2/ The BIG question: Is the thesis on track

Other question:

Is revenue growing?

Is revenue growing?

Are margins stable/expanding?

Are margins stable/expanding?

Profits?

Profits?

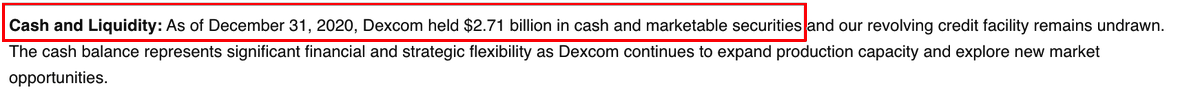

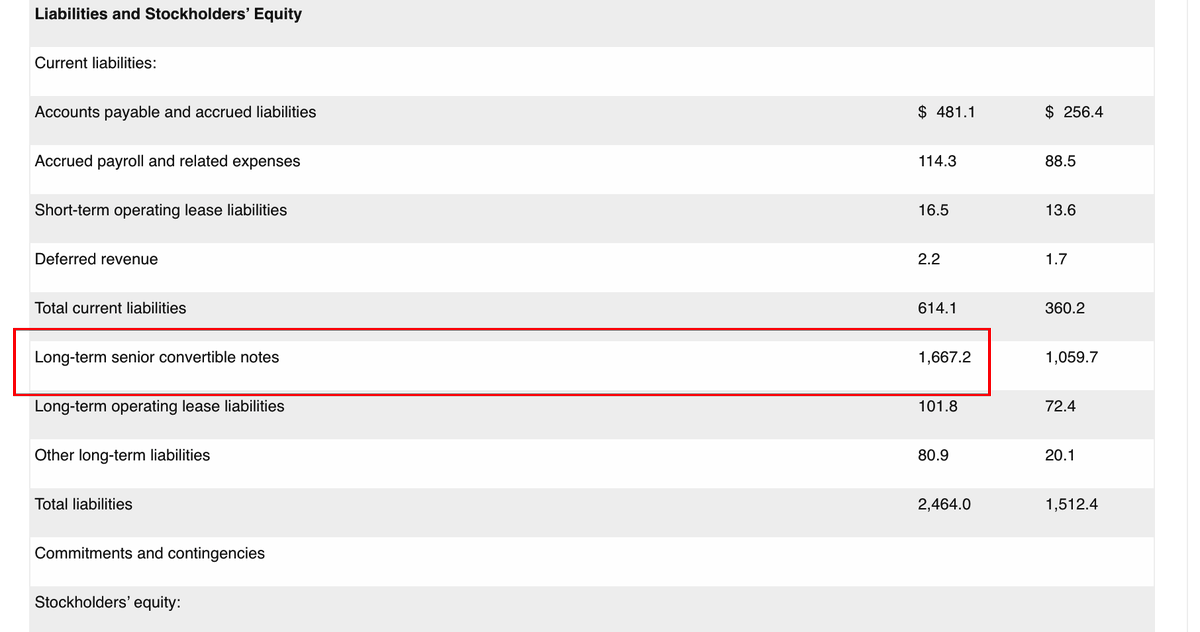

Balance sheet?

Balance sheet?

New opportunities?

New opportunities?

New threats?

New threats?

Other question:

Is revenue growing?

Is revenue growing? Are margins stable/expanding?

Are margins stable/expanding? Profits?

Profits? Balance sheet?

Balance sheet? New opportunities?

New opportunities? New threats?

New threats?

3/ I open 4 browser tabs

Tab 1 - Current company earnings report / shareholder letter

Tab 2 - Previous company earnings report / shareholder letter (check guidance)

Tab 3 - Analyst estimates

Tab 4 - Call Transcript

Tab 1 - Current company earnings report / shareholder letter

Tab 2 - Previous company earnings report / shareholder letter (check guidance)

