recent trends in retail trading - a thread

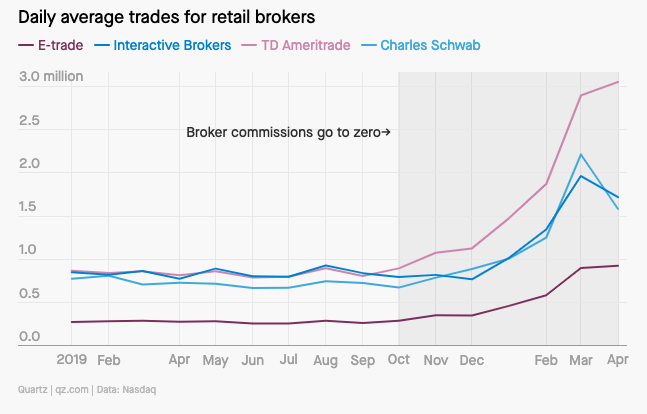

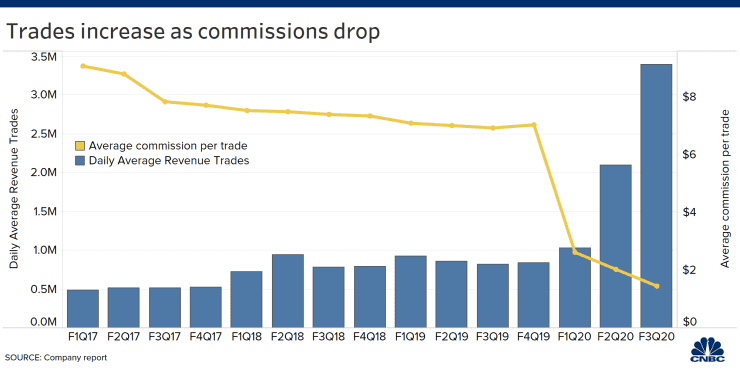

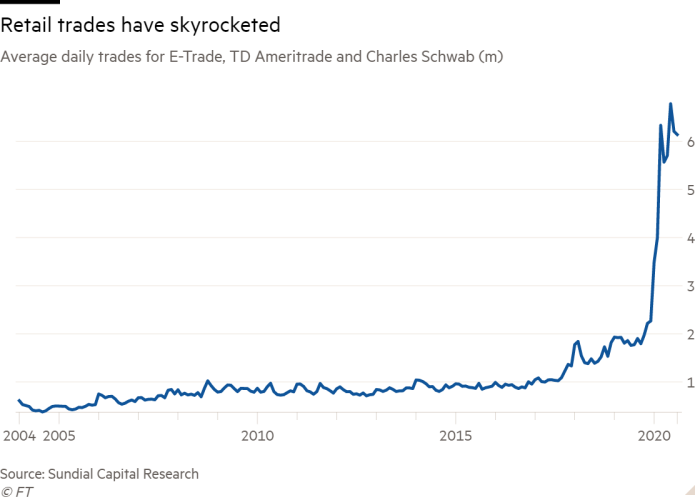

(1/5) just a few months before corona hit, several online brokerages cut commissions to zero, and the frequency of trades in retail accounts immediately started going up, a lot:

(1/5) just a few months before corona hit, several online brokerages cut commissions to zero, and the frequency of trades in retail accounts immediately started going up, a lot:

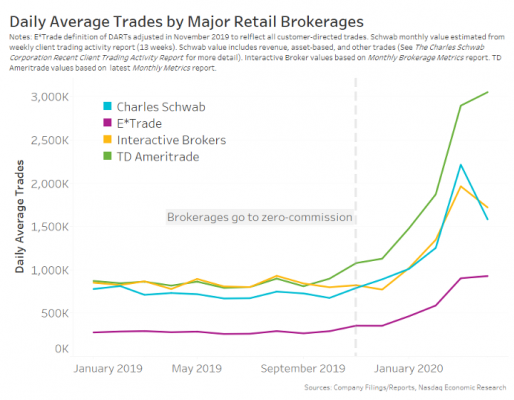

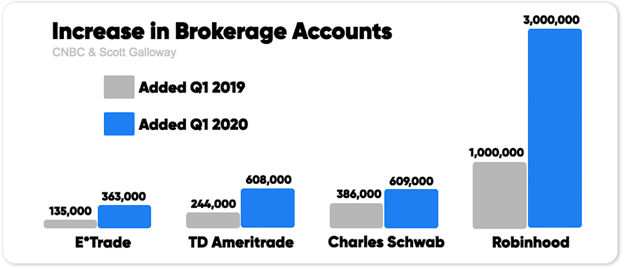

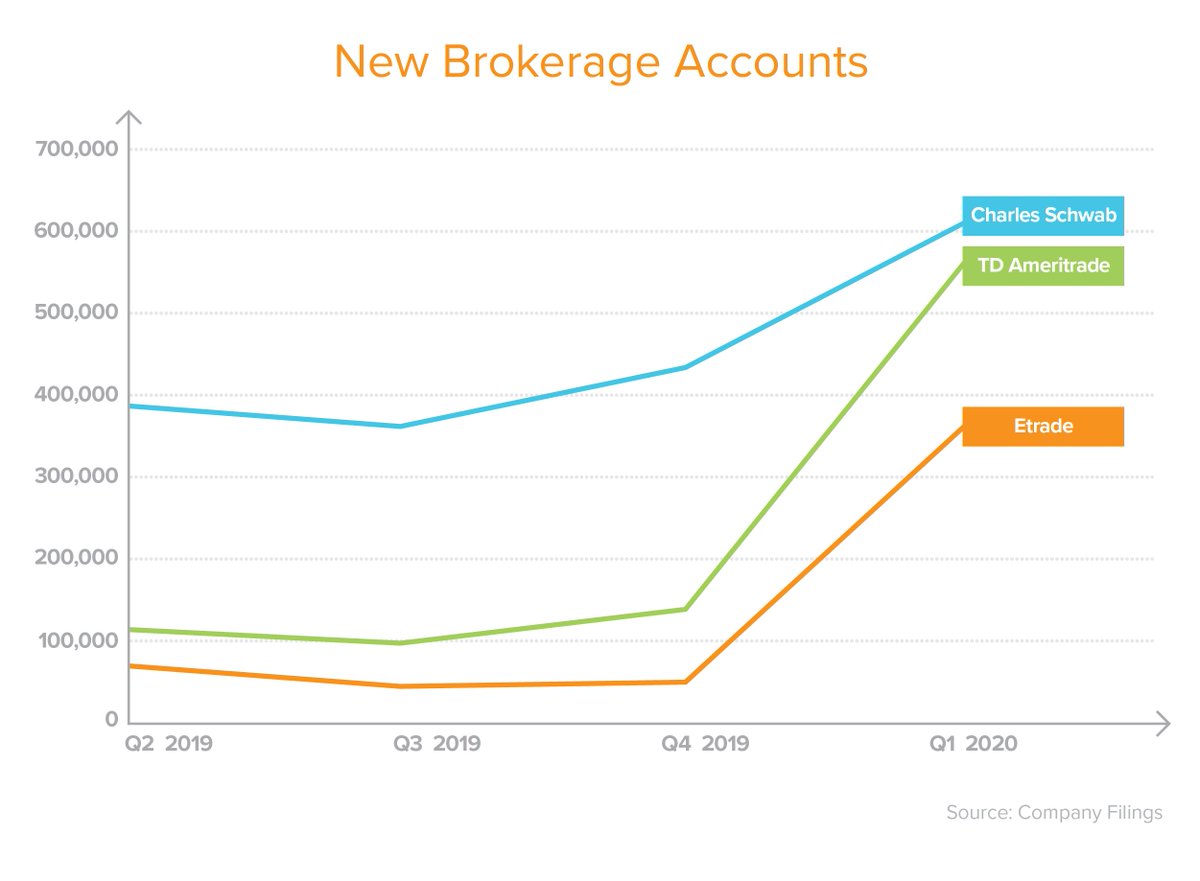

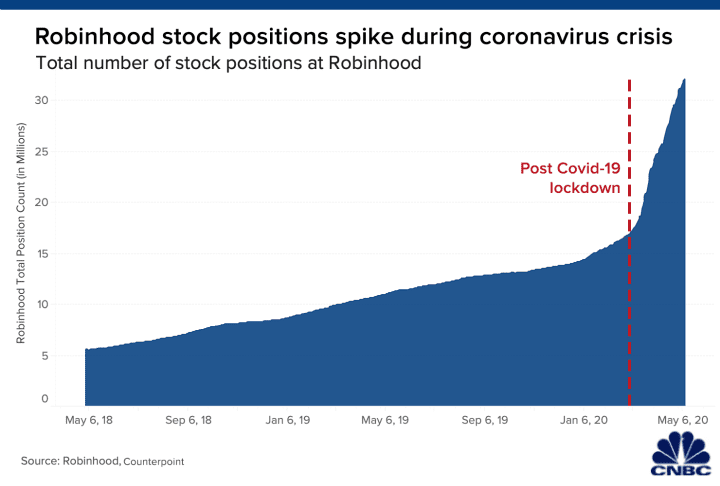

(2/5) corona lockdowns massively increased the number of new online trading accounts being opened and the number of trades being placed:

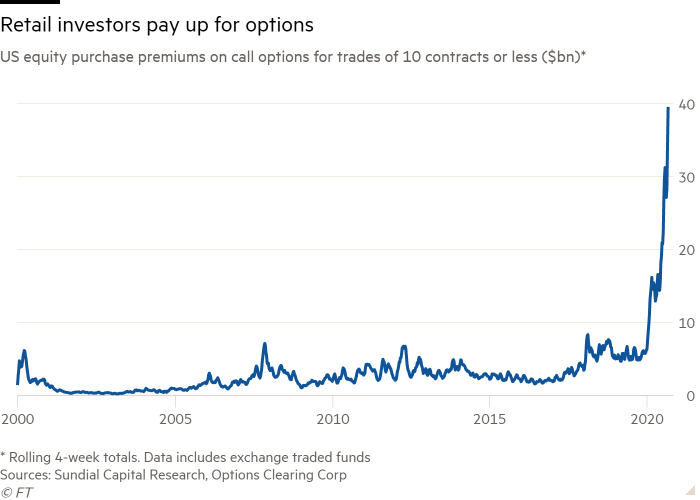

(3/5) retail investors quickly switched from buying shares (they did buy shares during the March 2020 dip) to buying options instead:

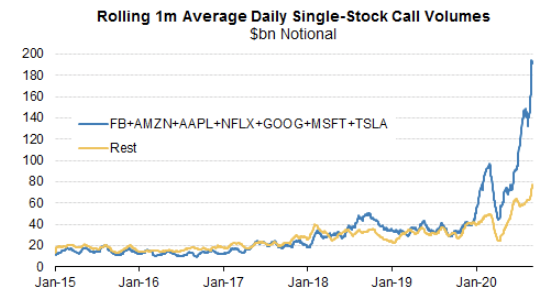

(4/5) what kind of options? calls, of course, because "stonks always go up", and options are cheaper and provide more leverage:

(5/5) most precisely, when buying those call options, retail investors have been buying 10 or fewer contracts at a time, with 2 or fewer weeks to expiration, mostly on individual hot tech names:

Read on Twitter

Read on Twitter