Valuations, Valuations, Valuations.

How to get comfortable with high valuations for high growth exceptional companies.

A data driven thread with some examples:

$CRWD $MELI $SE $OKTA

How to get comfortable with high valuations for high growth exceptional companies.

A data driven thread with some examples:

$CRWD $MELI $SE $OKTA

For this thread I looked very high growth and high valuation companies which I believe mostly did not have Covid alone tail winds.

To prevent endless (and counter productive) debate, I eliminated $ETSY, $PTON, $ZM, etc. since folks might argue their growth is Covid related.

To prevent endless (and counter productive) debate, I eliminated $ETSY, $PTON, $ZM, etc. since folks might argue their growth is Covid related.

I am trying to answer some questions for myself:

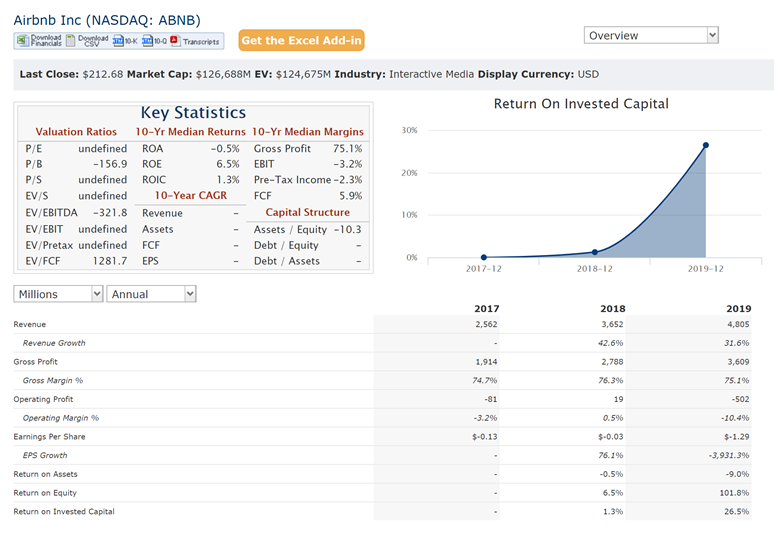

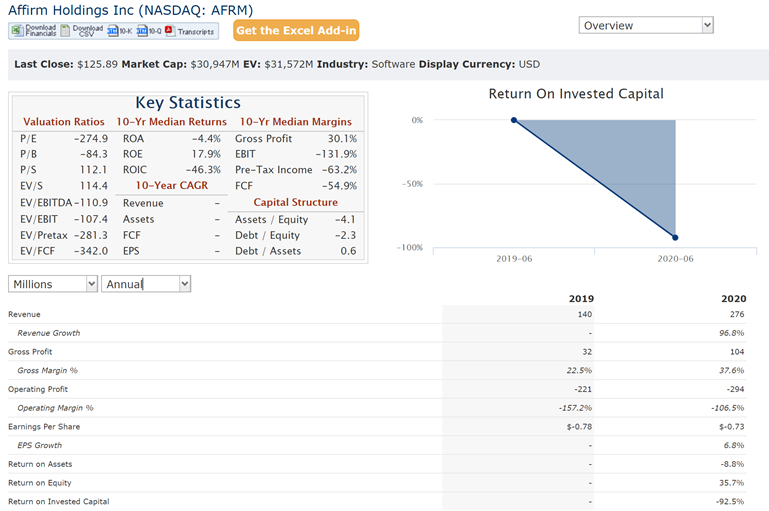

1. What data tells me to get COMFORTABLE buying highly valued companies? E.g. $ABNB $AFRM etc. These are just examples, I am sure there are others

2. What data tells me that stock X is highly valued deserving vs. not deserving

1. What data tells me to get COMFORTABLE buying highly valued companies? E.g. $ABNB $AFRM etc. These are just examples, I am sure there are others

2. What data tells me that stock X is highly valued deserving vs. not deserving

The hypothesis:

GREAT companies command a premium and will always do so - e.g. $NFLX $AMZN $TSLA etc. <again these are examples>.

The premium is sometimes a bet on future earnings growth, i.e. revenue + margin

Other times it is a bet on something else <unknown>

GREAT companies command a premium and will always do so - e.g. $NFLX $AMZN $TSLA etc. <again these are examples>.