Tab 3 - Analyst estimates

Tab 4 - Call Transcript

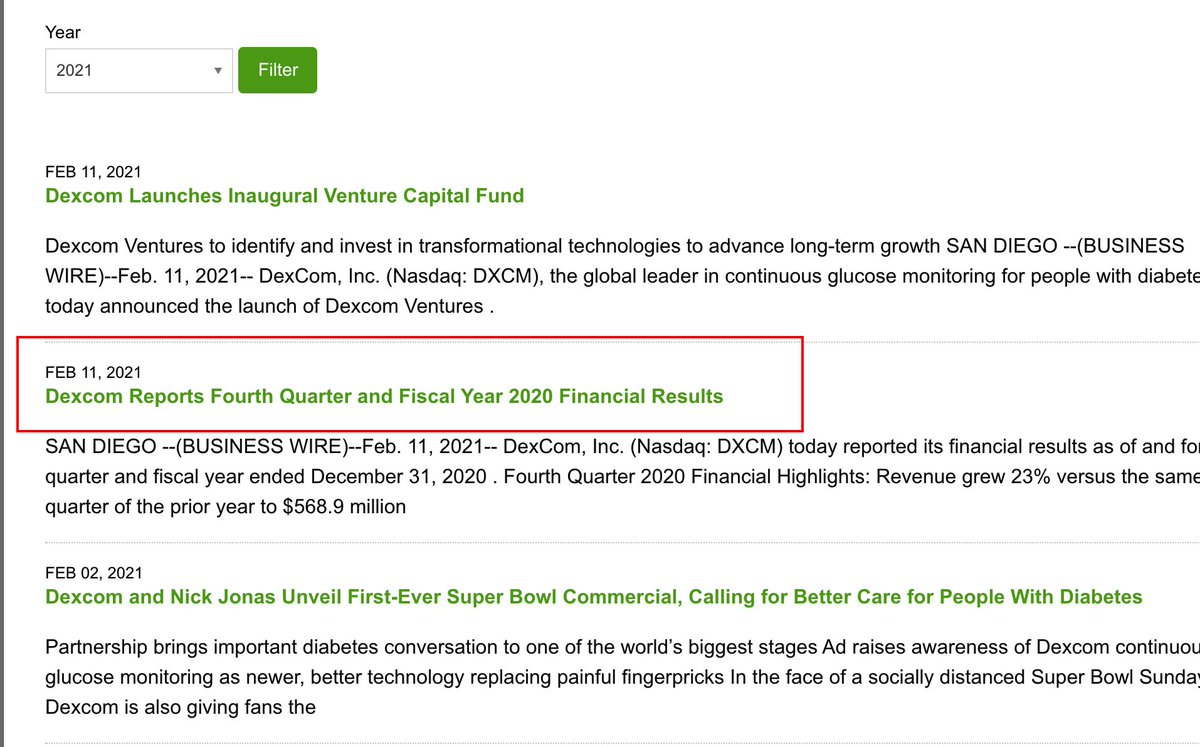

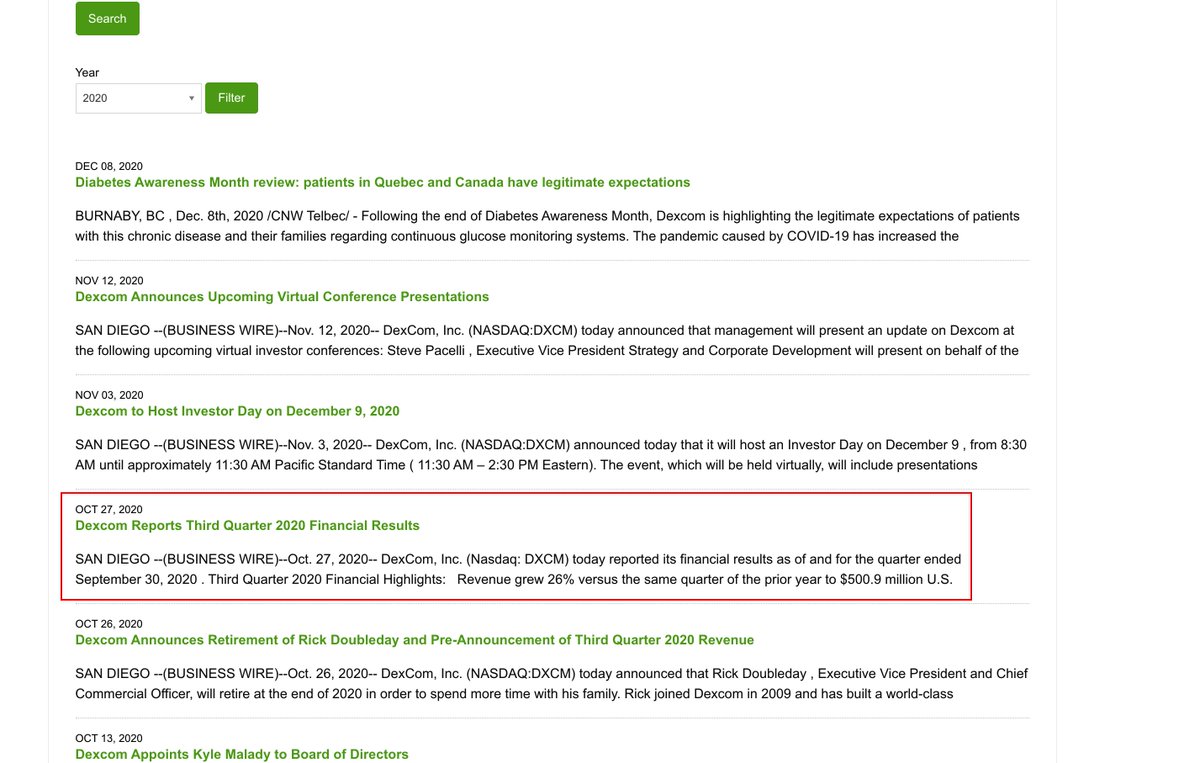

4/ Tabs 1 & 2 - Find the current & previous earnings report

I search "Dexcom Investor Relations"

I click on "press release"

Open the newest quarterly earnings report and last quarter

It can also be a shareholder letter/presentation

I search "Dexcom Investor Relations"

I click on "press release"

