The latest from @tragicbios and yours truly:

"Inflation: The Good, The Bad, and The Transitory."

How the Fed should be evaluating inflation and the inflation trajectory within the context of its forward guidance from September: https://employamerica.medium.com/inflation-the-good-the-bad-and-the-transitory-cc289f524c1c

"Inflation: The Good, The Bad, and The Transitory."

How the Fed should be evaluating inflation and the inflation trajectory within the context of its forward guidance from September: https://employamerica.medium.com/inflation-the-good-the-bad-and-the-transitory-cc289f524c1c

Following the results of their framework review, the Fed formalized its forward guidance in September 2020 to condition its interest rate policy on a set of individually necessary economic conditions.

The Fed's commitment to aim for nothing short of maximum employment is to be commended. We had written previously about just how important it was that the Fed commit to achieving maximum employment as a necessary precondition for any interest rate increase https://medium.com/@skanda_97974/the-fed-still-needs-to-do-its-part-six-ways-to-improve-the-evans-rule-to-recover-jobs-and-wages-1a27c9806647

And given due credit to the Fed for following through thus far!

What's most important now is how the Fed clarifies its forward guidance conditions; how will it evaluate maximum employment, inflation readings, and the inflation outlook? https://employamerica.medium.com/the-feds-forward-guidance-prioritizing-labor-markets-to-ensure-a-robust-recovery-for-all-8a806a1b2bcf

What's most important now is how the Fed clarifies its forward guidance conditions; how will it evaluate maximum employment, inflation readings, and the inflation outlook? https://employamerica.medium.com/the-feds-forward-guidance-prioritizing-labor-markets-to-ensure-a-robust-recovery-for-all-8a806a1b2bcf

Our piece today is really focused on how to separate the inflation outlook into three separate scenarios

1) No inflation (fairly straightforward)

2) Transitory inflation (sectoral shocks reverse as a result of re-opening)

3) Persistent inflation (wage-driven)

1) No inflation (fairly straightforward)

2) Transitory inflation (sectoral shocks reverse as a result of re-opening)

3) Persistent inflation (wage-driven)

