1/

Zimbabwe - Afreximbank loans

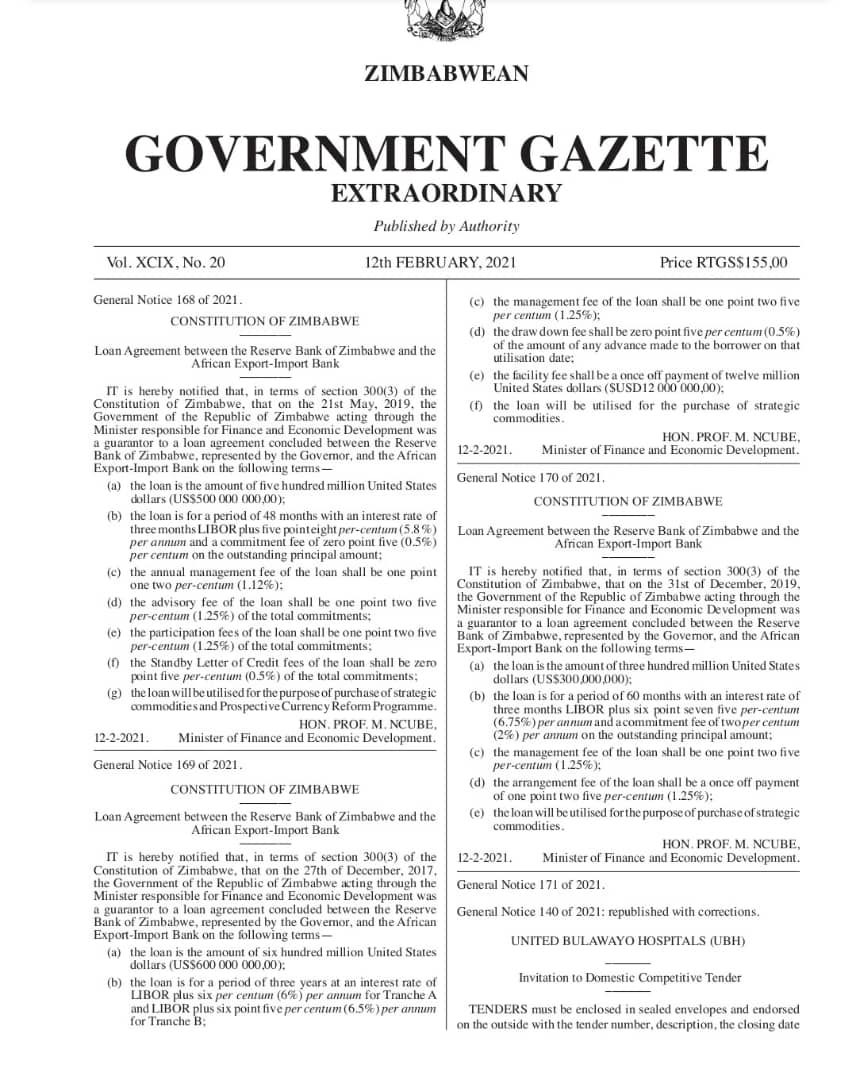

On the 12th of Feb 2021, compelled by a court order, the MOF gazetted loans taken by RBZ it guaranteed.

It is very clear why RBZ & GOZ were secretive about these loans to the point of making its apologists deny the very existence of them.

Zimbabwe - Afreximbank loans

On the 12th of Feb 2021, compelled by a court order, the MOF gazetted loans taken by RBZ it guaranteed.

It is very clear why RBZ & GOZ were secretive about these loans to the point of making its apologists deny the very existence of them.

2/

For example, over the last 3yrs it has been pointed out that;

(a) RBZ is involved in quasi fiscal activities

(b) GOZ treasury has no surplus

These two points are linked. RBZ comes directly under the Minister’s armpit. RBZ took over treasury responsibilities & its deficits.

For example, over the last 3yrs it has been pointed out that;

(a) RBZ is involved in quasi fiscal activities

(b) GOZ treasury has no surplus

These two points are linked. RBZ comes directly under the Minister’s armpit. RBZ took over treasury responsibilities & its deficits.

