Cont

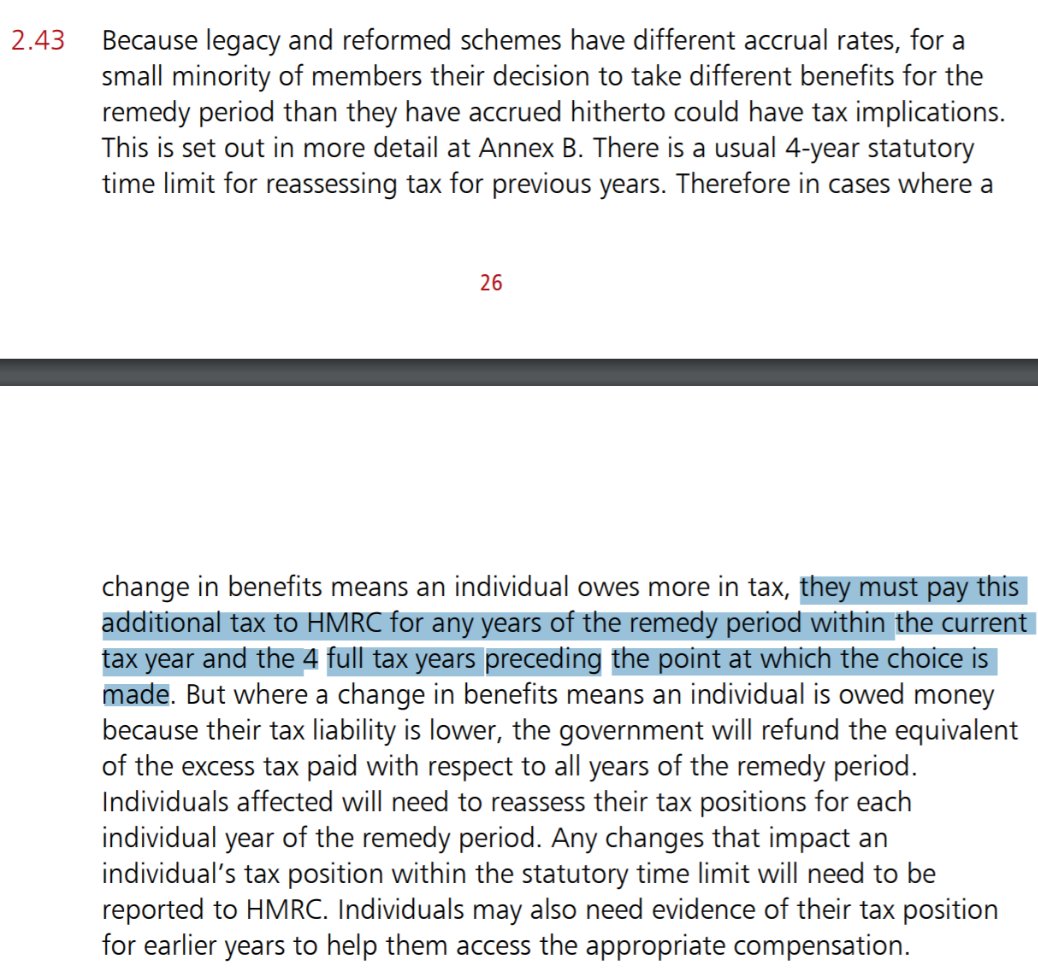

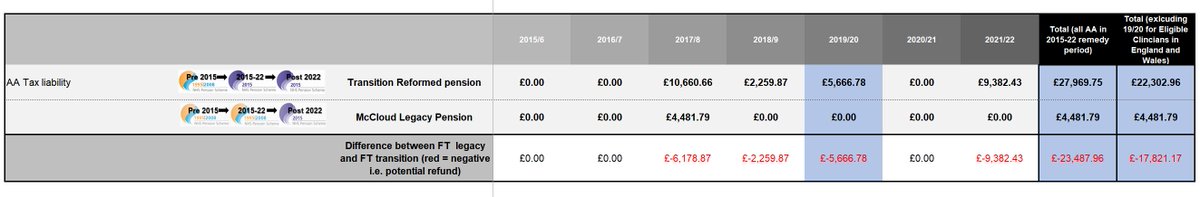

26/ If you have paid AA tax between 1995-22 it is likely your charges will be lower in 1995 than in 2015 scheme. This is because the AA rules are particularly unfair to members of 2 schemes. If your AA charges go down during any of the remedy period, you can claim a refund

26/ If you have paid AA tax between 1995-22 it is likely your charges will be lower in 1995 than in 2015 scheme. This is because the AA rules are particularly unfair to members of 2 schemes. If your AA charges go down during any of the remedy period, you can claim a refund

27/ It does not matter if you paid cash for AA or used scheme pays, if you overpaid these charges can be refunded. If you charges go up (unlikely unless you have “MHO” status) you may have to pay back tax. There is usually a statutory limit of 4 years for paying underpaid tax.

28/ This limit of 4 yrs of underpaid tax was referenced in the consultation document  , although the position is less clear in the full consultation response. We will need to see the final regulations to understand the implications.

