2/ As DeFi TVL grows, the need for insurance products and risk management tools only increases. The recent @CreamdotFinance, @AlphaFinanceLab and @iearnfinance exploits highlight this - all acting as free marketing campaigns for projects like @NexusMutual

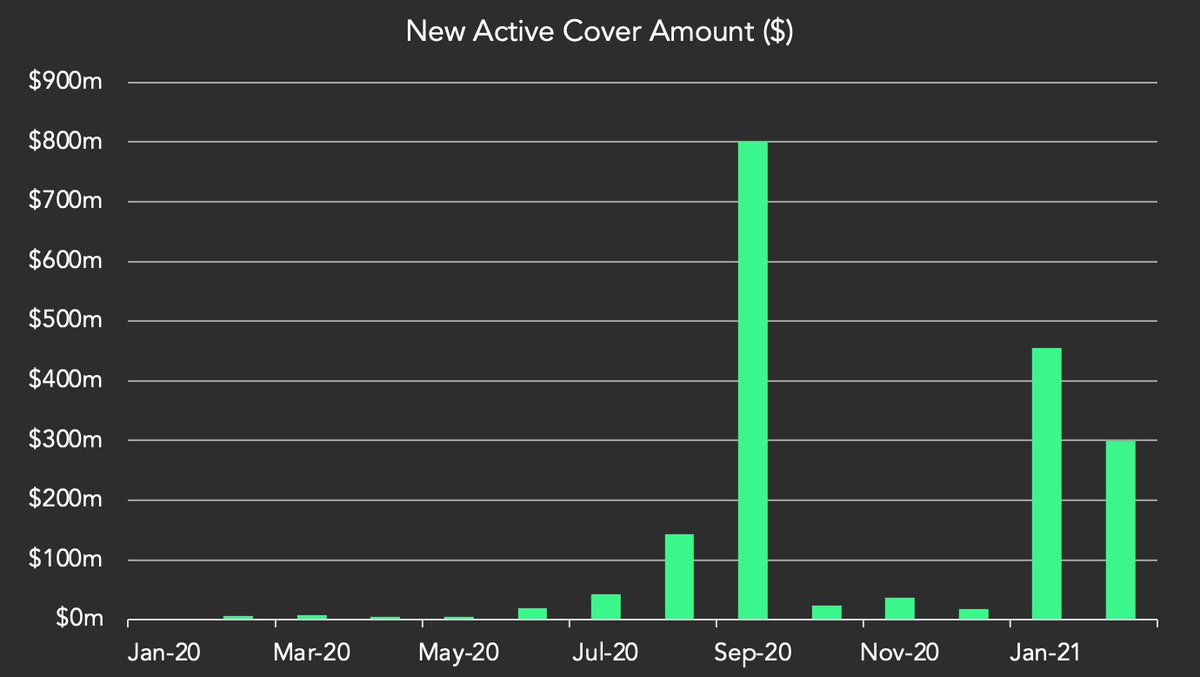

2/ We are now starting to see significant flows of active cover being taken against the mutual - $454m in January alone

3/ This growth has been driven by a wider range of cover types, increased capacity for popular smart contract, as well as 'emerging' brokers like @ArmorFi who act as insurance distributors for @NexusMutual https://twitter.com/ArmorFi/status/1360928473548804098?s=20

