I just wasted my morning watching the stimulus debate between @LHSummers and @paulkrugman. It's crazy Summers was ever influential. 1/

First, Summers concedes the 2009 stimulus was too small. He then tries to whitewash his own complicity by blaming Congress for shrinking the package slightly. But, it was he himself who advised to kneecap the package before sending it to Congress. 2/

Secondly, Summers himself is a fan of the theory that democrats should not throw stones and criticize a Dem. administration. I don't hold this theory, obviously, but this is what Larry is doing with the goal of slightly shrinking this stimulus. It's an odd hill to die on. 3/

Third, it is funny Summers washes his hands at the outset of thinking about any political economy considerations. In 2009, he argued that while we'd have liked a $2 trillion stimulus, political economy concerns dictated it must stay smaller than $1 trillion. 4/

This was an astonishing misread of the political & economic situation. The Federal stimulus (part of which was the AMT patch which would have happened anyway), was smaller than the sum of state and local austerity. Thus in fact it was an austerity package. 5/

Because the economy of course did not recover in part b/c of fiscal austerity & the LT, the Democrats lost a record 63 seats in the House in 2010, which was a redistricting election, and the Tea Bagger victory. 6/

Fourth, the US has been stuck in liquidity trap for 12 years! If the worst thing that happens is that we have some inflation and get out of the liquidity trap, I'm missing why this is a bad thing. Larry warns that "something" bad may happen, but he doesn't quite say what. 7/

He alludes several times to financial problems caused by stimulus. So what if there is another GameStop. There will be even if we shrink this stimulus. I predict DogeCoin will still get into a bubble regardless, and then crash. No reason to keep the economy depressed to avoid. 8/

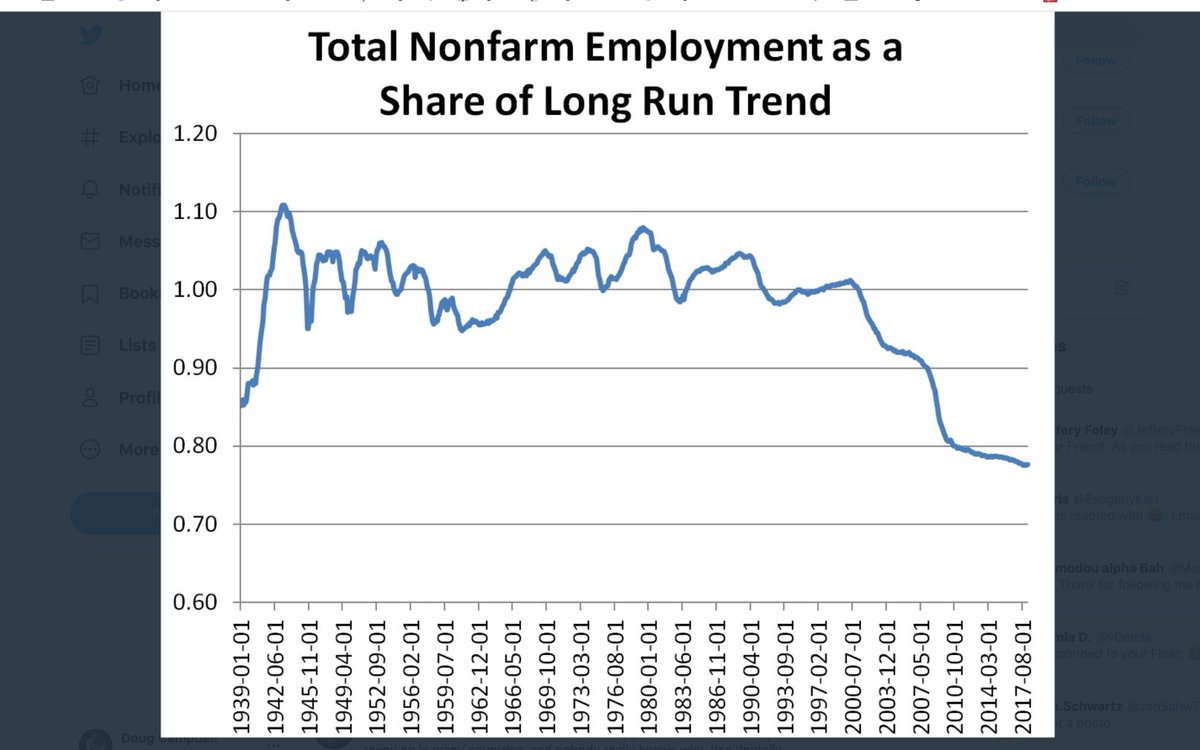

The economy, and labor employment had not been running hot for over two decades, in no small part thanks to Larry's economic policy mismanagement. It's simply bizarre to think this stimulus will result in runaway inflation. 9/

Having said that, as we come out of the Covid recession, there is a good chance headline inflation temporarily passes 2% as commodity prices bounce back. When it does, I expect Larry and other people to sound the inflation alarm, only for core inflation to stabilize.

Given the zero lower bound constraint, it's clear the US needs a higher inflation target than just 2%, or we will be faced with frequent liquidity traps going forward. 4% would be a better target. Not sure how a thinking macroeconomist could disagree we need a higher target. 11/

If Larry is correct the stimulus will cause a spike in inflation, once again I ask, given the ZLB, why is this not a good thing? Given that we have let the economy run cold for over a decade, the risks here are very asymmetric. 12/

So, what is really going on here? Larry is upset he was not picked for a spot in the administration, so he is throwing stones. In fact, if the economy overheats as he thinks, the UI checks and some of the local support will not go out anyway, so what is his beef, exactly? 13/

It seems to be that he believes Democrats should renege on the very popular $2,000 stimulus checks which they just won the Senate by promising. Classic useless ivory tower "I'm holier than thou" advice. 14/

My big fear is that the Fed will overreact to a slight increase in temporary inflation, as a small # of remaining restaurants raise prices on an onslaught of demand, and we remain in a liquidity trap as policymakers once again do too little. 15/

What will then happen is that -- more restaurants will open, to match demand. Commodity prices will stabilize at higher levels. Not runaway inflation, which the Fed knows how to fix anyway by raising interest rates. 16/

It's still the case that no economy has successfully escaped a liquidity trap outside of a war. Japan has been stuck in one for nearly 30 years! The Biden stimulus just might get the US out. 17/Final.

An additional thought: given that the labor market hasn't been run hot for so long, and given that there may be temporary supply shortages of things like restaurants and airlines ramping up flights, plus given the risk of the ZLB...

I think it's clear the Biden administration should try to run the economy slightly too hot for the next 2-3 years. Over the next 3 years, the Biden stimulus comes out to less than 3% of GDP. Doesn't sound like it is likely to be "too much" to me.

US GDP is still over 20% below it's long-run trend. The stimulus could well be 5X too small to produce the kind of inflation Summers fears. The impact of WWII spending & inflation was... the definitive end of the liquidity trap and a great post-war economy.

But this stimulus is obviously vastly smaller than what happened during wartime, which didn't have the negative effects Summers says he worries about.

Read on Twitter

Read on Twitter