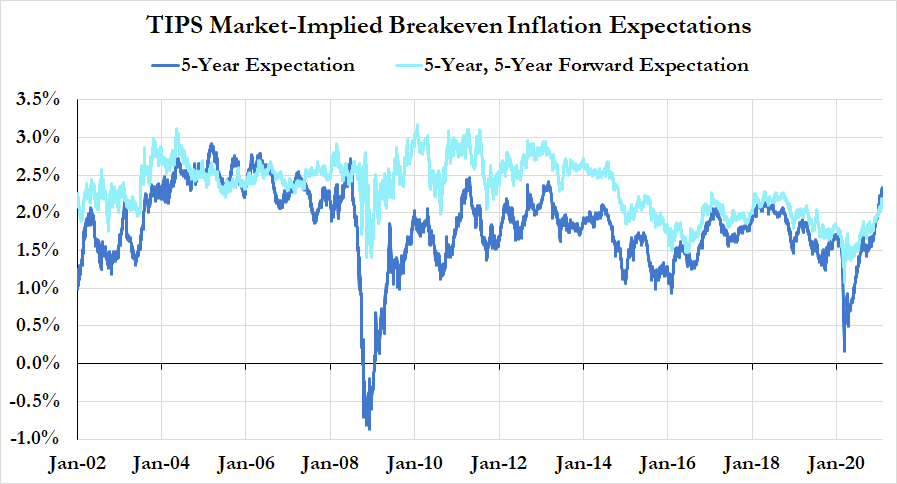

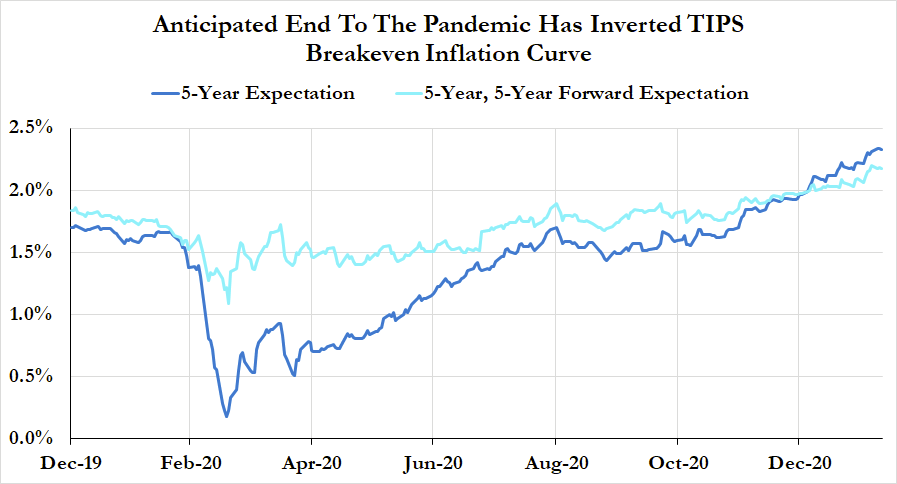

Inflation has been embedded in recent market hype and policy discourse, but risks need to be put in their proper context. Market-implied expectations have risen, but the risk is frontloaded and not historically abnormal. More consistent with transitory inflation than persistent.

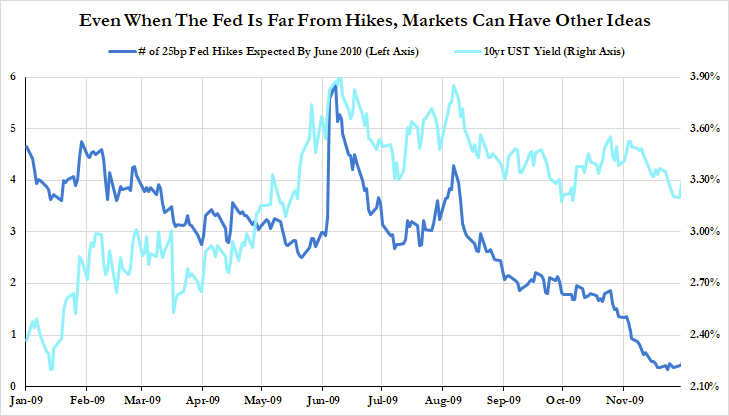

While the Fed's communications thus far have indicated that it is far from any prospect of rate hikes, there can be a disconnect b/w Fed policy and what markets start anticipating at the first sniff of recovery, inadvertently tightening financial conditions in the process

Scenario #1: no major inflationary impulse through 2%.

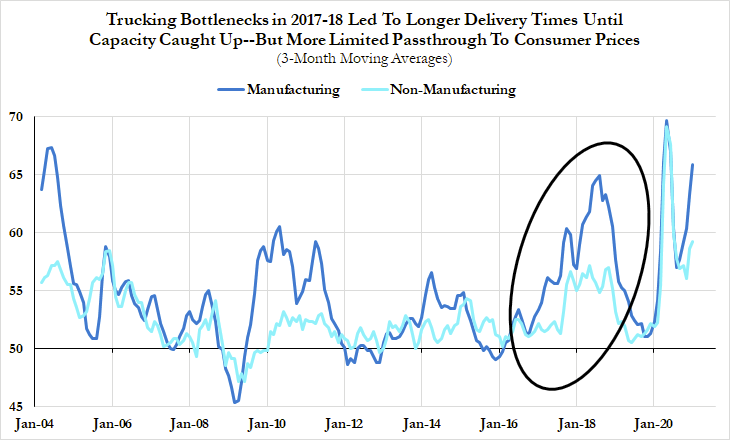

This is the most benign, but not out of question either. Firms-may be less inclined to lean solely on price increases for managing capacity constraints (as was the case during 2017-18 trucking labor and fleet shortages).

This is the most benign, but not out of question either. Firms-may be less inclined to lean solely on price increases for managing capacity constraints (as was the case during 2017-18 trucking labor and fleet shortages).