The premium is sometimes a bet on future earnings growth, i.e. revenue + margin

Other times it is a bet on something else <unknown>

I cannot qualify <GREAT>, so I will leave that discussion to you. "Great", like "Beauty" is in the eyes of the beholder.

Great may == Terrific Management, Superior Management team, Amazing product combined + Moat (Differentiator)

Great may == Terrific Management, Superior Management team, Amazing product combined + Moat (Differentiator)

Supporting data for thesis to be proven or not:

1. Great companies constantly beat projections and raise guidance

2. Great companies grow more than <market> or competitors

3. Great companies do well regardless of market conditions

1. Great companies constantly beat projections and raise guidance

2. Great companies grow more than <market> or competitors

3. Great companies do well regardless of market conditions

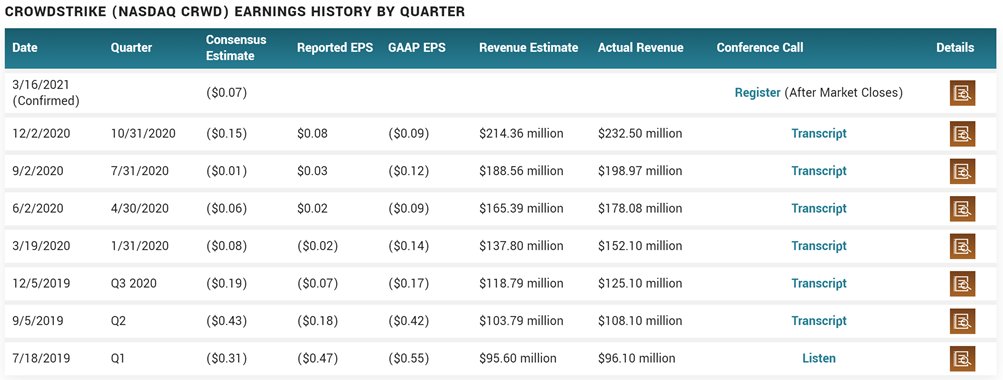

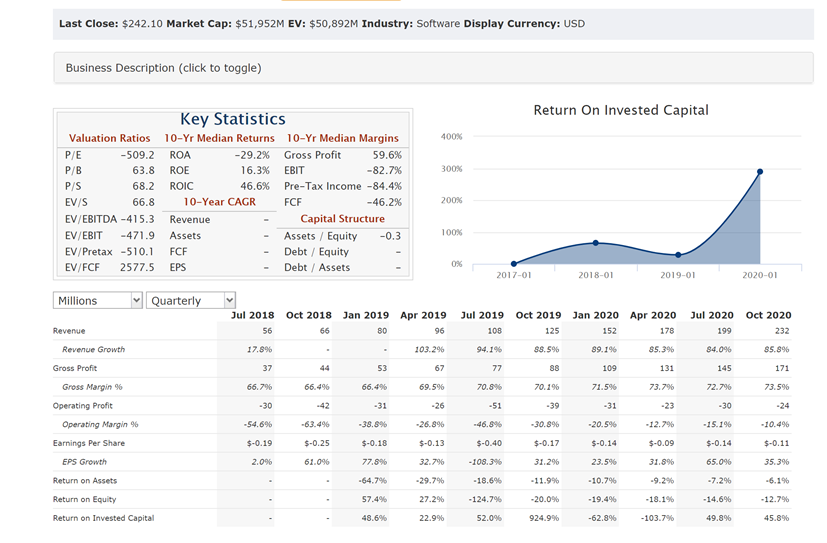

E.g. $CRWD went public on Jun 2019, at $5.7B Mcap, $119M in revenue, 23X LTM revenue

