Chart Updates - These are only updated when necessary as am an investor rather than trader. The 'Purple boxes' in most charts were 'buy boxes' set and shared when $GDX was $43.

Premise - Today's update will start with my bias on $DXY. As this sets the tone for my expectations.

Premise - Today's update will start with my bias on $DXY. As this sets the tone for my expectations.

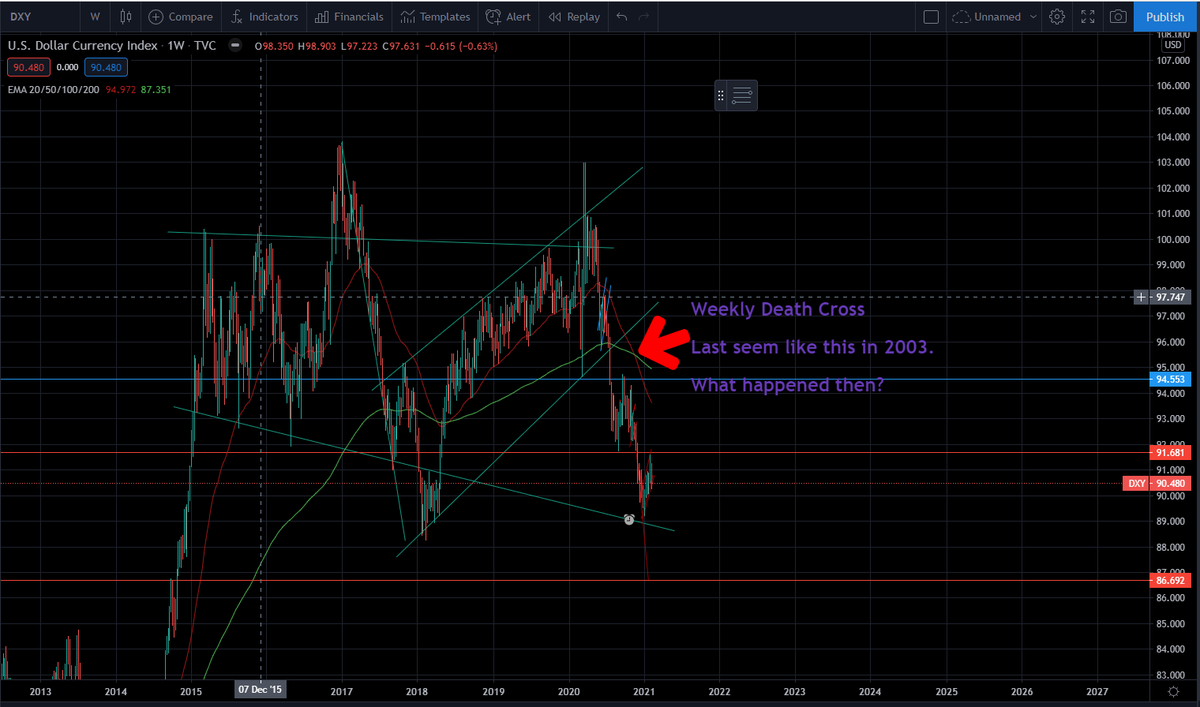

$DXY - We are in a long term bear market with a decline similar to what we saw in 2003. There will be bounces, but the trend is down. When 'Joe Pub' realises we have a race to the bottom G/S will ignite.

Strong currency = Low exports. The battle between Fed and ECB is public

Strong currency = Low exports. The battle between Fed and ECB is public

$Euro the ECB is desperate to mitigate the risk of strong Euro. Friday's break out of the bull flag threatens a run to 1.26 quick time. Today's tweet was a transparent attempt to keep the euro in check. It will fail.

Expect unlimited money - this will drive markets higher

Expect unlimited money - this will drive markets higher

The currency battle will create volatility in all markets. But what we will NOT see is a change of strategy - The jawboning of 'loose monetary policy' is not to reassure the people... It is to signal in plain sight that the CBs of the world are diluting their currencies - Rikards

My thesis is that this drives money to hard assets. Gold medium term as a monetary metal, Silver now as an industrial metal - As we have seen in almost all other commodities - Copper, Platinum, Timber, Corn etc

Silver is the play right now - It will respond to QE infinity

Silver is the play right now - It will respond to QE infinity

Individual Miners - Two methodologies -

Measured moves - Break out of Wedges - Horizontal bands. Strong miners have hit these targets

Fib Extensions: 1 is a 'safe sale'/ 1.6 is 'usual sale'. I suspect fundamentals will drive miners above these. So included weekly to see macros

Measured moves - Break out of Wedges - Horizontal bands. Strong miners have hit these targets

Fib Extensions: 1 is a 'safe sale'/ 1.6 is 'usual sale'. I suspect fundamentals will drive miners above these. So included weekly to see macros

$AG - Suspect this will be one of the strongest movers.

Breaking out of 10 year resistance and retesting this.

Breaking out of 10 year resistance and retesting this.

$HL - A Robinhood favourite. Very strong over summer of 2020 and lead the run.

Safe territory and investing in new tech. Could change many peoples lives - buy and hold.

Safe territory and investing in new tech. Could change many peoples lives - buy and hold.

$PAAS - Chart looks very clean.

$MAG - Very resilient. Buy and hold.

$EXK - Heavily requested and has been making some lovely moves of late.

$FSM - Huge upside here. A large holding of mine.

$SILJ - I can't hold this as based in UK. However, if you can this is a great way to play bull market and not get caught out by individual miners. Ideal for novices or those people with... you know... A life.

$SLV - A favourite of the 1%

Summary: Silver as an industrial metal will benefit from fundamentals. The WSB may be the finger that pulls this trigger - but holders expected this anyway.

Expect volatility. This is a bull and they are hard to buy and hold. You will make MORE money by 'setting and forgetting'

Expect volatility. This is a bull and they are hard to buy and hold. You will make MORE money by 'setting and forgetting'

I will now look at charts for you 'Wild Cats' buying nano caps in the belief that once they reach 800% they will be flush with liquidity and you will be able to exit with the grace of a seasoned fund manager...

Read on Twitter

Read on Twitter