3/

RBZ losses, are directly treasury’s losses & by law must be included in the consolidated revenues & expenditures. This never happened, so the right hand claimed it was clean, when all the time the stolen goods were in the left hand.

RBZ losses, are directly treasury’s losses & by law must be included in the consolidated revenues & expenditures. This never happened, so the right hand claimed it was clean, when all the time the stolen goods were in the left hand.

4/

The Gazette is revelatory in 3 distinct ways;

(i) Zim sanctions do not affect its ability to borrow & move money internationally

(ii) Interest on loans is more than 10% p.a

(iii) Zim is in a debt trap

The Gazette is revelatory in 3 distinct ways;

(i) Zim sanctions do not affect its ability to borrow & move money internationally

(ii) Interest on loans is more than 10% p.a

(iii) Zim is in a debt trap

5/

RBZ total foreign debt is US$5bn as of Sept 2020. 80% of which was assumed post coup of Nov 2017. OFAC would’ve seen & approved these transactions including anytime Zim made interest payments.

US$1.4bn from Afreximbank had GOZ guarantee. Meaning GOZ was a direct party...

RBZ total foreign debt is US$5bn as of Sept 2020. 80% of which was assumed post coup of Nov 2017. OFAC would’ve seen & approved these transactions including anytime Zim made interest payments.

US$1.4bn from Afreximbank had GOZ guarantee. Meaning GOZ was a direct party...

6/

..to the transaction. At no point did OFAC raise a red flag. Or outright stop the transaction. It is very clear that Zim sanctions don’t affect its ability to transact with the world. Nor it’s ability to borrow. There are many international lenders to Zim, apparently.

..to the transaction. At no point did OFAC raise a red flag. Or outright stop the transaction. It is very clear that Zim sanctions don’t affect its ability to transact with the world. Nor it’s ability to borrow. There are many international lenders to Zim, apparently.

7/

Chinamasa’s Lima plan of 2016 comprehensively addressed political & institutional reforms before tapping into international markets. Without reforms, immediately after a coup, GOZ started borrowing without any guiderails & none to stop profligacy.

Chinamasa’s Lima plan of 2016 comprehensively addressed political & institutional reforms before tapping into international markets. Without reforms, immediately after a coup, GOZ started borrowing without any guiderails & none to stop profligacy.

8/

It’s a hard lesson to Zim & to Afreximbank & other lenders (China included) why Zim desperately requires deep political & institutional reforms. It’s for creditors own good. Treasury claims of surplus were not entirely for Zimbabwean ears but for foreign lenders.

It’s a hard lesson to Zim & to Afreximbank & other lenders (China included) why Zim desperately requires deep political & institutional reforms. It’s for creditors own good. Treasury claims of surplus were not entirely for Zimbabwean ears but for foreign lenders.

9/

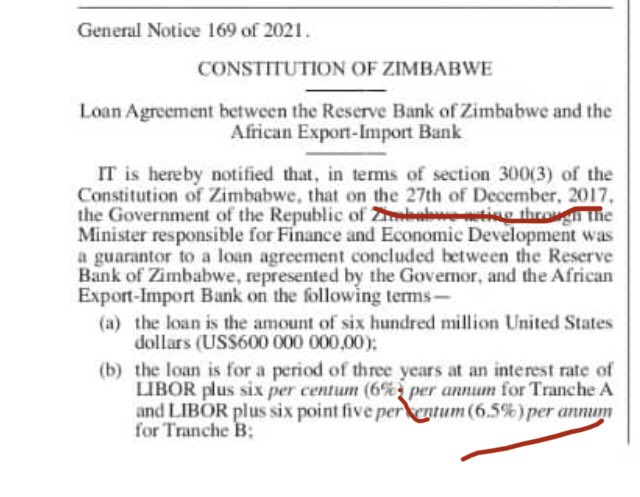

The first loan from Afreximbank was made on the 27th of Dec 2017. A 3yr loan that was due end of 2020.

