1/ Bitcoin And The Rise Of The Megacorp

- What does it mean to have corporate treasuries buying Bitcoin?

- How Bitcoin will help make companies independent of countries

A thread

- What does it mean to have corporate treasuries buying Bitcoin?

- How Bitcoin will help make companies independent of countries

A thread

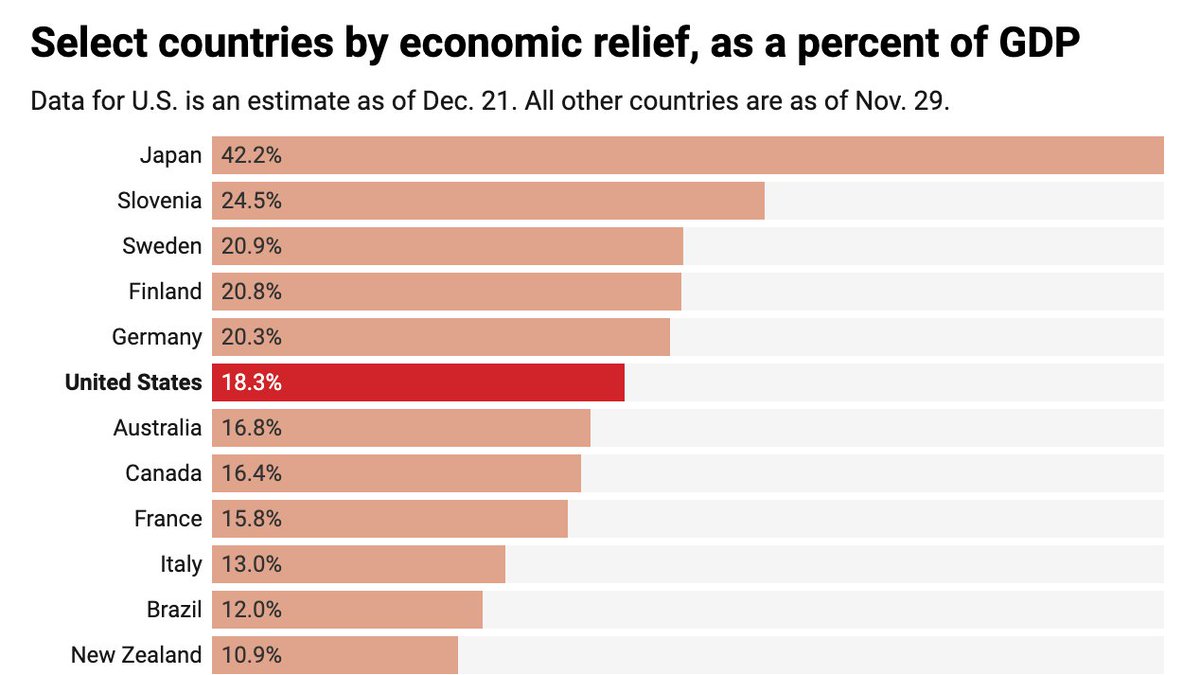

2/ Governments across the world had elevated debt and structural financial issues before COVID hit. Once COVID unleashed economic destruction, governments engaged in unprecedented money printing operations on both a fiscal (above) and monetary policy level.

3/ ”There is an infinite amount of cash in the Federal Reserve” - Neel Kashkari said on March 22, 2020 (He’s the president of the Minneapolis Fed)

4/ As businesses became concerned with the outlook of they world, the started to pile up cash to the tune of $2.5 trillion by the end of 2020 (elevated cash accumulation had already been happening over the last 10 years).

https://www.spglobal.com/ratings/en/research/articles/201208-u-s-corporates-hold-record-2-5-trillion-cash-to-meet-pandemic-shock-debt-reaches-7-8-trillion-11762147

https://www.spglobal.com/ratings/en/research/articles/201208-u-s-corporates-hold-record-2-5-trillion-cash-to-meet-pandemic-shock-debt-reaches-7-8-trillion-11762147

5/ Companies hold cash to protect against uncertainty, ensure their ability to fund critical projects, and compete.

