Coupang $CPNG, South Korea's eCom marketplace IPO.

$12B in Rev, growing at 91% YoY, $500M loss, seeking $50Bvaluation

Comparables.

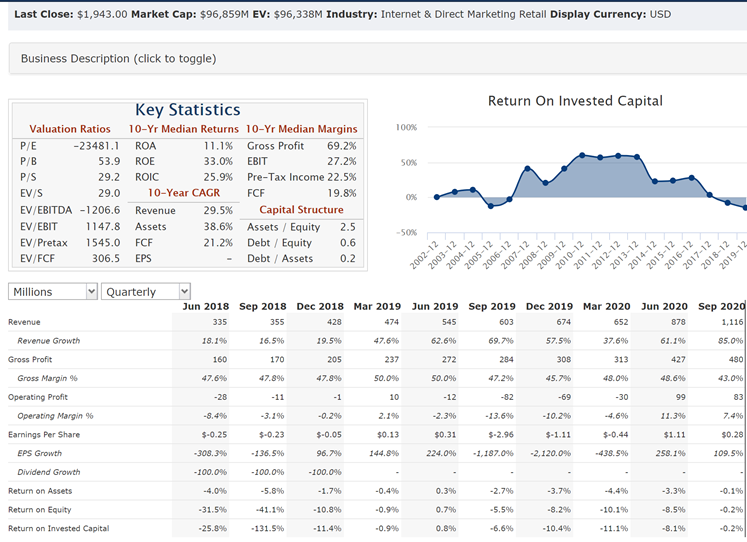

$MELI ~$5B in Rev, $96B Mcap

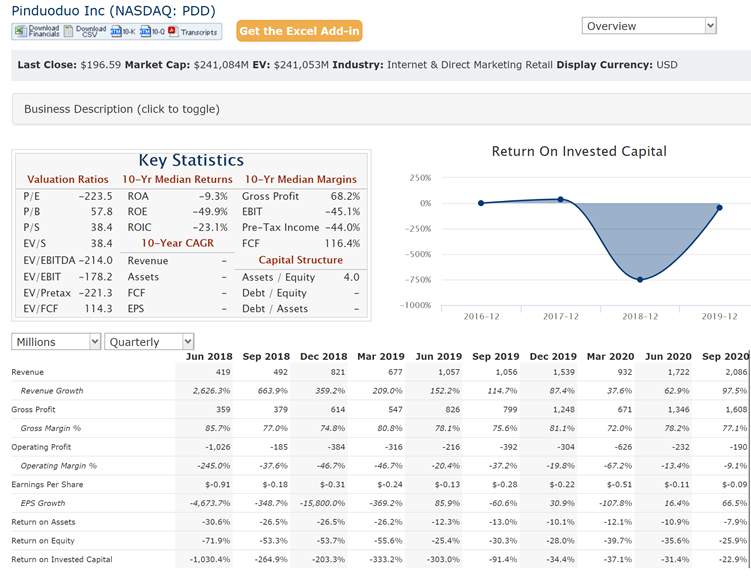

$PDD $9B Rev, $196B Mcap

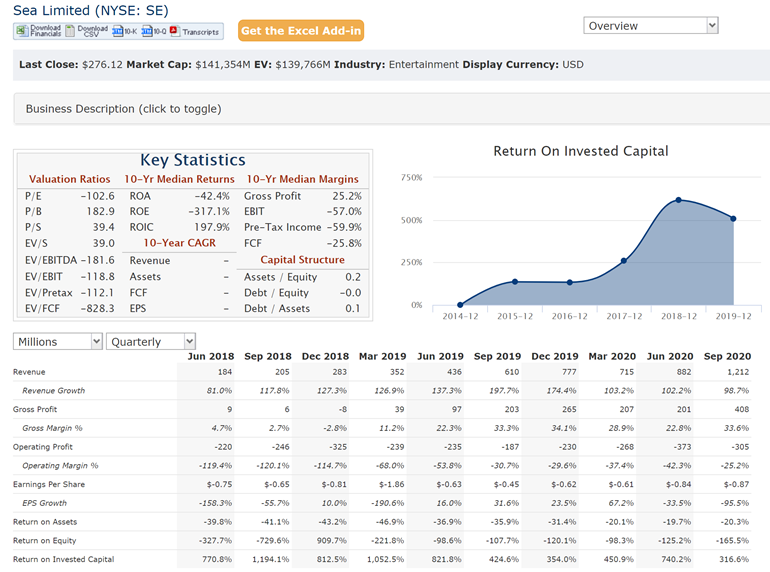

$SE $5B Rev, $141B Mcap

I thinks this FLIES on debut.

https://www.reuters.com/article/us-coupang-ipo-idUSKBN2AC1EL

$12B in Rev, growing at 91% YoY, $500M loss, seeking $50Bvaluation

Comparables.

