Another long series of threads on @dextfprotocol

Who are its actors, what can they do and why they may want to participate?

DEXTF have 4 main actors:

A - Investors

B - Portfolio Managers

C - Liquidity Providers

D - Arbitrageurs

Who are its actors, what can they do and why they may want to participate?

DEXTF have 4 main actors:

A - Investors

B - Portfolio Managers

C - Liquidity Providers

D - Arbitrageurs

Most users can be many of these at the same time, but let's focus on Investors first.

What can you do as an investors?

What can you do as an investors?

1. As an investor the simplest thing you can do is to find a fund you like on the platform (a fund that has a uniswap pool) and buy it on uniswap

When you want to change you can swap it on uni for another fund or sell it and exit

When you want to change you can swap it on uni for another fund or sell it and exit

Which funds have a uni pool?

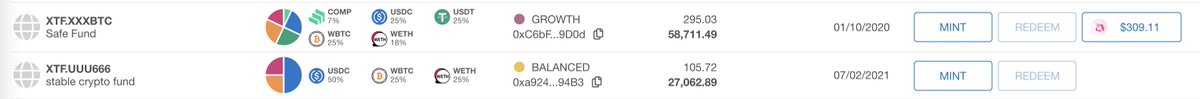

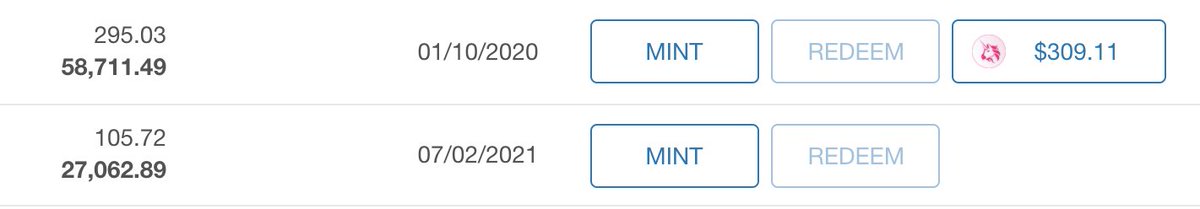

You can easily see it on the dapp: on the right you have all the actions you can do for each fund, if there is a button with a uni symbol you can trade it (it will also show the price on uniswap)

Why you want to do this?

You can easily see it on the dapp: on the right you have all the actions you can do for each fund, if there is a button with a uni symbol you can trade it (it will also show the price on uniswap)

Why you want to do this?

1.a the first reason is returns on the XTF: today there are 78 XTF on the dapp and only 4 are losing money since inception, the worst lost 5%...

The remaining 74 funds are all up from 7% to 1590% ... nice!

The Portfolio Managers in DEXTF are doing an excellent job!

The remaining 74 funds are all up from 7% to 1590% ... nice!

The Portfolio Managers in DEXTF are doing an excellent job!

1.b the second reason is the following:

Investors in #DeFi today, need to choose between aping in cool #DeFi tokens which are going up 2-20x or get the very juicy yields in the farms

With DEXTF you can do both: every investor is rewarded nice APY just for being an investor

Investors in #DeFi today, need to choose between aping in cool #DeFi tokens which are going up 2-20x or get the very juicy yields in the farms

With DEXTF you can do both: every investor is rewarded nice APY just for being an investor

They don't need to do ANYTHING

The brains at @dextfprotocol will monitor things in the back and reward you automatically

note: once staking contracts are ready and you will simply have to stake the XTF units

So: you keep your upside (see 1.a) and get the APY

The brains at @dextfprotocol will monitor things in the back and reward you automatically

note: once staking contracts are ready and you will simply have to stake the XTF units

So: you keep your upside (see 1.a) and get the APY

Also to nota that these are not Liquidity Pools, there is no Impermanent Loss, there is no extra smart contract risk

Just nice simple APY

Just nice simple APY

1.c the third reason is that if you try to replicate an XTF in your wallet, you need to trade in and out each components

If you buy an XTF you do 1 uniswap tx, if you buy the 10 components you do 10tx

If you buy an XTF you do 1 uniswap tx, if you buy the 10 components you do 10tx

With current gas costs, if you have less than 20K to invest, you can easily pay over 10-20% in tx costs... which go down 90% if you use XTF funds

One dollar saved is one dollar earned...

One dollar saved is one dollar earned...

2. The second thing you can do is to mint a fund

2.1 You can do this via kyber swap: you pay USDC, WETH or DAI, kyber creates the basket and DEXTF creates new units of the fund. I strongly DISCOURAGE this option as kyber v2 uses a huge amount of gas

2.1 You can do this via kyber swap: you pay USDC, WETH or DAI, kyber creates the basket and DEXTF creates new units of the fund. I strongly DISCOURAGE this option as kyber v2 uses a huge amount of gas

2.2 Or you can mint by buying all the components of the funds in uni/sushi/balancer/dodo/matcha/1inch, etc

Once they are in your wallet you can start the minting

https://twitter.com/dextfprotocol/status/1358026625883930625?s=20

Once they are in your wallet you can start the minting

https://twitter.com/dextfprotocol/status/1358026625883930625?s=20

2.a you want to do this as sometimes the price of a fund on uni is higher than its value (the sum of the parts) and you can buy it more cheaply by creating it

How can I see this? the dapp will tell you https://twitter.com/Be1garat/status/1356848392119463941?s=20

How can I see this? the dapp will tell you https://twitter.com/Be1garat/status/1356848392119463941?s=20

2.b All the APY rewards will apply the same as per 1.b above

Once you own an XTF you get the rewards, irrespective if you created it or bought it

Once you own an XTF you get the rewards, irrespective if you created it or bought it

2.c you want to do this also to effect an arbitrage: if the XTF on uni are more expensive that their value then you may not only want to use mint to own the fund but you may also want to sell the fund on uni to lower its price

Congrats you just made a riskless profit and you are now an Arbitrageur, I will write a separate thread for them but you can read this if interested https://twitter.com/Be1garat/status/1356848326193385478?s=20

2.d Finally you may want to do it because the fund you like does not have a uni pool or the pool is small and the amount you want to buy moves the price too much

3. The third thing you can do is to provide liquidity in a Fund LP

Once you have your XTF Tokens (bought or minted you can use them to provide liquidity to fund pools) which will get you extra APY ON TOP

But now you are a Liquidity Provider which is another thread

Once you have your XTF Tokens (bought or minted you can use them to provide liquidity to fund pools) which will get you extra APY ON TOP

But now you are a Liquidity Provider which is another thread

The only important thing from the point of view of the Investors who provide liquidity is that the rewards are ON TOP of those obtained as investors

Read on Twitter

Read on Twitter