The Bull Case for $INDEX

I've seen a lot of confusion and misconceptions around value accrual for @indexcoop's governance token

This thread is to clear up why it is DeFi's most overlooked token

I've seen a lot of confusion and misconceptions around value accrual for @indexcoop's governance token

This thread is to clear up why it is DeFi's most overlooked token

1/

First some quick stats:

10m $INDEX

Treasury: 52.5% (over 3 yrs)

Set Labs: 28% (over 3 yrs)

Liquidity Mining: 9% (Oct 5-Dec 5)

Methodologists: 7.5% (over 1.5 yrs)

DeFi Pulse: 2% (over 3 yrs)

DPI Holder Airdrop: 1%

First some quick stats:

10m $INDEX

Treasury: 52.5% (over 3 yrs)

Set Labs: 28% (over 3 yrs)

Liquidity Mining: 9% (Oct 5-Dec 5)

Methodologists: 7.5% (over 1.5 yrs)

DeFi Pulse: 2% (over 3 yrs)

DPI Holder Airdrop: 1%

2/

The core activities that $INDEX governs are:

-New Products

-Treasury Management

-Fee Splits (Streaming, Issue/Redemption, Performance)

-Active Management (Intrinsic Productivity)

-Meta-Governance

The core activities that $INDEX governs are:

-New Products

-Treasury Management

-Fee Splits (Streaming, Issue/Redemption, Performance)

-Active Management (Intrinsic Productivity)

-Meta-Governance

3/

Currently, @indexcoop manages ~$130m with $DPI

$DPI holders are charged a 0.95% annual streaming, or subscription, fee

0.65% is attributable to the Coop. Every month, the Coop treasury accrues:

[(DPI AUM * 0.65%)/12]

Currently, @indexcoop manages ~$130m with $DPI

$DPI holders are charged a 0.95% annual streaming, or subscription, fee

0.65% is attributable to the Coop. Every month, the Coop treasury accrues:

[(DPI AUM * 0.65%)/12]

4/

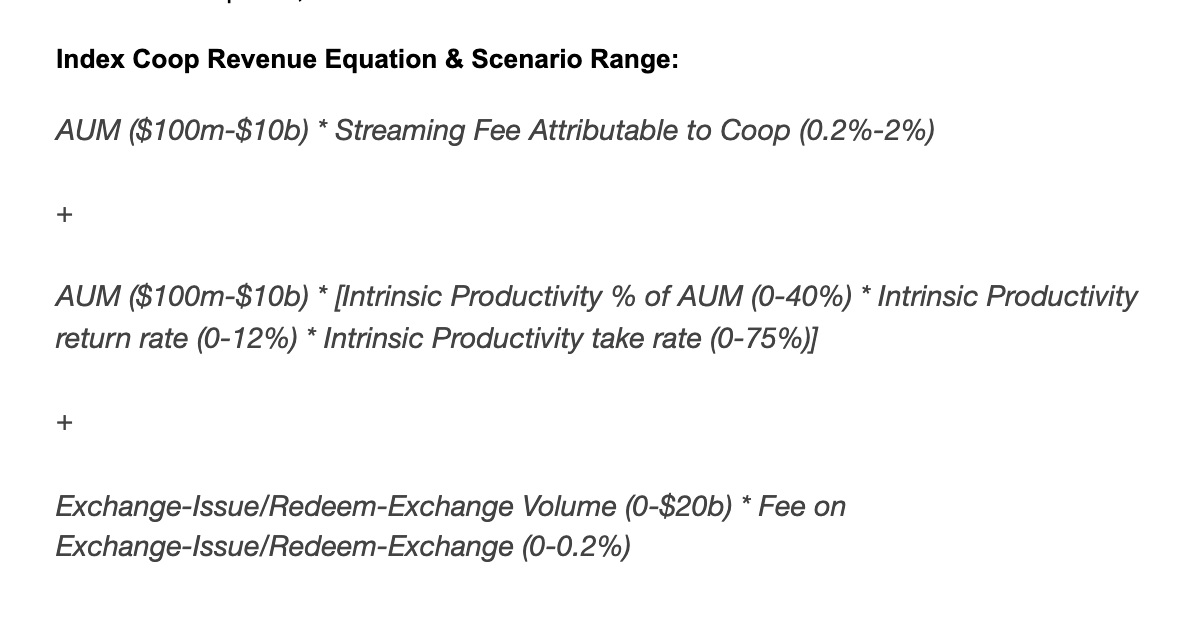

Outside of streaming fees, there are other potential revenue sources for $INDEX

via @SetProtocol, the Coop can charge performance or entry/exit fees on mint/redeem volume

Eventually, they will actively manage the underlying assets in their products (intrinsic productivity)

Outside of streaming fees, there are other potential revenue sources for $INDEX

via @SetProtocol, the Coop can charge performance or entry/exit fees on mint/redeem volume

Eventually, they will actively manage the underlying assets in their products (intrinsic productivity)

5/

@indexcoop plans to release products at a quicker pace in 2021

I've modeled out 2023 revenue scenarios for the Coop based solely on $DPI

(Please Note: This model is intentionally crude, and meant to illustrate a range of outcomes based on growth scenarios)

@indexcoop plans to release products at a quicker pace in 2021

I've modeled out 2023 revenue scenarios for the Coop based solely on $DPI

(Please Note: This model is intentionally crude, and meant to illustrate a range of outcomes based on growth scenarios)

6/

You can begin to model out valuations based on P/S ranges (accounting for 10m INDEX) for each scenario

This model is applicable to each new product that the Coop releases

Hopefully this provides some clarity around the value capture mechanisms for @indexcoop's $INDEX

You can begin to model out valuations based on P/S ranges (accounting for 10m INDEX) for each scenario

This model is applicable to each new product that the Coop releases

Hopefully this provides some clarity around the value capture mechanisms for @indexcoop's $INDEX

Bonus/

One heuristic I find exciting is the idea of $INDEX as a long-dated option on DeFi

As $DPI maintains its status as category winner for DeFi ETF, it continues to gain a share of the underlying tokens

$DPI can grow as a percentage of its components as DeFi itself grows!

One heuristic I find exciting is the idea of $INDEX as a long-dated option on DeFi

As $DPI maintains its status as category winner for DeFi ETF, it continues to gain a share of the underlying tokens

$DPI can grow as a percentage of its components as DeFi itself grows!

Bonus 2/

While hard to apply a valuation to, the concept of Meta-governance is a powerful one

The idea is $INDEX holders receive value via proxy voting power for the DPI components https://defirate.com/indexcoop-metagov/

While hard to apply a valuation to, the concept of Meta-governance is a powerful one

The idea is $INDEX holders receive value via proxy voting power for the DPI components https://defirate.com/indexcoop-metagov/

Read on Twitter

Read on Twitter

![3/Currently, @indexcoop manages ~$130m with $DPI $DPI holders are charged a 0.95% annual streaming, or subscription, fee0.65% is attributable to the Coop. Every month, the Coop treasury accrues:[(DPI AUM * 0.65%)/12] 3/Currently, @indexcoop manages ~$130m with $DPI $DPI holders are charged a 0.95% annual streaming, or subscription, fee0.65% is attributable to the Coop. Every month, the Coop treasury accrues:[(DPI AUM * 0.65%)/12]](https://pbs.twimg.com/media/EuCZ41NVEAcTY5G.png)