Some recent buzz around $MYO so I thought I would do a thread to summarize my research. Read at your own peril. :)1/

$MYO is a med device comp selling an assisstive device for people with reduced strength in their arms. In an nutshell, the devices measures a person's muscle signals and stregnthens the intended movements with their device. 2/

The target population are people with chronic arm paralysis. Mgmt's TAM is 3M people with chronic arm paralysis and is estimated to grow at 250k. Not all of these people qualify for a device, but the large unmet need still exists. 3/

Competitors in the exoskeleton space include $EKSO and $RWLK but they have no direct competitors in the upper extremity space. The technology for measuring the signal and using a motor to amplify movement is patented until 2039 too. When asked about competition on the 3QCC, 4/

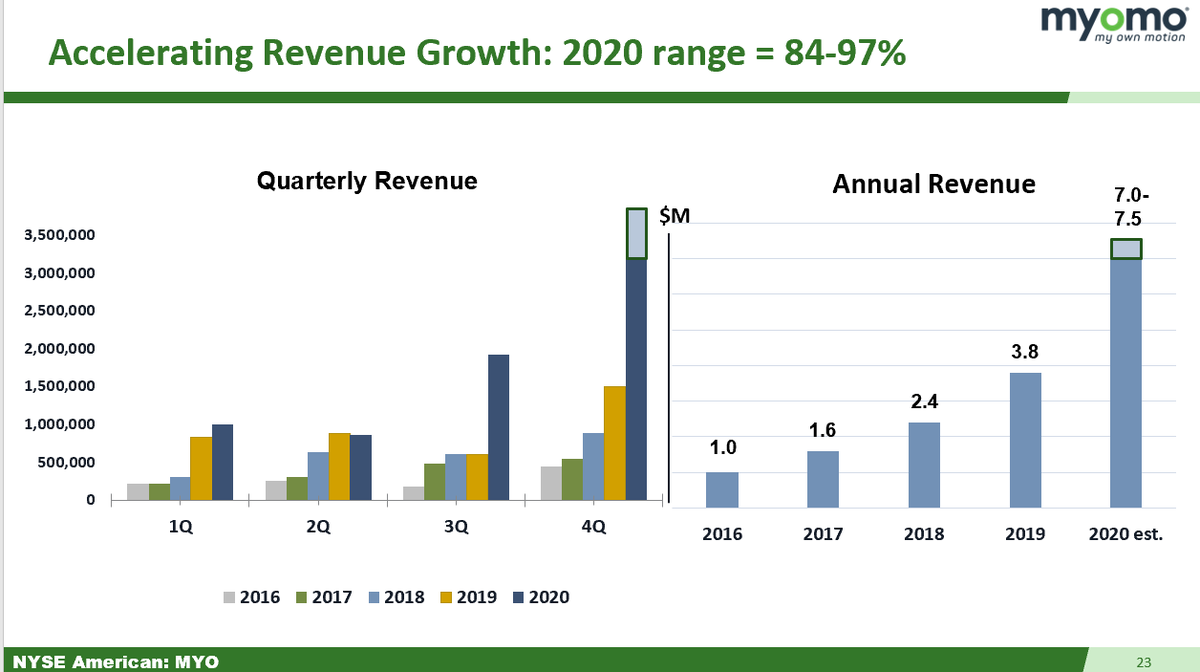

The device has been developed and they are now focusing on the sales rollout. The device costs >30k, thus insurance reimbursement is necessary for any sales. Revenue growth was 80%+ in the last year, acceleration YoY. 5/

