$GHVI - a thread on Matterport.

Disclaimers:

1. I dont own shares.

2. I am/was a skeptic - If you search $GHIV and my name on twitter you will see me worried about valuation

3. @plantmath1 and @Innovestor_ have done a good job on valuation & background

4. Dont FOMO

Disclaimers:

1. I dont own shares.

2. I am/was a skeptic - If you search $GHIV and my name on twitter you will see me worried about valuation

3. @plantmath1 and @Innovestor_ have done a good job on valuation & background

4. Dont FOMO

My investment thesis will be based on 5 pillars with data and examples:

1. Digitizing "analog" opportunities is a mega trend

2. "Residential" home owner tours is the "toy" @cdixon

3. Data exhaust makes for follow on opportunities

4. Margin growth

5. Risks: proceed with caution

1. Digitizing "analog" opportunities is a mega trend

2. "Residential" home owner tours is the "toy" @cdixon

3. Data exhaust makes for follow on opportunities

4. Margin growth

5. Risks: proceed with caution

1. Digitizing "Analog"

When "analog" things are digitized, opportunities expand 10X to 100X.

Examples: $AAPL iTunes, $NFLX, $AMZN catalogs

https://en.wikipedia.org/wiki/Digitization

When "analog" things are digitized, opportunities expand 10X to 100X.

Examples: $AAPL iTunes, $NFLX, $AMZN catalogs

https://en.wikipedia.org/wiki/Digitization

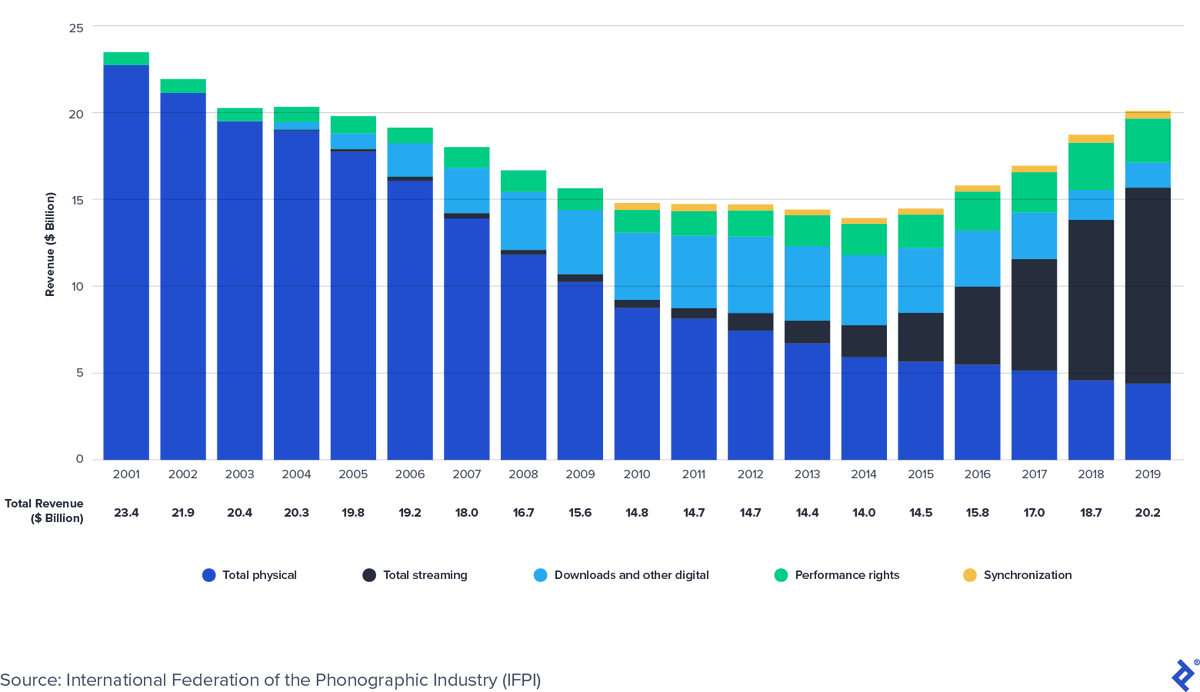

a) $AAPL - CD Sales in 2007 (aka Before IPhone) for albums were 511M with a total market of $18B

