@Astra / $HOL

Who are they? What do they do? And why do I think they have the potential to be the next 20-bagger startup?

This thread will deep dive how @Astra is well positioned to take advantage of an emerging ONE TRILLION DOLLAR+ industry in the next decade.

[THREAD]

Who are they? What do they do? And why do I think they have the potential to be the next 20-bagger startup?

This thread will deep dive how @Astra is well positioned to take advantage of an emerging ONE TRILLION DOLLAR+ industry in the next decade.

[THREAD]

What does Astra do?

(2/21) @Astra is the first pure-play public space company looking to provide a variety of launch services to help streamline privatization of space.

A primary example is delivering low-earth orbit satellites at scale.

Here’s there mission statement below:

(2/21) @Astra is the first pure-play public space company looking to provide a variety of launch services to help streamline privatization of space.

A primary example is delivering low-earth orbit satellites at scale.

Here’s there mission statement below:

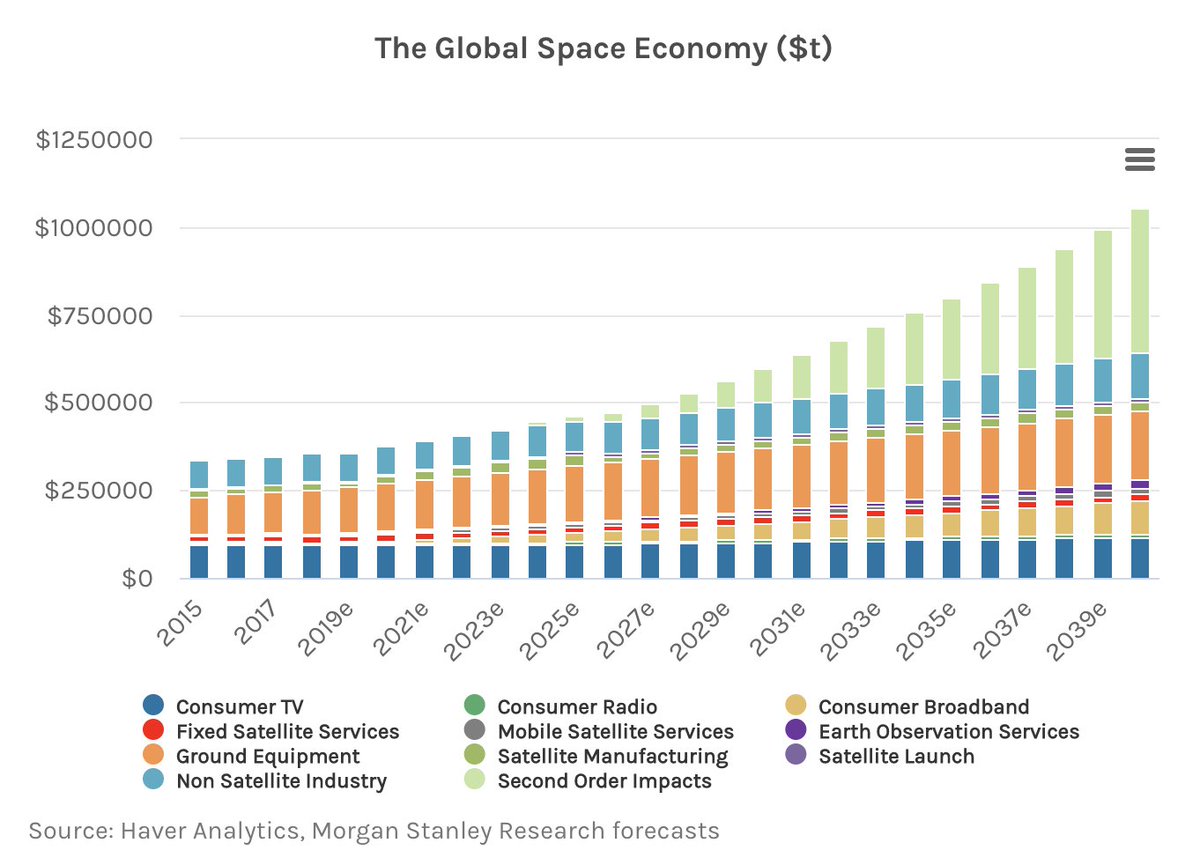

(3/21) Today, the space industry is worth $350B.