Open the newest quarterly earnings report and last quarter

It can also be a shareholder letter/presentation

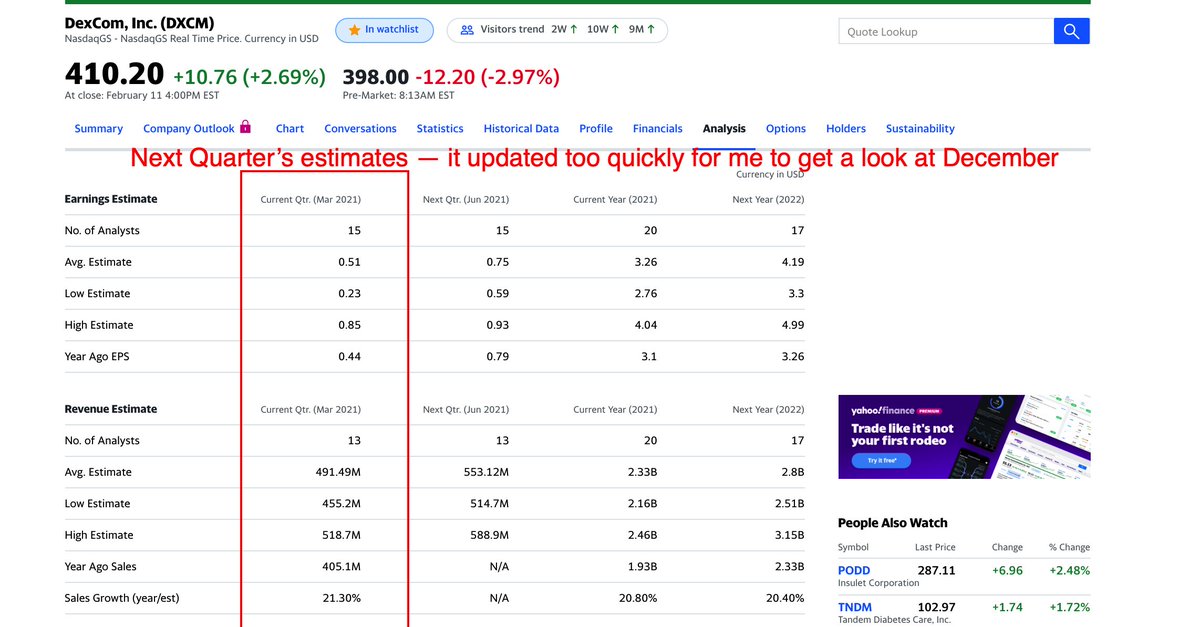

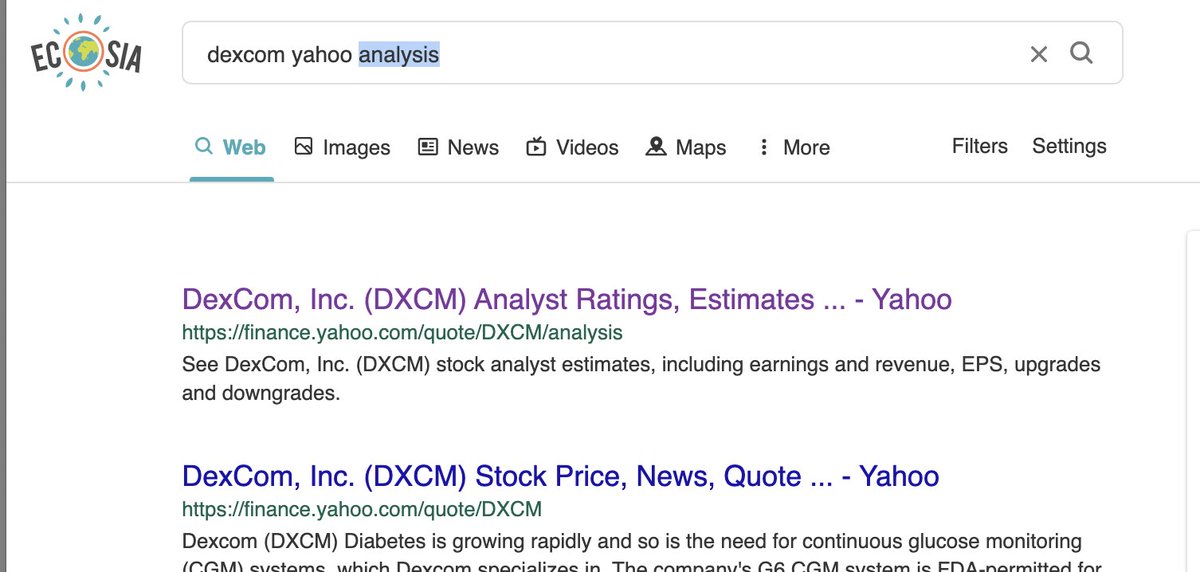

5/ Tab 3 - Find the quarterly analyst estimates

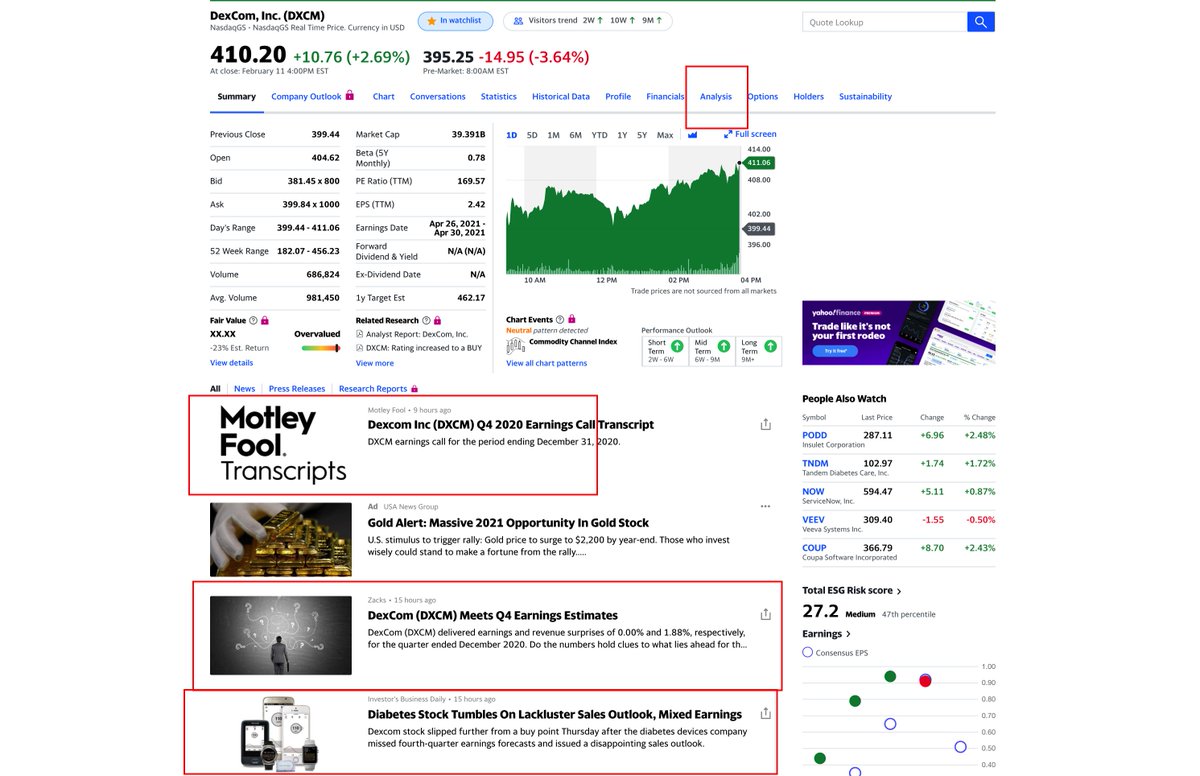

Open up $DXCM in yahoo finance

The "news" section usually has a link to reports on whether the company beat/met estimates

The "analysis" tab is a good source, but sometimes it updates to the next quarter too quickly

Open up $DXCM in yahoo finance

The "news" section usually has a link to reports on whether the company beat/met estimates

The "analysis" tab is a good source, but sometimes it updates to the next quarter too quickly

