Ladies and gentlemen, $STIC

The company got some hype out of the gate but things have gotten quiet. I am here to hype up the masses.

BarkBox is going public via SPAC, trading as $STIC currently, & will eventually trade as $BARK

Not inv. advice

The company got some hype out of the gate but things have gotten quiet. I am here to hype up the masses.

BarkBox is going public via SPAC, trading as $STIC currently, & will eventually trade as $BARK

Not inv. advice

The company is something like the nexus of $SFIX and $CHWY. They provide (i) a monthly subscription service that delivers unique meals, toys, & treats for your pup, (ii) a standalone web store (iii) & a blog for dog owners. As far as I can see, the company has 6 key segments -->

-BarkBox: toys and treats based on a monthly theme (subscription)

-BarkShop: operates as an e-com platform, selling toys, dog care products, and more (standalone non-recurring basis)

-BarkBright: dental care - toothpaste and dental chews (sub)

-BarkShop: operates as an e-com platform, selling toys, dog care products, and more (standalone non-recurring basis)

-BarkBright: dental care - toothpaste and dental chews (sub)

-BarkEats: custom formulated dog food (sub)

-SuperChewer: seemingly made for bigger dogs, offers ""2 tough toys, 2 meaty chews, and 2 bags of treats"" (sub)

-BarkPost: operates a blog on dogs (looks to be all internally written material, wish they would open it up to all owners)

-SuperChewer: seemingly made for bigger dogs, offers ""2 tough toys, 2 meaty chews, and 2 bags of treats"" (sub)

-BarkPost: operates a blog on dogs (looks to be all internally written material, wish they would open it up to all owners)

