lower volatility.

and #TSLA would have given you a similar return at lower volatility.

and #TSLA would have given you a similar return at lower volatility.

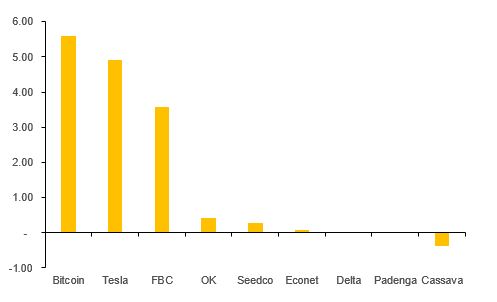

Next step is to divide return by volatility so we can determine the amount of return you got per unit of risk.

As you can see #Bitcoin , #Tesla and #FBC would give you 4 units of return per unit of risk! That’s sweet!

, #Tesla and #FBC would give you 4 units of return per unit of risk! That’s sweet!

As you can see #Bitcoin

, #Tesla and #FBC would give you 4 units of return per unit of risk! That’s sweet!

, #Tesla and #FBC would give you 4 units of return per unit of risk! That’s sweet!

This is a good conceptual framework to think about investments – how much return am I getting for how much risk.

Shout out for making it to the end!

@kudzie_sharara @MorganCo_ZW @NoelNyasha @wallstreet_god

Shout out for making it to the end!

@kudzie_sharara @MorganCo_ZW @NoelNyasha @wallstreet_god

Read on Twitter

Read on Twitter