$GHVIU Matterport is a spatial data company focussing on digitising real estate and was founded in 2011 by Matt Bell & Dave Gausebeck

It runs a 3D data platform that turns a space into an accurate and immersive digital twin that can be used to design and render any space

It runs a 3D data platform that turns a space into an accurate and immersive digital twin that can be used to design and render any space

It runs a 3D data platform that turns a space into an accurate and immersive digital twin that can be used to design and render any space

It runs a 3D data platform that turns a space into an accurate and immersive digital twin that can be used to design and render any space

The company started by selling $ 4500 professional VR cameras but quickly made the switch towards mobile

Today, users can create a virtual twin of any space they want by using their iPhone’s camera https://techcrunch.com/2015/06/25/matterport/

Today, users can create a virtual twin of any space they want by using their iPhone’s camera https://techcrunch.com/2015/06/25/matterport/

Today, users can create a virtual twin of any space they want by using their iPhone’s camera https://techcrunch.com/2015/06/25/matterport/

Today, users can create a virtual twin of any space they want by using their iPhone’s camera https://techcrunch.com/2015/06/25/matterport/

With its solutions, Matterport mainly targets the B2B sector such as the hospitality, industrial and real estate markets

Enabling these to maximise customer engagement, improve quality, reduce costs and decrease risks

Enabling these to maximise customer engagement, improve quality, reduce costs and decrease risks

Enabling these to maximise customer engagement, improve quality, reduce costs and decrease risks

Enabling these to maximise customer engagement, improve quality, reduce costs and decrease risks

It now serves over 250,000 customers in over 150 countries, customers include:

$RDFN

$RDFN

$ABNB

$ABNB

$MSFT

$MSFT

$H

$H

$JLL

$JLL

$RDFN

$RDFN $ABNB

$ABNB $MSFT

$MSFT $H

$H $JLL

$JLL

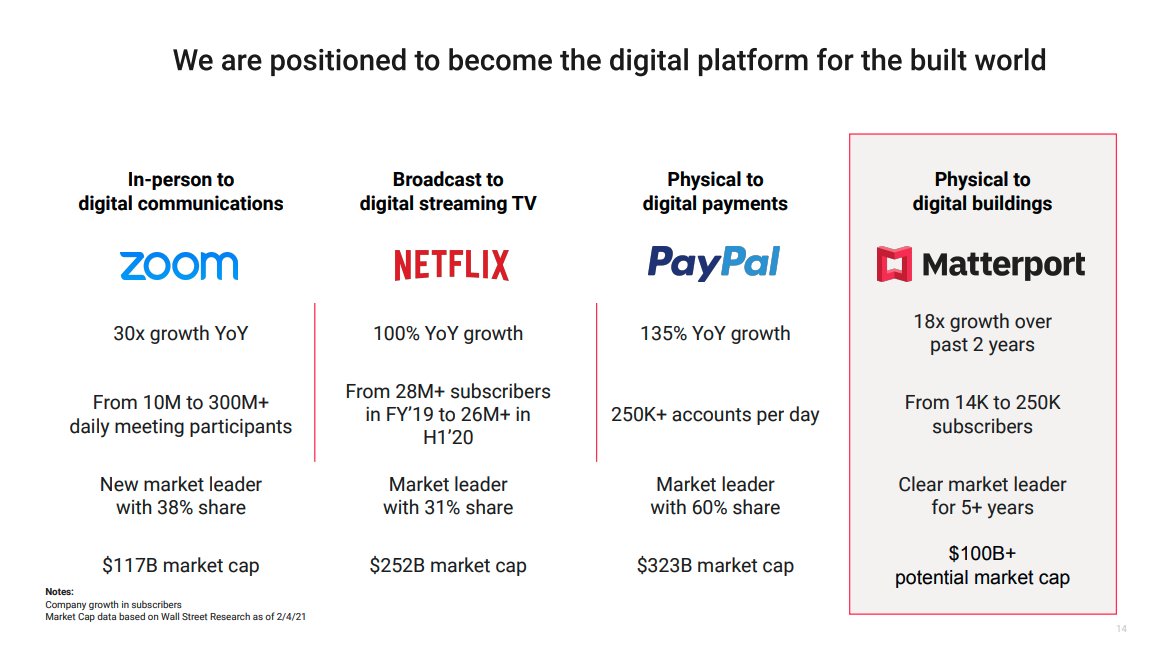

Matterport pitches itself as the $ZM $NFLX and $PYPL of its industry - enabling a shift from physical interactions to a digital platform