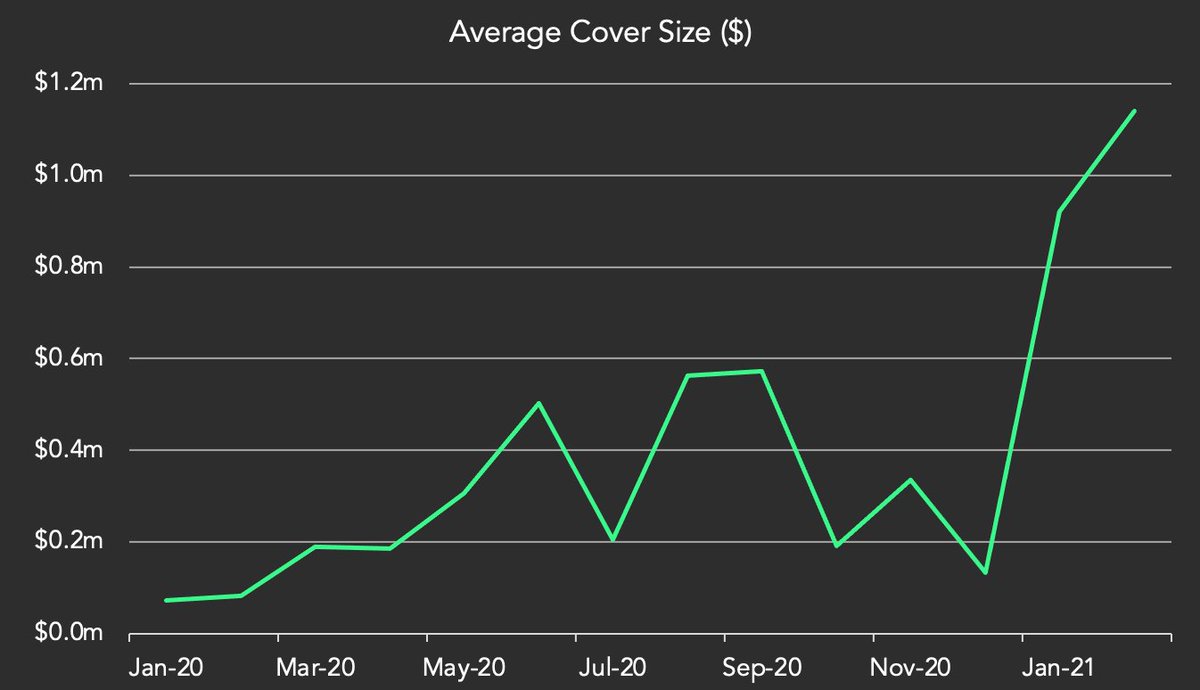

4/ The size in average cover is now trending with rising stakes in DeFi. Average cover size on @NexusMutual is now $1.1m. Higher cover amounts means the mutual is becoming a moat for trust, not just liquidity.

5/ As new cover grows, so do the fees that flow into the mutual. Why is this important? Because fees are the long-term source of growth for @NexusMutual @Delphi_Digital https://twitter.com/Delphi_Digital/status/1300878972826398720?s=20

6/ That is why accessibility is equally important. Brokers like @ArmorFi that allow for non-KYC cover underwritten by @NexusMutual will be a primary driver for the demand side. https://twitter.com/DeFi_Dad/status/1361002117834678275?s=20

