$TSLA buying $BTC and $MA saying the trend behind digital currency is unmistakable! @Waymo and $GM's Cruise seemingly ahead in the AV race. @tiktok_us scaling out eCommerce and @reddit doubling its valuation.. Be sure to subscribe for the latest in tech! https://granitebaycap.substack.com/ https://twitter.com/GranitebayCap/status/1359973823961997313

$TSLA has taken a $1.5b cash position in Bitcoin; catalysing a 22% rally in the digital currency. The company said it wants to provide more flexibility to diversify & maximise returns on its cash, whilst indicating it may acquire and hold more digital assets over the long-term

$MA said in a blog post that digital assets are becoming a more important part of the payments world and that the trend is “unmistakable”. In light of this, Mastercard announced that this year they will “start supporting select cryptocurrencies directly on our network”.

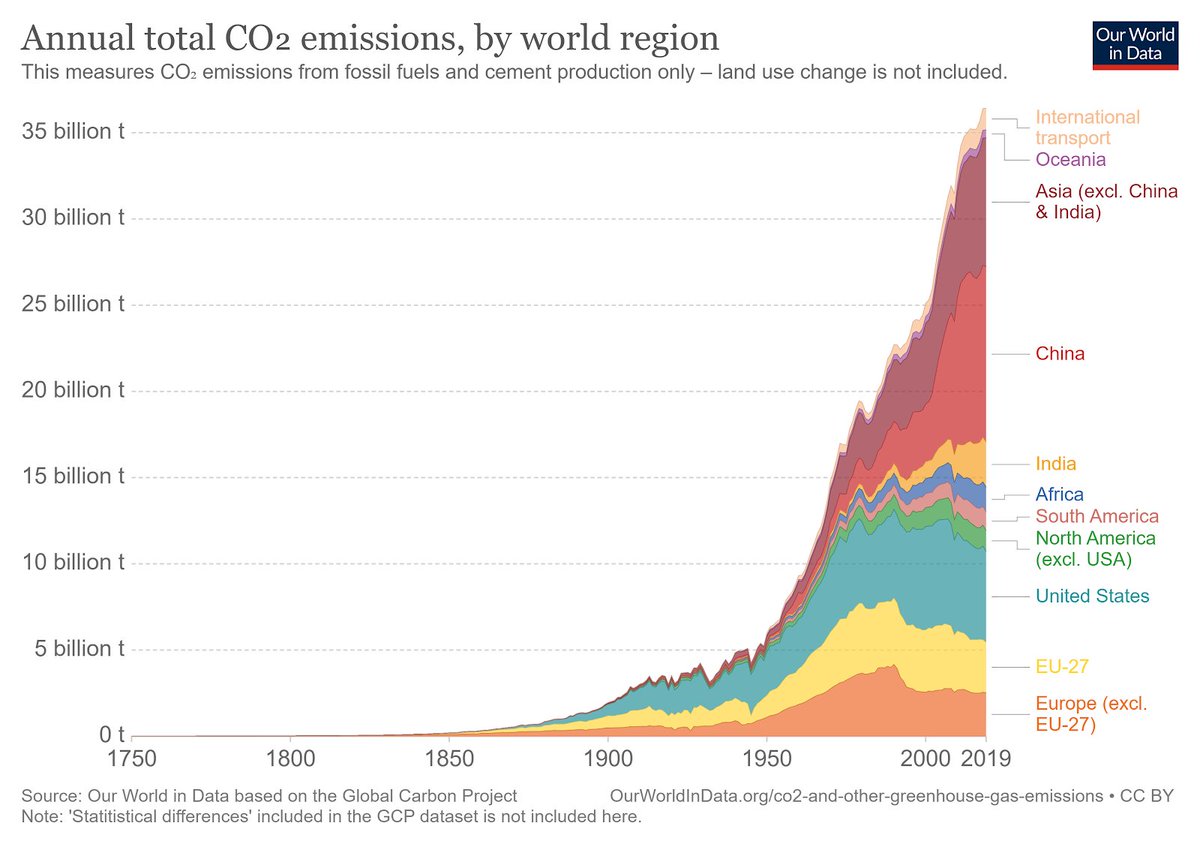

@elonmusk's $100m XPrize invites innovators to create and demonstrate solutions that can pull CO2 directly from the atmosphere. The aim is to help remove up to 6 gigatons of CO2 per annum by 2030 and 10 gigatons by 2050 (estimated to avoid the worst effects of climate change).

