The new $DEXTF tokenomics just went live. Liquidity mining annualized rates of return are now as high as $1,500%. Can read the full tokenomics announcement here  https://dextfprotocol.medium.com/dip-3-liquidity-investment-mining-program-e1419353e846

https://dextfprotocol.medium.com/dip-3-liquidity-investment-mining-program-e1419353e846

https://dextfprotocol.medium.com/dip-3-liquidity-investment-mining-program-e1419353e846

https://dextfprotocol.medium.com/dip-3-liquidity-investment-mining-program-e1419353e846

Liquidity mining is a key feature of Decentralized Finance protocols. Liquidity mining rewards are used to attract liquidity and users, and decentralize ownership, thus bootstrapping a sustainable decentralized community of stakeholders.

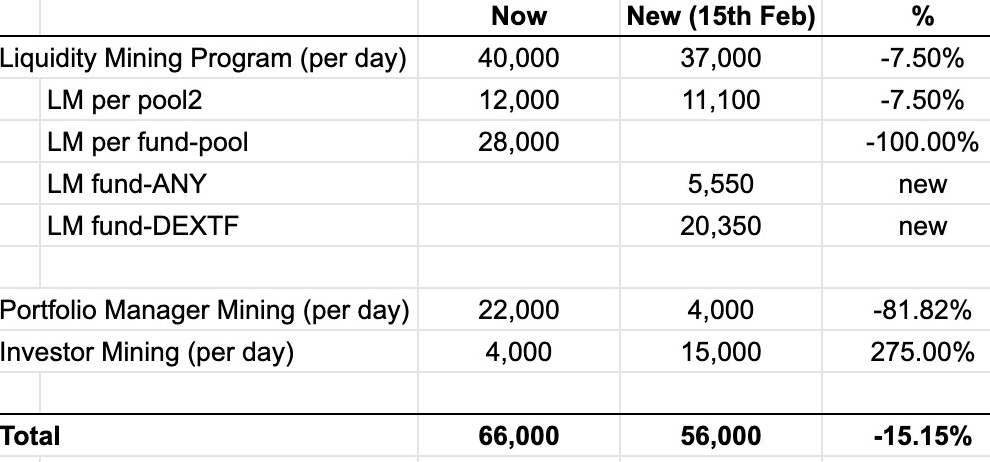

Up to now, DEXTF focused on rewarding portfolio managers (PMs). The platform thus attracted a great number of portfolio managers and not that many investors. This just changed. The focus is now on incentivizing investors and increasing assets under management.

More specifically, the objective of the new tokenomics is threefold:

#1 Incentivize investors

#2 Increase DEXTF demand

#3 Reduce protocol inflation

#1 Incentivize investors

#2 Increase DEXTF demand

#3 Reduce protocol inflation

To achieve this, DEXTF prioritized rewards to investors, and those who provide liquidity for fund tokens (XTFs) against DEXTF token. In the process, protocol overall inflation was reduced by 15%.

Higher AuM would eventually translate into higher management/performance fees. As the userbase grows, every stakeholder wins. This is the way.

Read on Twitter

Read on Twitter