And according to Morgan Stanley, the privatization of space will dramatically increase this valuation to a conservative estimate of over $1T (+186%) by 2040.

Potential economic drivers for this expected valuation is seen below.

And according to Morgan Stanley, the privatization of space will dramatically increase this valuation to a conservative estimate of over $1T (+186%) by 2040.

Potential economic drivers for this expected valuation is seen below.

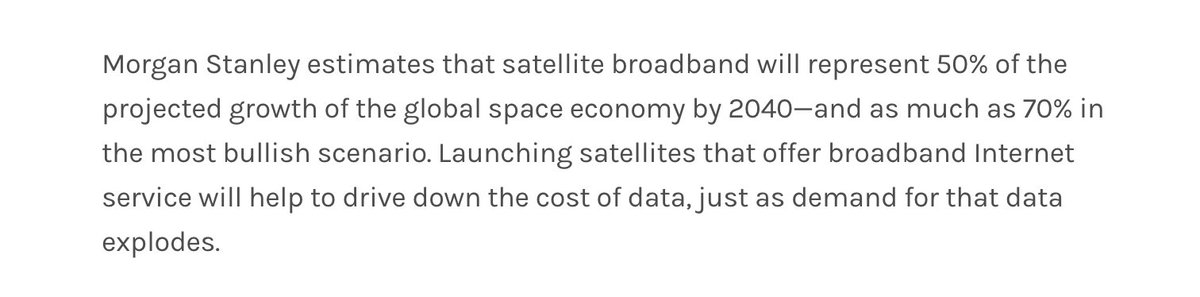

(4/21) In addition, they project satellite broadband to represent as high as +70% of the projected growth driver of the entire space economy.

For launching satellite payloads as a main service for @Astra, they’re positioned to emerge as a leader of space logistics.

For launching satellite payloads as a main service for @Astra, they’re positioned to emerge as a leader of space logistics.

