2/ Calculate Hype.

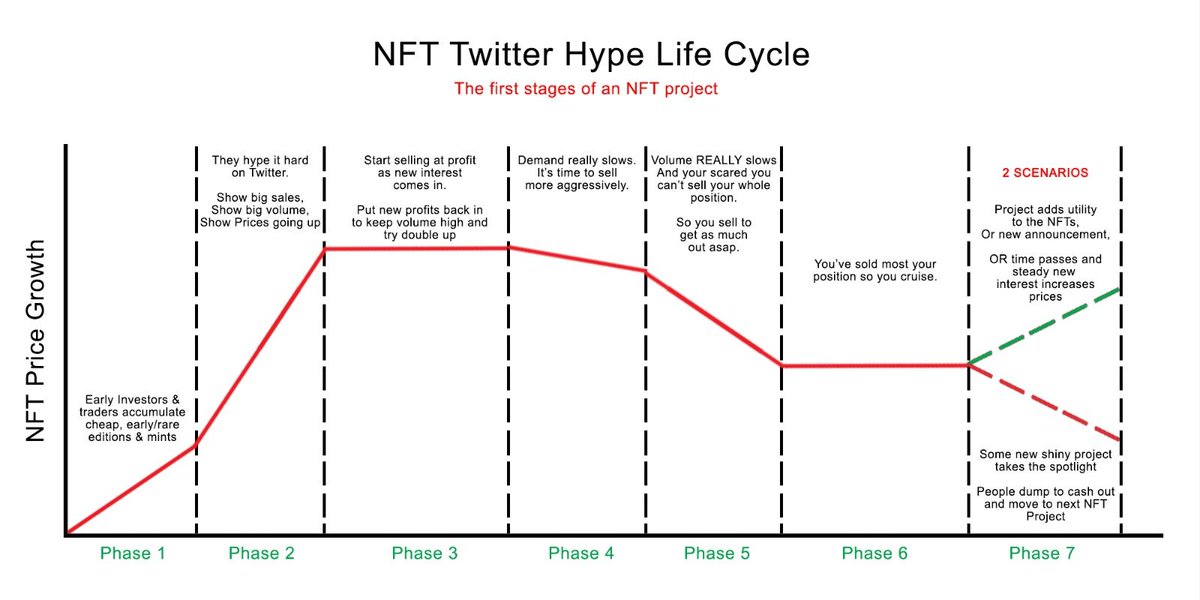

Understand the below graph.

Which phase of the project life cycle below are you entering at?

There are some STRONG parallels between traditional chart trading and NFT 'trading'.

Understand the below graph.

Which phase of the project life cycle below are you entering at?

There are some STRONG parallels between traditional chart trading and NFT 'trading'.

2/ Negotiate.

One of the best things in this space is everything can be negotiated. Especially if you buy bulk.

beneficial for seller because you're helping them exit/liquidity/get eth.

You get a lower buy price. Gives you a risk buffer.

win-win

One of the best things in this space is everything can be negotiated. Especially if you buy bulk.

beneficial for seller because you're helping them exit/liquidity/get eth.

You get a lower buy price. Gives you a risk buffer.

win-win

3/ Announce or Signal your activity.

This is actually what VC's or Larger Investors do.

Gives them more deal flow, (More people DM them with investment opportunities).

Allows people to learn about the project.

This is actually what VC's or Larger Investors do.

Gives them more deal flow, (More people DM them with investment opportunities).

Allows people to learn about the project.

4/ Sales Volume is your best friend.