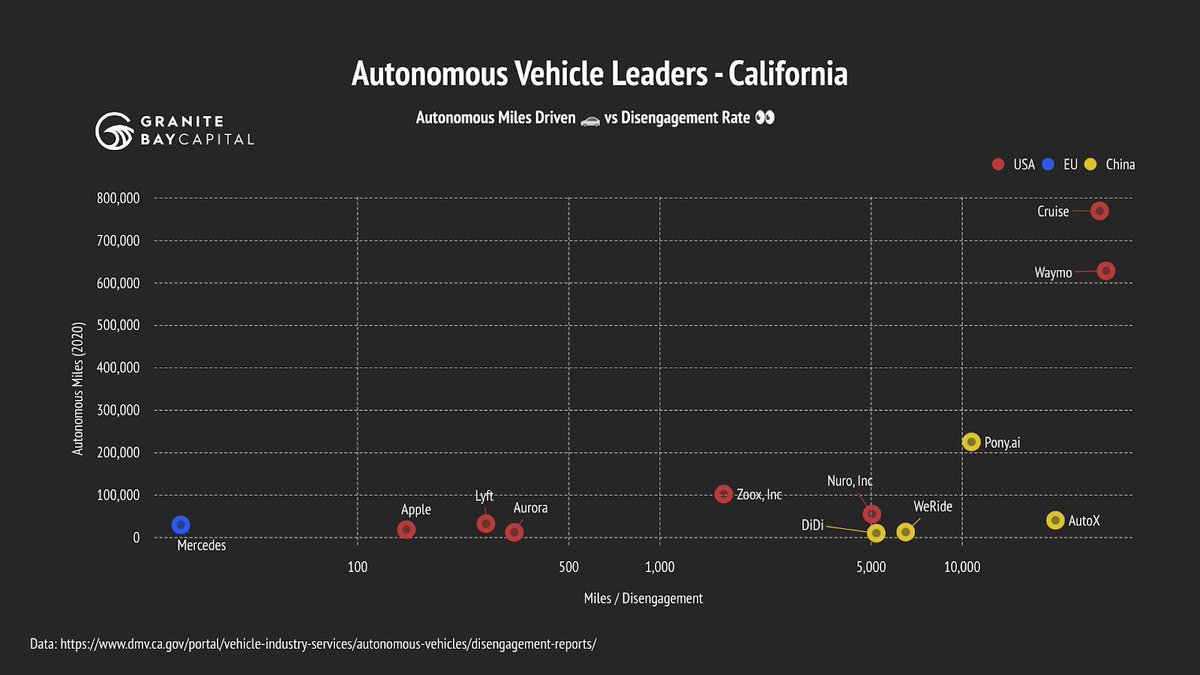

California released the 2020 disengagement report which shows progressed companies are in their AV ambitions. $GM Cruise and $GOOG Waymo appear WAY ahead of the competition. But, they did have a very good head start.

Samsung (005930.KS) is considering the location of a US-based chip plant, estimated to cost >$17b. Austin is being considered where they are seeking tax subsidies of $805m over 20 years for the manufacture of more advanced chips used by the likes of $QCOM, $NVDA & $TSLA

Early last year Taiwan Semi $TSM, who control the lion’s share of the chip market, said they would build a $12b plant in Arizona. This all comes at a time of vast global chip shortages, impacting all key manufacturers from General Motors through to Sony’s Playstation.