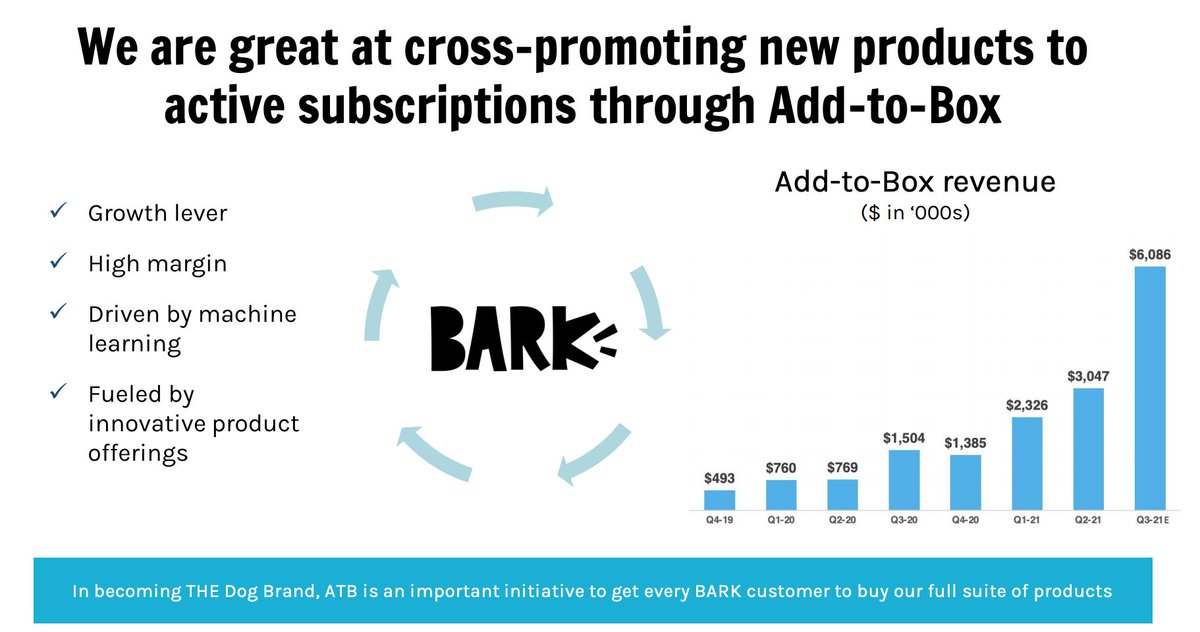

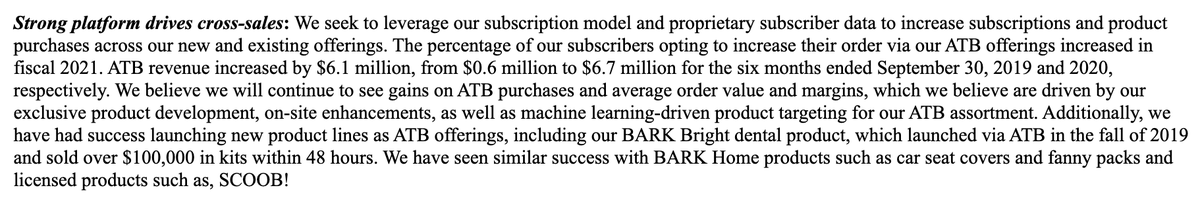

Note: the company has an add-to-box (""ATB"") feature that allows consumers to add specific items to their customized boxes. These can be done on a 1-off or recurring basis.

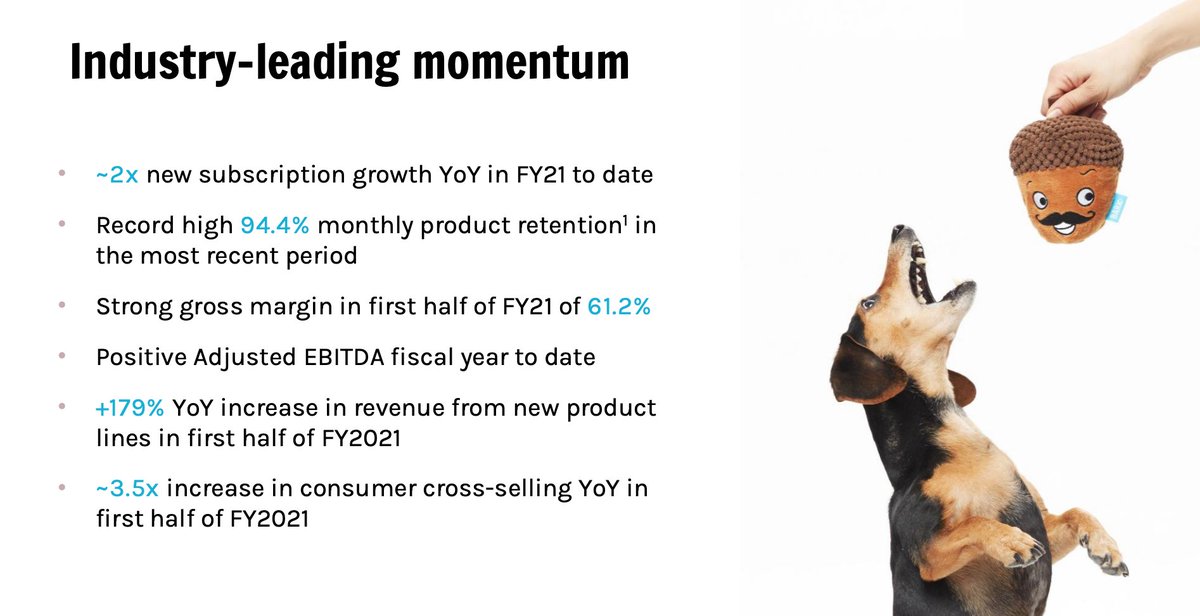

Phenomenally, ATB rev has increased over 300% in Q3 on a YoY basis and 296% for Q2 YoY!

Phenomenally, ATB rev has increased over 300% in Q3 on a YoY basis and 296% for Q2 YoY!

The company makes their own toys and own food and can therefore offer customers unique value (i.e. $45 worth of value in a box that only costs $30). As of Sep 2020, the Co was serving 1+ million dogs monthly. For reference, c. 63m households in the US own dogs. 90+% WHITESPACE!!!

