My  Biggest Investing Mistakes

Biggest Investing Mistakes

Biggest Investing Mistakes

Biggest Investing Mistakes

Only looking at the share price

Only looking at the share priceI bought penny stocks at the start

My logic: 100 shares of $1 stock > 1 share of $100 stock

WRONG!

The price of 1 share is meaningless!

What matters is how great the company is!

Only looking at dividend yield

Only looking at dividend yieldI bought stocks with 10%+ yields

My logic: 10% yield > 1% yield

WRONG!

The dividend got cut and the share price dropped -- a double-whammy!

A high yield is Wall Street's way of saying "this yield is not sustainable, watch out"

Selling a great stock early

Selling a great stock earlyI bought $DXCM in 2007 for ~$6

I sold it 1 month later after a 15% gain

Current price: $412.58

I was in a rush to take profits, so I missed out on HUGE upside

If the opportunity is huge, hold!

Not buying a great stock due to valuation

Not buying a great stock due to valuationI've made this mistake over and over again

I didn't buy $ZM at $80 because the valuation was "insane"

Current price: $455

If you like everything about the company except the valuation, but some

Even if it's just a little bit

Buying too much of a "sure thing"

Buying too much of a "sure thing"I thought $KMI was a SURE THING in 2014

I made it my largest position at $35

$KMI fell 70% in 2015

70%!!!!!!

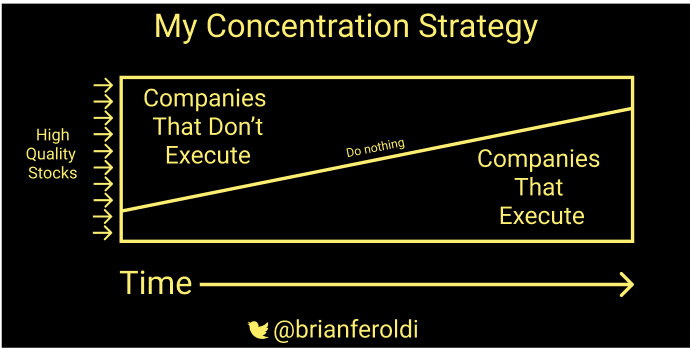

Lesson: Cap your exposure, NO MATTER YOUR CONVICTION, and let your portfolio concentrate itself

Only looking at P/E ratio

Only looking at P/E ratioI use to apply the P/E ratio to ALL stocks

I didn't buy $CRM in 2005 at $5 cause its P/E ratio was >100

Current price: $240

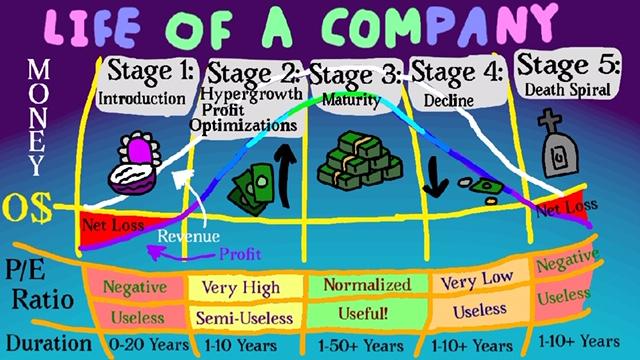

Lesson: P/E ratio only works on stocks that are OPTIMIZED FOR EARNINGS

Don't use it on companies in phase 1, 2, 4, 5

Thinking "I Missed It"

Thinking "I Missed It"Great companies can win for years and years and years!

I haven't bought lots of great stocks because I thought the good times were over

If it's a great company, you can get in late, and still win big

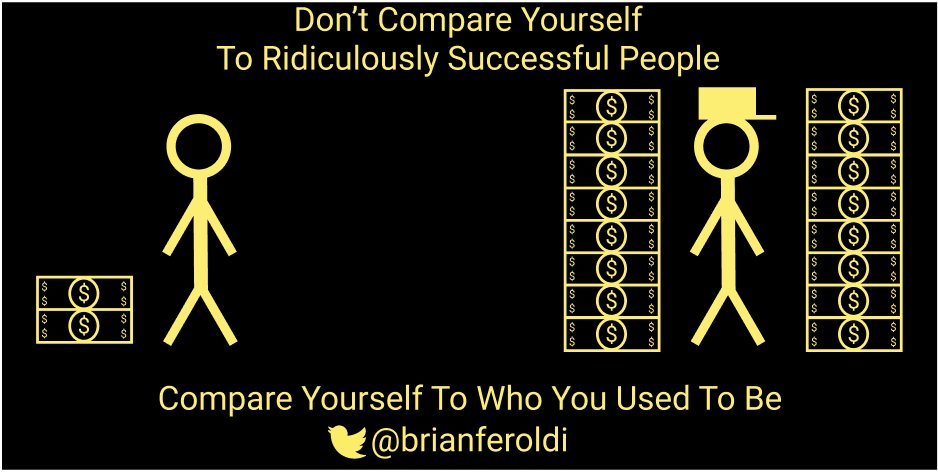

Comparing myself to other investors

Comparing myself to other investorsI have a bad habit of comparing myself against other successful investors

but, if other investors are doing better than me, SO WHAT?? That doesn't matter!

What matters is how I am doing compared to my goals!

Comparison is the thief of joy

Not listening to people I trust

Not listening to people I trustI have ignored buy recommendations on $SHOP, $NFLX, $NVDA, $ZM, $MTCH, $IDXX, $TWLO, $ADBE

FOR YEARS

Even though they were recommended by @DavidGFool @TomGardnerFool and @FoolJeffFischer

All of whom are much better investors than me!

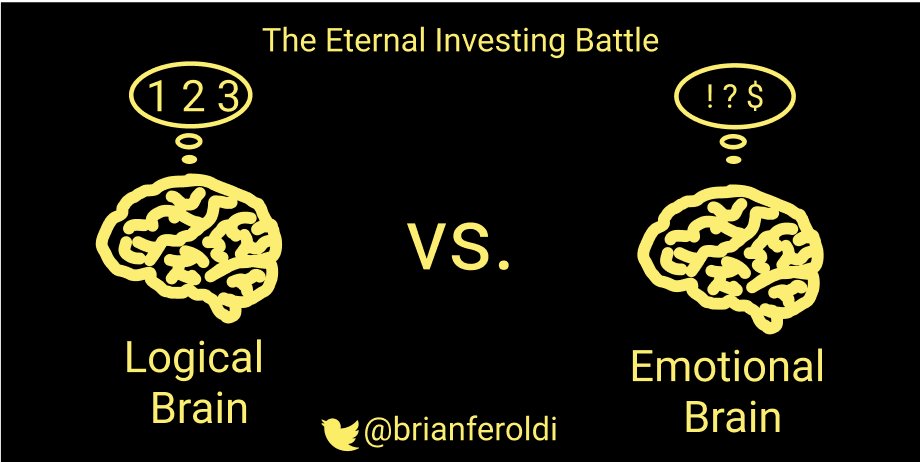

Repeating the same mistakes

Repeating the same mistakesI have a habit of learning investments lessons the hard way AND slowly

I can all but guarantee that I'll repeat some of these mistakes again (especially the "not buying on high valuation" mistake)

What can I say - I'm human

Read on Twitter

Read on Twitter