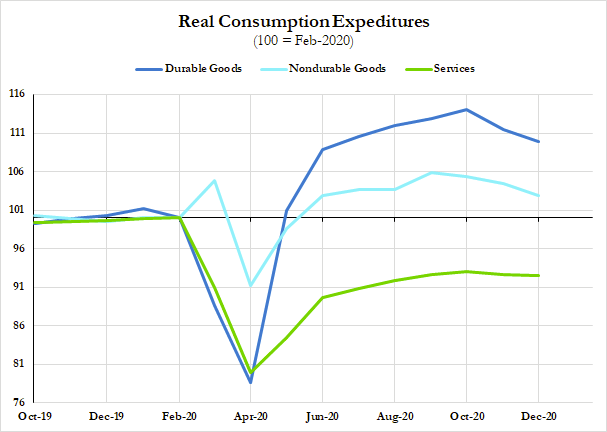

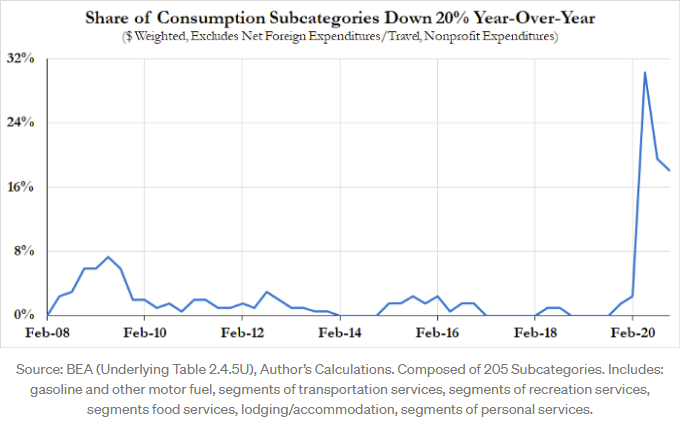

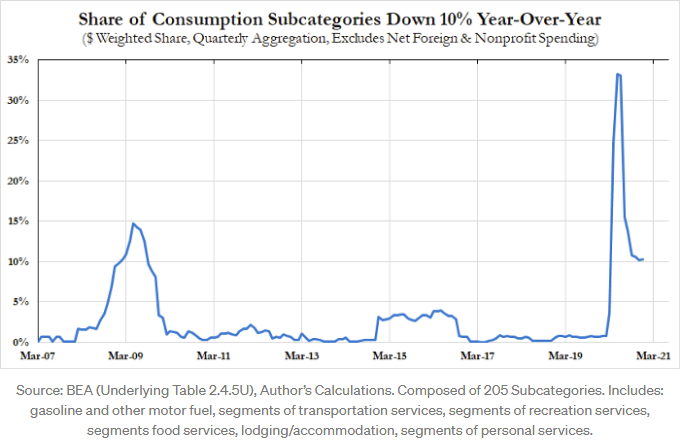

Scenario #2: transitory inflationary impulse takes readings past 2%.

This seems most plausible in light of the catch-up spending we are likely to see in discretionary consumer services, which have remained depressed even as policy supported goods consumption in 2020H2

This seems most plausible in light of the catch-up spending we are likely to see in discretionary consumer services, which have remained depressed even as policy supported goods consumption in 2020H2