By creating all products in house &managing the sales process, they have created a treasure trove of data and are continuously building a direct relationship with customers; proven by 8.5m social media followers, 11m email contacts and 40% email open rate vs. 19% industry avg

The flywheel accelerates as the company uses that data in concert with an in-house design team to build new products. The design team has been recognized by Time, Fast Company, & more. Producing in house should lead to substantial operating leverage & economies of scale over time

While D2C makes up the majority of the companies revenue (91%), they are expanding via traditional retail & e-com. The Company's products can be bought individually online (BarkShop, $AMZN) or in store via the Company's retail partners ($TGT, $COST, $BBBY, $CVS, PetCo, PetSmart)

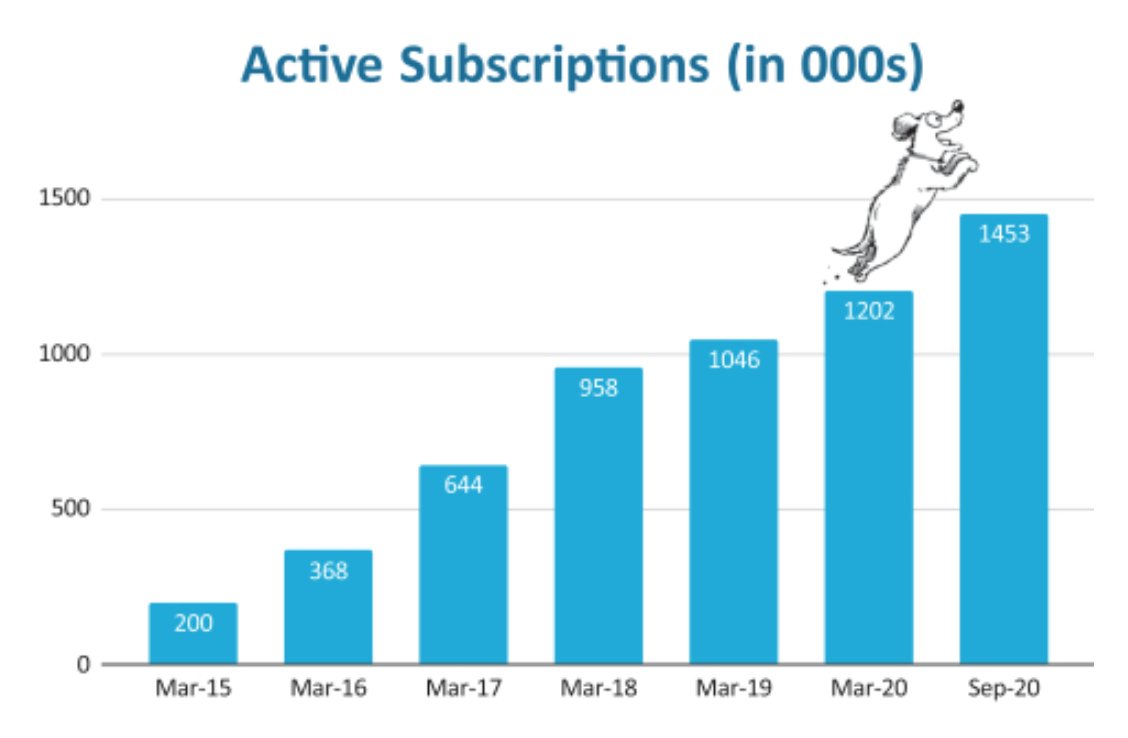

Since 2015 (Mach) to 2020 (Sep.) the company has posted active sub growth of c. 50% p.a. That is strong sustained growth. The Company saw a big boost during peak COVID times, Q2 & Q3 2020, proven by 554k new subs relative to 244k new subs over Q2 & Q3 of 2019.

Over the those 2 hot quarters for the company, churn averaged 5.9%. Despite this, the company increased overall net subs from 1.2m as of March 2020 to 1.5m as of Sep. 2020, an increase of 25%.