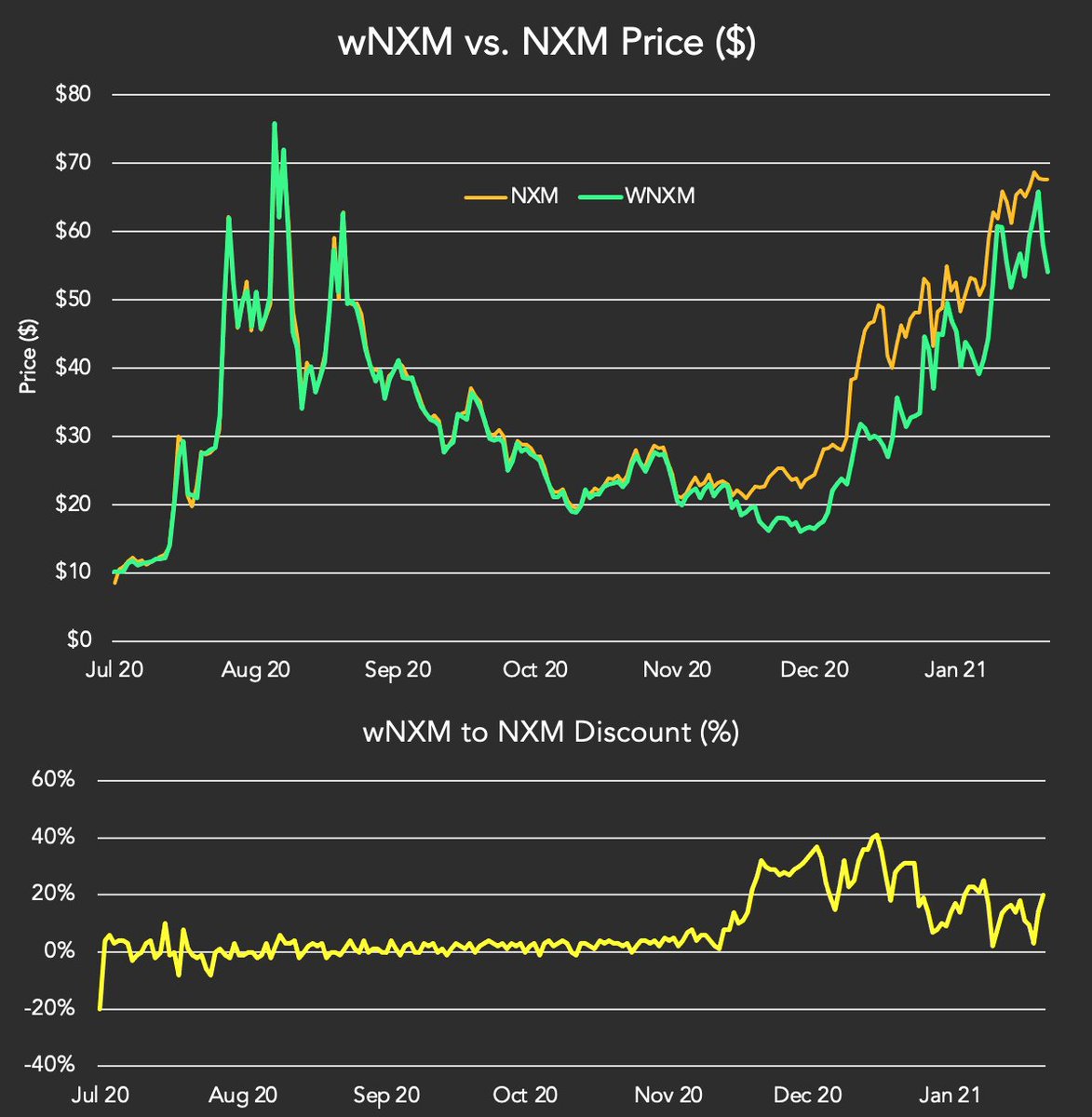

7/ Despite the recent cover growth, $wNXM has been trading at a discount to $NXM for months. With the MCR% at 100%, arbs are unable to realise any profit. When the MCR% *does* increase, NXM holders are opting to sell out via the bonding curve when they get a chance.

8/ So it seems as though the market might be future discounting @NexusMutual's prospects as well as the insurance sector as a whole. So what can help drive the mutual's TVL beyond cover fees? Capital pool yield. @jdorman81

9/ The mutual will be able receive yield on its $865m capital pool. The code has been audited and the community is to decide on its investment strategy over the coming months. https://forum.nexusmutual.io/t/investing-the-mutuals-assets/249

10/ The mutual will likely start making <10% of its capital productive with the aim to increase this up to 90% over time - the remaining 10% being used to pay claims from. https://forum.nexusmutual.io/t/investment-strategy-framework-eth2-staking/363

11/ As the yield increases the size of the capital pool, the bonding curve dictates that the MCR% (the short-term driver of $NXM) also increases all else equal. In other words, mutual members stand to benefit from capital pool yield directly.

12/ Insurance is a sector that is both necessary and primed for growth. Just as in CeFi, it's clear insurance will be foundational pillar in this new parallel financial system, aiding in the continued growth and maturation of DeFi.

{fin}

{fin}

Read on Twitter

Read on Twitter