EXIT STRATEGY

How do you determine when to exit?

My exit strategy is always fluid but its predicated on one thing: sell volume

The first thing you need to get down though is the exact opposite of an exit; your ENTRY

Incorrect entry should always be followed by a quick exit

How do you determine when to exit?

My exit strategy is always fluid but its predicated on one thing: sell volume

The first thing you need to get down though is the exact opposite of an exit; your ENTRY

Incorrect entry should always be followed by a quick exit

Why is entry so important? Because you need to assess and mitigate the risk involved with your entry first before you can properly outline your exit.

You need to have an exit even before you enter;not having one when it turns on you quickly will lead to big losses and bag holding

You need to have an exit even before you enter;not having one when it turns on you quickly will lead to big losses and bag holding

Example:

What’s the difference between entering in 1,2 or 3 on the $CRBP daily chart?

Entry 1 is buying at support within an extended consolidation between 1.2-1.4. You’re buying at a position where the sell volume is low and buyers are accumulating in a distinct support zone

What’s the difference between entering in 1,2 or 3 on the $CRBP daily chart?

Entry 1 is buying at support within an extended consolidation between 1.2-1.4. You’re buying at a position where the sell volume is low and buyers are accumulating in a distinct support zone

A great plan would be optimizing entry by buying at the bottom support. Typically, I don’t set hard stops when I buy at supports and just accumulate dips. I’ll only cut if it begins to lose this support and starts downtrending and selling volume becomes more prevalent than buying

Now lets say its been climbing like how $CRBP has and you want to enter

You need to look back at past support/resistance levels to know where the supply and demand will be. Fibs are great for this also

Heres the outline from previous supports which then become resistances

You need to look back at past support/resistance levels to know where the supply and demand will be. Fibs are great for this also

Heres the outline from previous supports which then become resistances

Zoomed in: Red line was a resistance zone that once broken had a violent move above with a pullback once it brokedown

Entry 2 has two scenarios. You either add on the breakout or you add on the pullback.

Breakouts almost always need to come back and confirm new support.

Entry 2 has two scenarios. You either add on the breakout or you add on the pullback.

Breakouts almost always need to come back and confirm new support.

This why I always emphasize sell at pops after it breaks down and reposition on the dip because those profits on those rips are useless if not realized. (I’ll outline the breakdown intraday using level 2 later)

If you didn’t enter on the breakout this is where chasers get caught

If you didn’t enter on the breakout this is where chasers get caught

If they don’t enter correctly and chase at the breakout then they get caught on the pullback and panic.

Adding on the breakout needs to be treated as a SHORT TERM exit play because at some point profit takers over come buying interest and selling volume is more prevalent.

Adding on the breakout needs to be treated as a SHORT TERM exit play because at some point profit takers over come buying interest and selling volume is more prevalent.

Adding on the pullback to support and reversal confirmation allows you to swing long

Entry 3 is straight chasing. Chart has already broken out and has become over extended

KEY here is that the higher the extension and rise; the higher your risk tolerance should be

here is that the higher the extension and rise; the higher your risk tolerance should be

Entry 3 is straight chasing. Chart has already broken out and has become over extended

KEY

here is that the higher the extension and rise; the higher your risk tolerance should be

here is that the higher the extension and rise; the higher your risk tolerance should be

Meaning the higher the entry; the quicker the exit

The risk involved with entry 3 is exponentially higher than entry at 1 so your exit strategy should reflect that

Your SL should be tighter and you should be taking profits much quicker

Risk is starting to outweigh the reward

The risk involved with entry 3 is exponentially higher than entry at 1 so your exit strategy should reflect that

Your SL should be tighter and you should be taking profits much quicker

Risk is starting to outweigh the reward

Now that we have the initial entry exit strategy we can shift on when to start taking profits.

This is where charting resistances are important. For new traders you absolutely need to overcome the learning curve of technical analysis. You need this to maximize execution.

This is where charting resistances are important. For new traders you absolutely need to overcome the learning curve of technical analysis. You need this to maximize execution.