Was it paid off?

All the evidence suggests otherwise.

The first loan from Afreximbank was made on the 27th of Dec 2017. A 3yr loan that was due end of 2020.

Was it paid off?

All the evidence suggests otherwise.

10/

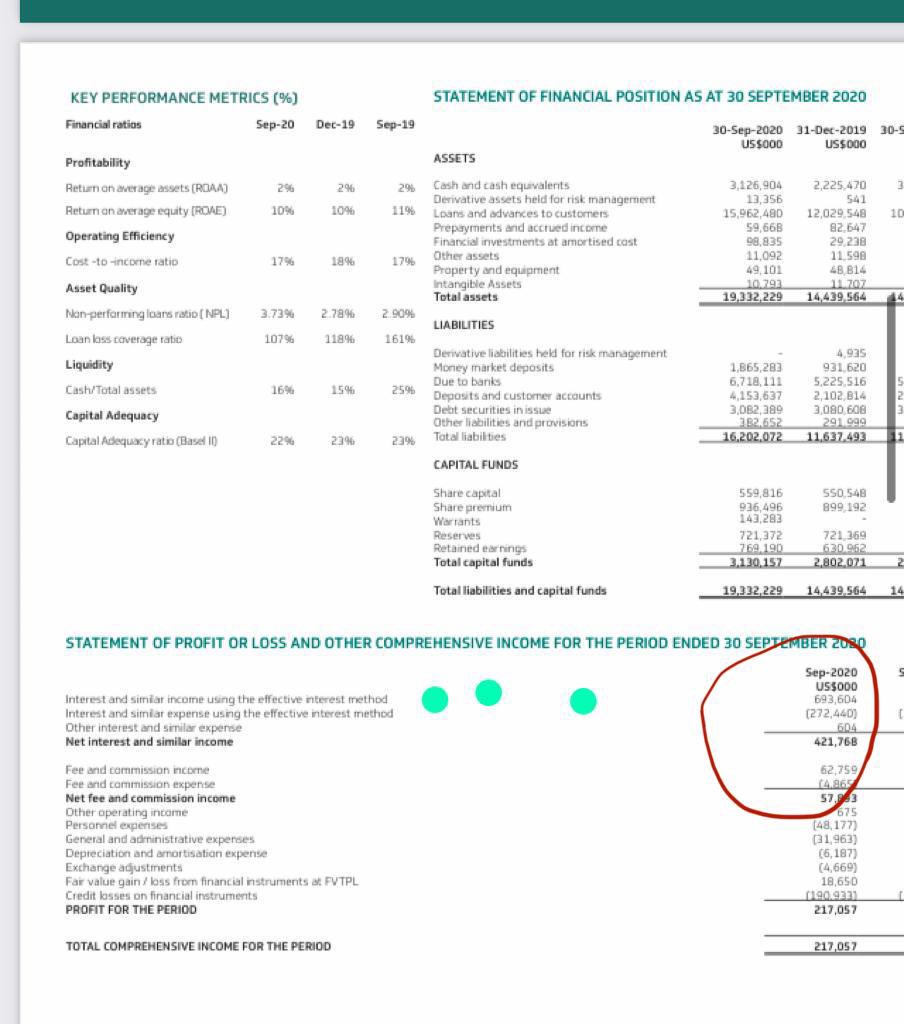

Zim has ZERO reserves. The 2020 budget did not have a sinking fund.

