I know everyone‘s focused on Bitcoin, Tesla, EVs, meme stonks, and the hottest SPACs.

I get it. The Ponzi sector is a-boomin’.

Still, one of the most attractive investment opportunities (to my eye) isn’t in any of these...it’s in those dirty and unpopular energy companies.

I get it. The Ponzi sector is a-boomin’.

Still, one of the most attractive investment opportunities (to my eye) isn’t in any of these...it’s in those dirty and unpopular energy companies.

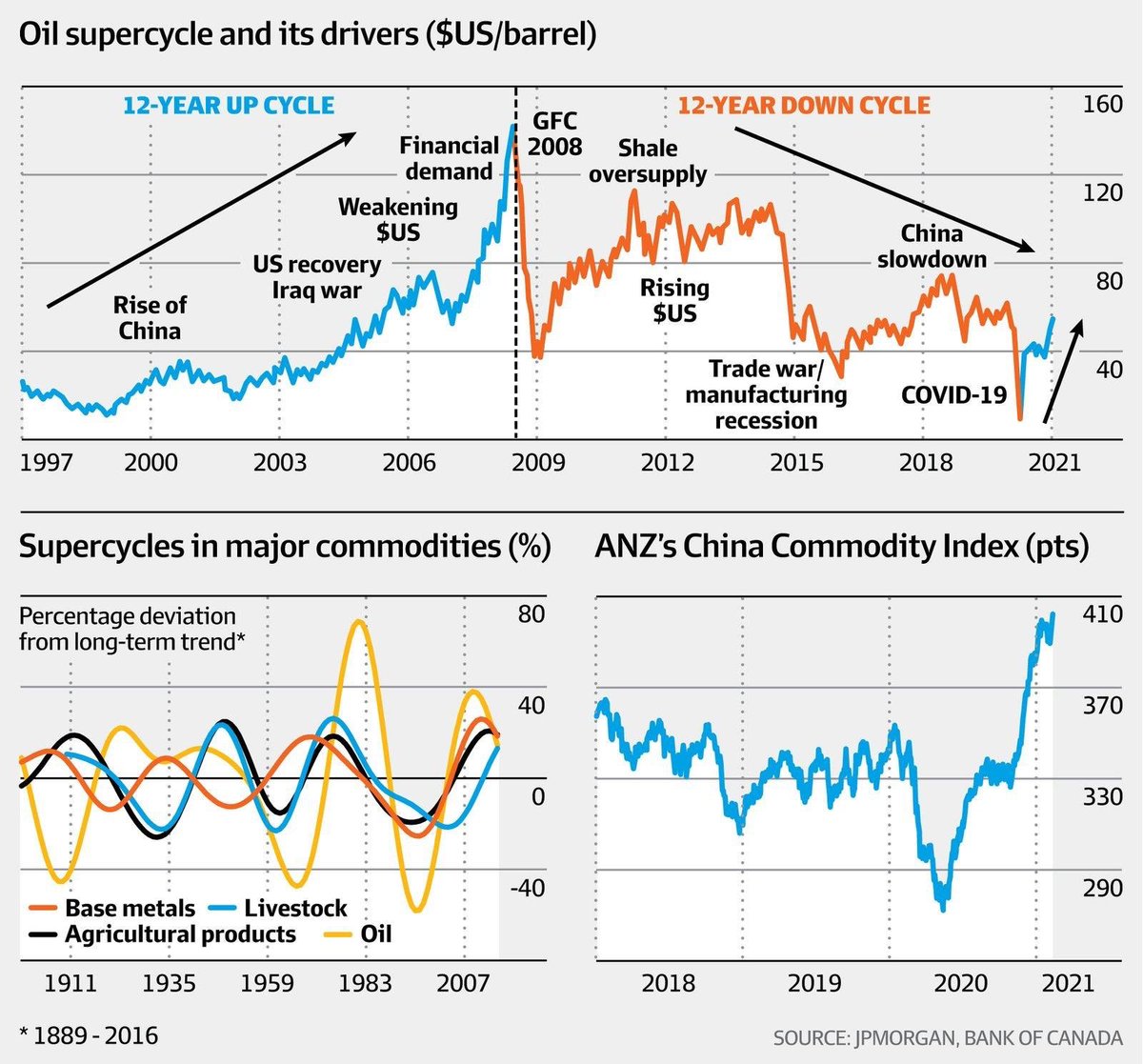

1- Commodities are cyclical, and oil’s cyclicality is among the most extreme of any commodity.

The first-ever negative oil price that we had in April ‘20 can be seen as the dramatic, almost poetic culmination of a brutal 12yr down cycle.