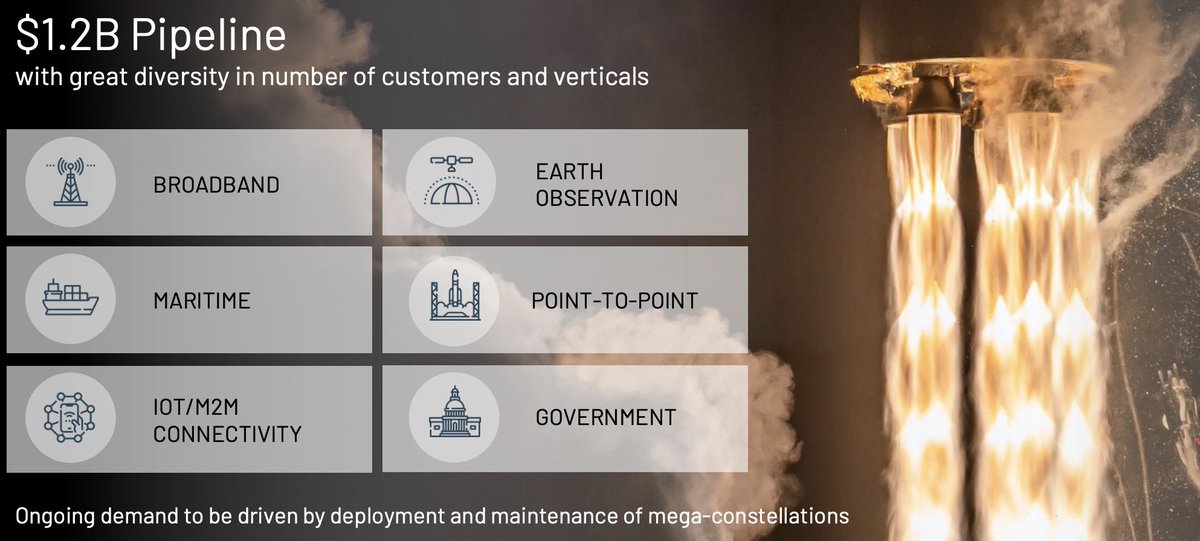

(5/21) More on this, @Astra is already seeing customers line up for their services. Here is what is confirmed:

10+ customers — 5+ of which are govt's

10+ customers — 5+ of which are govt's

50+ launches & 100+ spacecraft in backlog

50+ launches & 100+ spacecraft in backlog

$150M+ in contracted revenue

$150M+ in contracted revenue

Awarded @NASA VLCS contract for their CubeSats

Awarded @NASA VLCS contract for their CubeSats

10+ customers — 5+ of which are govt's

10+ customers — 5+ of which are govt's 50+ launches & 100+ spacecraft in backlog

50+ launches & 100+ spacecraft in backlog $150M+ in contracted revenue

$150M+ in contracted revenue Awarded @NASA VLCS contract for their CubeSats

Awarded @NASA VLCS contract for their CubeSats

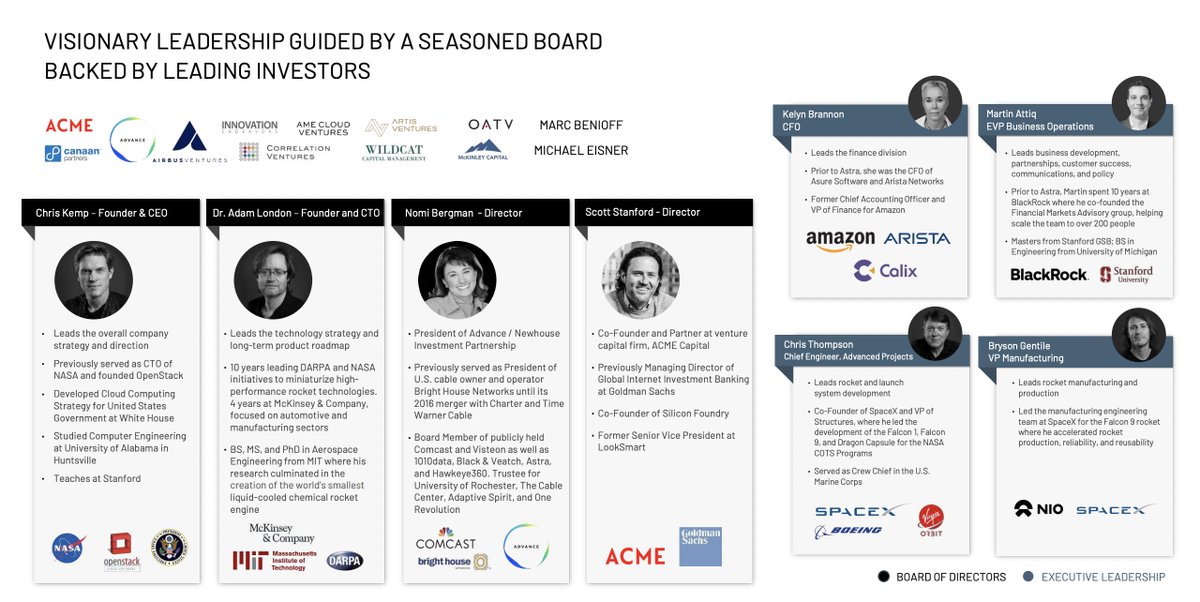

(6/21) To fulfill their backlog of customers, @Astra is piloted by one of the best leadership teams I've seen in recent memory.

Their culmination of experience stem from relevant industry leaders such as: @NASA @SpaceX @Boeing @VirginOrbit and more.

