1/ #RealYield is the ultimate driver for #Gold price; to be exact, it's the #negative #RealYield that had been driving the gold price!

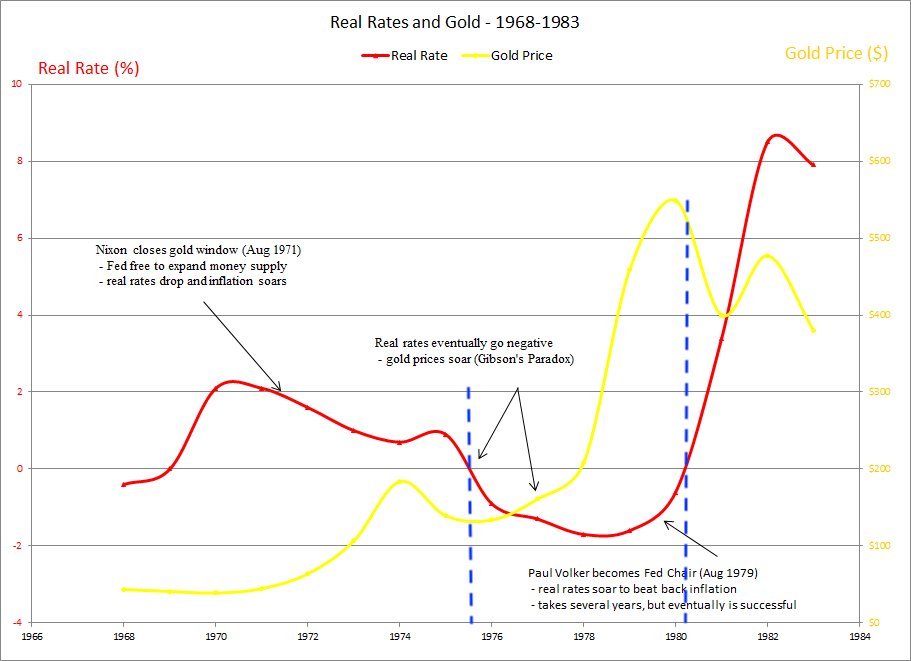

An important historical fact was during the 1975 - 1980s hyper-inflationary period, #Gold went parabolic due to #RealYield going "negative"...

An important historical fact was during the 1975 - 1980s hyper-inflationary period, #Gold went parabolic due to #RealYield going "negative"...

2/ Look at the above chart closely, #gold price started to bottom in tandem with #realyield dropping below 0%; conversely, #gold price peaked ahead of the #realyield turning positive.

In other words, gold price can be a leading indicator prior to the #realyield turning positive!

In other words, gold price can be a leading indicator prior to the #realyield turning positive!