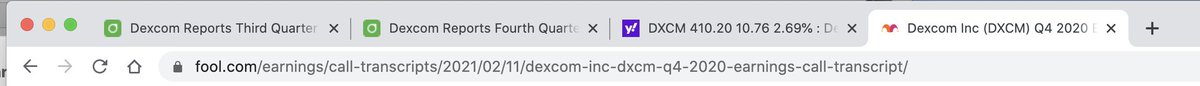

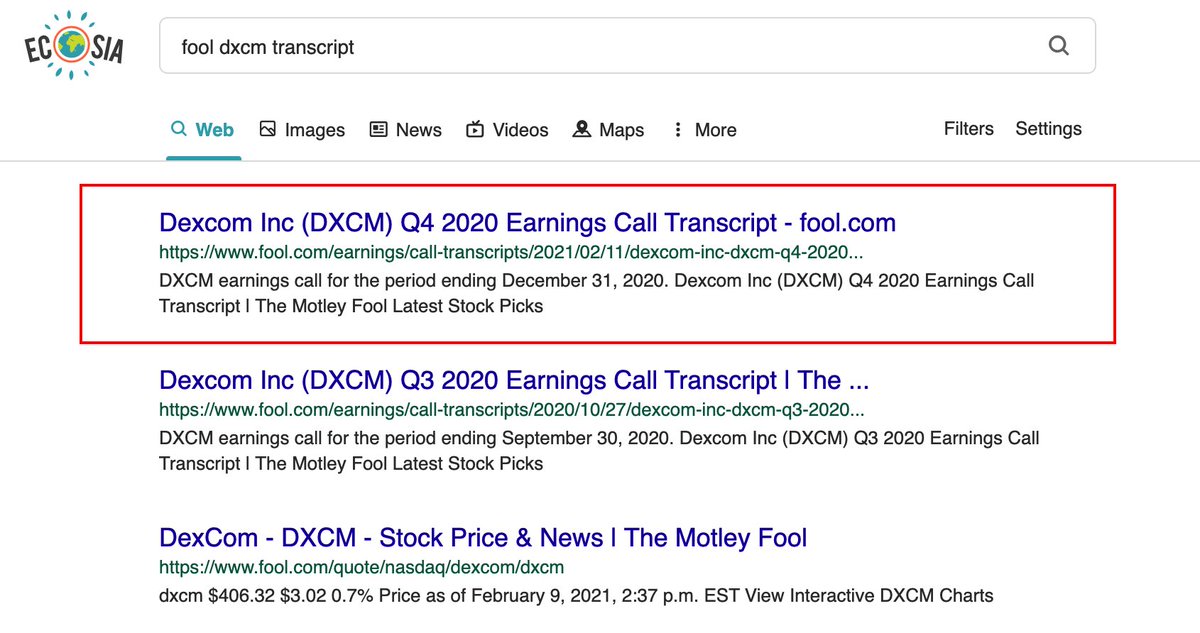

6/ Tab 4 - Find a transcript of the earnings call

@themotleyfool transcripts are best

Sometimes links are on Yahoo Finance news

Search "Fool DXCM Transcript" if not

Seekingalpha / NASDAQ are two other free sources

@themotleyfool transcripts are best

Sometimes links are on Yahoo Finance news

Search "Fool DXCM Transcript" if not

Seekingalpha / NASDAQ are two other free sources

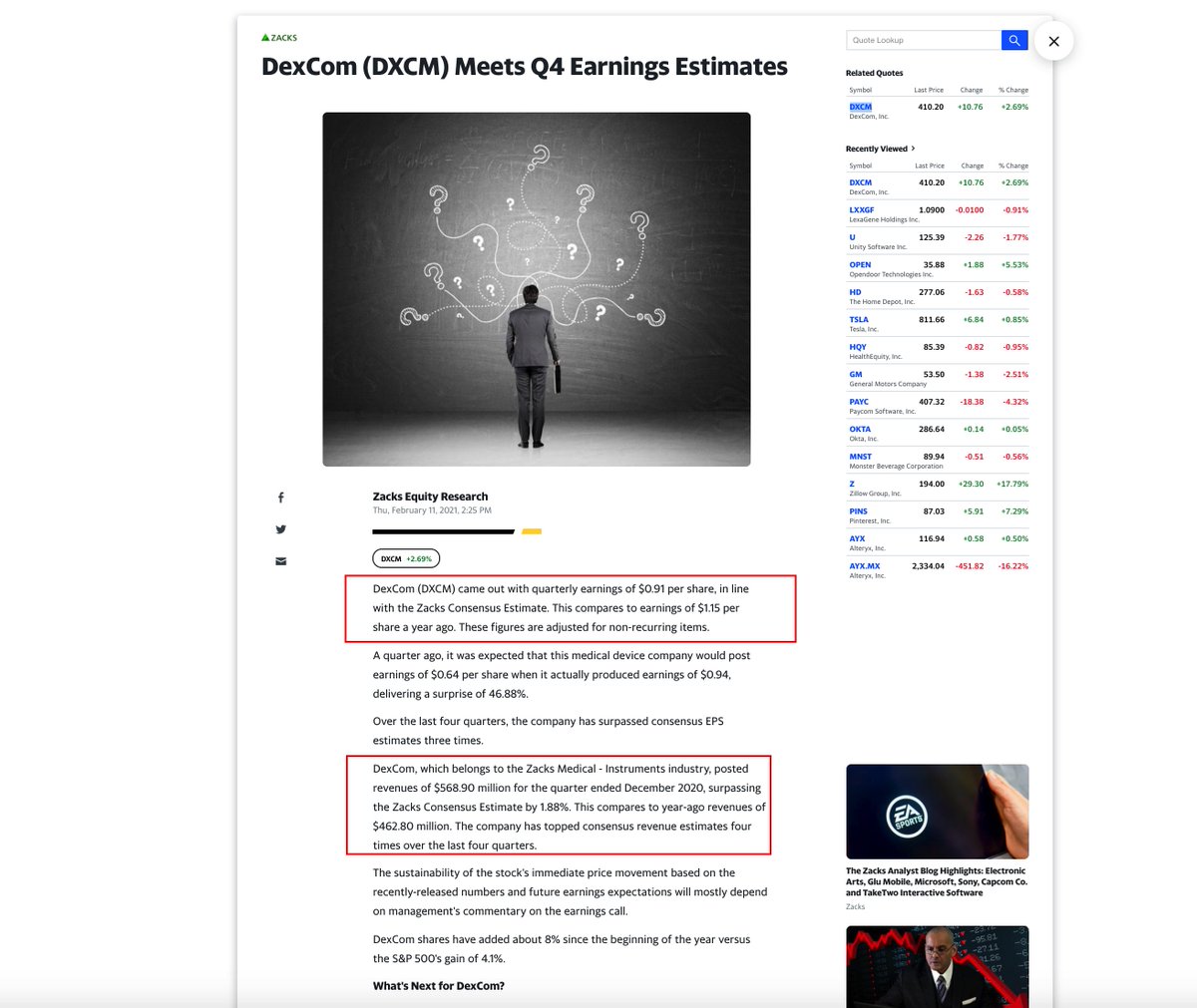

7/ In most recent earnings, I check the headline numbers:

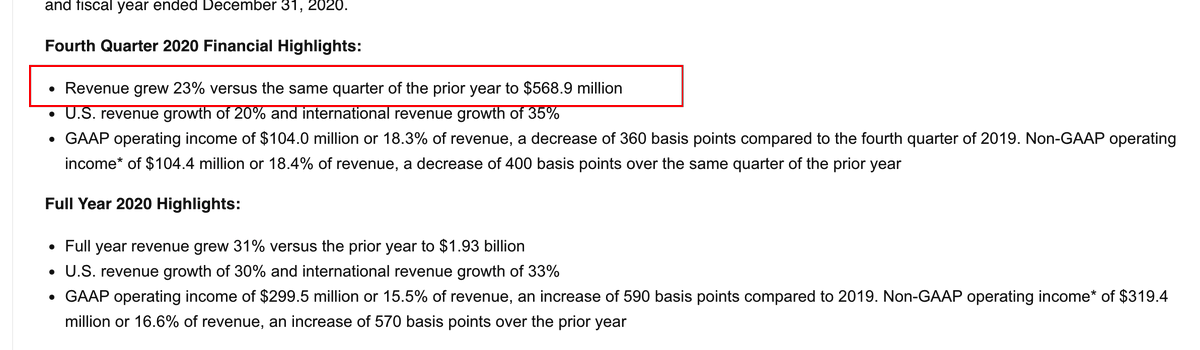

Revenue growth: 23% to $569 million

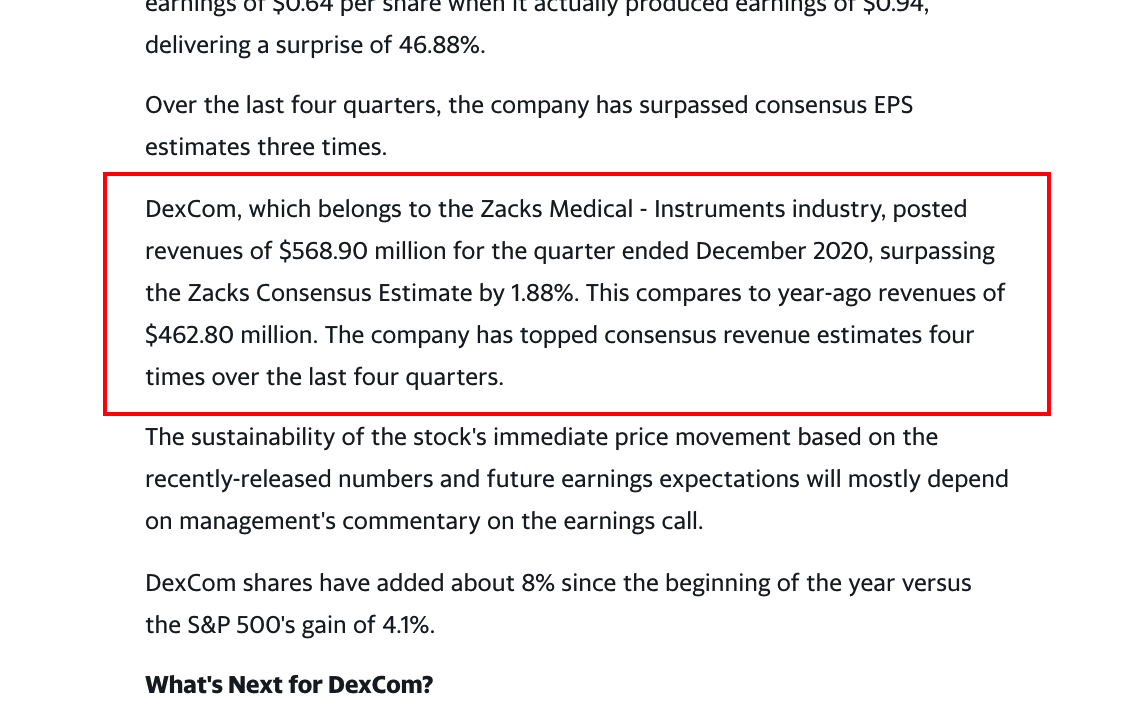

Revenue vs. Wall Street expectations (beat by 1.88%)

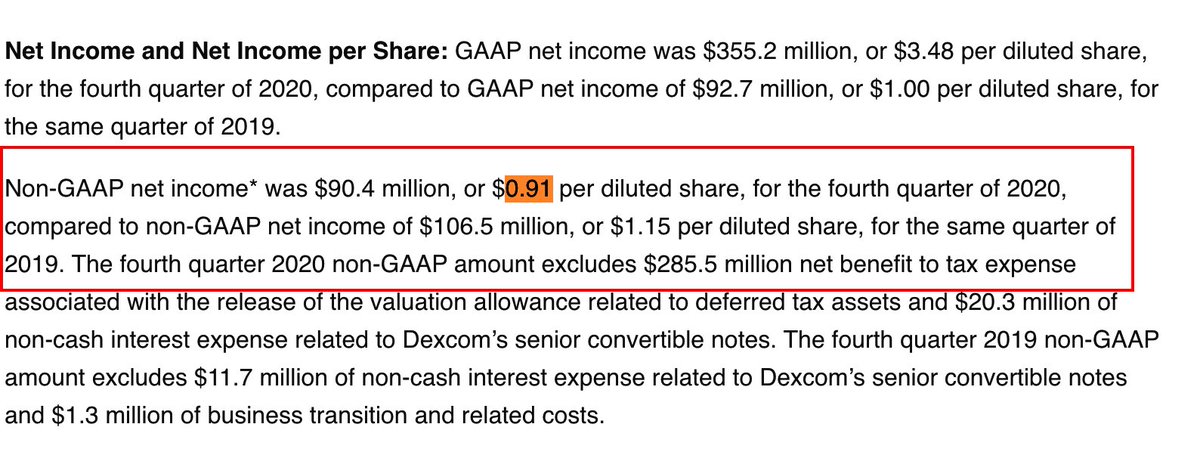

non-gaap EPS growth: -21% to $0.91

EPS vs. Wall Street expectations (meet expectation)

Revenue growth: 23% to $569 million

Revenue vs. Wall Street expectations (beat by 1.88%)

non-gaap EPS growth: -21% to $0.91

EPS vs. Wall Street expectations (meet expectation)