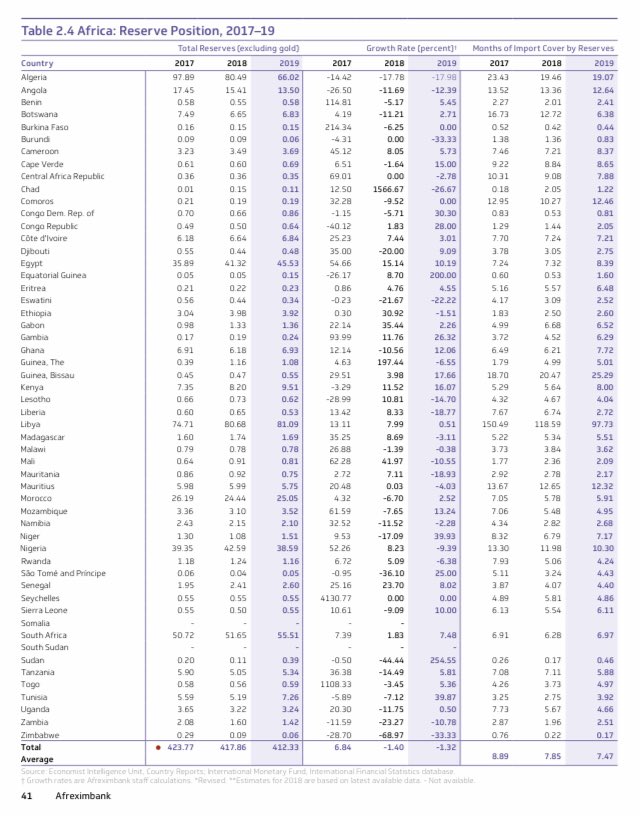

Afreximbank was aware that RBZ had zero reserves( see pic, Zim reserves position is at the bottom of the table)

Was the loan rolled over?

Zim has ZERO reserves. The 2020 budget did not have a sinking fund.

Afreximbank was aware that RBZ had zero reserves( see pic, Zim reserves position is at the bottom of the table)

Was the loan rolled over?

11/

The loans suggests a bullet payment at the end of the loan tenure and were not amortized. If the loan was amortized RBZ monthly reports would show this.

The loans suggests a bullet payment at the end of the loan tenure and were not amortized. If the loan was amortized RBZ monthly reports would show this.

12/

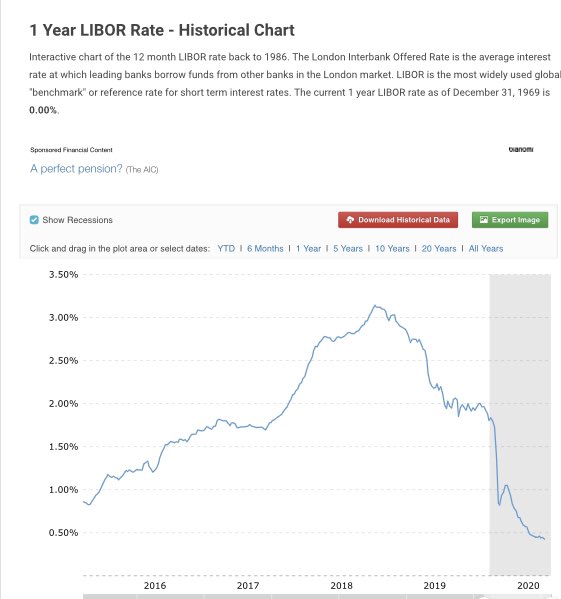

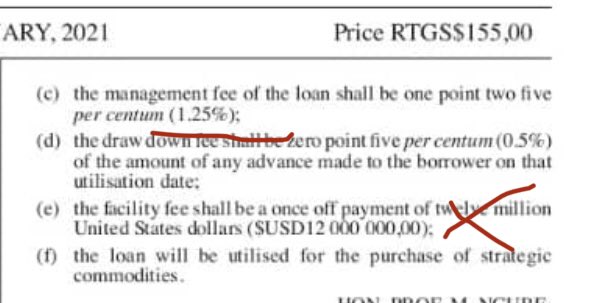

The terms of loans are onerous. In Dec 2017, LIBOR was 2%.

RBZ own laws emphatically prohibit loans above LIBOR plus 7% without RBZ express approval. This is the reason for institutional reforms. Currently the regulator approves its own loan interest exemptions.

The terms of loans are onerous. In Dec 2017, LIBOR was 2%.