In the long run, the company aims to become a $ 100B company - supported by its market leading position, innovative solution fast growth

In the long run, the company aims to become a $ 100B company - supported by its market leading position, innovative solution fast growth

In the long run, the company aims to become a $ 100B company - supported by its market leading position, innovative solution fast growth

In the long run, the company aims to become a $ 100B company - supported by its market leading position, innovative solution fast growth

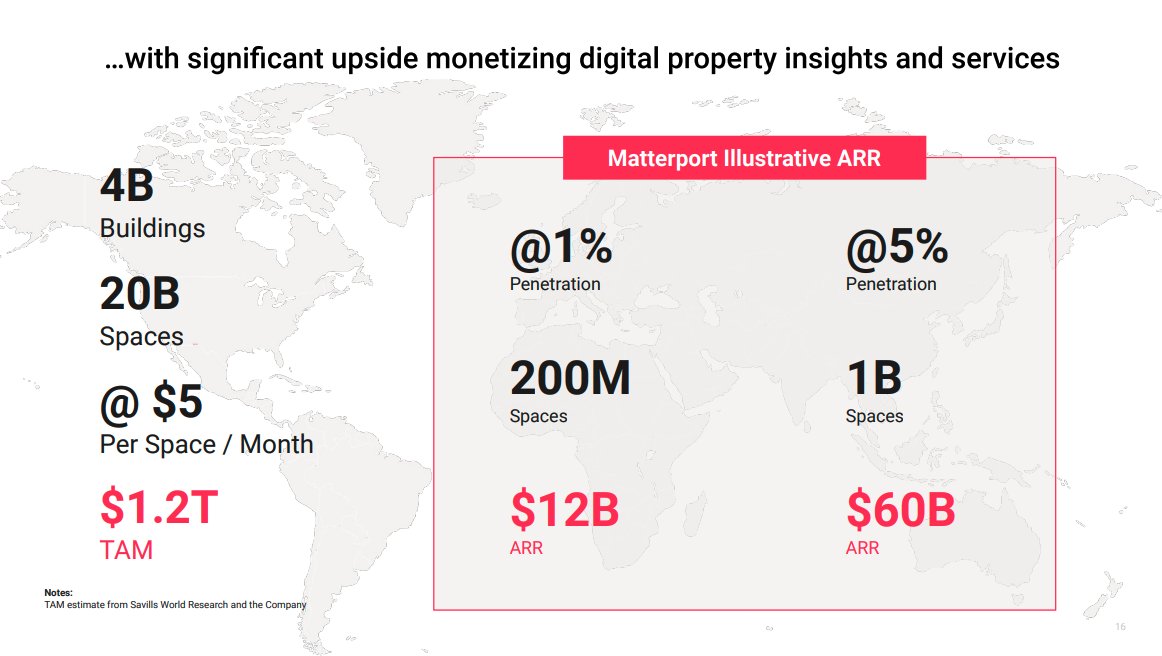

The valuation is further supported by the online shift of real estate and by additional monetisation possibilities (data, services)

Matterport could reach $ 60B in annual sales by capturing 1B spaces - or 5% of total addressable market

Matterport could reach $ 60B in annual sales by capturing 1B spaces - or 5% of total addressable market

Matterport could reach $ 60B in annual sales by capturing 1B spaces - or 5% of total addressable market

Matterport could reach $ 60B in annual sales by capturing 1B spaces - or 5% of total addressable market

