Twice a year we all grab some popcorn & watch the politicized revision of the EU list of non-cooperative jurisdictions aka the #blacklist of #taxhavens.

3 interesting countries to look at this time: Turkey, Australia and Dominica.

A quick thread on why!

3 interesting countries to look at this time: Turkey, Australia and Dominica.

A quick thread on why!

Let's start easy. Dominica. Dominica will end on blacklist for having a lower rating by the OECD Global Forum on exchange of information on request. Interestingly, it will now have the same rating about Malta....oeps. Same story as with Panama. Double standards.

Turkey is much more interesting and it is not the first time it is a cause for concern for EU diplomats and ministers. Turkey is on the grey list of not having bilateral exchanges of automatic exchange (CRS) with all EU countries and for a low rating by Global Forum.

Turkey had time until end of 2020 to settle the situation (this already a diplomatic concession). However, Turkey still has a too low rating at Global Forum and it has been postponing any new revision by Global Forum. Also it still does not have all bilateral exchanges in place.

@ElodieLamer has well described this in a recent article

https://plus.lesoir.be/354922/article/2021-02-12/openlux-la-diplomatie-des-listes-noires-et-ses-limites

As you can see on the OECD website, Turkey has no exchanges in place with Belgium, France, Cyprus, Germany, and Netherlands...I wonder why...

https://plus.lesoir.be/354922/article/2021-02-12/openlux-la-diplomatie-des-listes-noires-et-ses-limites

As you can see on the OECD website, Turkey has no exchanges in place with Belgium, France, Cyprus, Germany, and Netherlands...I wonder why...

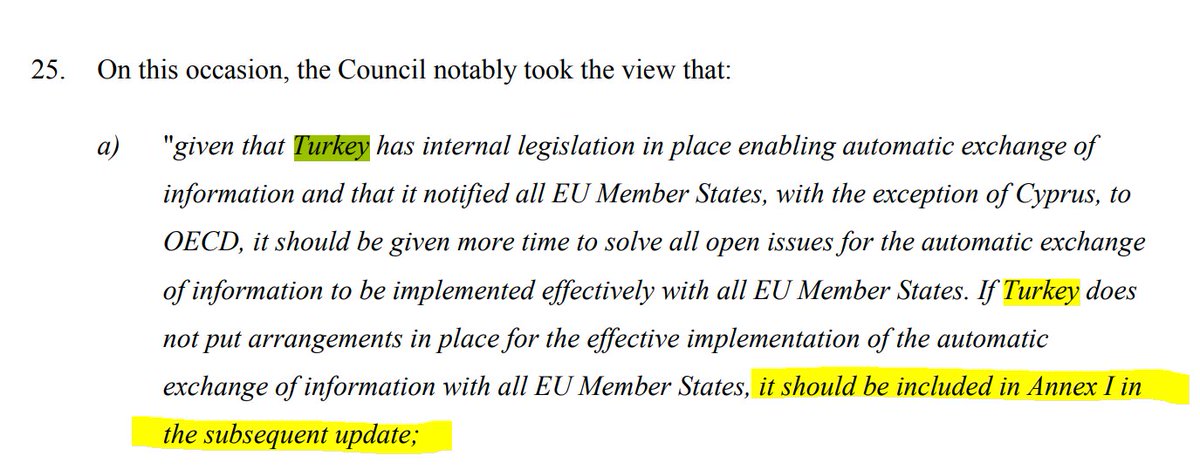

In June 2020, the progress report of the Code of Conduct (those assessing the situation) to the Council, Turkey was mentioned as follows.

I don't see how Turkey could still escape the blacklist at this stage. How do you explain this to Panama and Dominica?

I don't see how Turkey could still escape the blacklist at this stage. How do you explain this to Panama and Dominica?

Australia has a harmful tax practice in the banking sector. It is to be seen whether this harmful tax practice has been properly amended.

Also each revision of the EU list should re-assess all countries in scope not just those targeted by black or grey list in last revision.

Also each revision of the EU list should re-assess all countries in scope not just those targeted by black or grey list in last revision.

@EP_Taxation has adopted recently a strong resolution on how the EU list of tax havens should be revised both in terms of process as well as criteria.

Certain EU countries, especially Denmark, have been advocating for such strong revision.

https://www.europarl.europa.eu/doceo/document/TA-9-2021-0022_EN.html

Certain EU countries, especially Denmark, have been advocating for such strong revision.

https://www.europarl.europa.eu/doceo/document/TA-9-2021-0022_EN.html

Read on Twitter

Read on Twitter