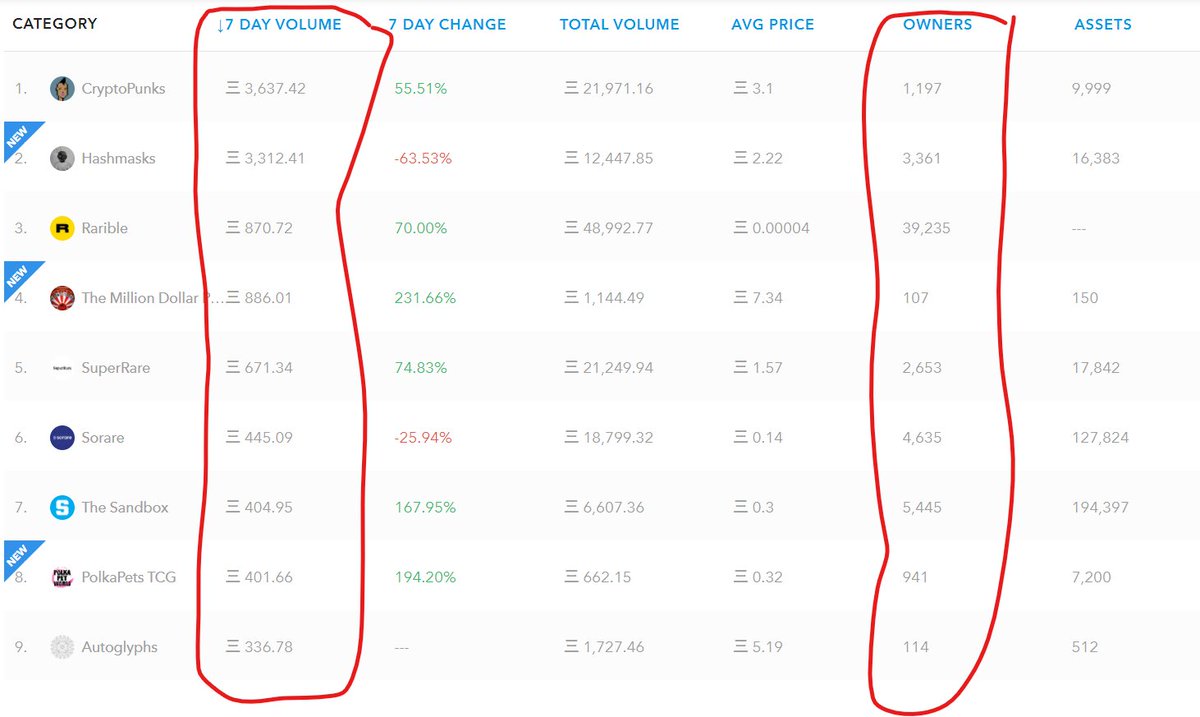

If 7 day volume starts to dry up, you run the risk of a dead market.

'Owners' lets you know how likely a project will stay relevant over time.