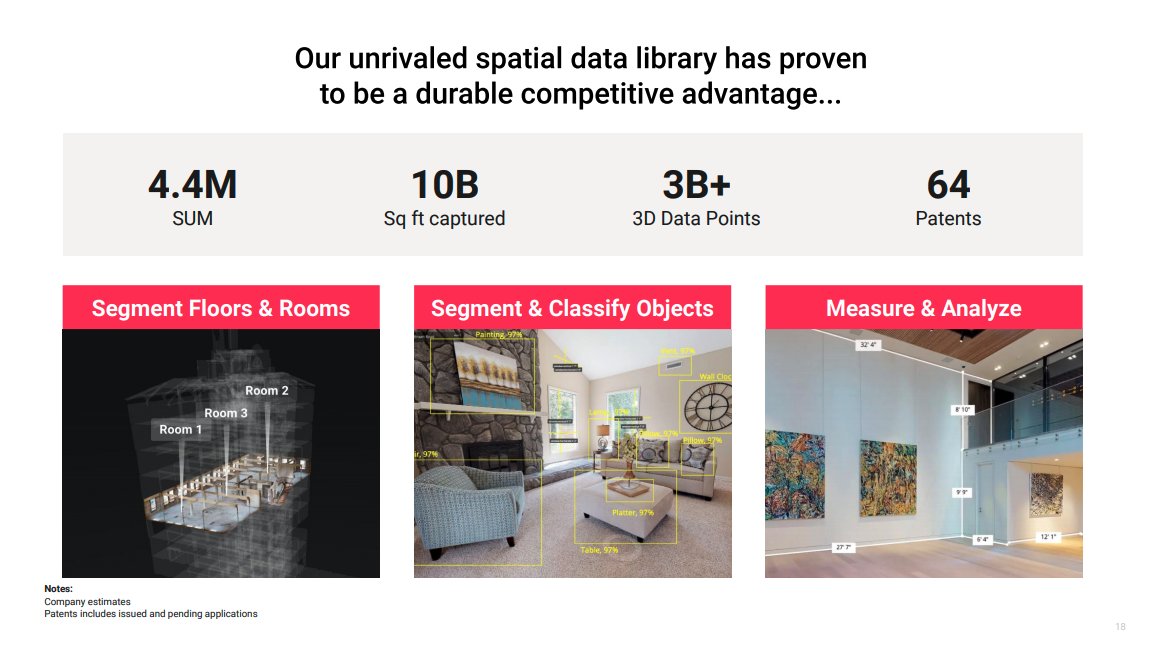

Matterport has gained a significant competitive advantage by compiling a spatial library based on over 10B sq ft of real estate

