Thread on investing in stocks.

I have been in trading since 12 years. After lots of ups and down I am finally earning consistently since last 3 years.

I always loved trading but somehow did not attached to investing part. but last few years read lots of books on investing.

I have been in trading since 12 years. After lots of ups and down I am finally earning consistently since last 3 years.

I always loved trading but somehow did not attached to investing part. but last few years read lots of books on investing.

As a system trader its not my cup of tea to choose random stocks for investing. so I need clear rules in investing. after reading lots of books I found one which has clear rules for investing. I recommend u read full book its amazing .I am writing short summary of this book.

First Step –

Out of 5000+ listed companies, you need to apply basic screener to sort out the

primary list. Followings are the criteria for primary screening

1. Last three years average Return on Equity (ROE) and Return on

Capital Employed (ROCE) both are greater than 20%.

Out of 5000+ listed companies, you need to apply basic screener to sort out the

primary list. Followings are the criteria for primary screening

1. Last three years average Return on Equity (ROE) and Return on

Capital Employed (ROCE) both are greater than 20%.

2. Debt to Equity Ratio is less than 1.

3. Promoters pledge less than 10% of their total shareholdings (better if it is NIL)

4. Last three years CAGR sales growth rate is more than 10%

5. Last three years CAGR profit growth rate is more than 12%

3. Promoters pledge less than 10% of their total shareholdings (better if it is NIL)

4. Last three years CAGR sales growth rate is more than 10%

5. Last three years CAGR profit growth rate is more than 12%

You will find only 40-80 companies are matching all the criteria mentioned

above out of 5000+ listed stocks. Depending on the market situation, you will

end up with the list of around 40-80 stocks that match all the above criteria.

u can complete first stage with

screener .in

above out of 5000+ listed stocks. Depending on the market situation, you will

end up with the list of around 40-80 stocks that match all the above criteria.

u can complete first stage with

screener .in

second step

u need to see stocks list manually as numbers can’t tell the full story. There are many hidden facts behind those figures.

1. “If the stock under consideration has P.E ratio of more than two times of last

three years average EPS growth then avoid the same.”

And

u need to see stocks list manually as numbers can’t tell the full story. There are many hidden facts behind those figures.

1. “If the stock under consideration has P.E ratio of more than two times of last

three years average EPS growth then avoid the same.”

And

2. "Only consider stocks for investment having last three years

annualized return is more than 10% with last one year’s return is

positive."

so go to http://screener.in login or register.

go to create new screen. paste below formula for step one to filter stocks in query.

annualized return is more than 10% with last one year’s return is

positive."

so go to http://screener.in login or register.

go to create new screen. paste below formula for step one to filter stocks in query.

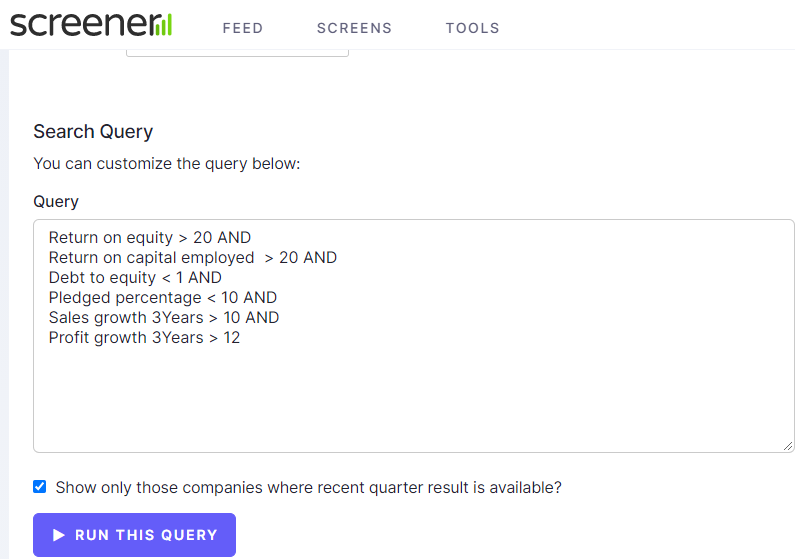

Return on equity > 20 AND

Return on capital employed > 20 AND

Debt to equity < 1 AND

Pledged percentage < 10 AND

Sales growth 3Years > 10 AND

Profit growth 3Years > 12

and click run this query.

check box for Show only those companies where recent quarter result is available.

Return on capital employed > 20 AND

Debt to equity < 1 AND

Pledged percentage < 10 AND

Sales growth 3Years > 10 AND

Profit growth 3Years > 12

and click run this query.

check box for Show only those companies where recent quarter result is available.

you will find 50 to 80 stocks as per market conditions.

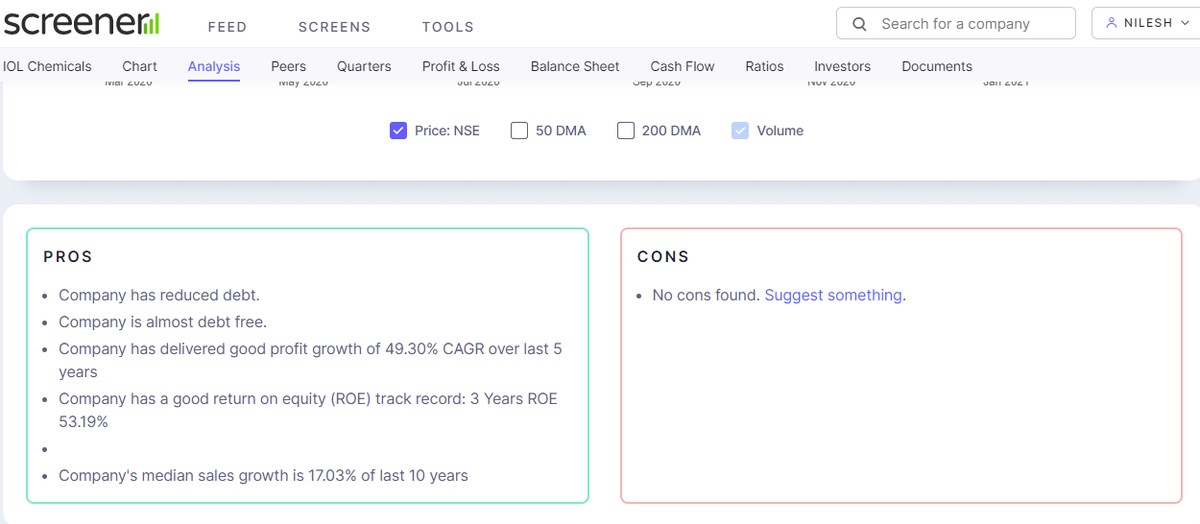

click on that stock and see charts for second step.

Also check pros and cons. its not in book but i found it useful to filter stocks.

filter stocks according to it.

i have been started investing as per above formula.

click on that stock and see charts for second step.

Also check pros and cons. its not in book but i found it useful to filter stocks.

filter stocks according to it.

i have been started investing as per above formula.

This is no holy grail for investing

don't put all your eggs in one basket do diversification also invest on regular time intervals

Book is master piece I have just written 1%.

please read full book

How to Avoid Loss and Earn Consistently in the Stock Market

by Prasenjit Paul

don't put all your eggs in one basket do diversification also invest on regular time intervals

Book is master piece I have just written 1%.

please read full book

How to Avoid Loss and Earn Consistently in the Stock Market

by Prasenjit Paul

Read on Twitter

Read on Twitter