In my latest report I describe what I believe to be a bubble in Toronto’s suburban housing market

I’ll summarize some of my key observations in this thread. https://www.movesmartly.com/move-smartly-report-february-2021

I’ll summarize some of my key observations in this thread. https://www.movesmartly.com/move-smartly-report-february-2021

2/ I first wrote about concerns of bubble-like conditions in the suburbs two months ago.

It wasn’t just the competitive market and rapidly rising prices that led me to suggest bubble-like conditions but also on the ground micro level observations. https://www.movesmartly.com/move-smartly-report-december-2020

It wasn’t just the competitive market and rapidly rising prices that led me to suggest bubble-like conditions but also on the ground micro level observations. https://www.movesmartly.com/move-smartly-report-december-2020

3/ It’s normal for Toronto’s housing market to be competitive with many houses getting multiple offers this time of year because demand is high and inventory is very low.

This is the hottest time of the year where homes get the most offers and some crazy prices

This is the hottest time of the year where homes get the most offers and some crazy prices

4/ Of the homes that would get multiple offers in previous years, roughly 95% of houses would sell for a price close to market value with maybe 5% of the houses selling for well above the market value.

But these few sales didn’t push all house prices up.

But these few sales didn’t push all house prices up.

5/ Agents and buyers would view these sales as outliers made by irrational or desperate buyers. Buyers would make their offer prices based on the 95% of homes that sold for current market value.

But things were looking very different in the suburbs a few months ago.

But things were looking very different in the suburbs a few months ago.

6/ More and more buyers started chasing the outlying (elevated) sale prices.

And they weren’t just chasing those prices, they felt that in order to win they needed to pay 2-3% more than what a similar house sold for just a couple of weeks ago.

And they weren’t just chasing those prices, they felt that in order to win they needed to pay 2-3% more than what a similar house sold for just a couple of weeks ago.

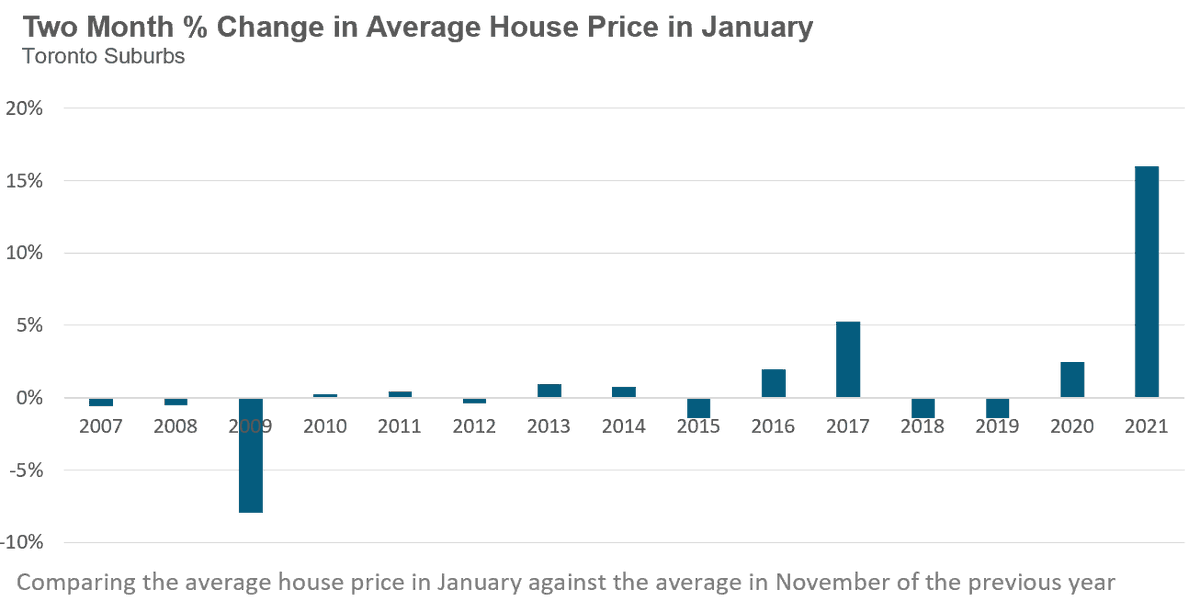

7/ That momentum kept building and by January we found that average house prices in the suburbs were up 16% in just 2 months (median up 14%).