, although the position is less clear in the full consultation response. We will need to see the final regulations to understand the implications.

, although the position is less clear in the full consultation response. We will need to see the final regulations to understand the implications.

, although the position is less clear in the full consultation response. We will need to see the final regulations to understand the implications.

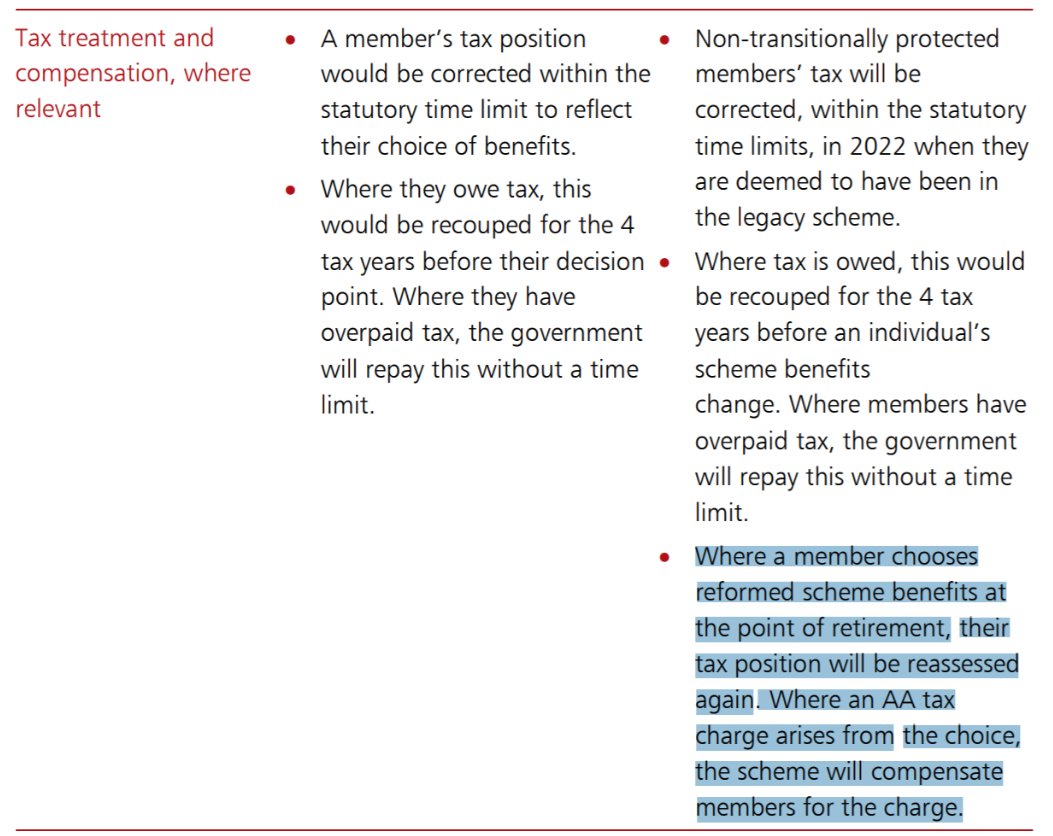

29/ The consultation document also stated that members who choose reformed 2015 in retirement & incurred AA charges would be “compensated”. Again detail in is less clear in the full consultation response. We will need to see the final regulations to understand the implications.