But now corporate executives are waking up to a reality where these fiscal and monetary policies will lead to massive devaluation of their cash pile.

But now corporate executives are waking up to a reality where these fiscal and monetary policies will lead to massive devaluation of their cash pile.

6/ In 2020, Michael Saylor, the CEO of MicroStrategy, rocked the world when he announced that he was going to take the billions MicroStrategy had in cash and put it in Bitcoin. https://cointelegraph.com/news/microstrategy-s-ceo-reveals-the-company-s-surprising-bitcoin-buying-strategy

7/ Bitcoin has a fixed 21 million supply that is unalterable, or subject to the whims of the masses or politicians. And it’s the best performing asset of the last decade, gaining almost 9,000,000%. This makes it an incredibly attractive way to preserve that cash pile.

8/ “If your company has money on its balance sheets and it’s sitting in fiat currencies like euros and dollars, they are losing about 15% of their purchasing power each year” - @michael_saylor

9/ Soon after Michael Saylor de-risked the move (from a career risk perspective), other companies started to pile in. This movement reached a fever pitch on Monday with Tesla announcing that they were allocating $1.5B into Bitcoin.

10/ “As part of the [updated investment] policy, we may invest a portion of such cash in certain specified alternative reserve assets. Thereafter, we invested an aggregate $1.50 billion in bitcoin under this policy.” - @Tesla 10k filing

11/ And last week, ~7,000 companies attended @michael_saylor Bitcoin Conference where he walked them through how companies can use Bitcoin in their treasury as a hedge.

The amount of Bitcoin held in corporate treasuries is now $56 billion (as of the time of this newsletter).

The amount of Bitcoin held in corporate treasuries is now $56 billion (as of the time of this newsletter).