This is a 2 month period when average prices don’t change much – here’s the historical 2 month % change in prices

This is a 2 month period when average prices don’t change much – here’s the historical 2 month % change in prices

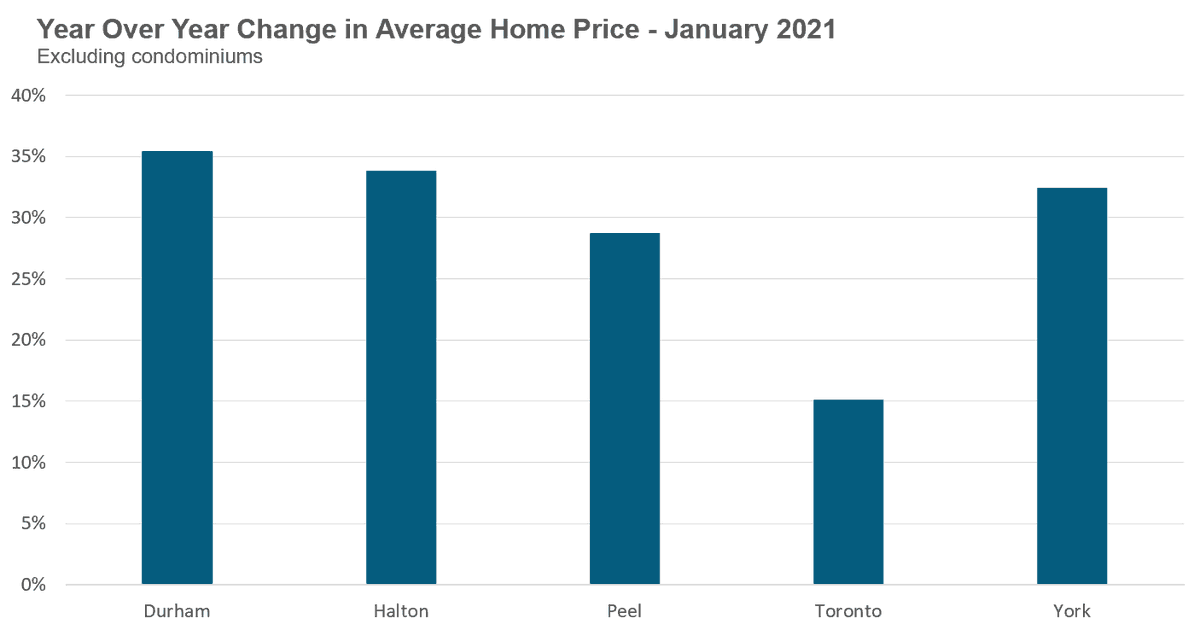

8/ This pushed average home prices in Halton, Durham and York regions up over 30% y/y and Peel up 29%