@graphcoreai, which has raised ~$700m from Dell, Bosch $BMW wants UK regulators to block $NVDA's acq. of Arm. "If Nvidia can merge the Arm & Nvidia designs in the same software, that locks out companies like Graphcore from entering the seller market" a Graphcore investor, said

It’s been a bad week for Hyundai’s (005380.KS) with the auto-maker backpedalling on earlier reports that they, and subsidiary Kia, are in talks with $AAPL on the development of an autonomous electric vehicle. Last week it was reported that a deal was close to being finalised.

@tiktok_us is following other social media peers in scaling out its e-commerce offering & monetising a highly engaged millennial & Gen Z user base. New features include self-service advertising, affiliate links (allowing influencers to link to brands) & in-app brand catalogues

$XONE has launched the world’s fastest, office-safe metal 3D printer. The printer will be launched in partnership with Canada’s Rapidia whose technology was the first to allow water-bound metal and ceramic parts to go directly from the printer to furnace with a debinding.

VanEck has launched an ETF to invest in social-media hyped stocks. The “Buzz NextGen AI US Sentiment Leaders Index” will invest in stocks that people are talking up on social media sites such as Reddit, $TWTR, $FB and platforms like StockTwits, Yahoo Finance and The Street.

Reddit has seen its valuation double to $6b after raising >$250m in a recent funding round. The company, buoyed by a surge in activity on ‘meme stocks’, decided now was the right time to invest further in the company. Reddit has >50m DAUs, with ad revenue up 90% in the last Q

Toyota ( http://7203.JP ), which has long resisted EVs in favour of hybrids, has finally announced that they will be releasing two EVs in 2022. Although details are scarce, it is expected that one of the EVs will be a Toyota and another, likely a Lexus SUV or crossover.

$BMBL has hit the public markets, surging to $70, 60% above its $43 issue price. This brings in $2.15b for the dating app. Revenues for 2021 is on track for ~$550m which would put the company on a fwd P/S of 18x - in line with its closest competitor $MTCH

Battery-cell startup Freyr will list on the NYSE via a SPAC deal. The Norwegian company, to be renamed Freyr Battery, expects to receive $850m as part of the merger to proceed with plans to install a battery cell production capacity of up to 43 GWh in four years.

Micromobility startup @helbizofficial is merging with GreenVision Acquisition Corp (GRNV), valuing the company at ~$400m. CEO Salvatore Palella said they will be expanding their products as a last-mile solution (2.7m users), further announcing plans to establish “ghost kitchens”

@Matterport, which creates immersive digital twin software, is going public in a SPAC deal valuing the company at $2b. Matterport’s 3D technology is used in more than 130 countries by firms like Redfin and Marriott; with the most common use-case being 3D property walkthroughs.

Electric truck maker @xostrucks is in talks to go public via a merger with NextGen Acquisition $NGAC, which would value the company at ~$2bn. Xos’ competitors include $NKLA, $TSLA, Daimler http://DAI.DE with their Freightliner eCascadia & Geely http://175.HK

$AMZN backed EV maker @Rivian is seeking an IPO in September, which would value the company at ~$50bn. Rivian have signed deals with Amazon and another investor Ford $F to supply them with delivery trucks & an EV platform respectively. To date, Rivian have raised ~$8.2b