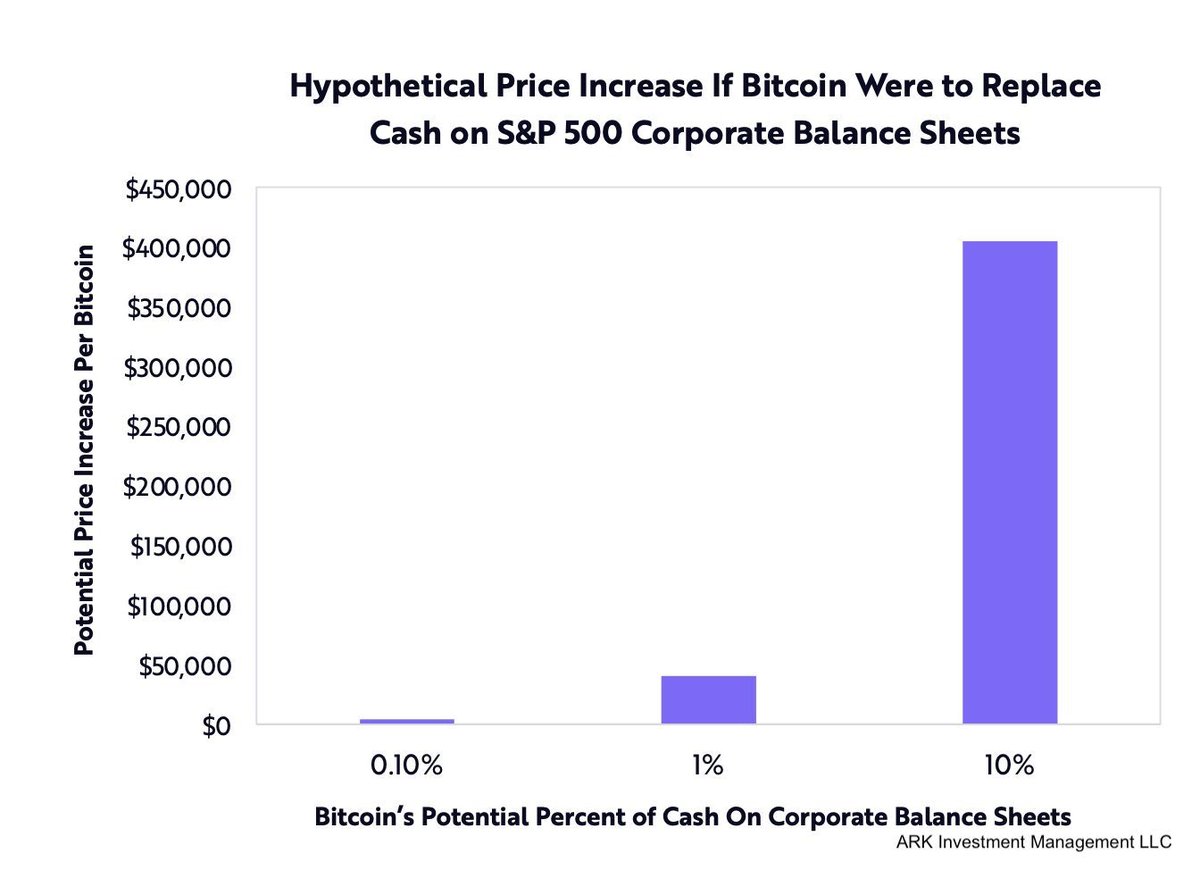

12/ An interesting analysis done by @yassineARK estimated that Bitcoin’s price would surge to $400,000 if just 10% of S&P 500 company cash was allocated.

13/ This is a huge moment for Bitcoin. Not only is it a huge validation of the “Gold 2.0” or “Store of Value” narrative, it makes it increasingly more difficult to ban.

14/ If many large companies bought Bitcoin with their treasury and then it was banned by the US government, the stock market would plummet, retail and institutional investors would be enraged, and politicians wouldn’t be reelected.

Bitcoin is just getting started.

Bitcoin is just getting started.

15/ The emperor has no clothes

Trust in our institutions is crumbling. COVID laid this bare with the poor medical and fiscal/monetary response by governments globally.

Trust in our institutions is crumbling. COVID laid this bare with the poor medical and fiscal/monetary response by governments globally.

16/ “The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust...."

17/ "...Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts.” - Satoshi

18/ The complete disconnect and hypocrisy of the bureaucrats as they themselves wined and dined while small businesses/plebs toiled under silly enforcement policies has lead to further disillusionment.

19/ COVID only partially represented the political/financial elite being completely disconnected from reality. Examples:

”Cryptocurrencies are a particular concern. I think many are used – at least in a transaction sense – mainly for illicit financing.” - @JanetYellen (2/7/21)

”Cryptocurrencies are a particular concern. I think many are used – at least in a transaction sense – mainly for illicit financing.” - @JanetYellen (2/7/21)

20/ “My No. 1 focus on cryptocurrencies, whether that be digital currencies or bitcoin or other things, is that we want to make sure that they’re not used for illicit activities” - @stevenmnuchin1 (1/25/2018)

21/ Total fines paid by the big banks for money laundering, manipulation, etc. over the last 10 years:

$330,904,834,105.

That’s right, $330 Billion.

And how many went to jail? Almost no one.

But sure, Bitcoin is the “problem.”

$330,904,834,105.

That’s right, $330 Billion.

And how many went to jail? Almost no one.

But sure, Bitcoin is the “problem.”

22/ ”[Bitcoin] a highly speculative asset, which has conducted some funny business and some interesting and totally reprehensible money laundering activity.” - ECB President Christine Lagarde (1/13/21)

23/ Lagarde was previously convicted of a financial crime in 2016 (for when she was France’s Finance minister) while serving as the managing director at the IMF. However, like all good politicians/bureaucrats, she escaped punishment and kept her job.

24/ The financial leaders across the world are scared and clueless.

Corporate leaders can sense it. We can all sense it.

“The more apparent it is that a system is nearing an end, the more reluctant people will be to adhere to its laws.” - The Sovereign Individual

Corporate leaders can sense it. We can all sense it.

“The more apparent it is that a system is nearing an end, the more reluctant people will be to adhere to its laws.” - The Sovereign Individual

25/ Enjoying this tweet thread so far?