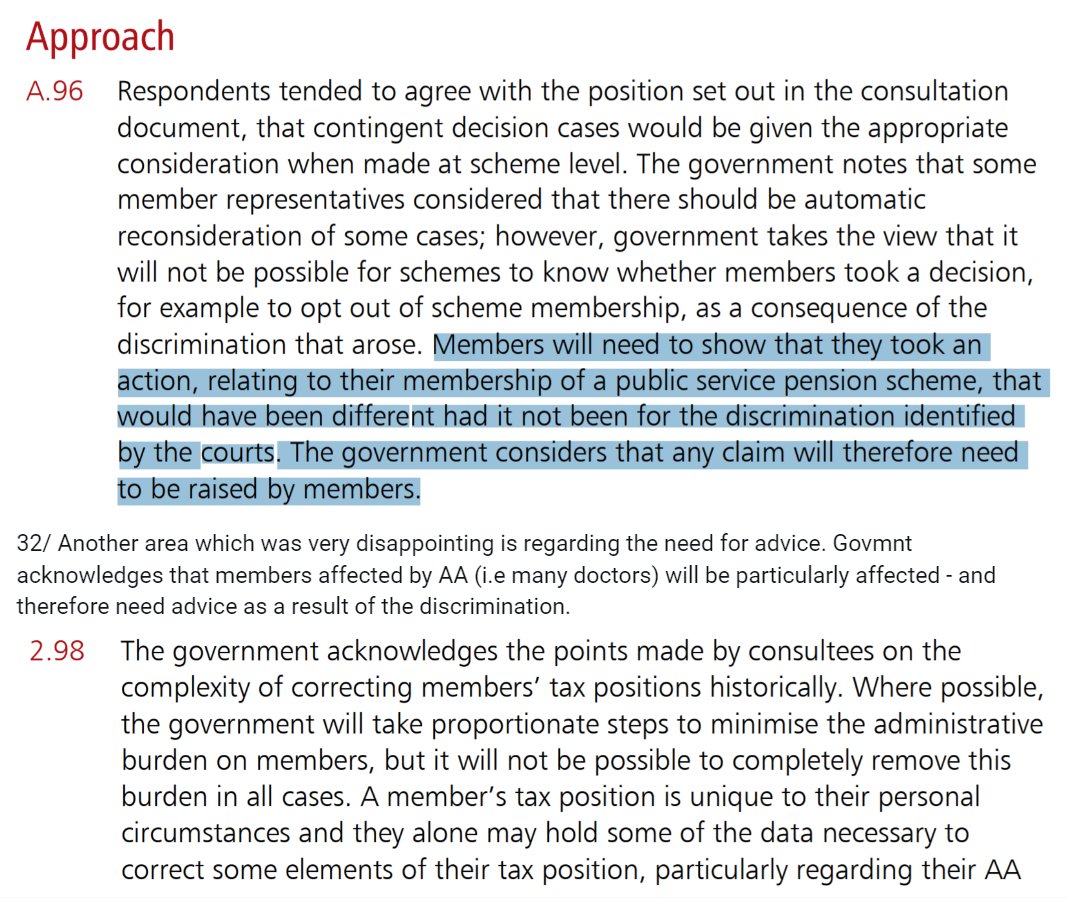

30/An important area are “contingent decisions”. Many members took decisions i.e. “opting out” of the scheme based on the age discrimination. @theBMA argued certain cases should automatically be compensated vs having to prove this on a “case by case” basis

31/ Government disagreed, and now cases will need to be made on a case by case basis, putting a huge burden on members and also the scheme to resolve this, with no guarantee of success. This is very disappointing and will likely form the basis of ongoing legal action

32/ Another area which was very disappointing is regarding the need for advice. Govmnt acknowledges that members affected by AA (i.e many doctors) will be particularly affected - and therefore need advice as a result of the discrimination.

33/ You will recall I mentioned the “cost cap” mechanism. Previously the scheme had identified a “floor breach” ie the ‘15 scheme was no longer “generous enough” (due in part to disgraceful pay rises). This should have triggered a rise in benefits i.e. 1/48ths instead of 1/54ths

34/ Instead government “froze” agreed cost-cap due to McCloud & is now saying costs from the (government’s illegal age discrimination) should be “member” costs in the cost-cap likely removing the “floor breach”. In other words, they want YOU to pay for THEIR mistake. Disgraceful.

34/ As I said, the decision over legacy (95/08) vs reformed (15) will *not* be simple. Many factors important

●when you want to retire

●need for lump sum

●need for dependent benefits

●how long your est. to live

●AA/LTA tax between choices

*DONT ASSUME LEGACY IS ALWAYS BEST*

●when you want to retire

●need for lump sum

●need for dependent benefits

●how long your est. to live

●AA/LTA tax between choices

*DONT ASSUME LEGACY IS ALWAYS BEST*

35/ We @TheBMA are actively looking if we can build tools - like the @TheBMA Goldstone modeller, to help you work out your tax position in both schemes  , and help you make the decision. Many people will still need advice. We’ll keep you posted.

, and help you make the decision. Many people will still need advice. We’ll keep you posted.

, and help you make the decision. Many people will still need advice. We’ll keep you posted.

, and help you make the decision. Many people will still need advice. We’ll keep you posted.

36/ You've probably gathered, this is not straightforward! Some things have gone our way (like “DCU”) - others will be an ongoing fight. There’s never been a better time to be part of a union. @theBMA have got your back

37/37

If you want to know more about pensions/"McCloud" , join me & @BMA_Pensions colleagues at one of our webinars. We've already had over 5000 people register, sign up early to avoid dissapointment.

Its free and open to all.

http://bit.ly/BMAMCCloudTGT

Pls RT!

[END thread 2/2]

If you want to know more about pensions/"McCloud" , join me & @BMA_Pensions colleagues at one of our webinars. We've already had over 5000 people register, sign up early to avoid dissapointment.

Its free and open to all.

http://bit.ly/BMAMCCloudTGT

Pls RT!

[END thread 2/2]

Read on Twitter

Read on Twitter

![37/37If you want to know more about pensions/"McCloud" , join me & @BMA_Pensions colleagues at one of our webinars. We've already had over 5000 people register, sign up early to avoid dissapointment.Its free and open to all. http://bit.ly/BMAMCCloudTGT Pls RT![END thread 2/2] 37/37If you want to know more about pensions/"McCloud" , join me & @BMA_Pensions colleagues at one of our webinars. We've already had over 5000 people register, sign up early to avoid dissapointment.Its free and open to all. http://bit.ly/BMAMCCloudTGT Pls RT![END thread 2/2]](https://pbs.twimg.com/media/EuGknhJXAAIc3QN.jpg)