Safe to say that marked the bottom...

The first-ever negative oil price that we had in April ‘20 can be seen as the dramatic, almost poetic culmination of a brutal 12yr down cycle.

Safe to say that marked the bottom...

2- This last year has been a wild ride for oil, and the US oil patch in particular has been structurally wounded.

The damage is done. US oil production topped out at ~13M bpd, now sitting below ~11M bpd.

The period of US shale hyper-growth appears to have come to an end.

The damage is done. US oil production topped out at ~13M bpd, now sitting below ~11M bpd.

The period of US shale hyper-growth appears to have come to an end.

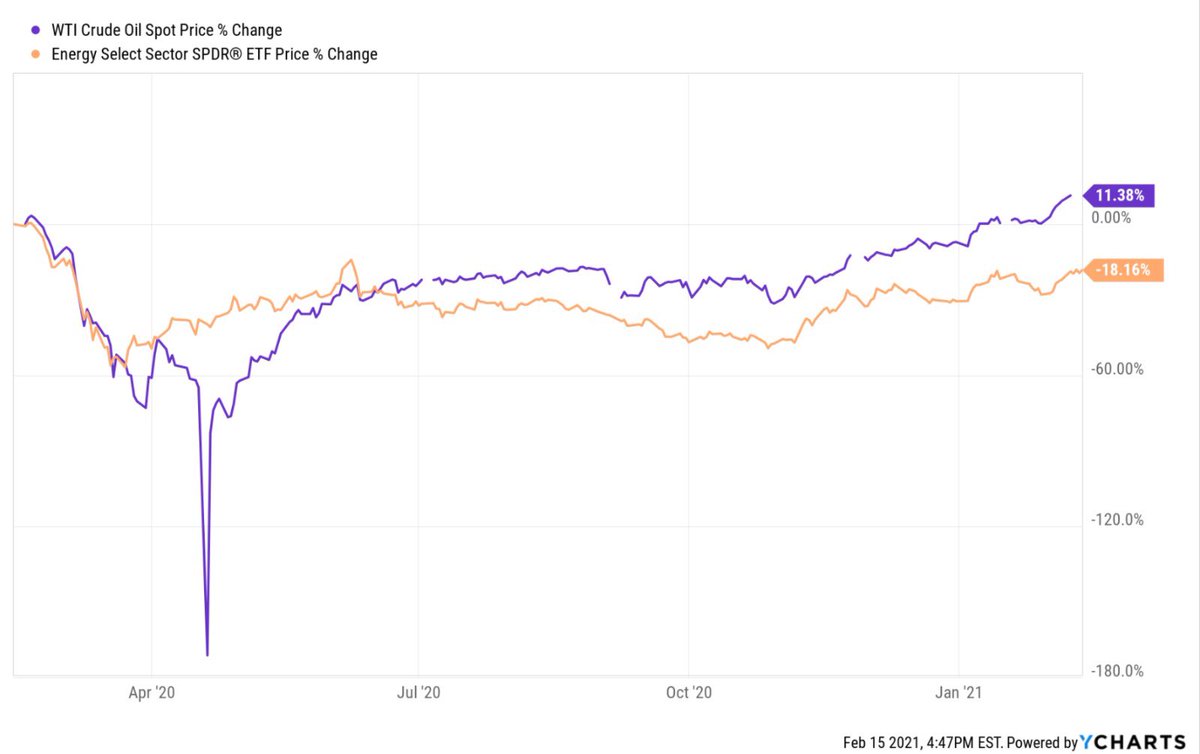

2A- Now, at WTI>$60 and HH>$3, many energy stocks have significant upside, if they were to return to the valuations they sported back when oil & gas prices were last at these levels.

While oil prices have fully recovered, energy stocks remain ~25% below pre-pandemic levels:

While oil prices have fully recovered, energy stocks remain ~25% below pre-pandemic levels:

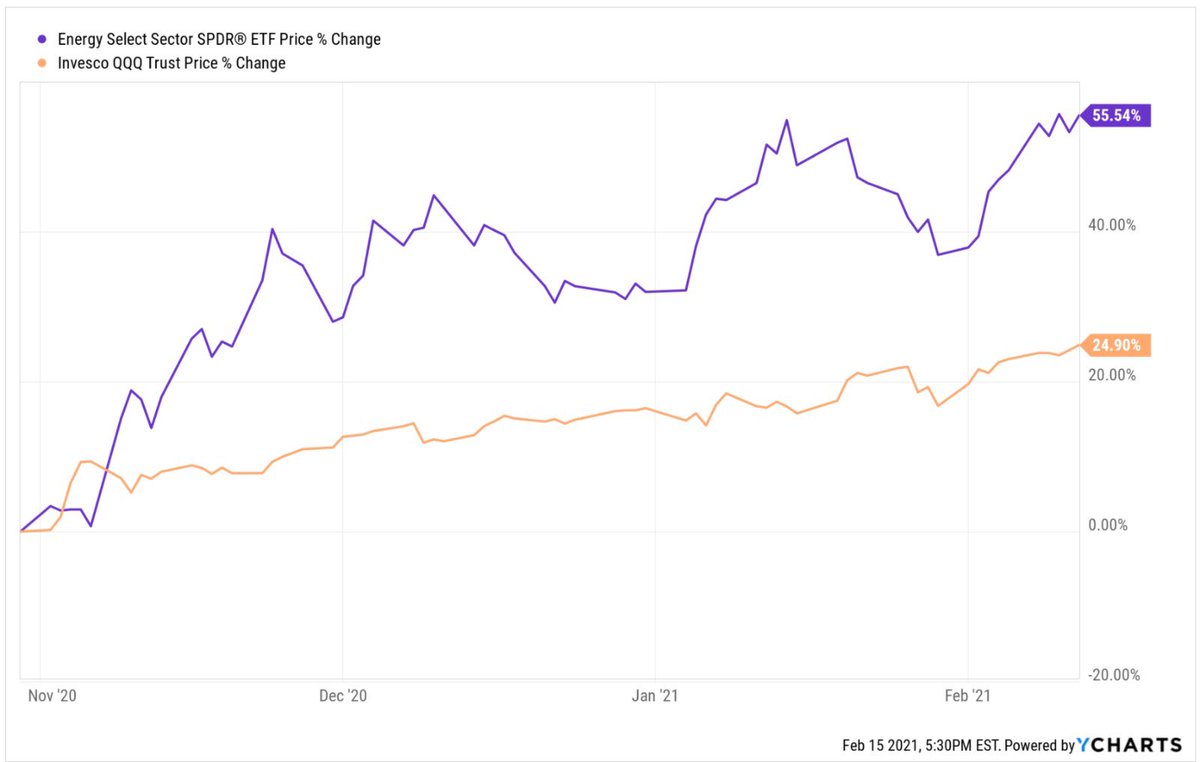

3- Not only that, but after about a decade of brutal energy underperformance relative to tech, we’re finally beginning to see the first signs of a reversal...

For one, energy has outperformed tech by over 30% since November:

For one, energy has outperformed tech by over 30% since November:

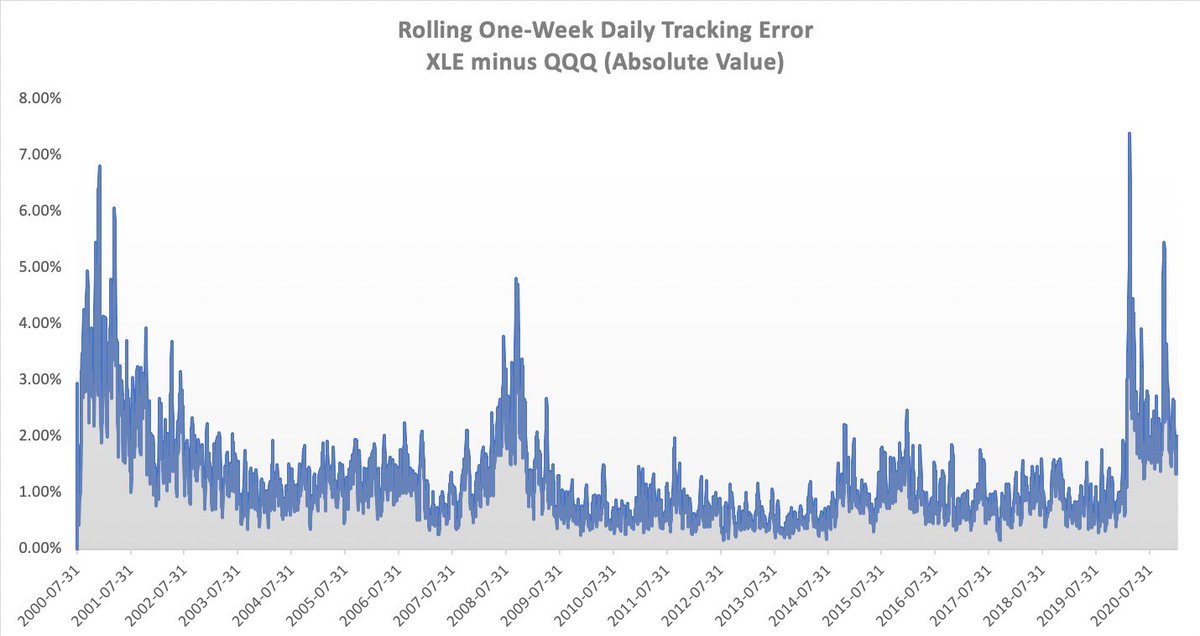

4- Also, the spread between energy and tech (proxied by $XLE and $QQQ) started whipsawing wildly in late 2019, and hasn’t really calmed down since:

Notice the last two times we saw this type of sector volatility... (hint: shortly before sharp reversals in relative performance)

Notice the last two times we saw this type of sector volatility... (hint: shortly before sharp reversals in relative performance)

4A- In 2000, this heightened level of sector volatility preceded a violent rotation out of tech and into energy.

It’s possible that the modern version of this violent rotation is already underway, as energy has outstripped tech by over 120% (annualized) in the last ~4 months.

It’s possible that the modern version of this violent rotation is already underway, as energy has outstripped tech by over 120% (annualized) in the last ~4 months.

5- Consider also that the MC of US Tech is ~$12T, while the MC of energy is ~$890B. To oversimplify, if just 2% of the money sitting in tech were to rotate into energy, it would lead to nearly 30% appreciation in the space.

Speaks to the explosive potential of this rotation.

Speaks to the explosive potential of this rotation.

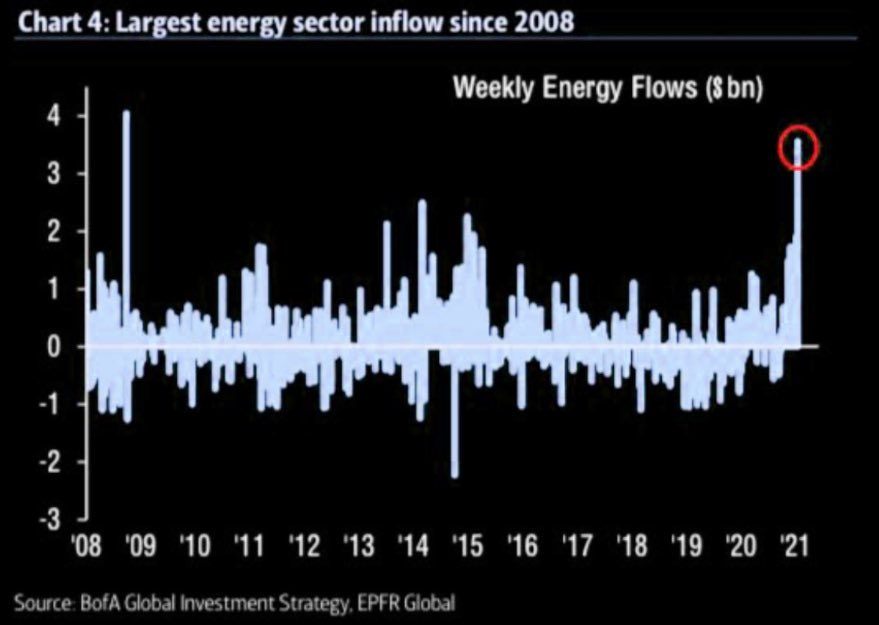

5A- And flows into energy are strong. We recently got our largest energy sector inflow since 2008...

6- I’m sure many of you are tempted to book some gains on your energy positions given the recent run-up.

The last several years have been rough for energy investors, to say the least. Hold on awhile longer, and I believe you’ll all be handsomely rewarded for your patience.

The last several years have been rough for energy investors, to say the least. Hold on awhile longer, and I believe you’ll all be handsomely rewarded for your patience.

7- I mean, FFS, the market cap of $TSLAQ alone is about equivalent to the entire S&P500 US energy sector.

Let that sink in...

Let that sink in...

For a high-level overview of the oil and gas thesis, and for my original basket of E&Ps (which has since changed), see this thread from late October: https://twitter.com/bvddycorleone/status/1319388061520809985?s=21 https://twitter.com/bvddycorleone/status/1319388061520809985

HT @contrarian8888 @Josh_Young_1 @PATCHnHrd @hkuppy @profplum99 @EnergyCynic @In_Sapiens @James56487175 @NextWaveEFT @pineconemacro @anasalhajji @TeddyVallee @ericnuttall @Convertbond @TihoBrkan @fundstrat @LynAldenContact

Thoughts/feedback/criticisms always welcome.

Thoughts/feedback/criticisms always welcome.

Read on Twitter

Read on Twitter