I used to be convinced of the merits of active investment management.

The more I researched, the less confident in active management I became. Now I invest all my cash into a passive strategy.

Here are 13 reasons why I changed my mind:

The more I researched, the less confident in active management I became. Now I invest all my cash into a passive strategy.

Here are 13 reasons why I changed my mind:

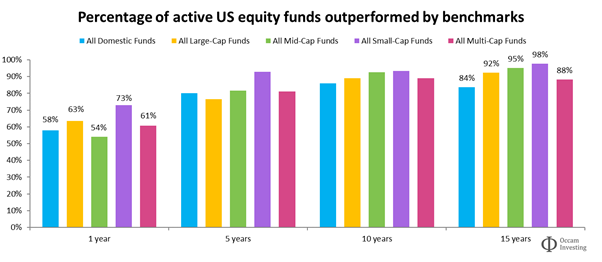

1/13: Starting with the obvious: passive has outperformed 90%+ of active managers over the long run.

It’s not just in the US – pick any region and the results are the same: https://www.spglobal.com/spdji/en/spiva/#/reports

It’s not just in the US – pick any region and the results are the same: https://www.spglobal.com/spdji/en/spiva/#/reports

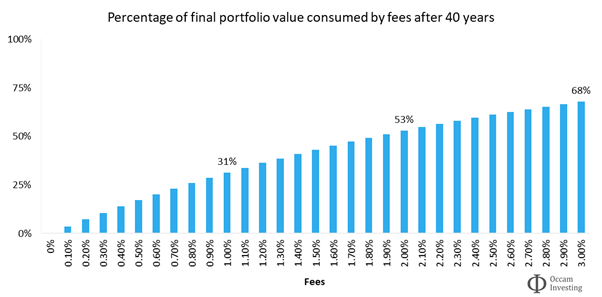

2/13: Passive has lower fees.

Nowhere is the phrase “You get what you pay for” less relevant than in investing.

A 1% fee reduces a portfolio’s size by 31% over 40 years.

31%!

1% sounds small, but it reduces a portfolio’s value by almost a third.

Nowhere is the phrase “You get what you pay for” less relevant than in investing.

A 1% fee reduces a portfolio’s size by 31% over 40 years.

31%!

1% sounds small, but it reduces a portfolio’s value by almost a third.

3/13: Passive is simple.

“I don’t invest in anything I don’t understand” – WB

What could be simpler that holding a small slice of every listed company?

No complex investment products, no dubious backtests, no unexpected surprises. Just one simple, yet powerful strategy.

“I don’t invest in anything I don’t understand” – WB

What could be simpler that holding a small slice of every listed company?

No complex investment products, no dubious backtests, no unexpected surprises. Just one simple, yet powerful strategy.

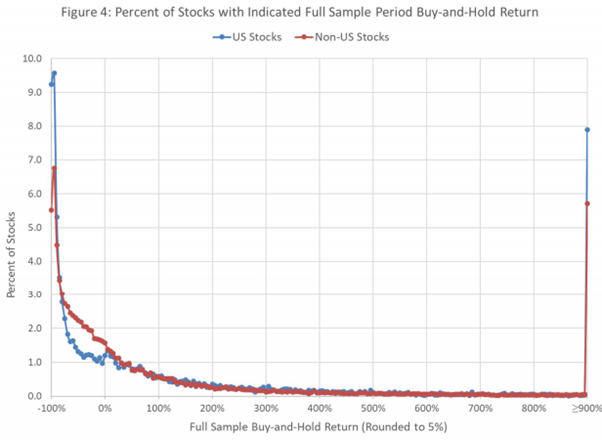

4/13: Stock returns are positively skewed.

The percentage of firms which account for all stock market wealth creation:

USA: 4.1%

Ex-US: <1%

Global: 1.3%

“Don’t look for the needle in the haystack. Just buy the haystack.” – Bogle

The percentage of firms which account for all stock market wealth creation:

USA: 4.1%

Ex-US: <1%

Global: 1.3%

“Don’t look for the needle in the haystack. Just buy the haystack.” – Bogle

5/13: Passive is more transparent and liquid.

You know exactly what you own, and can easily track performance.

There are no lockup periods, no opaque performance reporting (IRR anyone?), and no liquidity issues.

You know exactly what you own, and can easily track performance.

There are no lockup periods, no opaque performance reporting (IRR anyone?), and no liquidity issues.

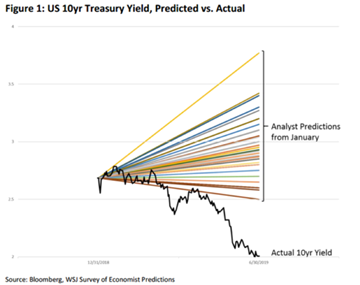

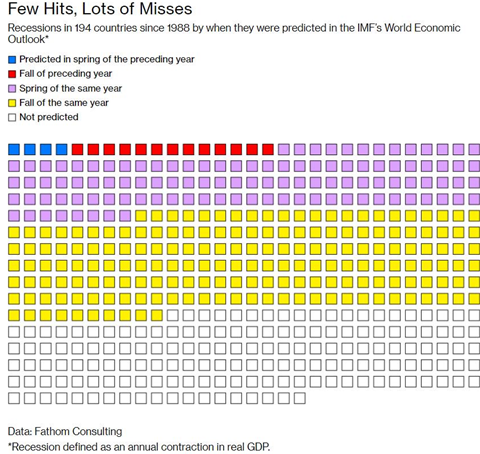

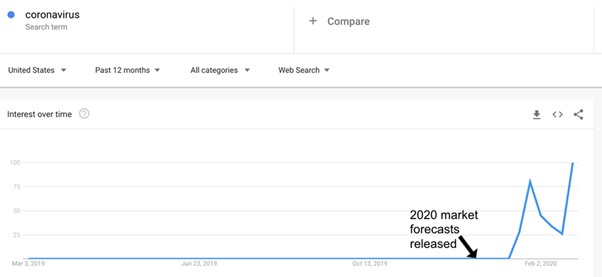

6/13: Passive doesn’t require forecasting.