It is able to segment a home’s rooms, classify objects and measure spaces

It is able to segment a home’s rooms, classify objects and measure spaces

It is able to segment a home’s rooms, classify objects and measure spaces

It is able to segment a home’s rooms, classify objects and measure spaces

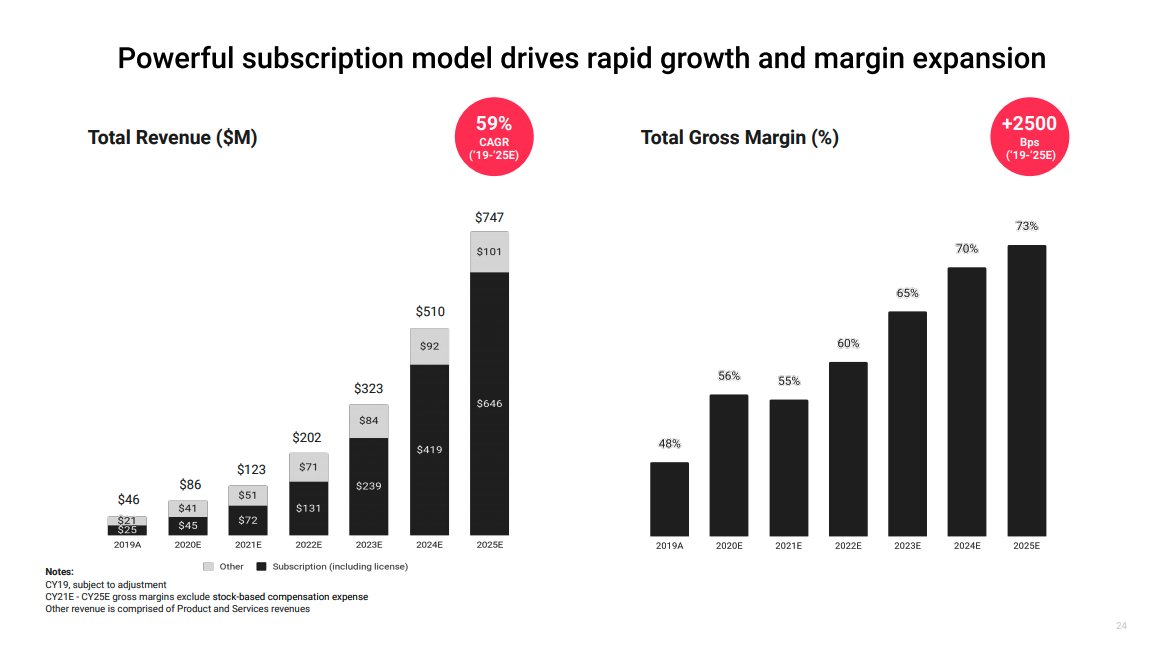

On the financial side, revenue is expected to grow 87% from 2019 to 2020 with sales reaching $ 86m in 2020

Net revenue retention stands at 112% and the company scores 82% subscription gross margins

Net revenue retention stands at 112% and the company scores 82% subscription gross margins

Net revenue retention stands at 112% and the company scores 82% subscription gross margins

Net revenue retention stands at 112% and the company scores 82% subscription gross margins

By 2025, the company expects its sales to reach $ 747m, up from $ 46m in 2019 - for a 59% CAGR over the same period

Matterport also expects it gross margins to reach 73% by 2025, up from 48% in 2019

Matterport also expects it gross margins to reach 73% by 2025, up from 48% in 2019

Matterport also expects it gross margins to reach 73% by 2025, up from 48% in 2019

Matterport also expects it gross margins to reach 73% by 2025, up from 48% in 2019

Matterport will go public at a $ 2.3B Enterprise Value (49 times 2019 sales and 26 times 2020 sales) through the Gores Holding VI SPAC

The SPAC is lead by Alex Gores, an investor active in private equity and best known for its leveraged buyouts of technology firms

The SPAC is lead by Alex Gores, an investor active in private equity and best known for its leveraged buyouts of technology firms

The SPAC is lead by Alex Gores, an investor active in private equity and best known for its leveraged buyouts of technology firms

The SPAC is lead by Alex Gores, an investor active in private equity and best known for its leveraged buyouts of technology firms

Bottom Line

Bottom Line

At a $ 2.3B enterprise value, the $GHVIU SPAC offers a reasonably priced entry into the fast growing “digital real estate” segment

At a $ 2.3B enterprise value, the $GHVIU SPAC offers a reasonably priced entry into the fast growing “digital real estate” segment Matterport is set to grow by 59% (company projections) over the next 5 years while growing its gross margins

Matterport is set to grow by 59% (company projections) over the next 5 years while growing its gross margins

Matterport is pioneer in its sector and has a considerable lead over competition

Matterport is pioneer in its sector and has a considerable lead over competition Giants such as Apple and Google are making inroads into AR and my supplant Matterport’s solution

Giants such as Apple and Google are making inroads into AR and my supplant Matterport’s solution

We stay on the sidelines for now and wait for the merger to close

We stay on the sidelines for now and wait for the merger to closeDon’t MISS any UPDATE on $GHVIU

Subscribe NOW

Subscribe NOW  https://getbenchmark.substack.com/

https://getbenchmark.substack.com/

Read on Twitter

Read on Twitter