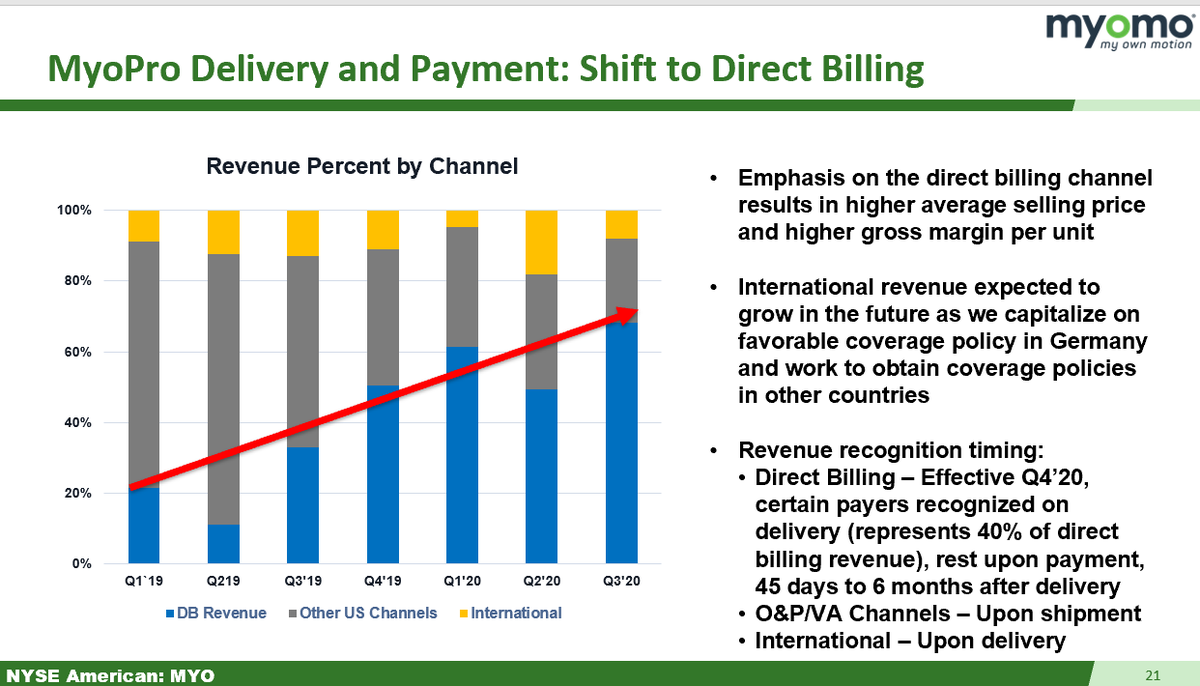

The growth can partially explained by an increase in the ASP. The company is pushing towards increasing the direct billing revenue portion meaning the company directly bills an insurance provider rather than having to circuitously go through a medical clinic 6/

This has had a material impact on revenues as one year ago, the ASP was 27,000$, but in Q3, the ASP was 38,000$. They also had a potential pull-forward in sales. Certain billers started recognizing revenue on delivery thus pushing revenue ahead 7/

Their revenue growth is buoyed by the dual tailwinds of increases in ASP and an increase in authorization number which led to the robust growth seen in the past year. 8/

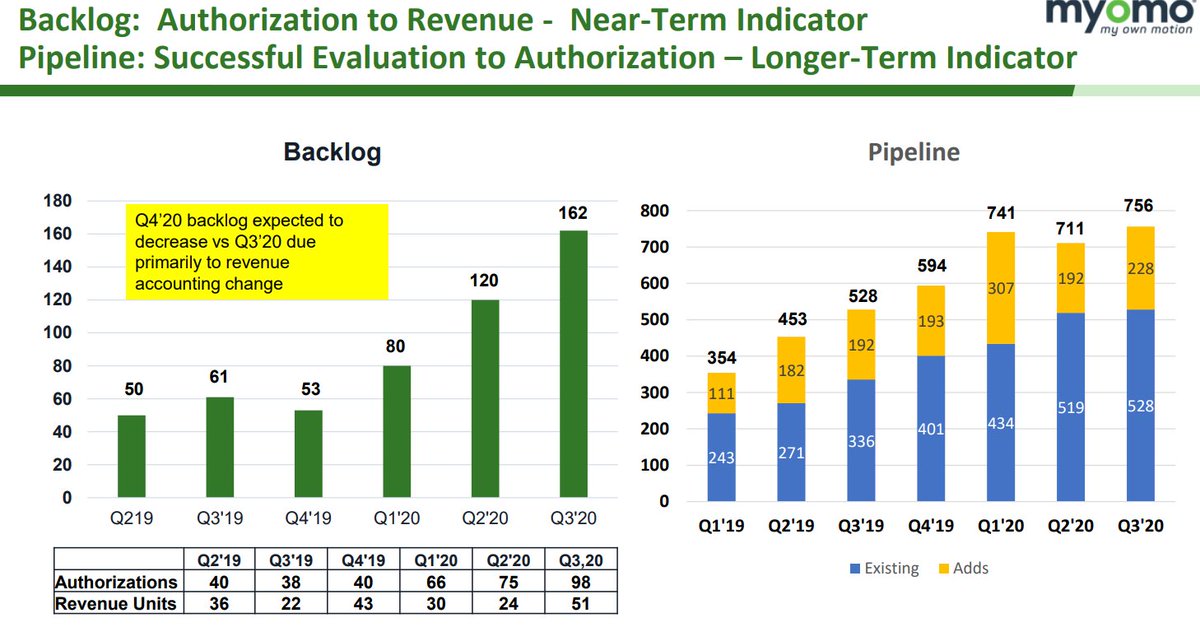

For future growth, we can look at the backlog and pipeline. The backlog is units authorized by insurance or are waiting for payment. The pipeline are people actively engaged with Myomo for a new device. Both are growing, but the pipeline recently slowed due to COVID 9/

The current process $MYO goes through for authorization is difficult and includes a lot of appeals to insurance. The conversion from the pipeline is fairly low, but this can provide a lever for growth. 10/