“I don’t let people do projections for me because I don’t like throwing up on the desk” - Munger

I have enough material on the uselessness of market forecasting to write at least one book.

So here are some pretty pictures instead.

“I don’t let people do projections for me because I don’t like throwing up on the desk” - Munger

I have enough material on the uselessness of market forecasting to write at least one book.

So here are some pretty pictures instead.

7/13: Passive has no minimums.

Many investment managers will only accept you if you’re already wealthy.

Passive is not only available to all, it’s just as powerful for those who invest £100 or £1m.

Ignore Robinhood – passive investing is the true democratisation of investing.

Many investment managers will only accept you if you’re already wealthy.

Passive is not only available to all, it’s just as powerful for those who invest £100 or £1m.

Ignore Robinhood – passive investing is the true democratisation of investing.

8/13: Passive has no capacity constraints.

Active investing is a zero-sum game. For each 1% of outperformance there must be 1% of underperformance.

But the market portfolio is unique: it’s the only portfolio everyone can hold.

It’s the ultimate positive-sum game.

Active investing is a zero-sum game. For each 1% of outperformance there must be 1% of underperformance.

But the market portfolio is unique: it’s the only portfolio everyone can hold.

It’s the ultimate positive-sum game.

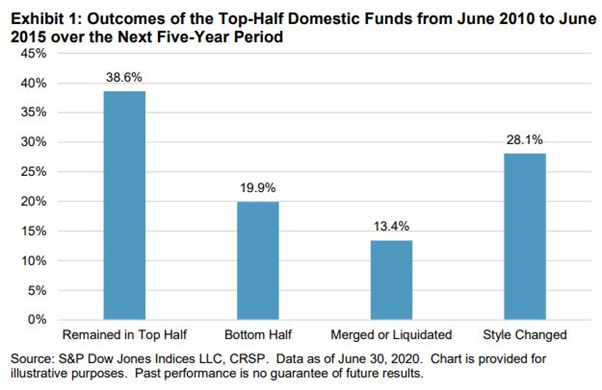

9/13: Passive doesn’t require picking winning fund managers.

The odds are stacked heavily against you picking a winning manager (see tweet #1/13 of this thread).

What’s more, even if you do manage to pick one, their outperformance is likely to be transitory.

The odds are stacked heavily against you picking a winning manager (see tweet #1/13 of this thread).

What’s more, even if you do manage to pick one, their outperformance is likely to be transitory.

10/13: Passive minimises stress.

When an active fund starts to underperform, what do you do?

Do you stick with it? Or lock in your losses and reallocate?

Passive removes the need for difficult and unnecessary choices.

‘Set-and-forget’ makes investing 10x less stressful.

When an active fund starts to underperform, what do you do?

Do you stick with it? Or lock in your losses and reallocate?

Passive removes the need for difficult and unnecessary choices.

‘Set-and-forget’ makes investing 10x less stressful.

11/13: Passive doesn’t incur the risk of a fund manager having to suspend or liquidate their fund.

Remember Neil Woodford’s Equity Income fund? Long Term Capital Management? Property funds during Brexit?

There are no star fund managers with passives.

Remember Neil Woodford’s Equity Income fund? Long Term Capital Management? Property funds during Brexit?

There are no star fund managers with passives.

12/13: Passive reduces conflicts caused by intermediation.

Active’s desire to grow AUM causes style drift, benchmark hugging, and selective stats.

AUM gatekeepers focus on short-term returns so they can recommend activity and justify their existence.

All bad for the investor.

Active’s desire to grow AUM causes style drift, benchmark hugging, and selective stats.

AUM gatekeepers focus on short-term returns so they can recommend activity and justify their existence.

All bad for the investor.

13/13: Passive becomes more powerful as it grows.

The active managers most likely to fall victim to passives are the ones who are least skilled.

Outperforming becomes more difficult for the remaining active managers, as they now only compete against other skilled managers.

The active managers most likely to fall victim to passives are the ones who are least skilled.

Outperforming becomes more difficult for the remaining active managers, as they now only compete against other skilled managers.

In short:

•Simple > complex

•Cheap > expensive

•“I don’t know” > forecasts

•Diversified > concentrated

•Set-and-forget > exigent

•Disintermediation > iatrogenics

It's great to see passives gaining traction here in the UK, but there's still a long way to go!

•Simple > complex

•Cheap > expensive

•“I don’t know” > forecasts

•Diversified > concentrated

•Set-and-forget > exigent

•Disintermediation > iatrogenics

It's great to see passives gaining traction here in the UK, but there's still a long way to go!

Read on Twitter

Read on Twitter