Their culmination of experience stem from relevant industry leaders such as: @NASA @SpaceX @Boeing @VirginOrbit and more.

(7/21) More on leadership:

At the helm, their founders Chris Kemp (CEO) and Dr. Adam London (CTO), both have proven track records at government agencies.

Chris previously served as @NASA’s CTO, while Dr. London has 10+ years experience leading rocket tech at both @NASA & @DARPA

At the helm, their founders Chris Kemp (CEO) and Dr. Adam London (CTO), both have proven track records at government agencies.

Chris previously served as @NASA’s CTO, while Dr. London has 10+ years experience leading rocket tech at both @NASA & @DARPA

(8/21) Why is this important?

They project an aggressive outlook of a $1.2B pipeline in the short-term.

To achieve this type of scale, a relevant-experienced leadership team is needed to meet a rapidly expanding demand with quick decision making to capitalize on opportunity.

They project an aggressive outlook of a $1.2B pipeline in the short-term.

To achieve this type of scale, a relevant-experienced leadership team is needed to meet a rapidly expanding demand with quick decision making to capitalize on opportunity.

(9/21) As scaling is not an easy feat for startups, @Astra's timeline has proven to meet demand as quickly as possible (more on this later) with their first commercial payload launching as soon as this summer.

Here is the CEO speaking about scale:

Here is the CEO speaking about scale:

(10/21) Why expediting scale for this industry is important:

This provides @Astra a first-mover advantage attribute among the growing competition.

With a widely untapped TAM (total addressable market), Astra will acquire a large market share to support aggressive projections…

This provides @Astra a first-mover advantage attribute among the growing competition.

With a widely untapped TAM (total addressable market), Astra will acquire a large market share to support aggressive projections…

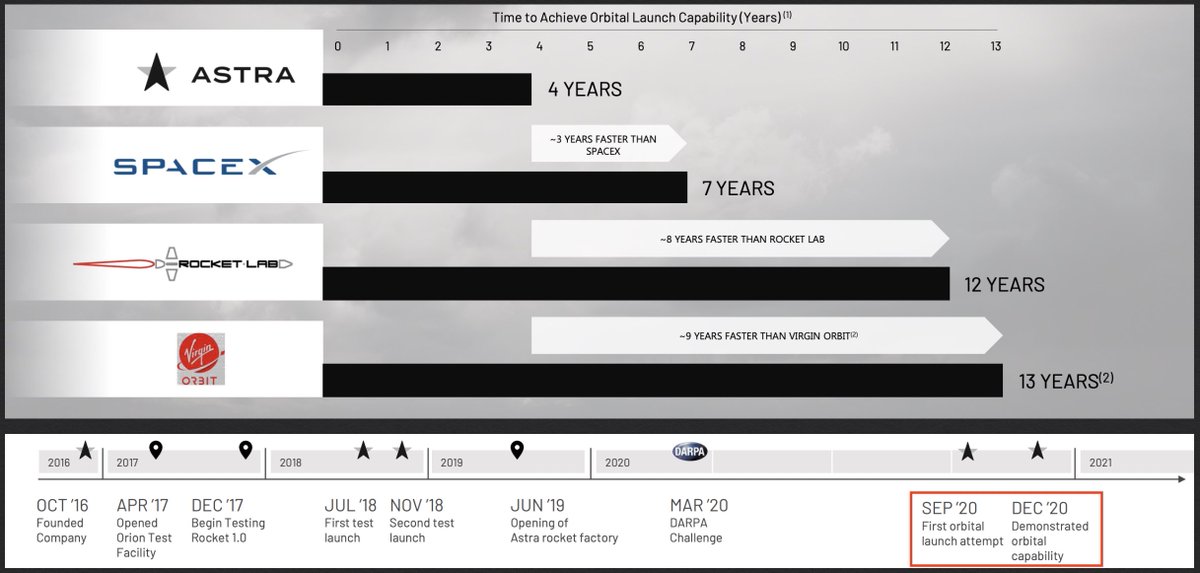

(11/21) …And they've proven they can scale quickly.