RBZ own laws emphatically prohibit loans above LIBOR plus 7% without RBZ express approval. This is the reason for institutional reforms. Currently the regulator approves its own loan interest exemptions.

13/

LIBOR 2%. Interest 6.5%. other fees 3.75%. Total yr1 interest is 12.25%. Above the RBZ own rules.

This is a devastating revelation. Most Economists had assumed interest was less than 4%. What Afreximbank normally charges.

LIBOR 2%. Interest 6.5%. other fees 3.75%. Total yr1 interest is 12.25%. Above the RBZ own rules.

This is a devastating revelation. Most Economists had assumed interest was less than 4%. What Afreximbank normally charges.

14/

Zimbabwe is highly profitable for Afreximbank. In its September 2020 results , interest & similar income was US$700m. On average (10%pa) on the US$1.4bn , Zim pays $140m a year.

This is 20% of Afreximbank interest income.

Zimbabwe is highly profitable for Afreximbank. In its September 2020 results , interest & similar income was US$700m. On average (10%pa) on the US$1.4bn , Zim pays $140m a year.

This is 20% of Afreximbank interest income.

15/

If Zimbabwe is paying 10% on its RBZ debt ( US$5bn) that equates to US$500m interest payments a year.

This is 20% of 2020 GOZ budget expenditure. 25% of revenues.

The debt has grown through interest capitalization & not necessarily new debt.

If Zimbabwe is paying 10% on its RBZ debt ( US$5bn) that equates to US$500m interest payments a year.

This is 20% of 2020 GOZ budget expenditure. 25% of revenues.

The debt has grown through interest capitalization & not necessarily new debt.

16/

In theory. A debt trap is when Interest on loans (i) is greater than GDP growth (g).

i > g

This means interest payments become an albatross to any growth. Debt grows exponentially. RBZ loans interest of 10% when the economy is in decline of -15% is a debt trap.

In theory. A debt trap is when Interest on loans (i) is greater than GDP growth (g).

i > g

This means interest payments become an albatross to any growth. Debt grows exponentially. RBZ loans interest of 10% when the economy is in decline of -15% is a debt trap.

17/

What does this mean for Zimbabwe?

Minister Mthuli is simply preparing Zimbabweans for the inevitable debt assumption Bill.

This will officially add US$5bn to the country’s foreign debt stock of US$9bn.

Ps. The farmers compensation of US$3.5bn is not yet official

What does this mean for Zimbabwe?

Minister Mthuli is simply preparing Zimbabweans for the inevitable debt assumption Bill.

This will officially add US$5bn to the country’s foreign debt stock of US$9bn.

Ps. The farmers compensation of US$3.5bn is not yet official

18/

The good news is that Afreximbank & the Chinese creditors will now be at the fore front of calling for reforms.

The smuggling of gold & its quantum is NOT coincidental. It’s to avoid formal international channels where creditors have stop orders against Zim exports.

The good news is that Afreximbank & the Chinese creditors will now be at the fore front of calling for reforms.

The smuggling of gold & its quantum is NOT coincidental. It’s to avoid formal international channels where creditors have stop orders against Zim exports.

19/

The bad news is that the ruling class can survive on extractive industry rent. Especially during a commodity boom. Political scientist have pointed out, the ruling elite will not reform themselves out of power.

There is no credible reason why the ruling elite must reform.

The bad news is that the ruling class can survive on extractive industry rent. Especially during a commodity boom. Political scientist have pointed out, the ruling elite will not reform themselves out of power.

There is no credible reason why the ruling elite must reform.

20/

Sanctions have not stopped Zim from tapping international capital.

Economic mismanagement & corruption accelerated post coup of Nov 2017. Reversing the gains of the GNU.

ALL creditors want reforms.

Commodity boom & corruption provides a way out for the ruling elite.

Sanctions have not stopped Zim from tapping international capital.

Economic mismanagement & corruption accelerated post coup of Nov 2017. Reversing the gains of the GNU.

ALL creditors want reforms.

Commodity boom & corruption provides a way out for the ruling elite.

Read on Twitter

Read on Twitter