For context, subscription retail has been quoted as having churn as high as 40%

For context, subscription retail has been quoted as having churn as high as 40%

Market detail:

The overall pet spend is estimated at $95.7b in 2019, estimated at $99.0b in 2020 representing a steady increase of 3.5% (not bad, not great)

*March 2020 e-commerce pet food sales jumped 77% higher YoY for the month, compared to 26% for brick-and-mortar

The overall pet spend is estimated at $95.7b in 2019, estimated at $99.0b in 2020 representing a steady increase of 3.5% (not bad, not great)

*March 2020 e-commerce pet food sales jumped 77% higher YoY for the month, compared to 26% for brick-and-mortar

Market detail (2):

63m homes have a dog (1 in every 2 American homes) -- LARGE TAM

*the company currently serves c. 1m dogs, they state, "we therefore believe we have an opportunity to significantly extend our customer base to other dogs, both in the U.S. and globally"

63m homes have a dog (1 in every 2 American homes) -- LARGE TAM

*the company currently serves c. 1m dogs, they state, "we therefore believe we have an opportunity to significantly extend our customer base to other dogs, both in the U.S. and globally"

Future growth:

In addition to traditional upsell, cross-sell, and new customer adds, the company sees a few interesting growth vectors:

1) International - ""We plan to assess timing of global expansion to take the BARK brand global and serve international dog parents""

In addition to traditional upsell, cross-sell, and new customer adds, the company sees a few interesting growth vectors:

1) International - ""We plan to assess timing of global expansion to take the BARK brand global and serve international dog parents""

2) New product launches -the Co is able to leverage existing customers to test new products as ATB. For instance, BARK Bright dental kit was initially marketed exclusively to BarkBox and Super Chewer subscribers and sold over $100,000 in kits within 48 hours of launch.

3) Grow retail: the Co sells products in more than 23,000 retail store locations and has marketing partnerships with brands (i.e.Subaru, Dunkin Donuts, Anheuser Busch) and intends to grow retail partnerships, significantly increasing reach and brand awareness.

4) (MY PERSONAL REQUEST) I'd love to see the company expand to serve cats. I do not know the cat mkt well and personally prefer dogs, but I do know there are a lot of cat owners; c. 30m in the US. Big mkt with lots of opportunity.