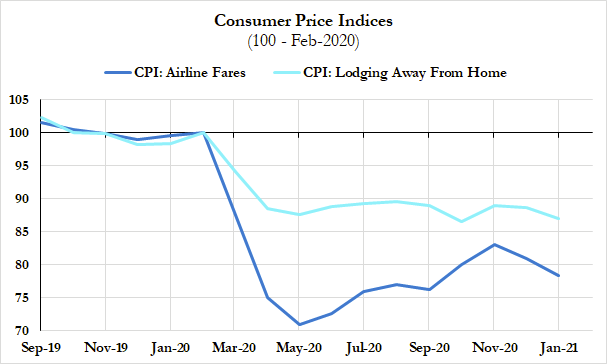

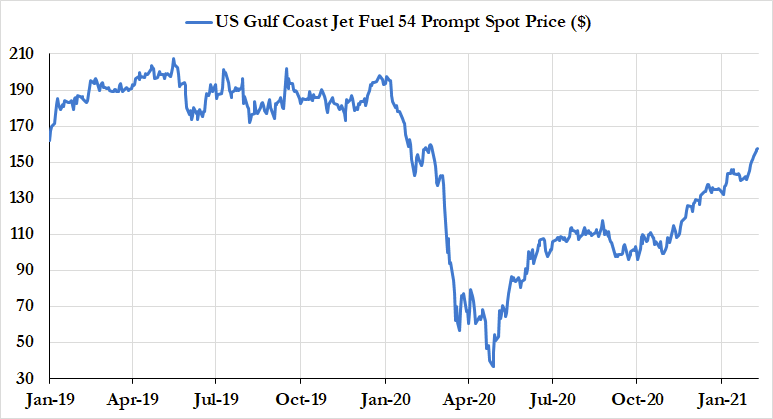

Upcoming inflationary impulses are most well-telegraphed in airline fares and lodging rates. If vaccinations proceed successfully, the economy seems well-poised to see a temporary surge in leisure, hospitality, and other travel-related spending. Jet fuel prices are on the move...

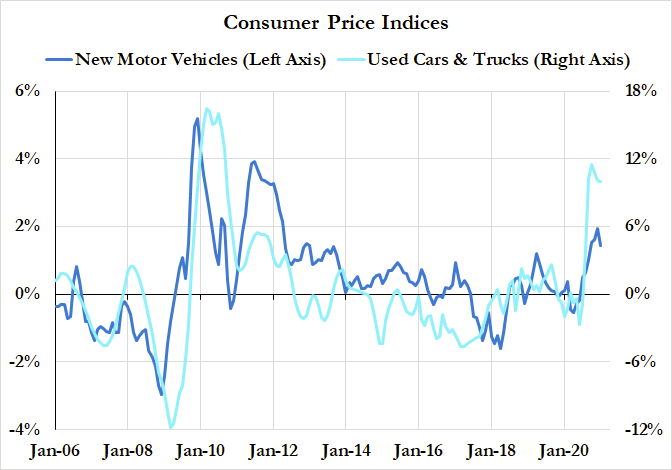

But we've seen this movie before. In response to the financial crisis and the Great Recession, the Fed and Congress took measures that directly supported motor vehicle demand. We saw a temporary surge in motor vehicle inflation, but almost just as quickly, began to dissipate

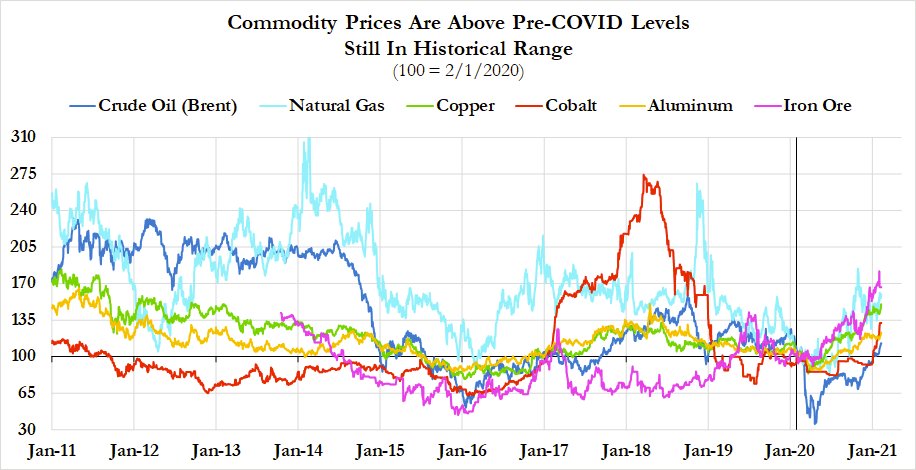

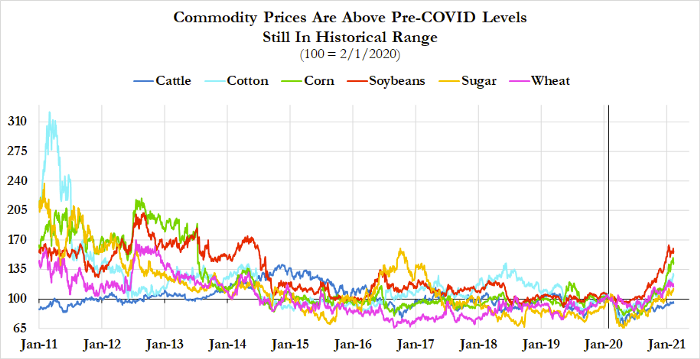

We are seeing a run-up in a variety of commodity prices that might also evoke analogies to the 1970s, but even these seem misplaced as of now. Yes, many prices have gone through pre-COVID levels, but more volatile prices need to be seen across a longer historical context...