Since then EVERY QUARTER they have beaten and raised guidance

Now they are at $1B TTM revenue, $52B Mcap, 52X LTM revenue

Since then EVERY QUARTER they have beaten and raised guidance

Now they are at $1B TTM revenue, $52B Mcap, 52X LTM revenue

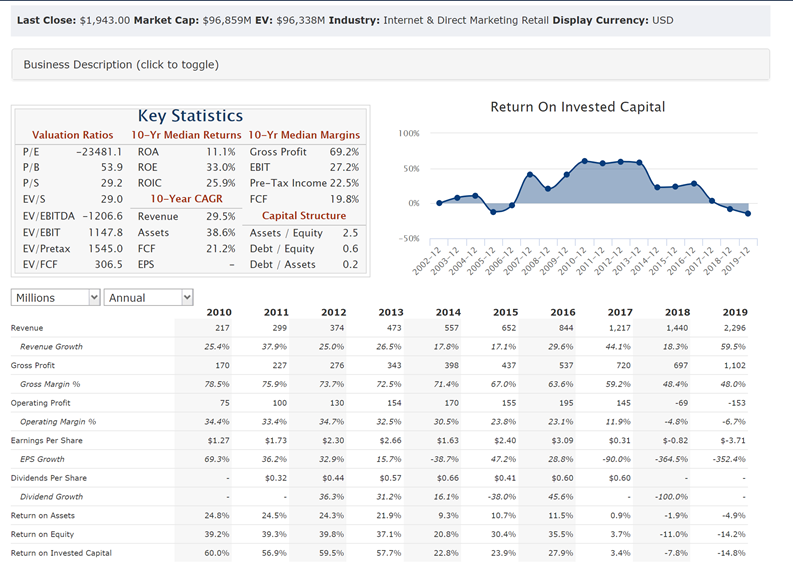

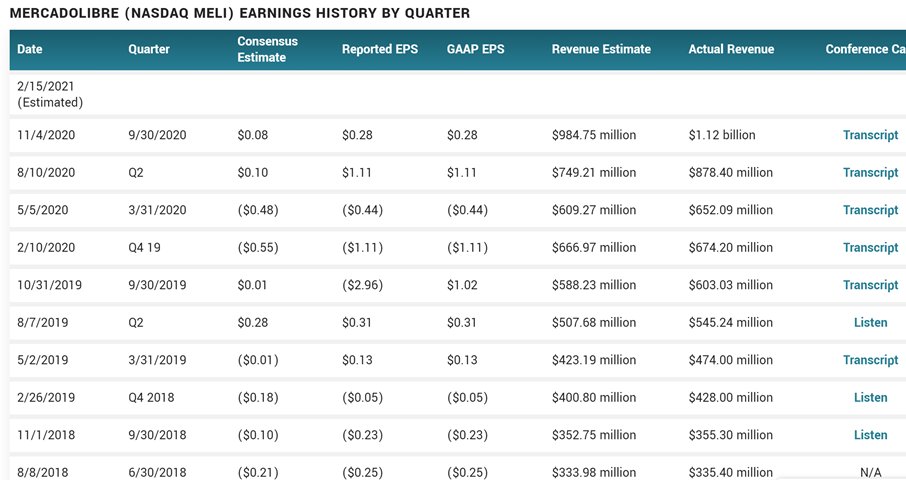

E.g. 2: $MELI went public Aug 2007, Mcap $1.6B, $85M, 188X LTM

Since then 82% of Q, they have beaten guidance

Now they are at $4B NTM revenue, $96B Mcap, 24X NTM

Since then 82% of Q, they have beaten guidance

Now they are at $4B NTM revenue, $96B Mcap, 24X NTM

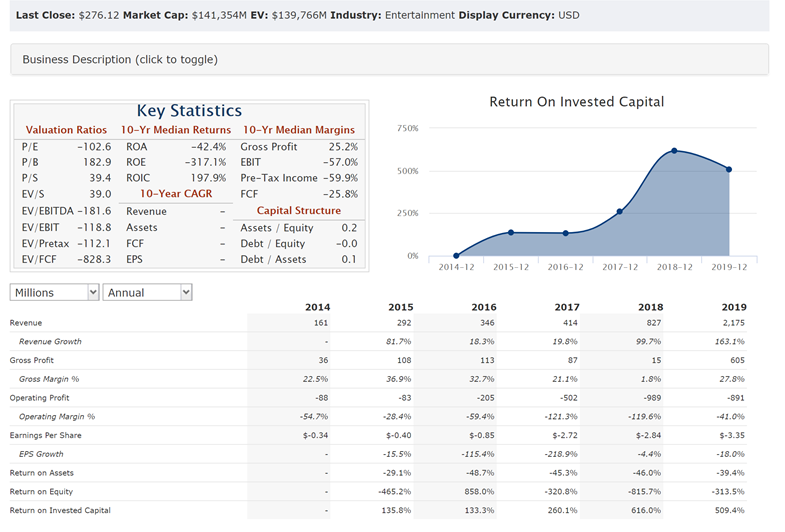

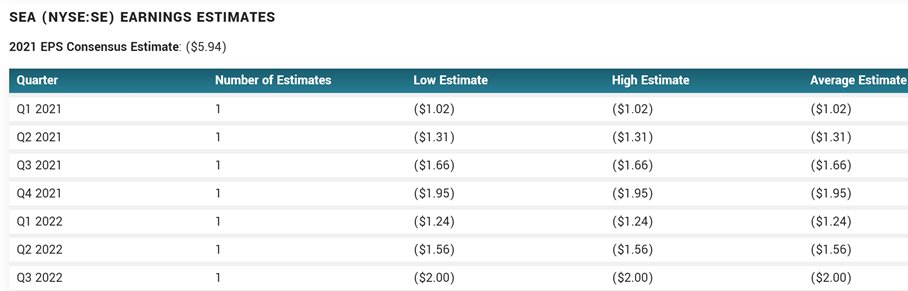

E.g. 3: $SE - went IPO Oct 2017 with $354M in LTM revenue, $5.4B in Mcap, at 15X LTM