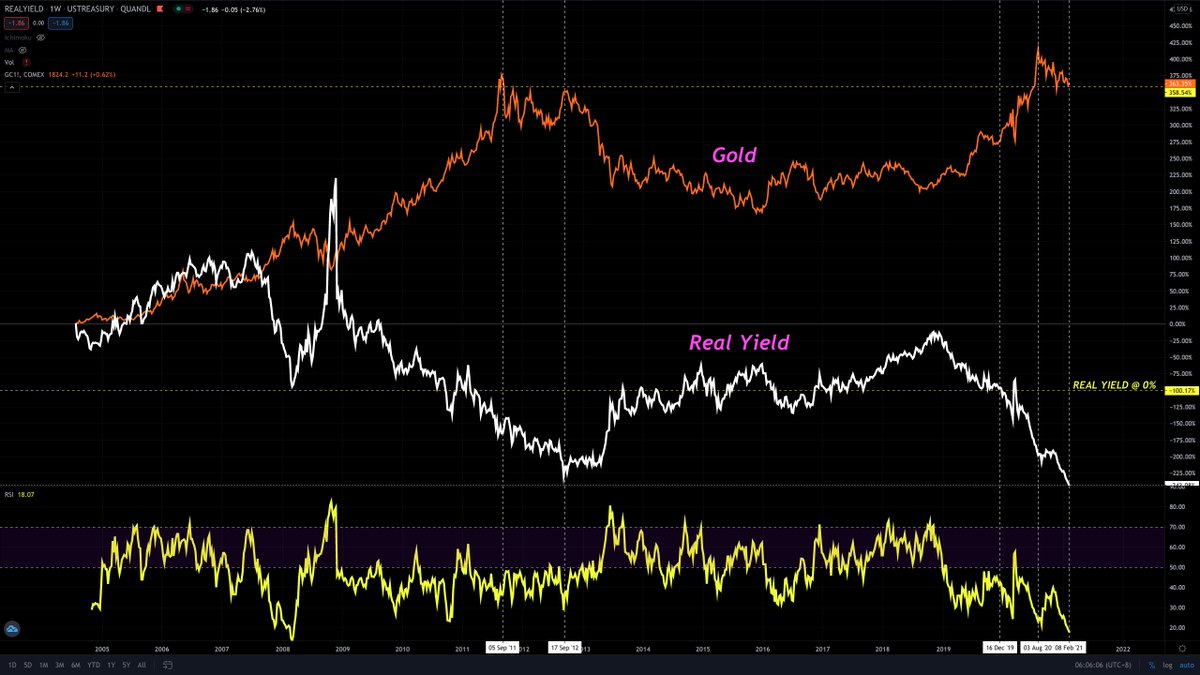

3/ Today's #gold price action (since Aug2020) is reminiscent of the period during #Year2011's peak where #gold price was dropping in tandem with #realyield prior to the bottoming in #realyield;

Gold price then turned decisively lower as #realyield finally bottomed.

Gold price then turned decisively lower as #realyield finally bottomed.

4/ The million $$$ question is really, can more #stimulus #paychecks & #increase of #min. #pay into main-street's spending power drive a sustainable #inflationary pressure in the coming months?

If yes, then, #gold is at risk of #nominal #yield pricing a faster move > #inflation!

If yes, then, #gold is at risk of #nominal #yield pricing a faster move > #inflation!

5/ Another very important take away from #Year1978 is this: when the #negatvie #realyield bottomed & rallied to 0%, #gold rallied along with it!

This is an important attribute that could sustain current #gold's uptrend should the #realyield bottomed again & rally towards 0%!

This is an important attribute that could sustain current #gold's uptrend should the #realyield bottomed again & rally towards 0%!

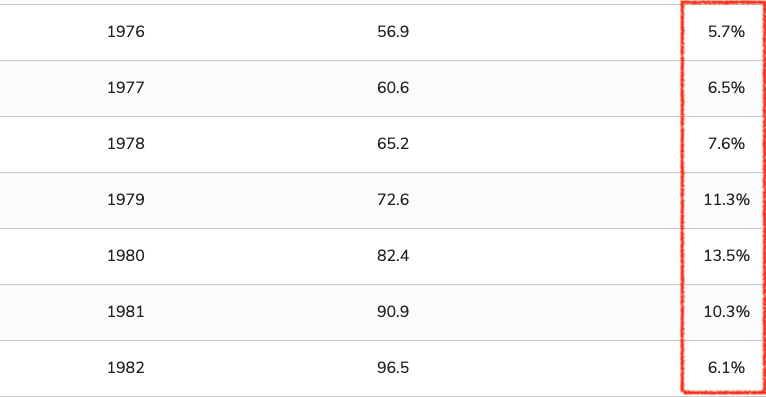

5/ What makes me think that when #realyield bottoms again #gold will rally like during Year 1978 and not Year2011? The answers lies in the #inflation itself!

When real yield bottomed in 1978, it was due to inflation!

When real yield bottomed in 2011, it was NOT due to inflation!

When real yield bottomed in 1978, it was due to inflation!

When real yield bottomed in 2011, it was NOT due to inflation!

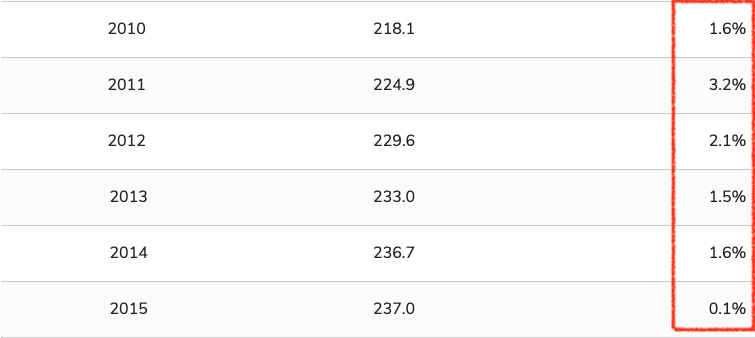

6/ In summary, as "real yield" (RY) = nominal yield (NY) - inflation "I":

When RY

When RY  because NY > "I" due to inflationary pressure, #gold

because NY > "I" due to inflationary pressure, #gold !

!

When RY

When RY  but inflationary pressure is

but inflationary pressure is  , gold

, gold

This conclusion likewise fits the bill that gold is an inflationary hedge!

This conclusion likewise fits the bill that gold is an inflationary hedge!

When RY

When RY  because NY > "I" due to inflationary pressure, #gold

because NY > "I" due to inflationary pressure, #gold !

! When RY

When RY  but inflationary pressure is

but inflationary pressure is  , gold

, gold

This conclusion likewise fits the bill that gold is an inflationary hedge!

This conclusion likewise fits the bill that gold is an inflationary hedge!

Read on Twitter

Read on Twitter