1/ Little thread about @saffronfinance_ and @Barn_Bridge below and why I believe risk mitigation platforms are an overlooked niche in DeFi

2/ With the raising institutional interest in the last couple of weeks, i'm still surprised how narrative hasn't shifted for what could be a door opening projects for more risk averse investors (TradFi) chasing exposure in crypto or DeFi

3/ check @Privatechad_ thread about securitization and tranching by http://saffron.finance to understand the concept. nicely explained, simple enough for anyone to digest https://twitter.com/Privatechad_/status/1356309323354398720?s=20

4/ Altough @saffronfinance_ and @Barn_Bridge took different approaches on how to develop their projects, each with its pros and cons, I do believe both should be taken into a consideration if you're in search for another DeFi blue chip

5/ Saffron launched fairly and straight away with the product but had sc issues early. Team reacted promptly, handled the situation professionally and kept delivering. I gave $sfi a slight first mover advantage here

6/ Barnbridge was ''farm to dump'' for a certain time but potential fundamental catalysts (as well as positive market sentiment) reflected on the price last couple of weeks so it started to catch up

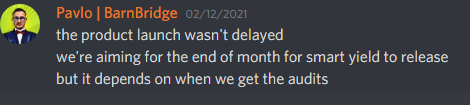

7/ To reduce the risk of smart contract fail (5/ ^), Barnbridge went for an "audit first" approach. Code for their main product, Smart Yield Bonds, is done and currently under audit by @OpenZeppelin - expected release is by the end of the month.

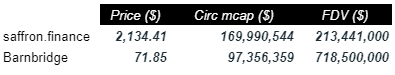

8/ It's hard to find a sector in DeFi that hasn't yielded blue chips valued billions of $. $bond and $sfi still look tiny in that regards

9/ Potential FA catalysts for both:

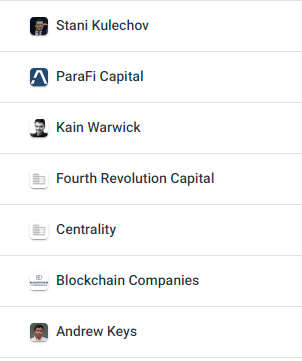

a) Announcement of latest funding rounds investors.

Barnbridge was funded by notable names in September (list below) but apparently they had still undisclosed rounds in November and December.

https://www.crunchbase.com/funding_round/barnbridge-seed--f4e698fb

a) Announcement of latest funding rounds investors.

Barnbridge was funded by notable names in September (list below) but apparently they had still undisclosed rounds in November and December.

https://www.crunchbase.com/funding_round/barnbridge-seed--f4e698fb

9/ same applies for @saffronfinance_ . Investors yet to be disclosed. Whoever did a minimum research can already guess some of them https://twitter.com/Privatechad_/status/1356309982409617411?s=20

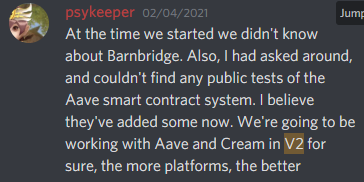

9/ b) Products launches, releases and integrations.

Smart Yield launch for Barnbridge and V2 with integrations for saffron

Smart Yield launch for Barnbridge and V2 with integrations for saffron

9/ c) Possible listings

None of two is listed on any notable cex yet and is hard to imagine it will stay so for long. Barnbridge ie., was added to @coinbase custody quickly after launch

https://custody.coinbase.com/assets

None of two is listed on any notable cex yet and is hard to imagine it will stay so for long. Barnbridge ie., was added to @coinbase custody quickly after launch

https://custody.coinbase.com/assets

10/ As the market is hyper sensitive at the moment and even small catalysts lead to nice price appreciation, I believe those two are decent enough to consider for a short/mid term investment. As always - DYOR

11/ To close this one down

Although stretched let me spark a narrative again:

"60% of Global debt yielding less than 1% & over $15 trillion of global debt yielding negative rates."

How long before some of them decide to get a taste of DeFi yields?

https://medium.com/barnbridge/introducing-barnbridge-3f0015fef3bb

Although stretched let me spark a narrative again:

"60% of Global debt yielding less than 1% & over $15 trillion of global debt yielding negative rates."

How long before some of them decide to get a taste of DeFi yields?

https://medium.com/barnbridge/introducing-barnbridge-3f0015fef3bb

Read on Twitter

Read on Twitter