$MELI ~$5B in Rev, $96B Mcap

$PDD $9B Rev, $196B Mcap

$SE $5B Rev, $141B Mcap

I thinks this FLIES on debut.

https://www.reuters.com/article/us-coupang-ipo-idUSKBN2AC1EL

Two more data points to compare:

Growth:

1 $MELI 97% YoY

2 $SE 103% YoY

3 $PDD 96% YoY

4 $CPNG 91% YoY

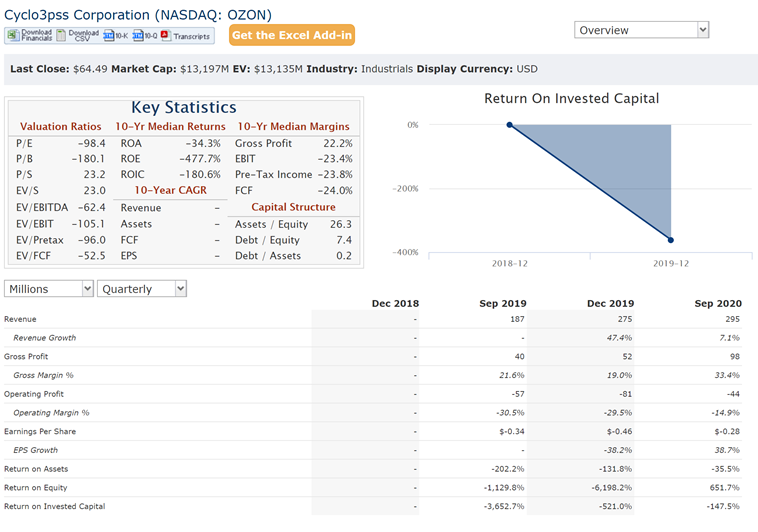

5 $OZON 73% YoY, $13B MCap

Growth:

1 $MELI 97% YoY

2 $SE 103% YoY

3 $PDD 96% YoY

4 $CPNG 91% YoY

5 $OZON 73% YoY, $13B MCap

One cautionary tale is $JMIA - 2 years to IPO day of listing price it has reached its listing price.