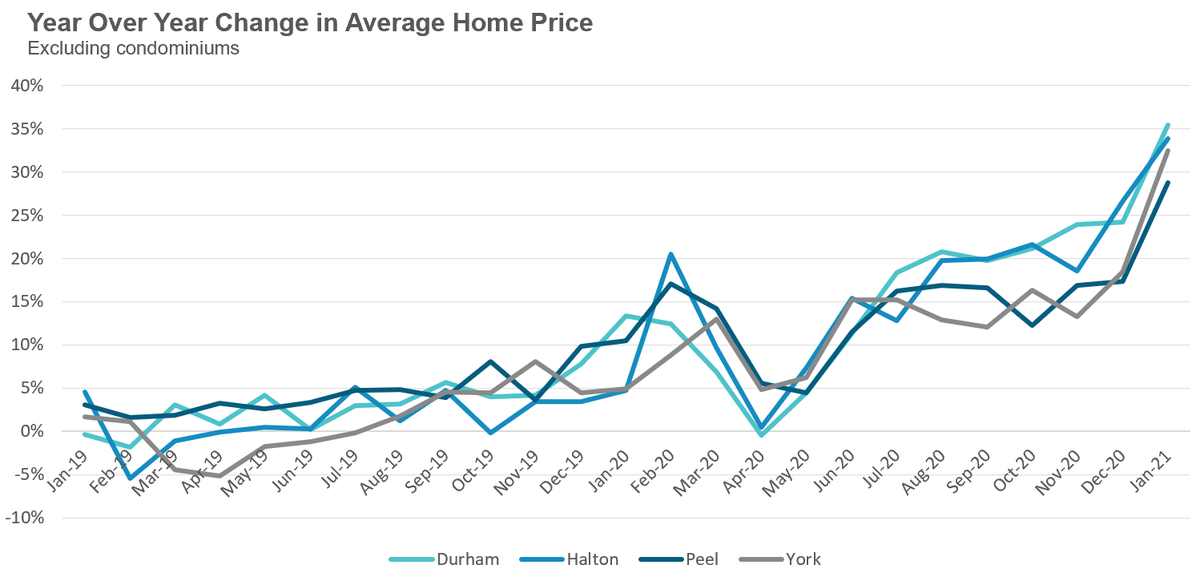

9/ If you look at the y/y change in house prices over the past 2 years we can see that the rapid price growth started in Q1-20 and after hitting pause due to lockdowns kept trending up

The trend & momentum that got us here isn’t new - it's been building for 12 months

The trend & momentum that got us here isn’t new - it's been building for 12 months

10/ If we look at the year over year change in house prices over a longer horizon we can see that the growth appears to be explosive during this period and during the 2016 bubble with the growth being far more rapid this time around.

11/ One way to see this is to consider how many months it took for house prices to appreciate by single digits to over 30%.

In 2017, it took 25 months — this year it took just eight months.

In 2017, it took 25 months — this year it took just eight months.

12/ The bubble this time around is different than the one in 2016/17 in many ways.

Policy makers have been overly confident that the housing market is doing just fine, there’s no bubble, because demand has been largely from end users vs investors.

Policy makers have been overly confident that the housing market is doing just fine, there’s no bubble, because demand has been largely from end users vs investors.

13/ This is a misguided conclusion.

Even if the market is driven by end users demand, they have pushed prices up significantly higher and faster than investors did in 2017 so I’m not sure why anyone would take any comfort in the prices end users are paying today

Even if the market is driven by end users demand, they have pushed prices up significantly higher and faster than investors did in 2017 so I’m not sure why anyone would take any comfort in the prices end users are paying today

14/ And my instinct is that investor demand across the GTA will accelerate in 2021 - we are already seeing this in the condo market - thanks in part to investors seeing the rapid price acceleration during a year when they were told house prices were going to crash

15/ In a normal market, policy makers don’t want to see a rapid acceleration in house prices and caution the market WELL before prices are rising 30% y/y.

That of course didn’t happen this time. The message from Ottawa has been that the

That of course didn’t happen this time. The message from Ottawa has been that the

16/ rapid price acceleration over the past 12 months is normal, nothing at all to worry about because it's not investors & that if the market starts to cool they’ll step in to keep the housing market going – this is leaving investors incredibly optimistic.

17/ The consensus view I hear from investors is that if you’re going to invest in a housing bubble, you want to ride the bubble that governments are supporting on the way up and the one they’ll throw every policy tool available at to avoid a decline in house prices

I don't blame them, a similar view appears to be motivating investors in the equity markets.

We are in for an interesting 2021. I share some thoughts on what to keep an eye out for in the months ahead in the report. https://www.movesmartly.com/move-smartly-report-february-2021

We are in for an interesting 2021. I share some thoughts on what to keep an eye out for in the months ahead in the report. https://www.movesmartly.com/move-smartly-report-february-2021

Read on Twitter

Read on Twitter