Sign up for my newsletter to get it first on Thursdays! https://danheld.substack.com/

Sign up for my newsletter to get it first on Thursdays! https://danheld.substack.com/

26/ “A megacorp is a corporation that is a massive conglomerate. They are so powerful that they can ignore the law, possess their own heavily armed private armies, be the operator of a privatized police force, hold "sovereign" territory, and even act as outright governments.”

27/ While this sounds like science fiction, there are real-life corporations (ex: colonial era) that have achieved megacorporation status in various ways:

The Dutch East India Company operated 40 warships and had 10,000 private soldiers to monitor its farflung spice empire

The Dutch East India Company operated 40 warships and had 10,000 private soldiers to monitor its farflung spice empire

28/ The British East India Company controlled a large colonial empire and maintained a 300,000 strong standing army in the mid-19th century before the company was dissolved and its territories absorbed into the British Empire.

29/ The Hudson's Bay Company was once the world's largest landowner, exercising control of its territory known as Rupert's Land which at one point consisted of 15% of the North American land mass.

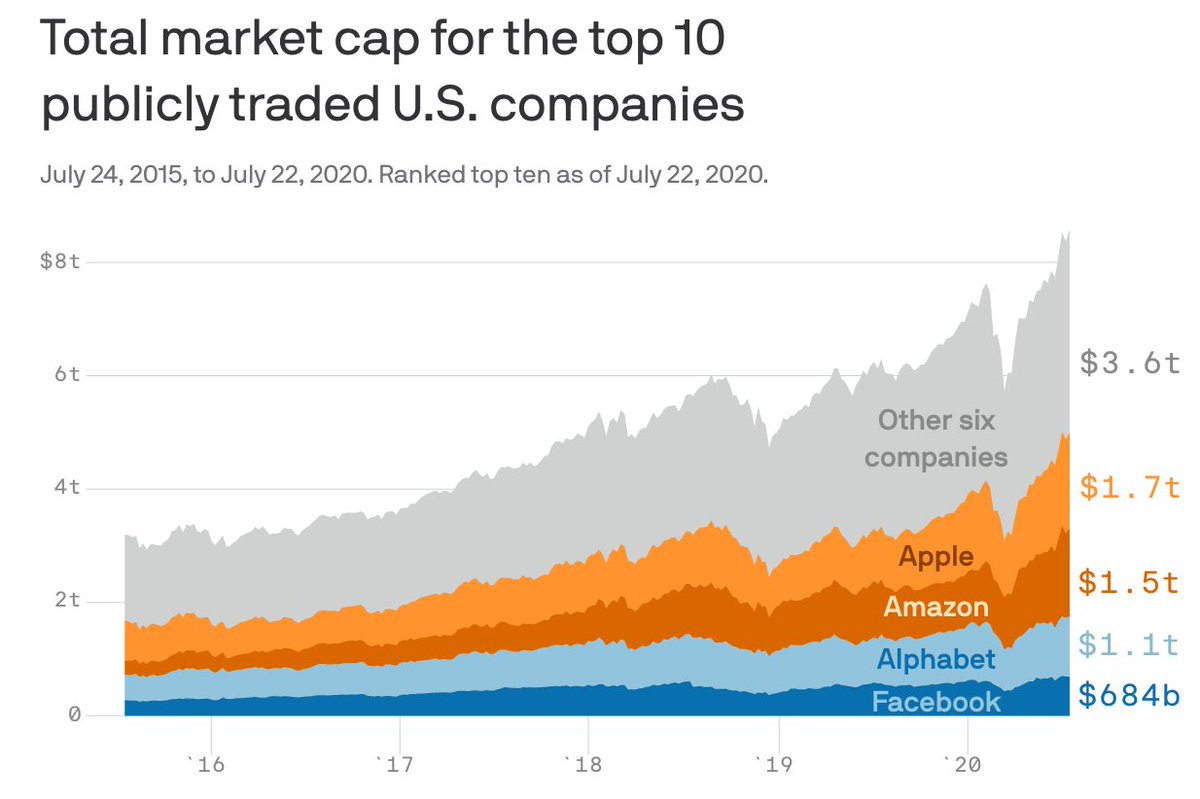

30/ The large tech corps: Facebook, Apple, Amazon, Alphabet are the new megacorps that have larger populations (ex: Facebook has 2.8 Billion monthly active users)

31/ .. Control more commerce (Apple and Alphabet represent a giant % of all smartphones), and are worth more than countries.