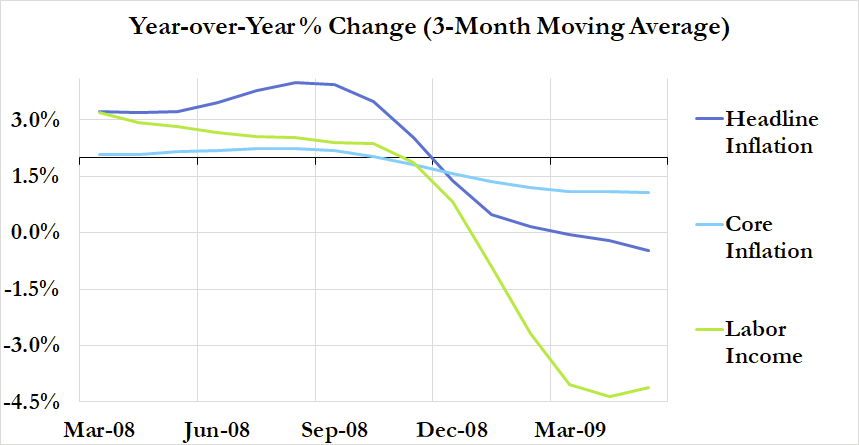

More importantly (and this gets us to Scenario #3), for any of these dynamics to have a persistent effect on the inflation outlook, there needs to be a follow-through to wage incomes. Without that, all you have is an assortment of relative price changes.