Since then they have beaten and raised guidance EVERY Q

Now they are $141B in Mcap, $4.2B NTM and 35X EV to NTM

Since then they have beaten and raised guidance EVERY Q

Now they are $141B in Mcap, $4.2B NTM and 35X EV to NTM

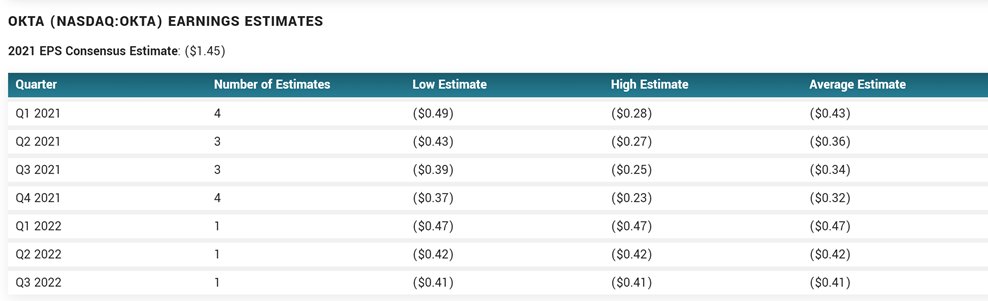

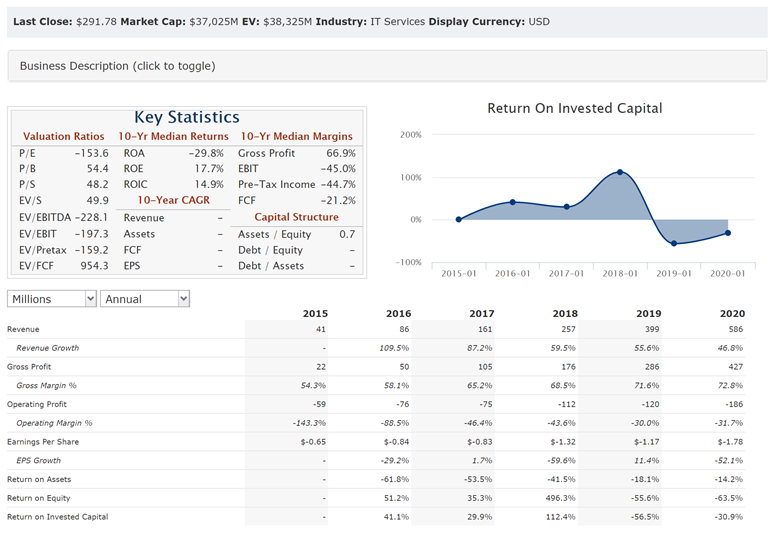

E.g. 4: $OKTA - went IPO Apr 2017, with $86M in LTM revenue, $2.14B in MCap at 24X LTM

Since they they have beaten and raised guidance EVERY Q

Now they are at $1B in NTM reveues, $37B in Mcap, 37X NTM

Since they they have beaten and raised guidance EVERY Q

Now they are at $1B in NTM reveues, $37B in Mcap, 37X NTM

I can give you 15 more examples (including Covid names e.g. $PTON $CHWY $ZM), but you get the point.

At time of IPO, except $MELI at 188X - ridiculously expensive, all others were expensive.

