Scarcity drives prices. Scarcity is determined by the relationship between Supply vs Demand.

Supply = Selling volume coming from new production (Flow) or existing stocks (Stock).

To analyse scarcity can look into Flow vs Demand. Stock divided by Flow says nothing about scarcity

Supply = Selling volume coming from new production (Flow) or existing stocks (Stock).

To analyse scarcity can look into Flow vs Demand. Stock divided by Flow says nothing about scarcity

High stock / flow says *nothing* about scarcity.

High stock / flow translates into low volatility. In theory, the higher the S2F, the lower the volatility.

High stock / flow translates into low volatility. In theory, the higher the S2F, the lower the volatility.

Think of it this way. In a high S2F asset a negative supply shock (e.g. earthquake destroys mines) drives prices higher, which leads to increased selling from holders' vast liquid stocks, containing the increase. A low S2F asset would see price run much further.

A high S2F makes the price of an asset more stable when faced with negative supply shocks or positive demand shocks.

High S2F contains the upside!

High S2F contains the upside!

For example, crude oil's S2F is very low, and thus its price runs wild when major supply disruptions occur.

Gold on the other hand has a very high S2F, and thus its price is not as affected by supply disruptions.

Gold on the other hand has a very high S2F, and thus its price is not as affected by supply disruptions.

The scarcity principle is an economic theory in which a limited supply of a good—coupled with a high demand for that good—results in a mismatch between the desired supply and demand equilibrium.

Scarcity is determined by the relationship between supply & demand. By *definition*.

Scarcity is determined by the relationship between supply & demand. By *definition*.

The Stock to Flow ratio is not a measure of scarcity. By definition. Nobody gets to redefine what scarcity means. https://twitter.com/Knightfall21/status/1361111881776324609?s=20

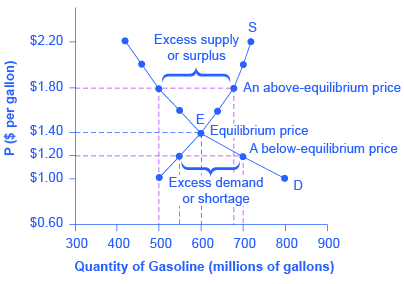

The Supply & Demand curves have a clearing price.

A market-clearing price is the price of a good or service at which quantity supplied is equal to quantity demanded, also called the equilibrium price.

A market-clearing price is the price of a good or service at which quantity supplied is equal to quantity demanded, also called the equilibrium price.

Something is scarce or in shortgage when demand exceeds supply. When this happens, price will increase to make supply and demand meet.

A decrease in supply can make something scarce.

Supply = Selling volume coming from new production (Flow) or existing stocks (Stock).

A decrease in supply can make something scarce.

Supply = Selling volume coming from new production (Flow) or existing stocks (Stock).

Stock / Flow ratio for a commodity is defined as years of inventory relative to annual supply.

Lower Stock or lower Flow can lead to scarcity.

But a higher Stock / Flow ratio says nothing about scarcity; instead, it indicates an asset is less likely to become scarce.

Lower Stock or lower Flow can lead to scarcity.

But a higher Stock / Flow ratio says nothing about scarcity; instead, it indicates an asset is less likely to become scarce.

When it comes to Bitcoin, halvings help price move up because Flow goes down, and not because Stock / Flow goes up. This is an uncontestable reality. https://twitter.com/krugermacro/status/1361246059796774914?s=20

Read on Twitter

Read on Twitter