8/ Results vs. guidance

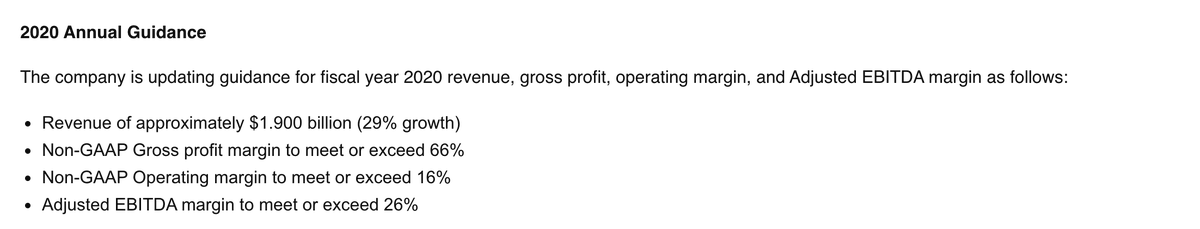

Management issued yearly guidance for 2020 in Q3 2020

Revenue +29% to $1.9 billion (actual +31% to $1.93 billion)

Non-GAAP Gross margin 66% (actual 66.7%)

Non-GAAP Operating margin 16% (actual 16.5%)

Management issued yearly guidance for 2020 in Q3 2020

Revenue +29% to $1.9 billion (actual +31% to $1.93 billion)

Non-GAAP Gross margin 66% (actual 66.7%)

Non-GAAP Operating margin 16% (actual 16.5%)

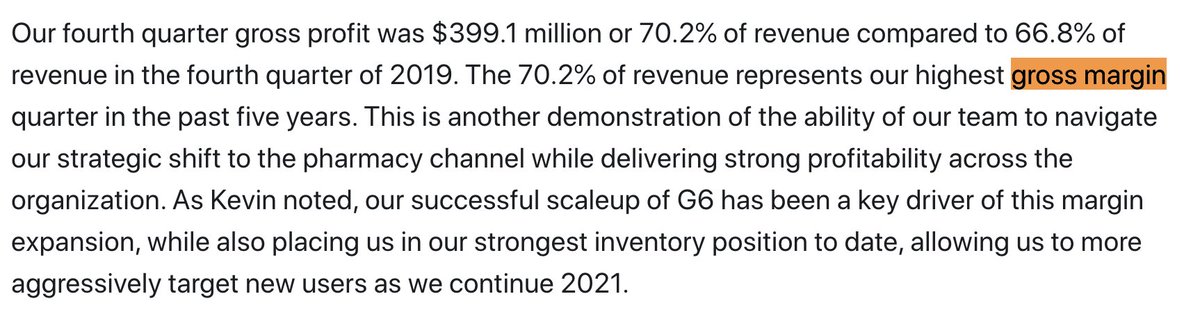

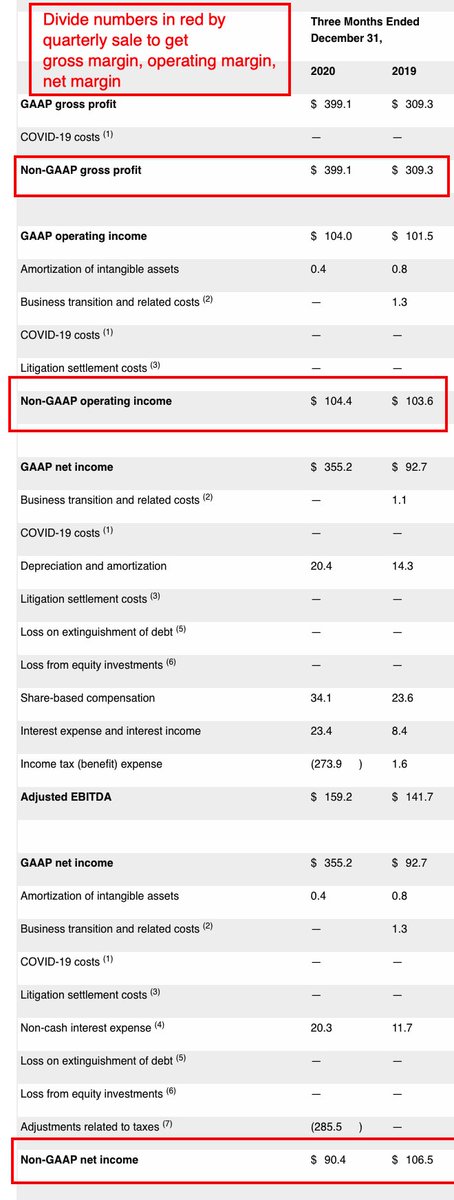

10/

Margins

Use transcript / press release / or calculate yourself

Gross 70.2% vs. 66.8% (gross profit grew faster than revenue)

Non-gaap Operating: 18.3% vs. 22.5% (investigate!)

non-gaap Net: 15.8% vs. 22.9% (investigate!)

Margins

Use transcript / press release / or calculate yourself

Gross 70.2% vs. 66.8% (gross profit grew faster than revenue)

Non-gaap Operating: 18.3% vs. 22.5% (investigate!)

non-gaap Net: 15.8% vs. 22.9% (investigate!)

11/

News from press release?

Building out salesforce (explains operating margin & net margin drop)

Building out salesforce (explains operating margin & net margin drop)

Reimbursement in France

Reimbursement in France

News from press release?