Regarding new pipeline adds, COVID slowed this process as people were reluctant to get a device when locked down. However, management expects to reaccelerate the pipeline adds in Q420 and Q121. The goal is 300 units new adds per quarter to get to FCF breakeven 11/

Their goal is to get to cash flow breakeven in 4Q21 and need $7m in sales/quarter to get there. Since the sales s\\cycle is 6-12 months, expansion in the pipeline will be reflected later in the year. The sales cycle could mean growth slows in 1H21 but reaccelerates in 2H21. 12/

There are a lot of future growth opportunities:

Intl - Currently, they have a CE mark and are working towards insurance coverage in Germany. In addition, they recently entered a Joint venture in China w/Ryzur Medical to sell the MyoPro device. 13/

https://myomo.com/wp-content/uploads/2021/01/Myomo-Ryzur-press-release-26-Jan-2021-1.pdf

Intl - Currently, they have a CE mark and are working towards insurance coverage in Germany. In addition, they recently entered a Joint venture in China w/Ryzur Medical to sell the MyoPro device. 13/

https://myomo.com/wp-content/uploads/2021/01/Myomo-Ryzur-press-release-26-Jan-2021-1.pdf

They have a 20% in the JV and a commitment from Ryzur to invest $8-20 mil over 5 years. In addition, they will receive 2.5$ million in upfront license fees and a minimum of 10.75 mil in sales over 5 years. Initial #'s aren't a lot, but the TAM is huge. 14/

Medicare Coverage: Myomo was recently certified as a provider by Medicare, but CMS codes for coverage/fees are TBD. The upshot of becoming a provider means reduced friction for Myomo devices being reimbursed.15/

While they were previously reimbursed via other device designations, Myomo can now directly enter into contract with insurances, thus reducing friction in the process. In addition, once a fee for Myomo is determined, it can be used by those covered by Medicare. 16/

However, there are some potential risks/downsides:

No Recurring Revenue - Since the lifetime of the device is long, Myomo has no recurring revenue and have to sell a larger number of units each year to grow. This is the biggest downside IMO. 17/

No Recurring Revenue - Since the lifetime of the device is long, Myomo has no recurring revenue and have to sell a larger number of units each year to grow. This is the biggest downside IMO. 17/

Low Insider ownership - Insider ownership is less than 5%, which is unusual for a microcap company growing extremely fast.

Insurance Reliance - without reimbursement, they can't sell their devices due to the cost. 18/

Insurance Reliance - without reimbursement, they can't sell their devices due to the cost. 18/

Low conversion rate - already mentioned, but I thought I would add it here. the conversion rate of the pipeline is pretty low with authorization which could either be a red flag or a future growth opportunity. 19/

Delays in Business - They expected Medicare coverage in 2020 which didn't happen. Myomo also delayed the release of a pediatric MyoPro that was intended for a 2020 launch. However, the delays could be a function of Covid as recent financial performance has been excellent. 20/

Valuation: Myomo has $13 mil in cash and no debt, giving them runway past 2021. Using a share price of $15 and FY20 numbers, the EV/Sales = 7.7x. for a company with expected growth of 50%+ and on the verge of profitability, it is cheap. 21/

Though I want to see the impact of the COVID decrease in the pipeline, I like the company. Mgmt highlights a huge TAM but only a select number of people with Chronic arm paralysis are eligible preventing a full exploitation of the TAM currently. 22/

This is a 'Prove it" story and if revenue growth continues to accelerate with an increase in the conversion rate from the pipeline and international growth, I will continue to add to my position. If they add some sort of RR, it would be appropriate to load the boat. 23/

Disclosure: I own shares of $MYO and bought a spec position at $12.42. I plan to add more as I have done more research into the company. I encourage you to check out their website and the device

https://myomo.com/

24/

https://myomo.com/

24/

For the unrolled full writeup check out my blog: https://adus.substack.com/p/myomo-writeup-myo

@CJOppel @GuiPhilipps let me know if I missed anything! Y'all introduced me to this one.

@CJOppel @GuiPhilipps let me know if I missed anything! Y'all introduced me to this one.

https://myomo.com/germanys-largest-statutory-health-insurance-company-approves-myopro/

looking better and better

looking better and better

Presentation 2/17 notes: They talked about how there are ~30k new patients that become eligible for the MyoPro each year. That new population is 900mil in new revenue each year. Lessened my worries about the Recurring revenue AND lessened concerns over patient eligibility.

In addition, their gross margins should improve to 70-75% as their revenue recognition changes to recognizes sales on delivery.

They also mentioned consumers marketing the Myomo device organically on Tiktok and other social media platforms (showed a person with a Myomo device playing a guitar on Tiktok).

They have been certified as a medicare provider and can enter contracts commercial payors. If they get part B approval....To the moon we go, still under 10x EV/Sales (TTM, after 4Q) which is ridiculous for a company with the goal of 80% growth next year near breakeven.

Read on Twitter

Read on Twitter