ht @monkeyrat100

ht @monkeyrat100

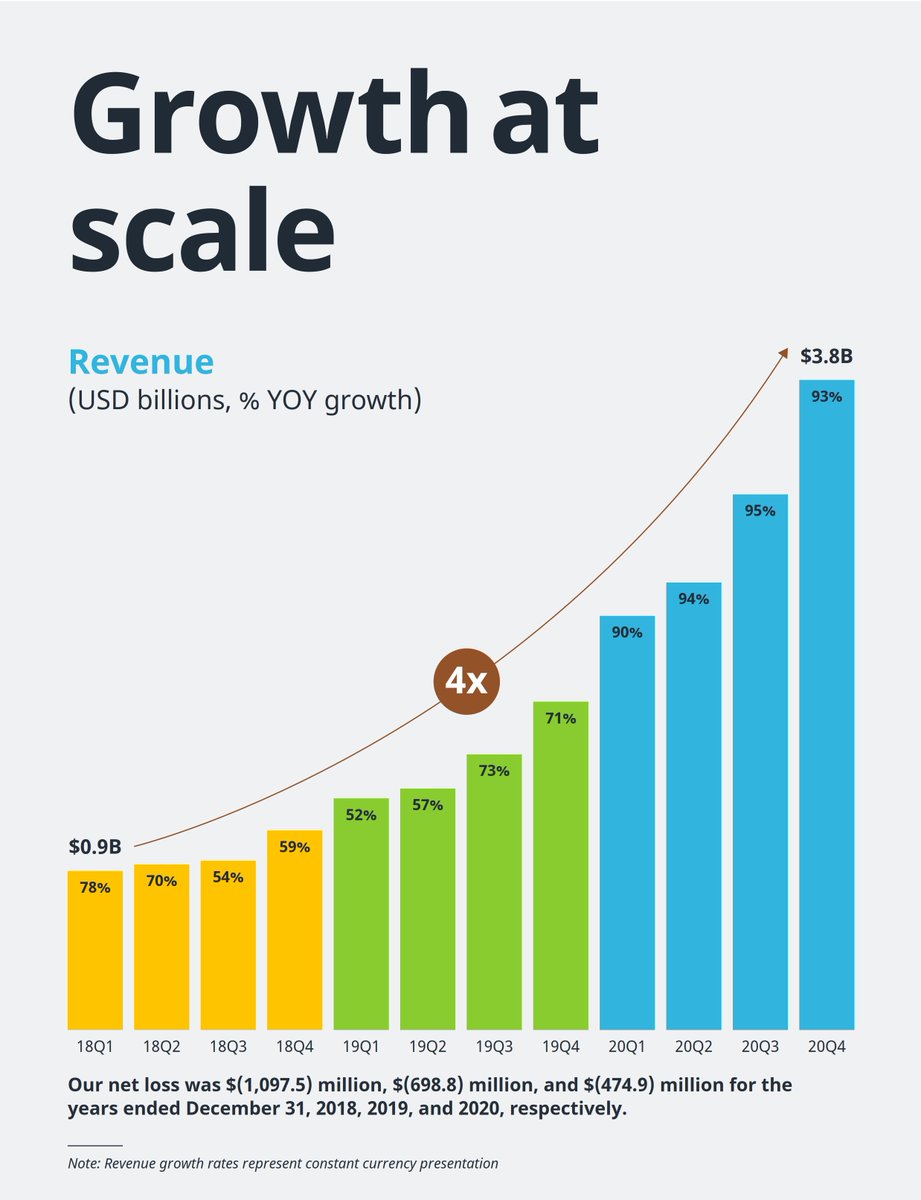

$CPNG - growth is escalating. Revenues grew faster during Covid (obviously), as good as $PTON growth at 3X the revenue.

Risk: Serving only the Korean market, $470 billion in 2019 and is expected to grow to $534 billion by 2024.

e-commerce segment of that total spend was $128 billion in 2019 and is expected to grow to $206 billion by 2024.

< Relatively smaller TAM>

e-commerce segment of that total spend was $128 billion in 2019 and is expected to grow to $206 billion by 2024.

< Relatively smaller TAM>

Korea is the 4th largest economy in Asia and the 12th largest globally. GDP o f $1.6 trillion and GDP per capita of $31,847.15 Total spend in retail, grocery, consumer foodservice, and travel in Korea was $470 billion in 2019 and is expected to increase to $534 billion in 2024.

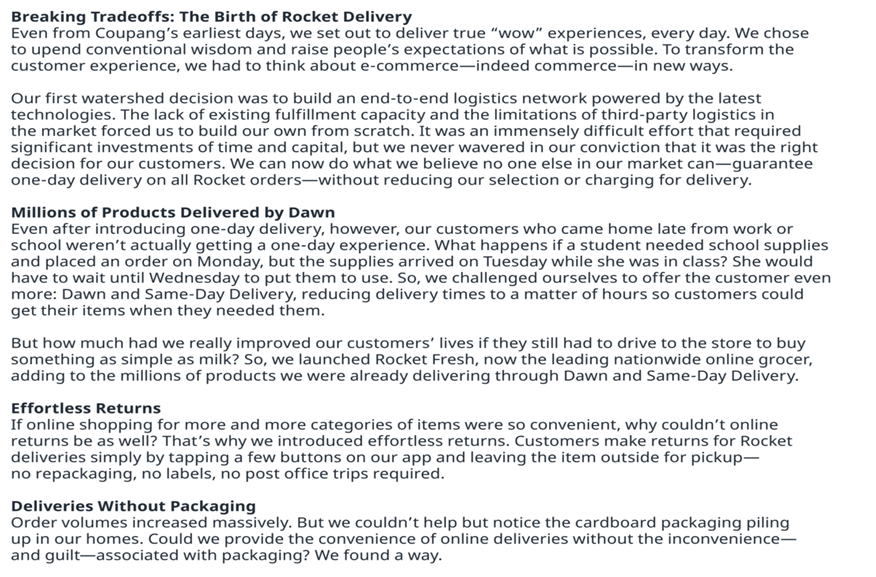

Check out their S1 filing. Lots of good reading.

This could be the next $MELI, $SE, $JMIA

https://docoh.com/filing/1834584/0001628280-21-001984/CPNG-S1

This could be the next $MELI, $SE, $JMIA

https://docoh.com/filing/1834584/0001628280-21-001984/CPNG-S1

Read on Twitter

Read on Twitter