With $AAPL iTunes and $SPOT & others, the market is $20B & will grow - not counting free YouTube music videos

( https://www.nytimes.com/2008/01/04/business/media/04music.html)

With $AAPL iTunes and $SPOT & others, the market is $20B & will grow - not counting free YouTube music videos

( https://www.nytimes.com/2008/01/04/business/media/04music.html)

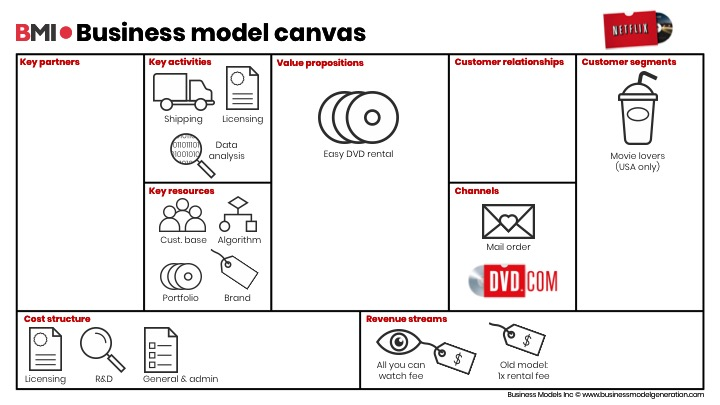

$NFLX In 2007, Netflix started streaming. In 2006, the movie "rental" business was $5.6B with Blockbuster alone at $2.4B

By 2020, $NFLX alone is a $7B business and "digitized" content (movies, TV shows) are a $18B market

https://smallbusiness.chron.com/movie-rental-industry-life-cycles-63860.html

By 2020, $NFLX alone is a $7B business and "digitized" content (movies, TV shows) are a $18B market

https://smallbusiness.chron.com/movie-rental-industry-life-cycles-63860.html

In 2001 Mail order catalog business (buying via physical book catalogs sent to your home) was a $19B business.

Today 3P sales on $AMZN via "catalog" providers alone is $29B in the US

https://multichannelmerchant.com/news/where-are-they-now-the-annotated-first-catalog-age-100/

Today 3P sales on $AMZN via "catalog" providers alone is $29B in the US

https://multichannelmerchant.com/news/where-are-they-now-the-annotated-first-catalog-age-100/

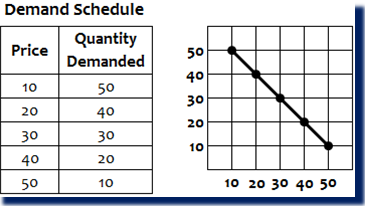

Summary of thesis (1): When you digitize an "analog" operation the market dramatically increases,

because

a) costs of distribution go down

b) costs of new production go down

Leading to

Increased demand OR

Larger Market.

because

a) costs of distribution go down

b) costs of new production go down

Leading to

Increased demand OR

Larger Market.

2. Residential home 3D tours are starting point.

The reason big new things sneak by incumbents is that the next big thing always starts out being dismissed as a “toy.” This is one of the main insights of Clay Christensen’s “disruptive technology” theory. https://cdixon.org/2010/01/03/the-next-big-thing-will-start-out-looking-like-a-toy

The reason big new things sneak by incumbents is that the next big thing always starts out being dismissed as a “toy.” This is one of the main insights of Clay Christensen’s “disruptive technology” theory. https://cdixon.org/2010/01/03/the-next-big-thing-will-start-out-looking-like-a-toy

If you are debating if "home owners" still need to view the home, or post Covid this will be a smaller business -

You are missing the POINT.

This is not about residential home models.

This is about digitizing indoor spaces - residential, commercial, industrial

You are missing the POINT.

This is not about residential home models.