On AVERAGE these grew rev 21% FASTER than projected growth and 49% faster than peers

At time of IPO, except $MELI at 188X - ridiculously expensive, all others were expensive.

On AVERAGE these grew rev 21% FASTER than projected growth and 49% faster than peers

So, Q 2: What data tells me ONE company is deserving of rich valuation and another is NOT?

1. Take SOM, divide by MCap at IPO and multiple by growth LTM to NTM - the best ones are are > 3 - 4X premium to Market SOM growth

e.g. $MELI 14X, $SE - 5X, $OKTA 3X and $CRWD 7X

1. Take SOM, divide by MCap at IPO and multiple by growth LTM to NTM - the best ones are are > 3 - 4X premium to Market SOM growth

e.g. $MELI 14X, $SE - 5X, $OKTA 3X and $CRWD 7X

Q1: What data tells me to get comfortable with buying richly valued companies?

Growth beat to Q expectations.

The best companies have beaten revenue and growth projections by 7% - 25% on average.

Think about that again - 7% to 25% beat on top of their already high expectations

Growth beat to Q expectations.

The best companies have beaten revenue and growth projections by 7% - 25% on average.

Think about that again - 7% to 25% beat on top of their already high expectations

So, how can I use this data?

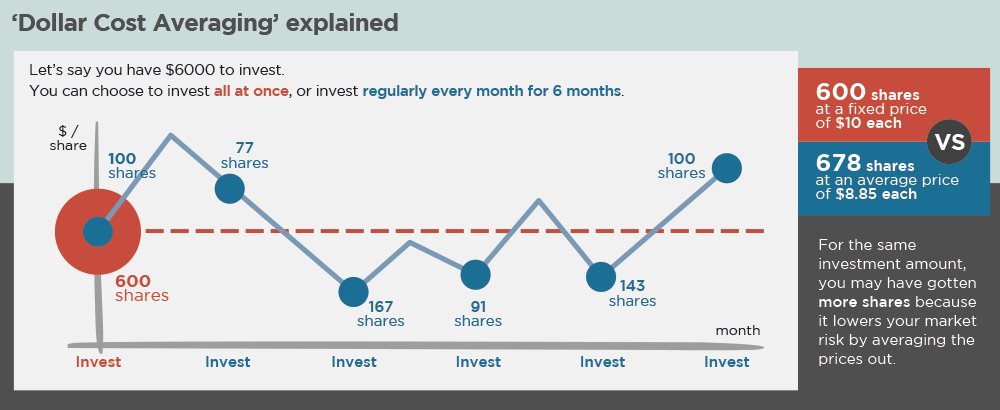

1. Buy companies after minimal DD knowing that their valuation may be high. Buy 25% - 50% of position.

2. Watch 1st Q earnings. Add 10% - 15% position on 7-25% beat in first Q of reporting

3. Watch 2nd Q earnings. Add remaining position on beat

1. Buy companies after minimal DD knowing that their valuation may be high. Buy 25% - 50% of position.

2. Watch 1st Q earnings. Add 10% - 15% position on 7-25% beat in first Q of reporting

3. Watch 2nd Q earnings. Add remaining position on beat

E.g. $GHVI - Matterport 129X LTM and 69X NTM - ooooh. Rich. Richer than $MELI and richest I have seen so far, but maybe have a small starter position and grow.

How big can this get? That's the question to ask.

How big can this get? That's the question to ask.

Glossary of terms I used:

1. LTM - Last Twelve Months

2. NTM - Next Twelve Months

3. SOM - Serviceable Obtainable Market

4. MCap - Market Capitalization

1. LTM - Last Twelve Months

2. NTM - Next Twelve Months

3. SOM - Serviceable Obtainable Market

4. MCap - Market Capitalization

$ABNB: IPO date Dec 2020, LTM Revenue $3.4B, MCap $102B with 30X M Cap to LTM

$ABNB today, $127.8B Mcap, NTM 4.5B, 28X MCap to NTM

If this is expensive, you are right. Wait till it gets nosebleed.

<CAUTION>: If there is a market correction, all stocks will drop.

$ABNB today, $127.8B Mcap, NTM 4.5B, 28X MCap to NTM

If this is expensive, you are right. Wait till it gets nosebleed.

<CAUTION>: If there is a market correction, all stocks will drop.

Read on Twitter

Read on Twitter