Founded in 2016, their rapid test launch success (TL below) achieved them the fastest in history to demonstrate orbital launch capability of a commercial vehicle.

They remarkably outpaced SpaceX by about 3 years

Founded in 2016, their rapid test launch success (TL below) achieved them the fastest in history to demonstrate orbital launch capability of a commercial vehicle.

They remarkably outpaced SpaceX by about 3 years

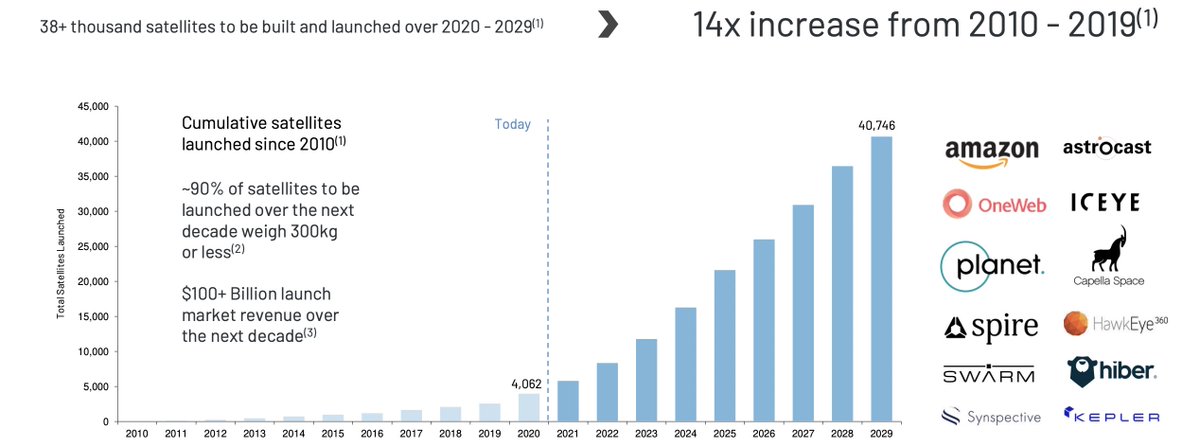

(12/21) @Astra's core competencies has garnered them continual success, positioning them at the forefront of overwhelming demand that’ll accumulate the company a surplus of immediate revenue drivers.

Over 38K satellites will be built and launched in the next decade alone.

Over 38K satellites will be built and launched in the next decade alone.