This is about digitizing indoor spaces - residential, commercial, industrial

Go back and read the @cdixon post I shared 2 tweets ago in this thread.

When things such as Matterport start out they look like "Toys". They are "cute" and dismissed by industry insiders as "interesting but not a game changer"

When things such as Matterport start out they look like "Toys". They are "cute" and dismissed by industry insiders as "interesting but not a game changer"

The market is in in Residential (15%) + Commercial including retail (45%) + Industrial (40%).

Digitizing all of them is going to explode the opportunities for this technology.

Dont be fooled by short term thinking that this is about "Zillow 3D home tours".

This is BIGGER

Digitizing all of them is going to explode the opportunities for this technology.

Dont be fooled by short term thinking that this is about "Zillow 3D home tours".

This is BIGGER

Summary of thesis 2: Residential home tours is a starting point. It looks like and feels like a toy but it not.

This can get LARGE - will Matterport be the one?

I dont know, but they have a great shot at being "THE" company in the digitized property world.

This can get LARGE - will Matterport be the one?

I dont know, but they have a great shot at being "THE" company in the digitized property world.

3. Data exhaust creates follow on opportunities.

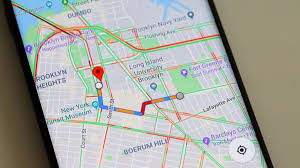

When you create a digital version of something you get more money from the "exhaust" or "meta data" and the "derivative data".

e.g. (a) Google digitized maps - revenue from $UBER, $DASH, etc. + Map data APIs

When you create a digital version of something you get more money from the "exhaust" or "meta data" and the "derivative data".

e.g. (a) Google digitized maps - revenue from $UBER, $DASH, etc. + Map data APIs

"Data exhaust"

e.g. (b) Coredata digitized home purchase data from all 3000+ US counties. They sell this data for analytics, to $OPEN $RDFN $Z, but also to Hedge funds and REITs for derivatives trading

e.g. (b) Coredata digitized home purchase data from all 3000+ US counties. They sell this data for analytics, to $OPEN $RDFN $Z, but also to Hedge funds and REITs for derivatives trading

Summary of thesis 3 - data exhaust.

When $GHIV - Matterport get a significant portion of Residential, Commercial and Industrial properties under digitization it will create new revenue streams.

That means their "projected forecasts" are low and purposely "under promised"

When $GHIV - Matterport get a significant portion of Residential, Commercial and Industrial properties under digitization it will create new revenue streams.

That means their "projected forecasts" are low and purposely "under promised"

