And I should mention something about interest. I paid a lower rate of interest than current students. For those starting in 2020 in England and Wales their rate of interest is 5.6%. So a third year student who owes £30,000 will have £1,680 added to their debt this year.

Therefore, many students will find the capital they owe, even when in work, going up, not down.

You might ask whether that on top of the de facto graduate tax the Plan 2 students are paying, the very large capital sums they must repay, whether an interest rate of 5.6% makes any prospect of repayment, for all those outside the very top jobs, remotely credible.

As a result of the interest, many graduates work for years while their stock of debt goes *up*

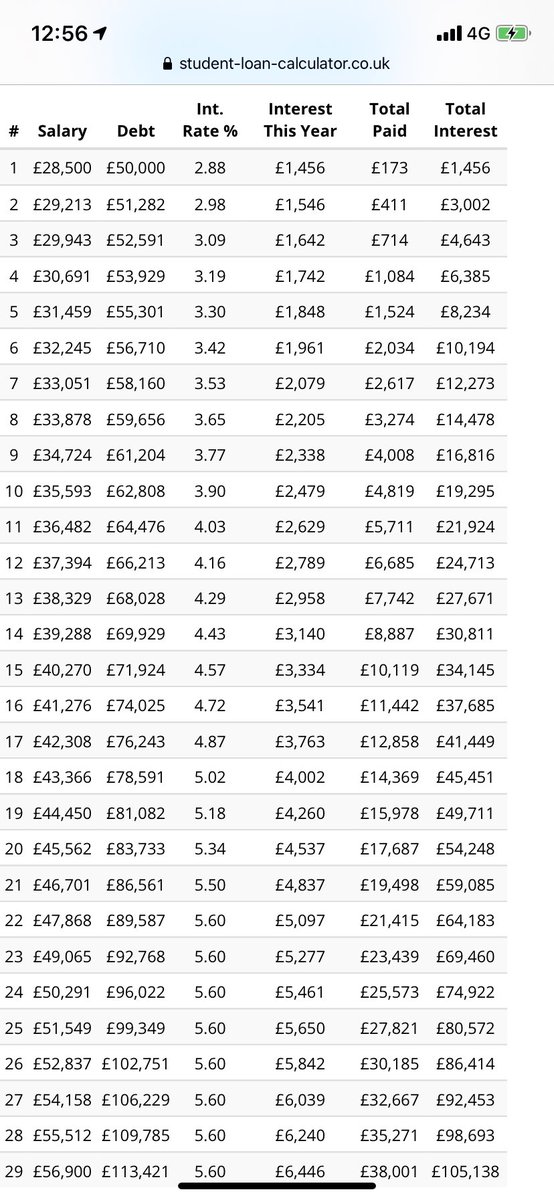

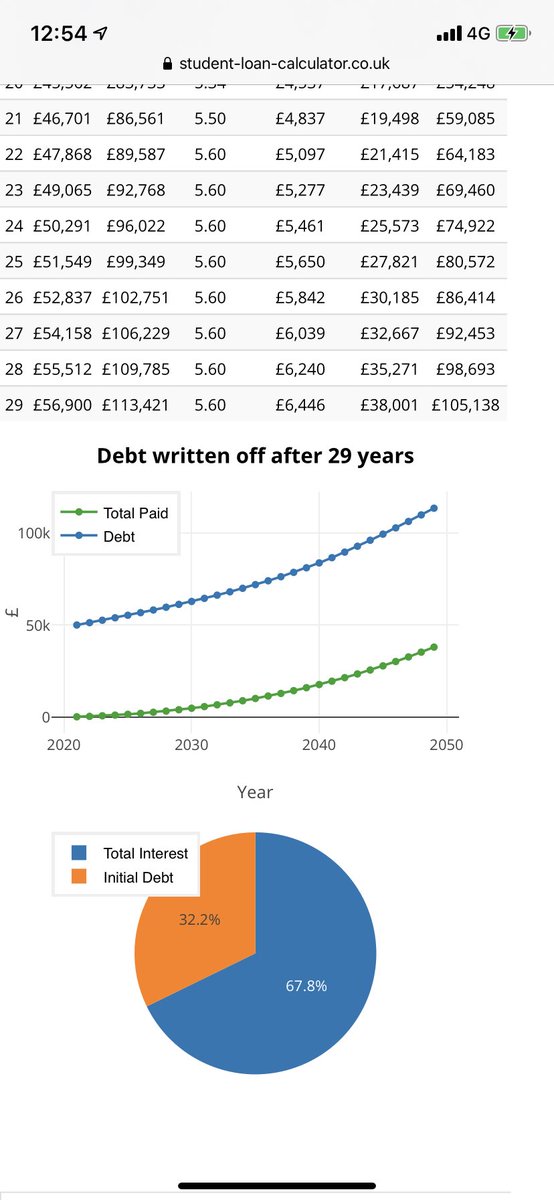

So let’s take a graduate on Plan 2 with a debt of £50k and a v respectable starting salary of £28,500.

Despite a good, rising salary their debt *never goes down*. Rises to £113k.

So let’s take a graduate on Plan 2 with a debt of £50k and a v respectable starting salary of £28,500.

Despite a good, rising salary their debt *never goes down*. Rises to £113k.

The system I was on (Plan 1) I think can (just) accurately be called a student loan system. The fees were much lower, the maintenance grant still exist to leaven some inequalities and the interest was lower.

For Plan 2 (since 2012) those things are no longer the case.

For Plan 2 (since 2012) those things are no longer the case.

I’m not saying whether the contributory principle is right or wrong, that’s for others to argue about: what I’m saying is that in particular, post-2012, we in fact have a de facto graduate tax. There’s no realistic prospect of many graduates paying back the stock of debt...

...and so it is, in effect, an extra income tax levy which will exist on graduates for 30 years. The debt will simply escape them and payments continue. I suspect older generations are ignorant of how the system operates in reality simply because they’ve never experienced it.

The fact that it is a de facto graduate tax generates all sorts of policy questions and it’d be better for the graduates and for policy makers to recognise it and treat it as such.

End.

End.

Actually, let me rephrase- it's a graduate tax which tends to fall most heavily on those from the poorest backgrounds (and some from wealthier ones escaping it altogether)

Sutton Trust says student from households in the lowest 40% of earners take on average debts of £51,600...

Sutton Trust says student from households in the lowest 40% of earners take on average debts of £51,600...

...compared to £38,400 in the top 20% of households.

As I say, the abolition of the maintenance grant was an crucial in making the system more regressive. ST estimates that introducing a system of means-tested fees and reinstating MGs would cut average student debt...

As I say, the abolition of the maintenance grant was an crucial in making the system more regressive. ST estimates that introducing a system of means-tested fees and reinstating MGs would cut average student debt...

...in half. In particular, it would slash debt among the 40% poorest students by 75%, from £51,600 down to £12,700, and mean those from the poorest backgrounds emerged with two thirds less debt than their better-off counterparts.

Read on Twitter

Read on Twitter