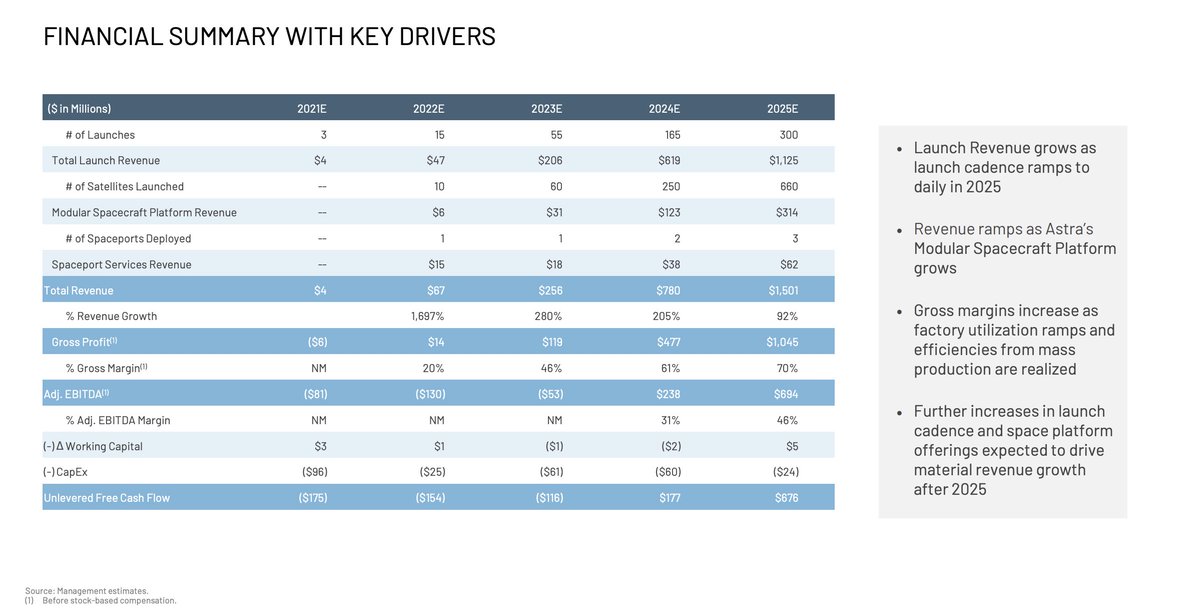

(13/21) With that, lets talk about their fundamentals.

+142.2% CAGR by 2023-2025E

+142.2% CAGR by 2023-2025E

2025E adj. EBITDA of $694M

2025E adj. EBITDA of $694M

2025E Gross Profit of $1.045B

2025E Gross Profit of $1.045B

Positive FCF by 2024

Positive FCF by 2024

Positive gross profit is projected as early as next year. Hoping to fulfill 15 launches in that span.

+142.2% CAGR by 2023-2025E

+142.2% CAGR by 2023-2025E 2025E adj. EBITDA of $694M

2025E adj. EBITDA of $694M 2025E Gross Profit of $1.045B

2025E Gross Profit of $1.045B Positive FCF by 2024

Positive FCF by 2024Positive gross profit is projected as early as next year. Hoping to fulfill 15 launches in that span.

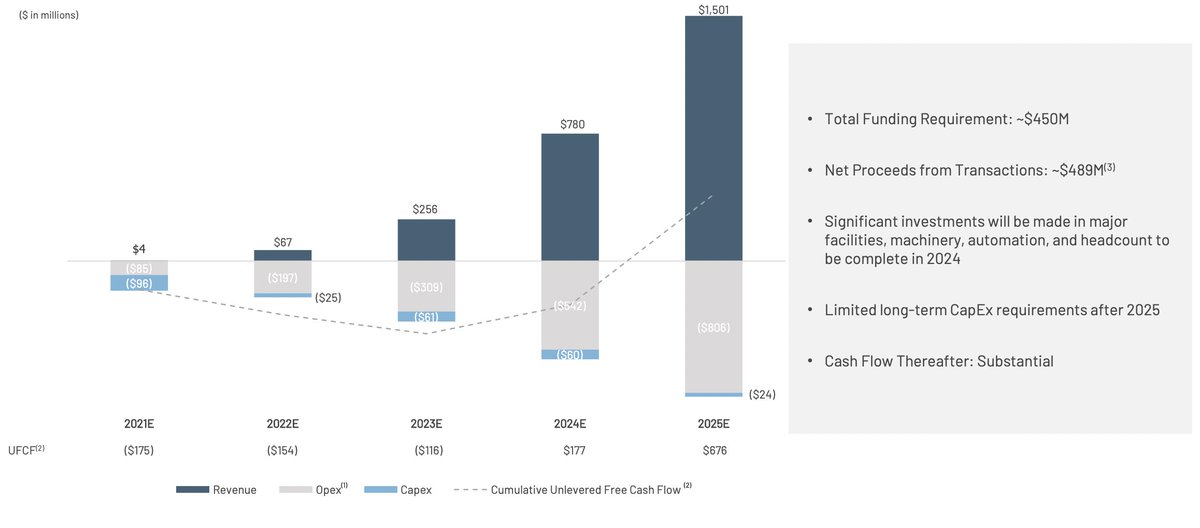

(14/21) More on fundamentals:

Still in pre-revenue stage ($1.5B projected gross rev by '25)

Still in pre-revenue stage ($1.5B projected gross rev by '25)

TEV @ $2.1B

TEV @ $2.1B

TEV/Adj. EBITDA projected at 3.1x

TEV/Adj. EBITDA projected at 3.1x

Only 1.4x multiple for TEV/Rev

Only 1.4x multiple for TEV/Rev

$200M PIPE

$200M PIPE

275.5M of outstanding shares de-SPAC (Merger in Q2 '21)

275.5M of outstanding shares de-SPAC (Merger in Q2 '21)

Funding outlook below:

Funding outlook below:

Still in pre-revenue stage ($1.5B projected gross rev by '25)

Still in pre-revenue stage ($1.5B projected gross rev by '25) TEV @ $2.1B

TEV @ $2.1B TEV/Adj. EBITDA projected at 3.1x

TEV/Adj. EBITDA projected at 3.1x Only 1.4x multiple for TEV/Rev

Only 1.4x multiple for TEV/Rev $200M PIPE

$200M PIPE 275.5M of outstanding shares de-SPAC (Merger in Q2 '21)

275.5M of outstanding shares de-SPAC (Merger in Q2 '21) Funding outlook below:

Funding outlook below:

(15/21) By standard, there fundamentals seem aggressive.

But given their efficient resume achieving orbital launch capability as quickly as they did, the projections aren’t as farfetched.

The key factor will be controlling costs as trailblazing a new industry is expensive.

But given their efficient resume achieving orbital launch capability as quickly as they did, the projections aren’t as farfetched.

The key factor will be controlling costs as trailblazing a new industry is expensive.

(16/21) While many may find pre-rev startups with little fundamental drivers to properly value the business, an important element for me to substitute this is a company's milestones.

Here’s a compiled list of video testimonies @Astra provides since their founding in 2016...

Here’s a compiled list of video testimonies @Astra provides since their founding in 2016...

(17/21) The greatest achievement to date:

December 15, 2020 — successful launch of orbital launch capability and nominal stage separation.

December 15, 2020 — successful launch of orbital launch capability and nominal stage separation.

(18/21) Here is an inside look of @Astra’s rocket factory (launched in June 2019) that’s in use, operational, and expanding.

(19/21) And finally, a more comprehensive list of @Astra’s milestones can be found in the link to their webpage down below. https://astra.com/welcome/

(20/21) In conclusion, @Astra's model, plus their approach to profitability, makes them an attractive investment to be the next multi-bag runner in the next few years.

I am long @Astra / $HOL and I plan on seizing every opportunity buying dips as many times as I can.

I am long @Astra / $HOL and I plan on seizing every opportunity buying dips as many times as I can.

(21/21) If you made it this far, thank you for tuning in! I appreciate you.

Special thanks to @Astra and other sources such as @MorganStanley, @CNBC, @YouTube & @TechCrunch.

If you enjoyed this thread, leave a comment down below as I’d love to hear your thoughts. Thanks again!

Special thanks to @Astra and other sources such as @MorganStanley, @CNBC, @YouTube & @TechCrunch.

If you enjoyed this thread, leave a comment down below as I’d love to hear your thoughts. Thanks again!

Read on Twitter

Read on Twitter![@Astra / $HOL Who are they? What do they do? And why do I think they have the potential to be the next 20-bagger startup?This thread will deep dive how @Astra is well positioned to take advantage of an emerging ONE TRILLION DOLLAR+ industry in the next decade.[THREAD] @Astra / $HOL Who are they? What do they do? And why do I think they have the potential to be the next 20-bagger startup?This thread will deep dive how @Astra is well positioned to take advantage of an emerging ONE TRILLION DOLLAR+ industry in the next decade.[THREAD]](https://pbs.twimg.com/media/EuNQD5FVEAAznpy.jpg)