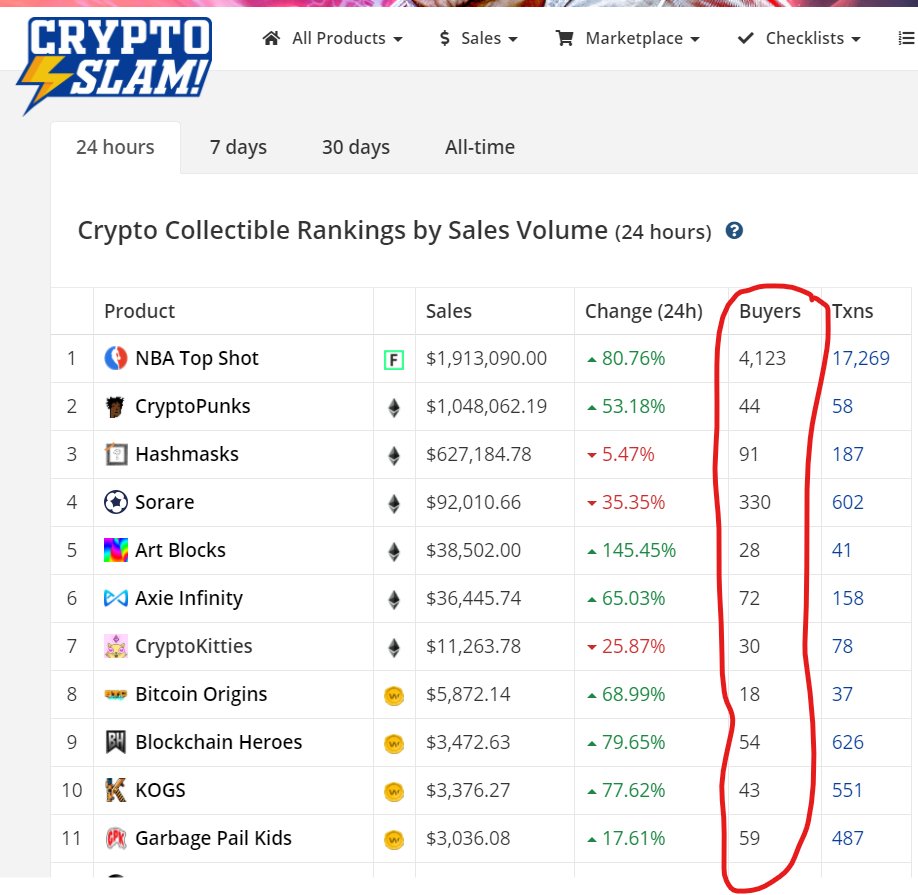

Cryptoslam gives you # of buyers in 24 hrs.

https://cryptoslam.io/

https://opensea.io/rankings

If 7 day volume starts to dry up, you run the risk of a dead market.

'Owners' lets you know how likely a project will stay relevant over time.

Cryptoslam gives you # of buyers in 24 hrs.

https://cryptoslam.io/

https://opensea.io/rankings

5/ Sell and re-invest.

The single best way to compound gains, ESPECIALLY if you're negotiating good deals/entry points.

have everything listed on market so if you get the price you want, you can get more $ to make plays with.

The single best way to compound gains, ESPECIALLY if you're negotiating good deals/entry points.

have everything listed on market so if you get the price you want, you can get more $ to make plays with.

6/ Know the demographic.

Are they mostly flippers talking about price?

Or are they excited to build/create?

This tells me when I need to exit ^

I'm not staying long if it's mostly flippers coz long term there's 0 value.

Are they mostly flippers talking about price?

Or are they excited to build/create?

This tells me when I need to exit ^

I'm not staying long if it's mostly flippers coz long term there's 0 value.

7/ Know the community.

The opportunity is in the weeds, (Discord/Twitter/private convo's).

Try be part of the conversation and be part of groups so you can help alert each other when things are going on/new projects, etc.

The opportunity is in the weeds, (Discord/Twitter/private convo's).

Try be part of the conversation and be part of groups so you can help alert each other when things are going on/new projects, etc.

8/ Crypto Swings.

Much of the industry has historically been connected to crypto markets.

ETH moons up, and people get edgy to sell their NFTs and jump on the ETH train.

There are people that purely play crypto/liquidity swings and go in and out based on the above.

Much of the industry has historically been connected to crypto markets.

ETH moons up, and people get edgy to sell their NFTs and jump on the ETH train.

There are people that purely play crypto/liquidity swings and go in and out based on the above.