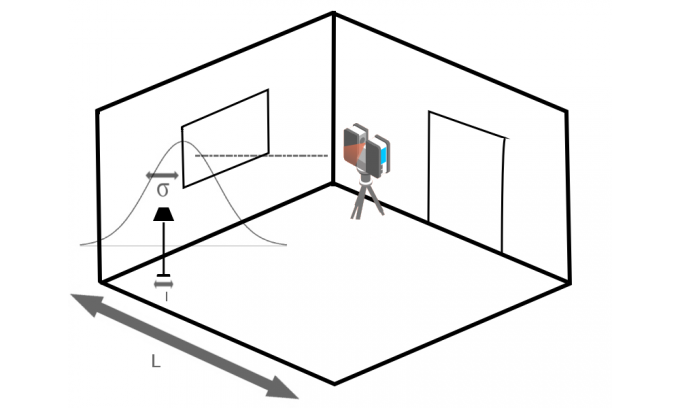

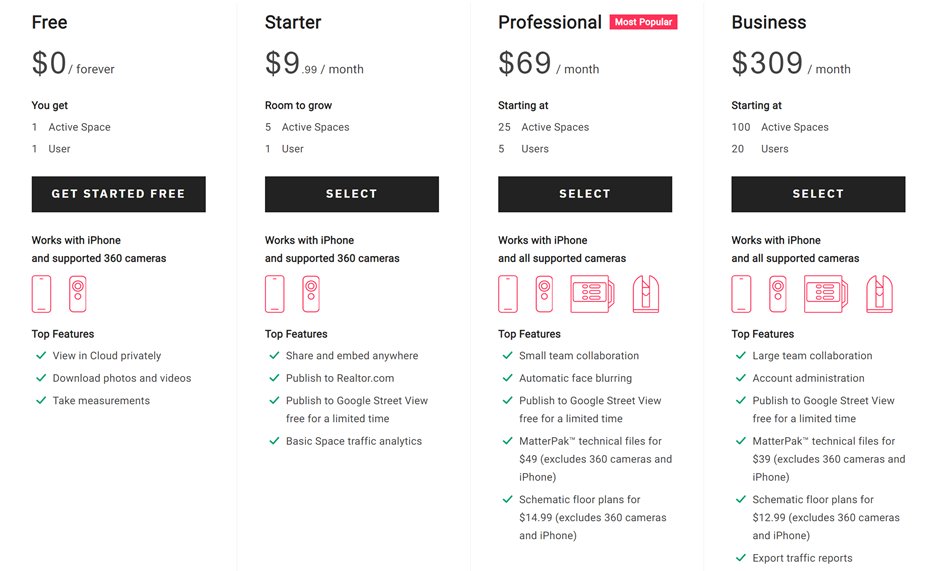

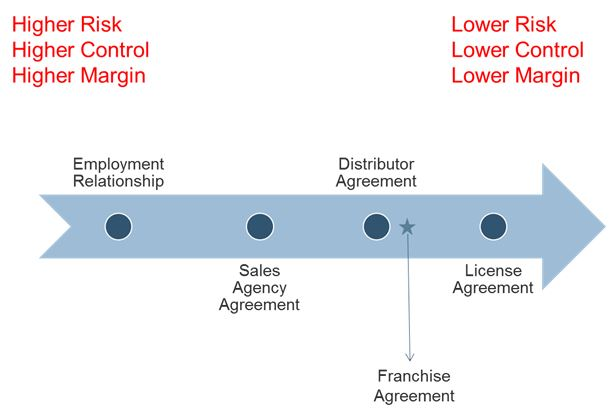

4. Margin growth: Matterport makes money with Hardware (product 3D camera), Software (tagging, imaging) and Storage.

They charge by # of "spaces" managed.

H/W has lower margin than S/W services. When iPhone 20 comes out and has 3D camera + depth built-in this will change

They charge by # of "spaces" managed.

H/W has lower margin than S/W services. When iPhone 20 comes out and has 3D camera + depth built-in this will change

