Last week in their Q4 FY20 earnings $DDOG showed continued reacceleration as its underlying growth rate returns to pre-pandemic levels

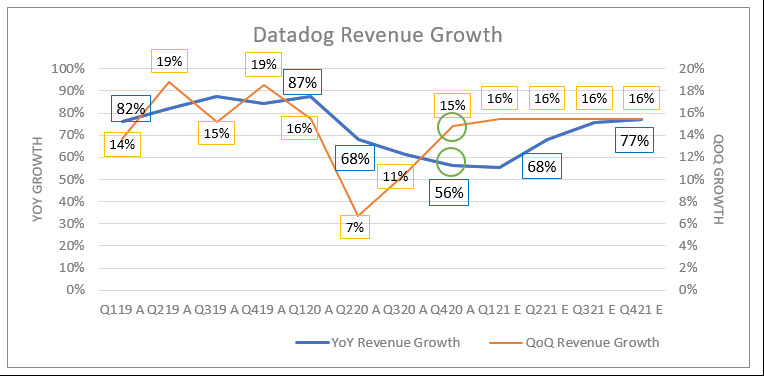

Reporting +56% growth YoY, Q2's result continues to weigh on $DDOG comps, but from Q2 21 $DDOG is positioned to return to ~65-70%+ YoY growth:

Reporting +56% growth YoY, Q2's result continues to weigh on $DDOG comps, but from Q2 21 $DDOG is positioned to return to ~65-70%+ YoY growth:

In 6 months since Q2 $DDOG share price is 'only' up +20%, something of an opportunity cost in this market

Over that time (Q2-4 inc.) $DDOG YoY revenue growth has decelerated from 68% to 56%, while its underlying seq. growth rate (annualised) has reaccelerated from 30% to 74%

Over that time (Q2-4 inc.) $DDOG YoY revenue growth has decelerated from 68% to 56%, while its underlying seq. growth rate (annualised) has reaccelerated from 30% to 74%

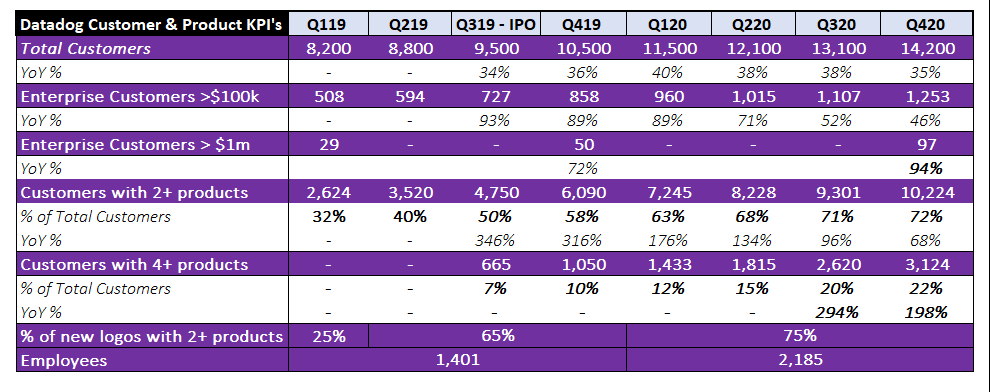

So what is driving $DDOG's revenue growth? Take a look at their customer and product KPI's:

Some observations: (1)

In Q3&4 Datadog reaccelerated new customer wins to pre-pandemic levels, while the value of new logo grows - 75% of new wins sold with 2+ products vs 25% in 2018

Some observations: (1)

In Q3&4 Datadog reaccelerated new customer wins to pre-pandemic levels, while the value of new logo grows - 75% of new wins sold with 2+ products vs 25% in 2018

(2)

Acceleration of Enterprise customers >$1m demonstrates efficacy of product upsell, with management even citing 7 figure upsell to Covid impacted travel co. in Q4

Products at different stages of growth curve, are 'far from full penetrated' and continue to expand

Acceleration of Enterprise customers >$1m demonstrates efficacy of product upsell, with management even citing 7 figure upsell to Covid impacted travel co. in Q4

Products at different stages of growth curve, are 'far from full penetrated' and continue to expand

(3)

Still 'very long runway' for existing products and adding new frictionless products (eg Security)

Azure and GCP partnerships to launch to market in 2021

'Doubling down on observability' 'aggressively adding functionality to products' 'aggressively hiring & ramping sales'

Still 'very long runway' for existing products and adding new frictionless products (eg Security)

Azure and GCP partnerships to launch to market in 2021

'Doubling down on observability' 'aggressively adding functionality to products' 'aggressively hiring & ramping sales'

$DDOG revenue is (generally) predictable, although management admits 'noisier' than normal. My Q3 & Q4 mid-range estimates were within $1-2m of results, Q1 21 estimate ~200m vs $186m guidance

If $DDOG can maintain its current growth rate or is not impacted further by pandemic (eg. repeat of Q2 optimisation), then +65-70% YoY in FY21 is possible vs +38% guidance

If Q1 continues trend, this could set up nicely ahead of softer Q2 comps and likely YoY reacceleration

If Q1 continues trend, this could set up nicely ahead of softer Q2 comps and likely YoY reacceleration

For those asking, all graphs/tables I have done myself in my threads so far - helps to tell the story. Data taken directly from earnings report & call transcripts (eg KPIs table). Estimates = indicative

Read on Twitter

Read on Twitter