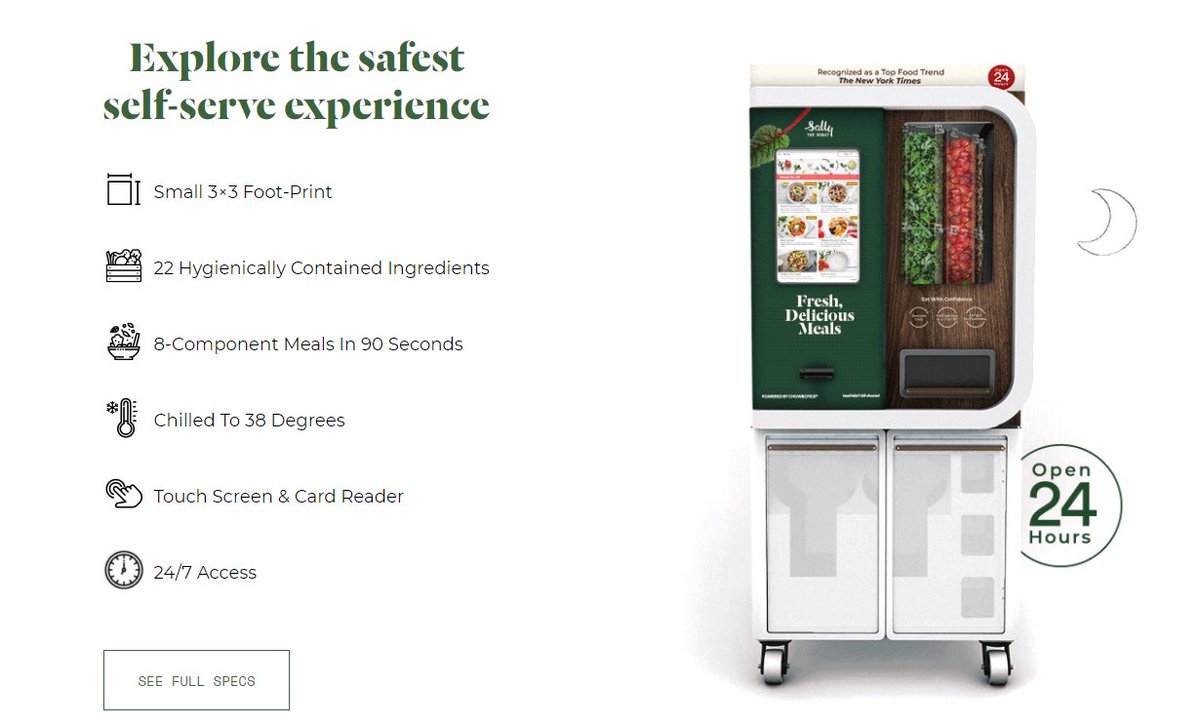

$DASH, which spruiked its focus on emerging tech in its recent IPO, has announced the acquisition of @chowbotics a meal prep vending machine. Chowbotics machines are available across a wide range of industries including Grocery, Healthcare and Higher Education

Electronic Arts $EA$ is acquiring mobile game developer @glumobile $GLUU in a deal worth $2.4b; roughly 35% higher than last trading levels. Glu’s gaming portfolio includes Kim Kardashian: Hollywood, Tap Sports Baseball and a Taylor Swift social network.

$MTCH are paying $1.73b in cash and stock for South Korea’s Hyperconnect whose two apps, Azar and Hakuna Live, allows users to connect with each other over language barriers. Azar is focussed on one-to-one video chat whilst Hakuna offers online live broadcasts.

FT reported that $MSFT made an approach to buy $PINS in recent months. According to the report, negotiations are not active and neither company are willing to make any comment. This would be a great deal for MSFT if it happened, however, there are a few hurdles to overcome.

Softbank ( http://9984.JP ) is investing $900m, via convertible debt, in Pacific Biosciences (PACB), a global leader in end-to-end genetic sequencing from sample prep, through to sequencing and data analysis.

PLUS MUCH MORE. Subscribe at: https://granitebaycap.substack.com/

PLUS MUCH MORE. Subscribe at: https://granitebaycap.substack.com/

@_SeanDavid

@SeifelCapital

@aadhansen

@RamBhupatiraju

@GetBenchmarkCo

@jaminball

@RihardJarc

@ballmatthew

@wintonARK

@BahamaBen9

@packyM

@shivsharma_5

@SpacGuru

@SPACtrack

@studios

@saxena_puru

@JonahLupton

@BrianFeroldi

@JoeySolitro

@GetBenchmarkCo

@morganhousel

@cperruna

@SeifelCapital

@aadhansen

@RamBhupatiraju

@GetBenchmarkCo

@jaminball

@RihardJarc

@ballmatthew

@wintonARK

@BahamaBen9

@packyM

@shivsharma_5

@SpacGuru

@SPACtrack

@studios

@saxena_puru

@JonahLupton

@BrianFeroldi

@JoeySolitro

@GetBenchmarkCo

@morganhousel

@cperruna

Read on Twitter

Read on Twitter