32/ For example, the four top publicly traded companies’ combined market capitalization is ~$5 Trillion (as of July 2020), which make them in aggregate the 3rd largest GDP in the world when compared to countries.

33/ Bitcoin unlocks the final step towards true independence from governments: control over money. Properly stored Bitcoin is nearly impossible to seize (especially with multi-signature set ups over different geographic areas).

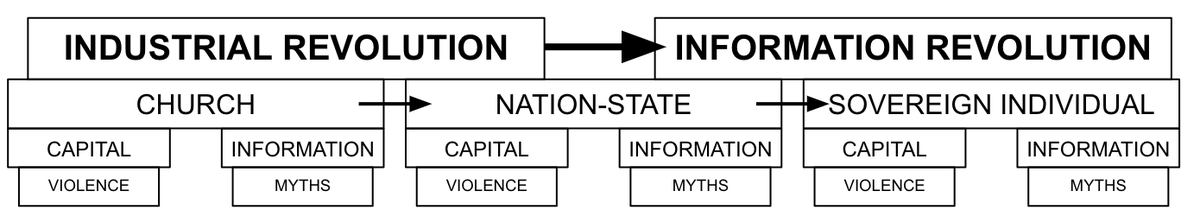

34/ In the book “The Sovereign Individual” it was predicted that citizens and companies would break free from government oppression (written in 1996).

35/ This would come about through the “Information Revolution” of the internet + encryption that would change the power dynamics with governments. Just like how the previous Industrial Revolution had led to the break up of the church and state.

36/ Why is this important? Businesses ultimately solve problems for people. That’s why other businesses and people pay for services/goods. The free flow of capital to solve problems is critical for a better quality of live for all humankind.

37/ “Governments will ultimately have little choice but to treat populations in territories they serve more like customers” - The Sovereign Individual

38/ Bitcoin is the key component of the transition to the “Information Revolution” that is predicted in the book. With it’s hard to seize nature + immutable transactions, Bitcoin resists the systemic overreach of the world governments in commerce.

39/ We’re already seeing some corporations declare their independence from governments, including Elon Musk’s other companies, SpaceX (and a potential spin off - Starlink).

40/ For example, Starlink could allow for servers in unregulated and unclaimed territories that can’t easily get taken down.

And if we extrapolate that to space, then these corporations are beyond the physical arm of these earth based governments, as SpaceX has indicated:

And if we extrapolate that to space, then these corporations are beyond the physical arm of these earth based governments, as SpaceX has indicated:

41/ “For services provided on Mars, or in transit to Mars via Starship or other colonisation spacecraft, the parties recognise Mars as a free planet and that no Earth-based government has authority or sovereignty over Martian activities,” - Mars Governing Law

42/ Bitcoin is the final step in setting individuals and corporations free from the physical constraints of the state system.

Bitcoin is the key element required to bring about the Information Revolution and the rise of the megacorps.

Bitcoin is the key element required to bring about the Information Revolution and the rise of the megacorps.

43/ Like this tweet storm? Sign up for my newsletter to get it first on Thursdays! https://danheld.substack.com/

Read on Twitter

Read on Twitter

![10/ “As part of the [updated investment] policy, we may invest a portion of such cash in certain specified alternative reserve assets. Thereafter, we invested an aggregate $1.50 billion in bitcoin under this policy.” - @Tesla 10k filing 10/ “As part of the [updated investment] policy, we may invest a portion of such cash in certain specified alternative reserve assets. Thereafter, we invested an aggregate $1.50 billion in bitcoin under this policy.” - @Tesla 10k filing](https://pbs.twimg.com/media/EuMr91_XUAAzMKW.jpg)