Resistances and identifying how price action and buying volume are at those zones are critical to gauge if it will continue higher or not

Whether on a intraday, daily or weekly; if selling pressure starts becoming more prevalent than buying pressure you need to take profits

Whether on a intraday, daily or weekly; if selling pressure starts becoming more prevalent than buying pressure you need to take profits

There are many different ways to identify when a chart starts breaking down either from support levels or from a breakout.

Level 2, chart patterns, candle stick structures and moving averages are my favorites

They all tell one story: sell volume is higher than buying interest

Level 2, chart patterns, candle stick structures and moving averages are my favorites

They all tell one story: sell volume is higher than buying interest

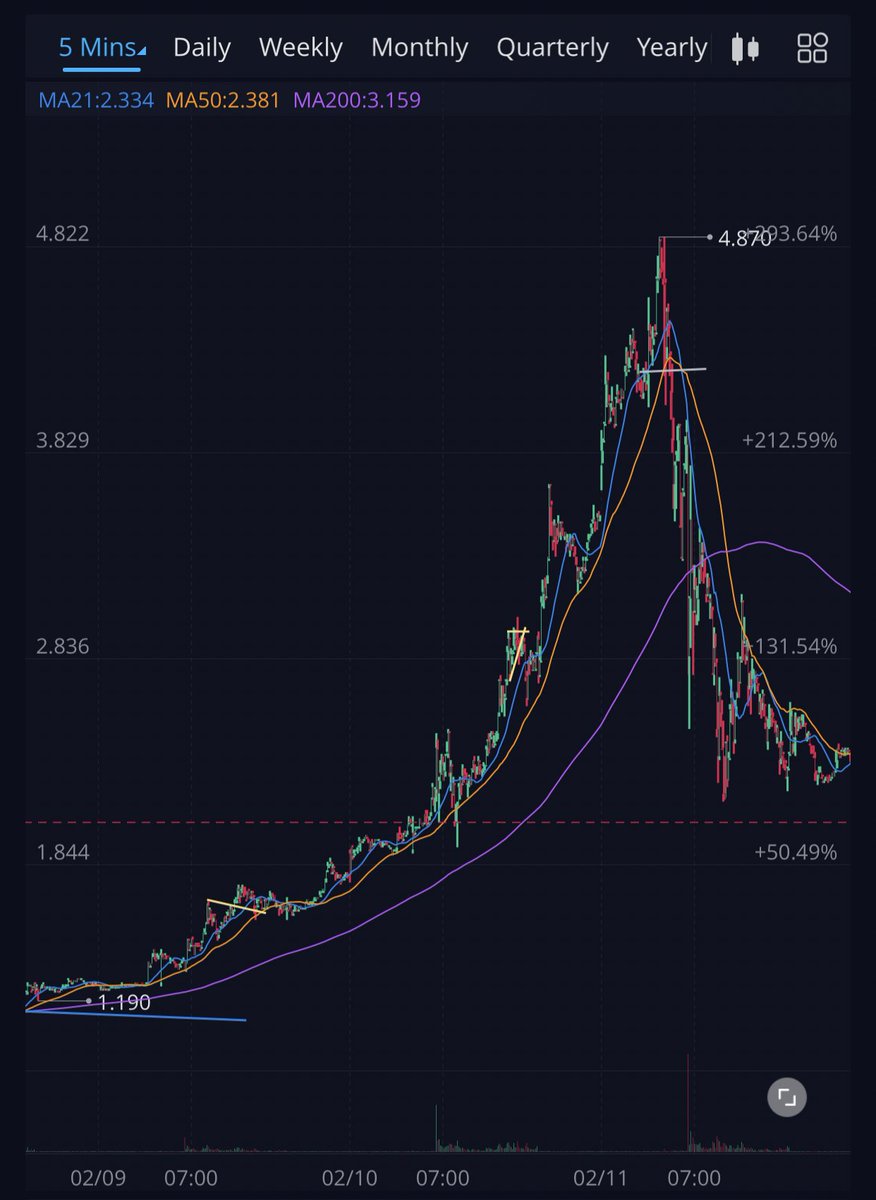

Example: $SNDL

Broke out and started running like crazy. What we need to figure is when we need to take profit