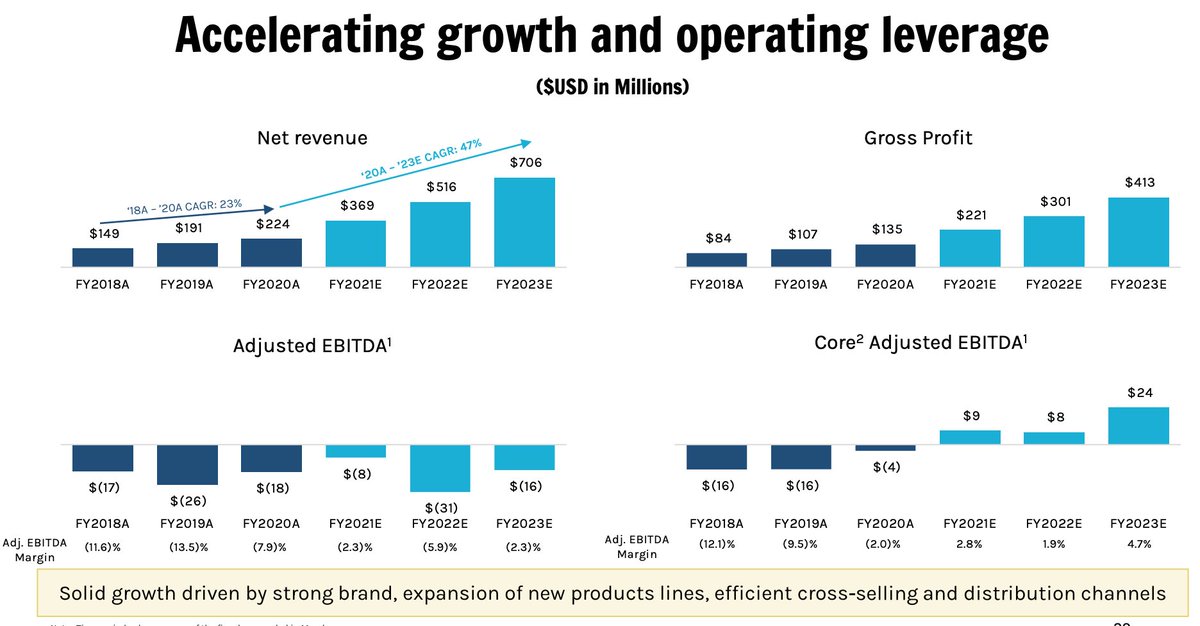

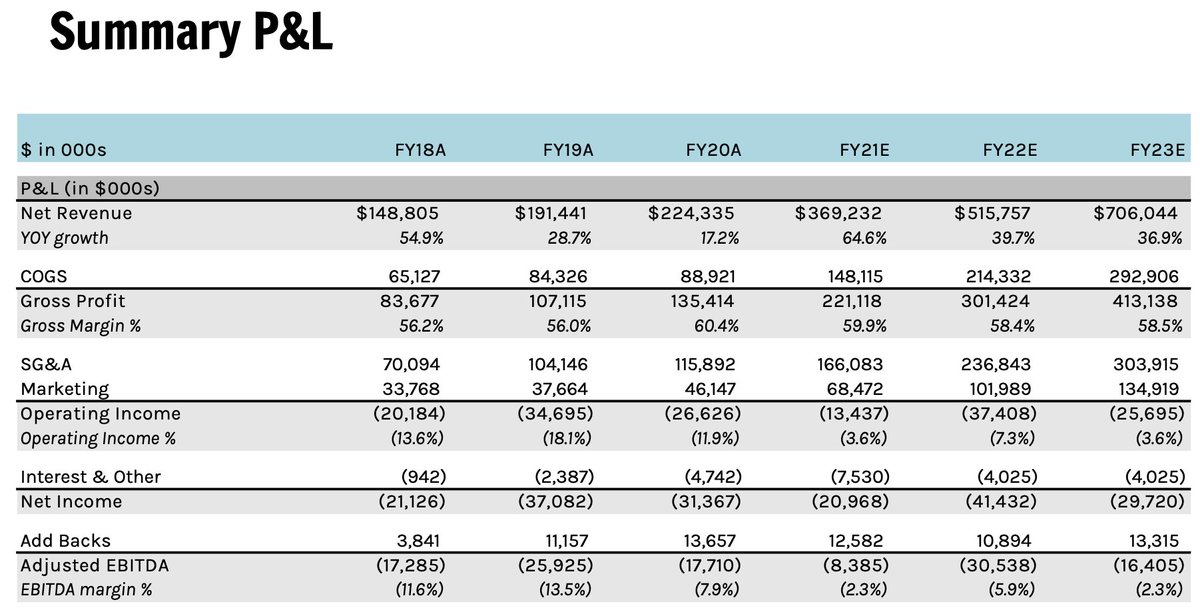

Financials:

Rev -> $224m ('20A), $369m ('21P) -- (64% YoY)

GM -> 60% ('20A), 60% ('21P)

Val -> pps of $15.22, implying EV of $2.699b; 12x LTM rev, 7.3x NTM rev.

Cheap in this mkt, given the projected growth and strong margins

Rev -> $224m ('20A), $369m ('21P) -- (64% YoY)

GM -> 60% ('20A), 60% ('21P)

Val -> pps of $15.22, implying EV of $2.699b; 12x LTM rev, 7.3x NTM rev.

Cheap in this mkt, given the projected growth and strong margins

Although the first comps that come to mind (& are in the investor pres.) are $CHWY, $FRPT, and $TRUP due to their connection to the pet space, I do not feel they are perfect comps. Different biz models, different margin & growth profiles, but same industry and customer base.

