Prem Watsa moved to Canada in his 20s, and built a $12 billion insurance empire from nothing

now he’s back to disrupt the insurance game in India.

His bet?

newly minted unicorn, Digit Insurance.

Quick

now he’s back to disrupt the insurance game in India.

His bet?

newly minted unicorn, Digit Insurance.

Quick

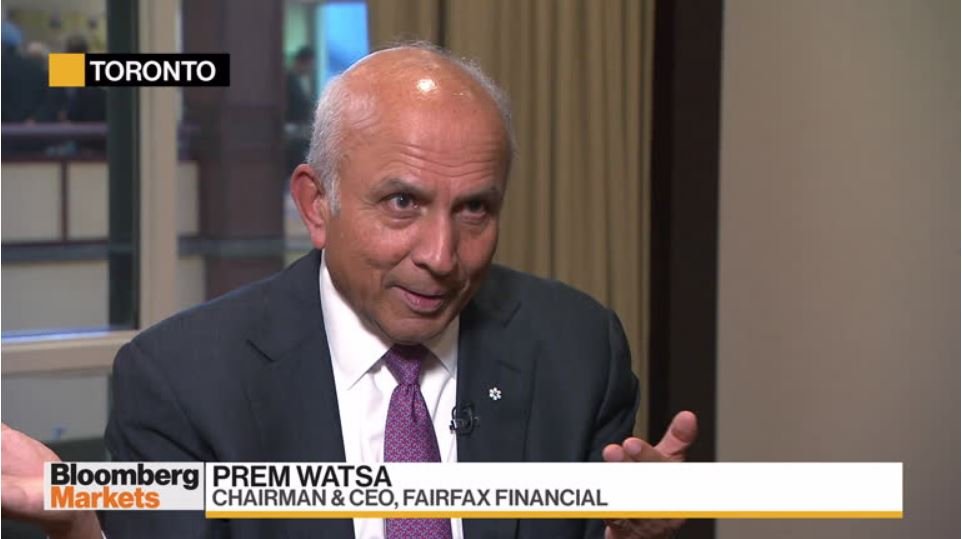

2) Prem Watsa is known as the “Warren Buffett of Canada”.

He is the founder and CEO of Fairfax Financial, an insurance behemoth with over $10 billion in annual revenues

Prem grew up in Hyderabad and attended IIT Madras for Chemical Engineering.

He is the founder and CEO of Fairfax Financial, an insurance behemoth with over $10 billion in annual revenues

Prem grew up in Hyderabad and attended IIT Madras for Chemical Engineering.

3) Unable to get into the IIMs in his first attempt, Prem decided to pack bags to stay with his brother in Canada.

There he enrolled in an MBA program, and began working on the sides to pay bills — including selling furnaces and air conditioners at one time

There he enrolled in an MBA program, and began working on the sides to pay bills — including selling furnaces and air conditioners at one time

4) When the MBA ended, Watsa got a job at Confederation Life, a Canadian financial services giant.

Prem started as a junior research analyst, and over time went on to become a portfolio manager there, spending the next 10 years at the company.

Prem started as a junior research analyst, and over time went on to become a portfolio manager there, spending the next 10 years at the company.

5) It was here that Prem was introduced to the gospel of “value investing”

an approach pioneered by legendary investors Ben Graham, Warren Buffet, and Charlie Munger that focuses on finding and investing in underappreciated public companies.

an approach pioneered by legendary investors Ben Graham, Warren Buffet, and Charlie Munger that focuses on finding and investing in underappreciated public companies.

6) With some cash saved up over those 10 years, Watsa decided to put his value investing learnings to work.

He rolled out his own investment house called the Hamblin Watsa Investment Counsel, in partnership with his boss at the old company

He rolled out his own investment house called the Hamblin Watsa Investment Counsel, in partnership with his boss at the old company

7) Soon they went out and acquired a tiny trucking insurance firm on the brink of bankruptcy, and renamed the company Fairfax Financial Holdings.

Fairfax (short for "fair, and friendly acquisitions")

Thus began Prem Watsa’s glorious journey to the top of the investing game.

Fairfax (short for "fair, and friendly acquisitions")

Thus began Prem Watsa’s glorious journey to the top of the investing game.

8) Watsa played his cards close to his chest, mostly avoiding the press and the media.

The trucking insurance business was expanded to add more categories including property, casualty, and other insurance verticals.