Building out salesforce (explains operating margin & net margin drop)

Building out salesforce (explains operating margin & net margin drop) Reimbursement in France

Reimbursement in France

12/

Read through transcript:

Gross margin

Gross margin  from new manufacturing facility

from new manufacturing facility

Super bowl commerical

Super bowl commerical

New service center in Lithuania

New service center in Lithuania

New manufacturing site in Malaysia

New manufacturing site in Malaysia

New sensor launching in 2nd half 2021

New sensor launching in 2nd half 2021

Enter VC space

Enter VC space

Read through transcript:

Gross margin

Gross margin  from new manufacturing facility

from new manufacturing facility Super bowl commerical

Super bowl commerical New service center in Lithuania

New service center in Lithuania New manufacturing site in Malaysia

New manufacturing site in Malaysia New sensor launching in 2nd half 2021

New sensor launching in 2nd half 2021 Enter VC space

Enter VC space

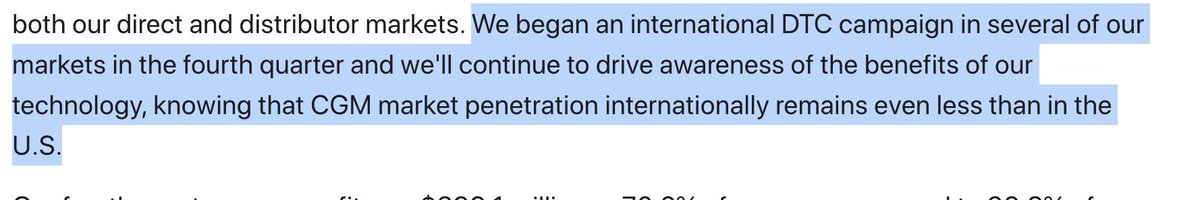

13/ Transcript

50% of sales now coming through pharmacy

50% of sales now coming through pharmacy

International sales 35% of revenue

International sales 35% of revenue

International DTC campaign launching

International DTC campaign launching

50% of sales now coming through pharmacy

50% of sales now coming through pharmacy International sales 35% of revenue

International sales 35% of revenue International DTC campaign launching

International DTC campaign launching

14/

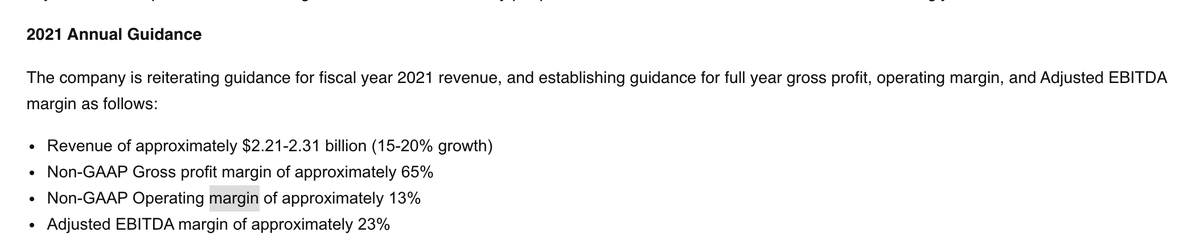

2021 Guidance:

Revenue:

Management expects 15% to 20% growth

Wall Street expects 21%

Margins:

Gross to 65%

to 65%

Operating 13%

13%

2021 Guidance:

Revenue:

Management expects 15% to 20% growth

Wall Street expects 21%

Margins:

Gross

to 65%

to 65%Operating

13%

13%

15/

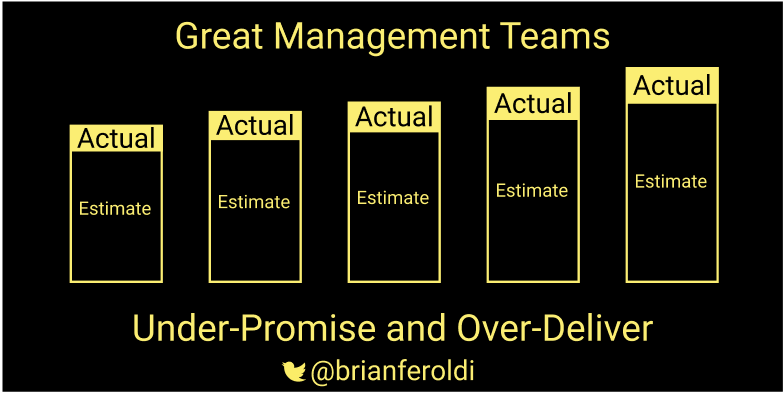

Management has a long history of under-promising & over-delivering, so I view these numbers as the floor, not the ceiling

Management has a long history of under-promising & over-delivering, so I view these numbers as the floor, not the ceiling

16/

My big takeaways:

Revenue growing

Revenue growing

Gross margin expanding

Gross margin expanding

International expansion

International expansion

Reinvestment year causing bottom-line to look worse

Reinvestment year causing bottom-line to look worse

2021 Margins will be weak

2021 Margins will be weak

Move to pharmacy working

Move to pharmacy working

G7 launching in 2021

G7 launching in 2021

VC fund adds optionality

VC fund adds optionality

THESIS ON TRACK

My big takeaways:

Revenue growing

Revenue growing Gross margin expanding

Gross margin expanding International expansion

International expansion Reinvestment year causing bottom-line to look worse

Reinvestment year causing bottom-line to look worse 2021 Margins will be weak

2021 Margins will be weak Move to pharmacy working

Move to pharmacy working G7 launching in 2021

G7 launching in 2021 VC fund adds optionality

VC fund adds optionalityTHESIS ON TRACK

19/ I email financial graphics like these every day for free

Interested?

https://brianferoldi.substack.com/

Interested?

https://brianferoldi.substack.com/

Read on Twitter

Read on Twitter