For new traders i recommend using moving averages

Uptrends tend to have base MA support levels traders use and follow. In the case of $SNDL it was 50ma on the 5 min

Broke out and started running like crazy. What we need to figure is when we need to take profit

For new traders i recommend using moving averages

Uptrends tend to have base MA support levels traders use and follow. In the case of $SNDL it was 50ma on the 5 min

This is where new traders need to sit back and let the momentum carry you. Having set price targets can cut you short on profits. What you need to learn is identifying when the chart starts breaking down and have set resistance levels to watch how price action is at those zones.

Breakdowns are relative though. A broken uptrend on a 5 min time frame doesn’t mean its broken on other time frames. Everything is always relative but generally, I like using shorter time frames to gauge when a stock breaks down if its running for short swings; longer ones for LT

Notice when the 50ma was broken on that pop to 4.8 there was a massive selloff without any quick recovery

There are other indicators like a head and shoulders with a neckline at 4.2

Or a bearish engulfing candle on the 30 min

All of these point to increased selling pressure

There are other indicators like a head and shoulders with a neckline at 4.2

Or a bearish engulfing candle on the 30 min

All of these point to increased selling pressure

You need to be disciplined on the breakdown and lock profit

Depending on conviction level ill hold all my shares if it keeps an uptrend and buy volume is strong

Don’t let the ebbs and flows shake you out as long as it holds the trendline and zones you identify as supports

Depending on conviction level ill hold all my shares if it keeps an uptrend and buy volume is strong

Don’t let the ebbs and flows shake you out as long as it holds the trendline and zones you identify as supports

A key point I want to add is if it rips on the 5 min intraday chart and overextends either vwap or the trendline youre following lock profits once you notice increased selling pressure. Chances are high it will regress to the mean and this is where you can buy back on the dip

I scalp and reposition my swings. Once you become more of an adept trader you can gauge the momentum of a day based on price action and level 2. There are micro movements within a swing that i take advantage of just from experience of timeframes throughout the day

Watching tape and level 2 enough gives you a sixth sense of how buyers and sellers react at certain price points. Its why the triangles I draw work very well. I dont just draw them for shits and giggles  theyre based on consolidation and buying interest compared to selling

theyre based on consolidation and buying interest compared to selling

theyre based on consolidation and buying interest compared to selling

theyre based on consolidation and buying interest compared to selling

In summary

My exit strategy is:

-RR in entry dictates initial exit plan

-Identify past resistances/supports

-Cut incorrect entries quickly

-Once in the green ride momentum while watching for breaks in uptrend indicators

-Beginners use MA’s first and then add pattern recognition

My exit strategy is:

-RR in entry dictates initial exit plan

-Identify past resistances/supports

-Cut incorrect entries quickly

-Once in the green ride momentum while watching for breaks in uptrend indicators

-Beginners use MA’s first and then add pattern recognition

-Once identified resistances are approached watch price action and level 2 for selling or buying pressure

-If a breakdown or selling pressure is more prevalent than selling pressure; lock profits

-Sell into strength on rips that overextend vwap or MA trendlines and buyback on dip

-If a breakdown or selling pressure is more prevalent than selling pressure; lock profits

-Sell into strength on rips that overextend vwap or MA trendlines and buyback on dip

Now to emphasize this is MY exit strategy. I let my winners run, sell on the breakdown and get back on the reversal. The OG followers can attest to this with swings like $MARA $GEVO $SNDL $BTBT $CLSK etc.

I don’t fault anyone for locking profits when they see it.

I don’t fault anyone for locking profits when they see it.

What I will fault people is them holding past the breakdown or bag hold till they turn grey. Cut losses quickly and move your capital to better plays. If you’re investing disregard this but if you want to trade or maximize your investment having an entry/exit plan is essential

Read on Twitter

Read on Twitter