So you’re in a long term relationship and are thinking about taking that next step: accessing a financial product together. So here are four questions you may be asking yourself related to getting financial products with your partner. A thread

#financetwitterJa

#financetwitterJa

1) Should we get a joint bank account together?

For those in a serious relationship (getting married, have a child or are already married) – definitely. Imagine if something happened and you needed to access your spouse’s bank account.

For those in a serious relationship (getting married, have a child or are already married) – definitely. Imagine if something happened and you needed to access your spouse’s bank account.

You can imagine that the bank won’t give you the time of day, especially if you are not married to the person. If you have a joint account, you can pool some funds in together and if God forbid something happens to either of you then your other half will not be left scrambling.

Some couples pool all their money together in a joint account, and some don’t pool any at all. The middle ground at a minimum (for serious relationships) is to at least keep your emergency savings fund there so either of you can access it.

This also applies to your children if you have any. If you want them or anyone else (e.g. a sibling) to access your account in case something happens to you, add them as a joint holder on the account. Ensure its someone you trust because they can access the money at any time.

A similar principle applies for investments. If you want someone else to be able to access it in case something happens you can open a joint brokerage account, you can get a joint mutual fund etc. Speak to your banker or investment adviser more about these options.

2) SHOULD WE BUY A HOUSE TOGETHER?

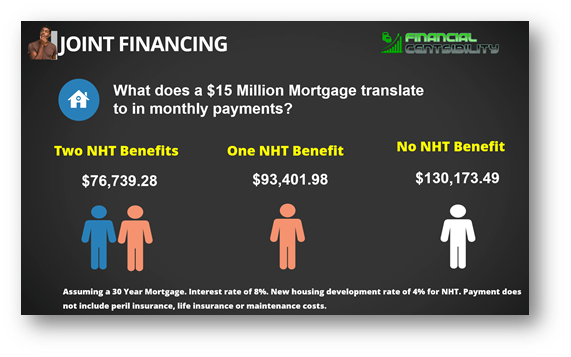

It will always be more cost effective for two persons to pay a mortgage than one. Two NHT benefits can access $13M dollars and one can access $6.5 M. What does that mean? For a $15 M mortgage the payments would be as follows for couples/ single

It will always be more cost effective for two persons to pay a mortgage than one. Two NHT benefits can access $13M dollars and one can access $6.5 M. What does that mean? For a $15 M mortgage the payments would be as follows for couples/ single

See my mortgage calculators on http://financialcentsibility.com/calculators to calculate it for different scenarios. So the couple that has two NHT benefits that are buying their first home will pay $17k less per month than just one person with a NHT Benefit.

If you are a couple with no NHT benefit (e.g. you are buying a second home or are not contributing to the NHT) then you are paying $60,000 more per month than a couple who both have a NHT Benefit. That could be the difference in you being able to buy the home or not.

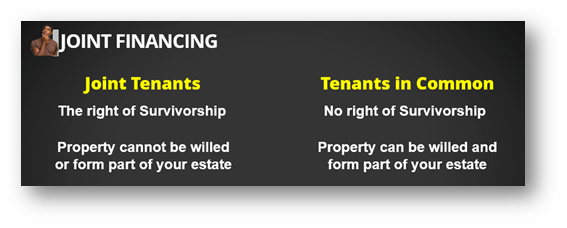

Again I am not a financial advisor or lawyer so speak to one about the implications of doing so. They may tell you about things like this … Joint Tenants or Tenants in Common? Your lawyer will present you with this option when you are going through the house purchase process:

Basically, for Joint Tenants whoever survives is the person that has the full rights to the property. E.g. if you outlive your husband and re-marry right away, you can will the house to your new husband and the 1st husbands kids can get nothing.

Joint Tenancy might be the option for you an your forever bae & you trust that person explicitly to do the right thing, especially if kids are involved. Stuff happens though so I would say if you are buying property with someone you are not married to, choose Tenants in Common.

3) SHOULD WE BUY A CAR /TAKE OUT A LOAN OR GET A CREDIT CARD TOGETHER?

It is always easier for two incomes to qualify for a loan than one, but that means both parties are responsible for repaying the debt if they co-borrowers. This includes credit cards.

It is always easier for two incomes to qualify for a loan than one, but that means both parties are responsible for repaying the debt if they co-borrowers. This includes credit cards.

If you plan to ask someone to take a loan out with you, if you don’t repay it, it will affect them negatively. There are situations that have gone really badly because persons do not understand this.

The same thing also applies if you are guaranteeing your partner’s loan.

The same thing also applies if you are guaranteeing your partner’s loan.

If they default then you are still obligated to repay it. Their debt will become yours and it will show on your credit report as outstanding if they don’t pay it. If someone asks you to be a co-applicant/guarantor on a loan, be prepared to repay the whole loan.

4) Should I get put my boo on my life insurance?

Visit my article on this here for the rest:

http://financialcentsibility.com/centsible-love-personal-finance-tips-for-couples/

Love will make people do some crazy things, but this valentines that think centsibly when making financial choices with your partner!

Visit my article on this here for the rest:

http://financialcentsibility.com/centsible-love-personal-finance-tips-for-couples/

Love will make people do some crazy things, but this valentines that think centsibly when making financial choices with your partner!

Read on Twitter

Read on Twitter