Fairfax acquired smaller insurance businesses along the way.

The trucking insurance business was expanded to add more categories including property, casualty, and other insurance verticals.

Fairfax acquired smaller insurance businesses along the way.

9) From 1985 to the end of 2010, Fairfax grew at an impressive 25% rate each year!

By 2010, revenues topped $6 billion, and the company was valued at over $8 billion.

Fairfax grew to become one of the largest financial institutions in Canada.

By 2010, revenues topped $6 billion, and the company was valued at over $8 billion.

Fairfax grew to become one of the largest financial institutions in Canada.

10) Back in India…

although Watsa has been involved in the Indian corporate circles personally, he had little direct business going on here.

Except a stake in insurer ICICI Lombard.

But he had been waiting for an opportunity to get in on the post-internet growth explosion

although Watsa has been involved in the Indian corporate circles personally, he had little direct business going on here.

Except a stake in insurer ICICI Lombard.

But he had been waiting for an opportunity to get in on the post-internet growth explosion

11) In 2016, Kamesh Goyal, an insurance industry veteran and now Chairman of Digit Insurance was pitching investors about his plans of disrupting the space.

Watsa got curious.

He had the money, and the expertise, and if he backed the right horse, this could be THE opportunity.

Watsa got curious.

He had the money, and the expertise, and if he backed the right horse, this could be THE opportunity.

12) Fairfax wrote Kamesh a tiny check.

As growth followed, Watsa doubled down.

in 2017, Fairfax sold all its stake in ICICI Lombard, and wrote Digit Insurance a $45 million check for 45% stake in the business.

Digit was valued at over $100 million

As growth followed, Watsa doubled down.

in 2017, Fairfax sold all its stake in ICICI Lombard, and wrote Digit Insurance a $45 million check for 45% stake in the business.

Digit was valued at over $100 million

13) India's insurance industry is a $100 billion annual gambit, with less than 5% market penetration.

COVID has brought millions more under the fold of coverage for the first time, but hundreds of millions are still waiting on the sidelines.

The game is as good as new

COVID has brought millions more under the fold of coverage for the first time, but hundreds of millions are still waiting on the sidelines.

The game is as good as new

14) And Digit is obviously playing for total domination.

So far they’ve managed to scale to over 15 million users, with top-line growth sustaining at 30%+ rates, clocking in $186 million in annual premiums.

In Jan 2021, they raised a new round at a $1.9 billion valuation

So far they’ve managed to scale to over 15 million users, with top-line growth sustaining at 30%+ rates, clocking in $186 million in annual premiums.

In Jan 2021, they raised a new round at a $1.9 billion valuation

15) So far, Prem Watsa has invested nearly $150 million in Digit, and he also advises Digit very closely on strategy and expansion.

At 70, and worth over a billion dollars, the India chapter of Watsa's entrepreneurial journey has just begun

At 70, and worth over a billion dollars, the India chapter of Watsa's entrepreneurial journey has just begun

16) Shout out to @Ruchir_V26 on nailing this thread!

Some references we used to read up on Digit

Fairfax's Wiki:

https://en.wikipedia.org/wiki/Fairfax_Financial

https://en.wikipedia.org/wiki/Prem_Watsa

Digit's raise:

https://www.moneycontrol.com/news/business/digit-insurance-becomes-first-unicorn-of-2021-with-1-9-billion-valuation-6350981.html

On attacking the Indian insurance space: https://economictimes.indiatimes.com/small-biz/startups/newsbuzz/how-billionaire-prem-watsa-is-steering-insurance-into-digital-world/articleshow/61953555.cms

Some references we used to read up on Digit

Fairfax's Wiki:

https://en.wikipedia.org/wiki/Fairfax_Financial

https://en.wikipedia.org/wiki/Prem_Watsa

Digit's raise:

https://www.moneycontrol.com/news/business/digit-insurance-becomes-first-unicorn-of-2021-with-1-9-billion-valuation-6350981.html

On attacking the Indian insurance space: https://economictimes.indiatimes.com/small-biz/startups/newsbuzz/how-billionaire-prem-watsa-is-steering-insurance-into-digital-world/articleshow/61953555.cms

If you liked this thread, you'll love the email we send out to nearly 7,000 readers every morning.

Join us

https://www.filtercoffee.co/

Read on Twitter

Read on Twitter