A thread on one of my wort performing positions in the last 12months and my thoughts going forward. $FTS.to is a nearly 100% regulated utility focused on transmission assets across NA. They are as stable and boring as they come and fit into the defensive alloc of the portfolio.

As many of you know I run a levered book with recent allocations running at ~130-150% net. and with stocks like $FTS I feel comfortable increasing my leverage, when $IBKR borrow is 1-1.5% and $FTS.to pays ~4% dividend growing @ ~6%/pa through 2025, I think it's attractive.

The initial thinking was the decline in yields and post-COVID flight to safety would see utilities as key benefactors as they act a defensive bond proxy. Some Utilities/IPPs I owned like $NPI.to and $AQN performed very well, but I credit that due to ESG bid instead of rates proxy

Here are some of narrative problems that emerged. 1) Some of their portfolio was exposed to COVID and while on the net underlying impact was marginal and transitory, investors still not comfortable - I believe the market would look past this to 21+

It always goes back to rate of change and fund flows. 2) Although yields are still far below pre-COVID levels, the Vax news has jolted a rotation out of utilities into cyclical reopening trades, this has sapped fund flows and lead to further weakness in the shares.

Another fear from the market is of lower regulated ROEs, which is the compensation mechanism for regulated assets. Generally speaking in 2020 rate cases/decisions have been relatively stable and any erosion due to lower WACC has been marginal, but this remains a concern.

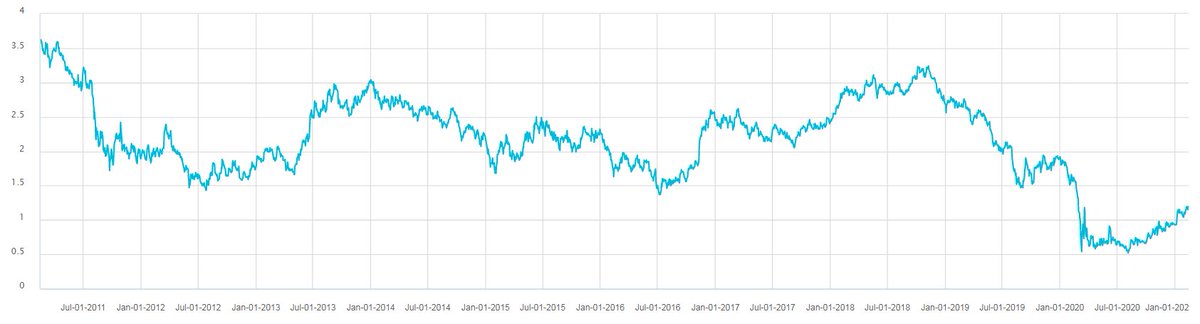

A working theory - while #VIX $VXX remains elevated, bond proxies typically become less correlated to underlying. The back testing I have done shows that the bond proxy relationship is strongest when IV is low. Premium having been squeezed and investors begin to grab for yield.

I have experienced this personally with a larger portion of my margin allocated to option writing in 2020/21 because of how elevated IV has been. This is likely due to uncertainties regarding post-COVID world and likely changes in risk controls post-March liquidity cascade.

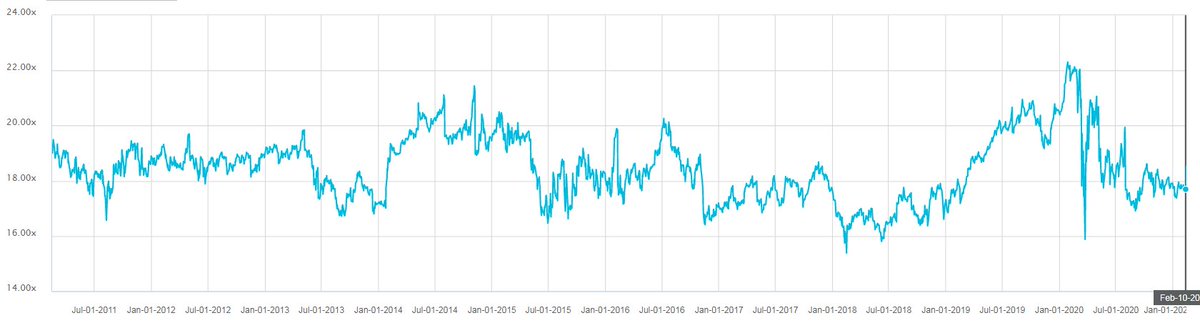

Going onto valuation. Forward P/E for $FTS.to has traded between 16x/22x over the last 10yrs. Now fwd P/E is at 17/18x, before similar multiples coincided with the hiking cycle of 2016-18, where US 10 year rates were in the 2-3% range for most of the period vs. 1.20% now.

Historically the bond proxy relationship was tight, see the relationship between yields and $XUT.to multiple below. Arguably, $FTS.to multiple could be in the 22-24x range (@ usual premium to group) in coming years as this relationship re-asserts. https://twitter.com/cap_zay/status/1342955782887919621

Assuming the multiple doesn't change over 5 yrs, this is a 9-9.5% IRR, assuming you can only sell end of year 5. I would be pretty confident in saying this outperforms broad market with a much lower volatility. But what I am really looking forward to is the re-rating.

Every 1.0x expansion in the multiple contributes to ~100bps of improvement to return. If you believe in the lower rates continuing, I wouldn't be surprised to see this trade at the high end of its range at 22x+, which would be a 13% IRR! For a low risk biz that's money, baby.

In a more aggressive scenario where the re-rate happens exactly 2 years from now, the same math gets you to a 18-19% IRR. Not bad for a utility.

Read on Twitter

Read on Twitter