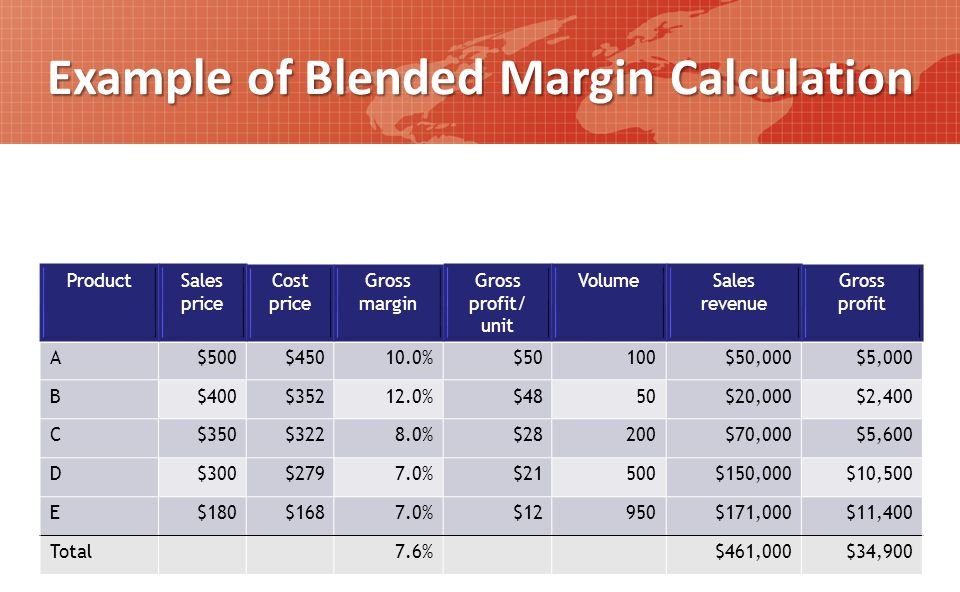

$GHVI Matterport's own camera will reduce in price over time. This will help with margin improvement. S/W margins of 90%+ and H/W margins of 50-60% will result in blended margins of 70% (depending on mix)

Summary of 4 - Margin growth.

Dont get fooled by their current low margin in the business. This is a company with secular movement to Software and services from 3D cameras alone.

This is similar to Apple moving from purely IPhone to Services - Margins on services are higher

Dont get fooled by their current low margin in the business. This is a company with secular movement to Software and services from 3D cameras alone.

This is similar to Apple moving from purely IPhone to Services - Margins on services are higher

5. Risks: I usually answer all questions people ask. If you are still stuck on

"Residential home tours" or

"This is a small market",

I am not going to respond.

You may be right. This investment is NOT for you.

Ignore it and move on would be my best suggestion

"Residential home tours" or

"This is a small market",

I am not going to respond.

You may be right. This investment is NOT for you.

Ignore it and move on would be my best suggestion

5. There are 3 major risks I see.

a) the "digitizing spaces" market is large, which will attract LARGE players aka $MSFT, $GOOG, etc.

Matterport wont want to compete with the large players NOW.

These seem to have bigger fish to fry now is the counter point

a) the "digitizing spaces" market is large, which will attract LARGE players aka $MSFT, $GOOG, etc.

Matterport wont want to compete with the large players NOW.

These seem to have bigger fish to fry now is the counter point

5 Risks

b) $AMZN AWS or $MSFT Azure or $GOOG GCP will commoditize "visual introspection" software technology (AI algorithms) and provide it for "pennies on the dime". For e.g. $TWLO Sendgrid mail or Mailchimp mailgun costs 5-10X $AWS Simple Email Service -

Cloud "Commoditizes"

b) $AMZN AWS or $MSFT Azure or $GOOG GCP will commoditize "visual introspection" software technology (AI algorithms) and provide it for "pennies on the dime". For e.g. $TWLO Sendgrid mail or Mailchimp mailgun costs 5-10X $AWS Simple Email Service -

Cloud "Commoditizes"

5 Risks

c) Matterport is unable to get its distribution figured out before another large company figures out the technology.

This is an ongoing RACE.

Startups figuring out distribution VS

Large incumbents figuring out technology

I think this is a LARGE risk for me.

c) Matterport is unable to get its distribution figured out before another large company figures out the technology.

This is an ongoing RACE.

Startups figuring out distribution VS

Large incumbents figuring out technology

I think this is a LARGE risk for me.

Summary of 5: Risks

3 big risks, of which 2 are "surmountable" or "can be ignored" but I would like to learn about their distribution approach and strategy.

a) FAANGM have other priorities right now

b) Cloud providers have bigger fish to fry.

c) Distribution needs focus

3 big risks, of which 2 are "surmountable" or "can be ignored" but I would like to learn about their distribution approach and strategy.

a) FAANGM have other priorities right now

b) Cloud providers have bigger fish to fry.

c) Distribution needs focus

Notes and References:

a. If you want to hear from others on "What use cases can you see for Matterport in "Industrial and Commercial segments - follow the thread below https://twitter.com/cperruna/status/1361373053792514053

a. If you want to hear from others on "What use cases can you see for Matterport in "Industrial and Commercial segments - follow the thread below https://twitter.com/cperruna/status/1361373053792514053

Notes and References:

b. Ask your self how big can this get https://twitter.com/mukund/status/1361046123259944960

b. Ask your self how big can this get https://twitter.com/mukund/status/1361046123259944960

Read on Twitter

Read on Twitter