In order to compare these companies, it is best to do so on a GP basis (showing EV/'21GP & EV/'22GP; could also adjust multiples for growth):

$STIC: 12.2x / 9.0x

$CHWY: 27.7x / 21.5x

$FRPT: 36.4x / 27.9

$TRUP: 38.6x / 31.1x

Adjust these for growth and the disparity grows larger

$STIC: 12.2x / 9.0x

$CHWY: 27.7x / 21.5x

$FRPT: 36.4x / 27.9

$TRUP: 38.6x / 31.1x

Adjust these for growth and the disparity grows larger

Concisely, I believe that Bark is well positioned to leverage data in a high value market to serve a large and growing TAM. They are undervalued relative to peers and still have significant growth levers to pull. Nothing in investing is automatic, but this seems like a slam dunk

Final thoughts:

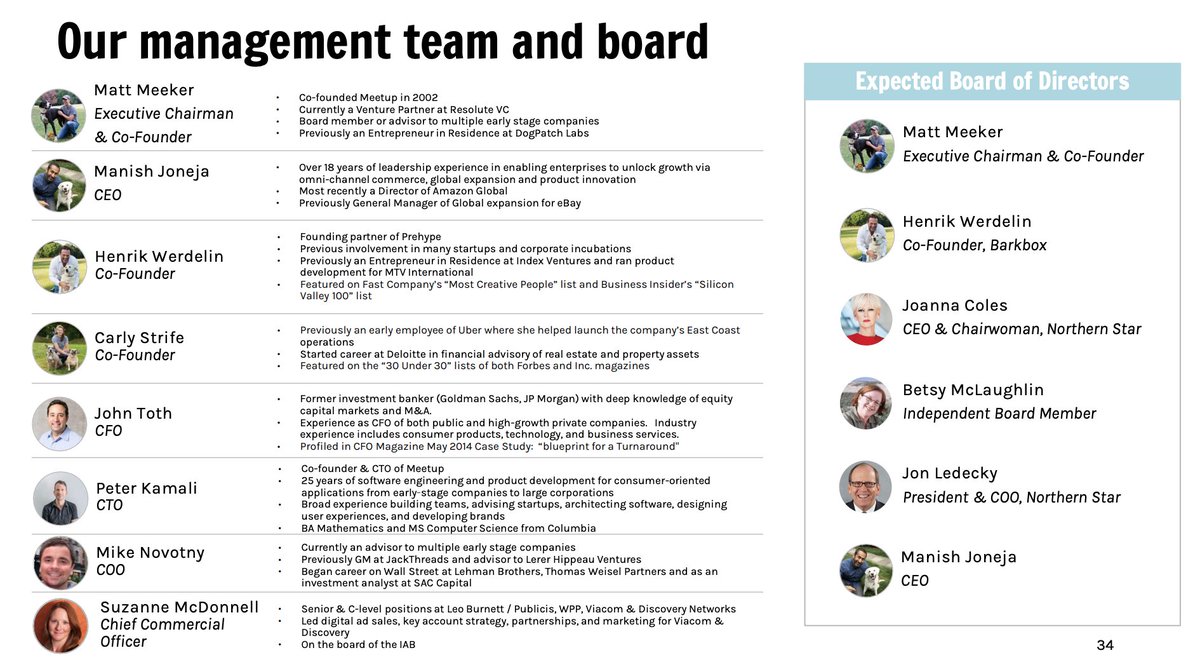

1) all 3 co-founders are still involved but CEO is now Manish Joneja who most recently was a director of Amazon Global (good for the global growth thesis)

2) Balance sheet looks good, net debt is -$375 (net cash position)

1) all 3 co-founders are still involved but CEO is now Manish Joneja who most recently was a director of Amazon Global (good for the global growth thesis)

2) Balance sheet looks good, net debt is -$375 (net cash position)

3) The data the company has built up is INVALUABLE and shows in their ability to launch new products and drive ATB revenue.

4) Bark sales on $AMZN are up 2.5x YoY, proving ability to succeed selling through a platform. This could be big for int'l growth.

4) Bark sales on $AMZN are up 2.5x YoY, proving ability to succeed selling through a platform. This could be big for int'l growth.

5) Gross margins in 2021FY are outperforming company projections; also showing pos adj EBITDA despite the investor presentation assuming neg adj EBITDA through 2023

6) GP per box and CAC are both moving in the right direction. Think a big Q is coming whenever they announce

6) GP per box and CAC are both moving in the right direction. Think a big Q is coming whenever they announce

Whenever the merger date gets set I think the ball starts rolling quickly. Still time to hop aboard the $STIC train but the doors are closing...

Read on Twitter

Read on Twitter