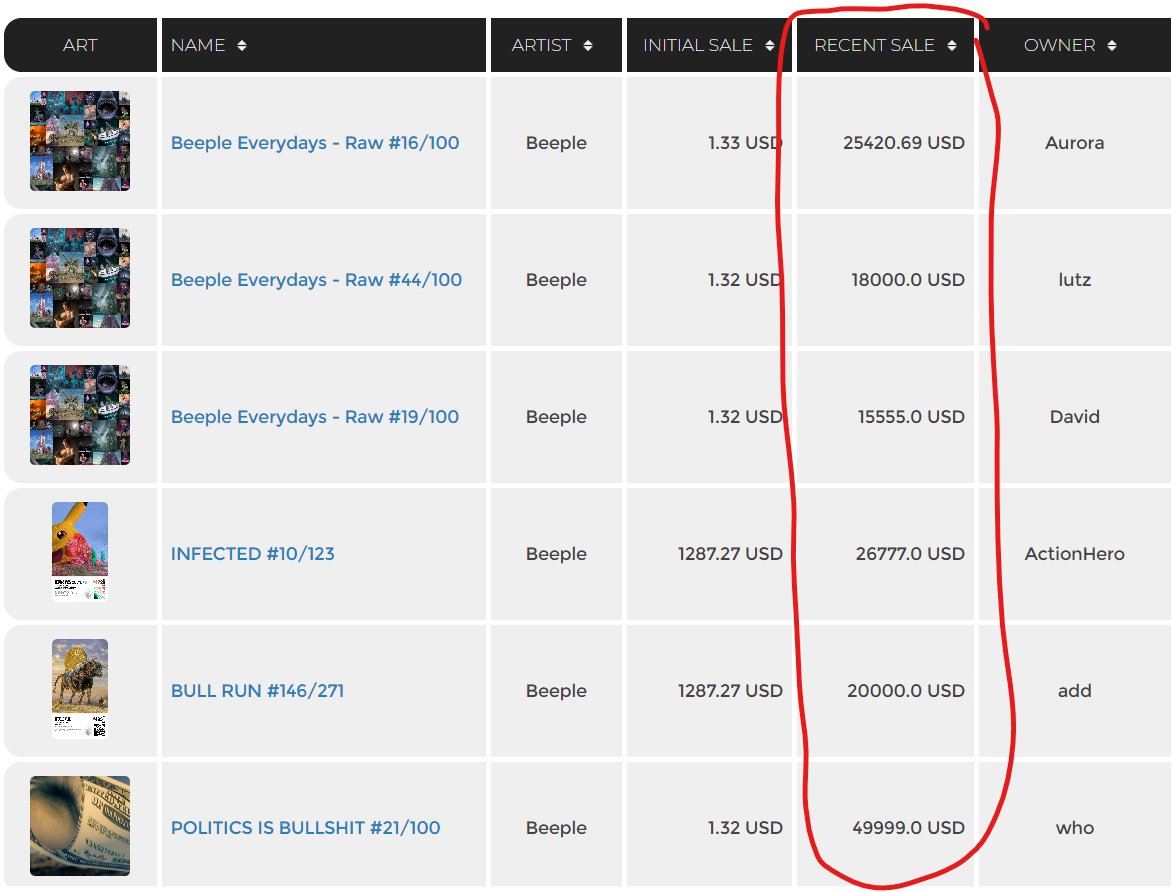

9/ Track 'Recent Sales' NOT 'Listed Prices'.

The difference is that recent sales are actually events that have happened. The latter is speculative.

This tells you what the market is willing to pay so if you can get pieces under that you can almost flip immediately for profit.

The difference is that recent sales are actually events that have happened. The latter is speculative.

This tells you what the market is willing to pay so if you can get pieces under that you can almost flip immediately for profit.

10/ There are some 'macro' investment strategies that allow you to invest in the industry as a whole.

Data websites, equity into dev teams, domain names, etc.

If you have a strategic seat at the above, it's a good play.

Data websites, equity into dev teams, domain names, etc.

If you have a strategic seat at the above, it's a good play.

11/ Know the project.

Some NFTs are not investible, (supply is continually introduced or still a lot to be released), some have supply capped.

If you can match up upcoming demand with an NFT project with capped supply then...you win.

Some NFTs are not investible, (supply is continually introduced or still a lot to be released), some have supply capped.

If you can match up upcoming demand with an NFT project with capped supply then...you win.

12/ This is just the tip of the ice berg.

There's no substitute for learning over time. If things don't make sense to you now, eventually they will.

Will continue to drop more, follow my YT -> https://www.youtube.com/channel/UCn_tz_81xsEIPjIXVzKahgQ

There's no substitute for learning over time. If things don't make sense to you now, eventually they will.

Will continue to drop more, follow my YT -> https://www.youtube.com/channel/UCn_tz_81xsEIPjIXVzKahgQ

Read on Twitter

Read on Twitter