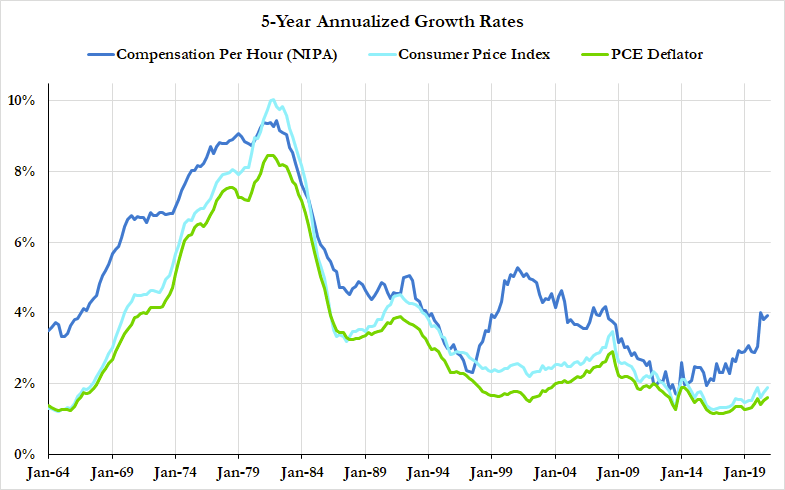

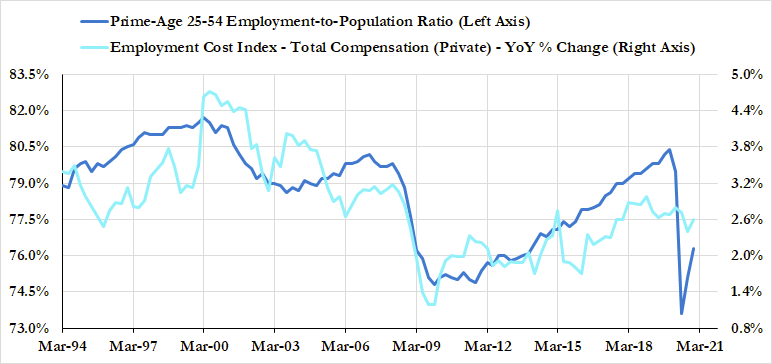

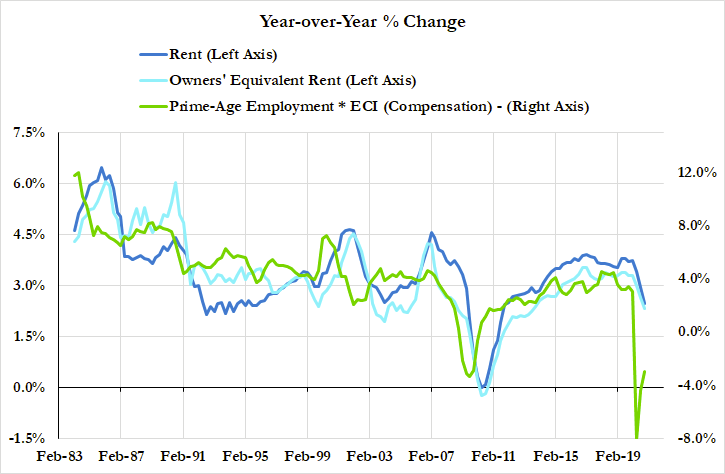

To believe that inflation is persistent, there must be some follow through from all of these previously cited price inflationary processes into wages. But we know that in the US, wage growth is still locally correlated to broad measures of labor market slack (broader than U-3)

These correlations are far from ironclad law but they provide a guide for thinking about how to confirm that inflation has more persistently accelerated. Prices were accelerating for most of 2008 but it was a sideshow. Main event: slack and incomes.

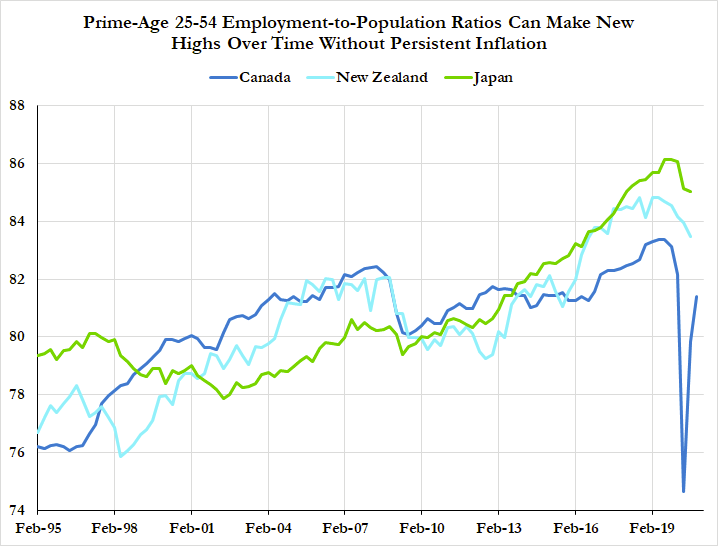

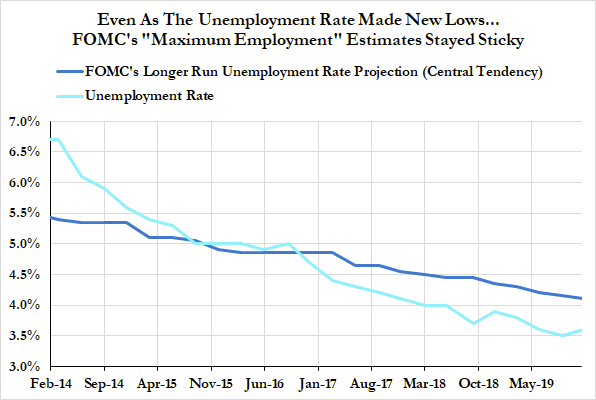

In a scenario where wages and prices accelerate faster than slack can erode back to pre-pandemic levels, the Fed should distinguish b/w what "maximum employment" might be in the short-run vs medium-run. Int'l evidence indicates that greater heights can be reached w/ enough time

Looking at the components of US inflation that exhibit more persistence and cyclicality, they are correlated to the growth rate in labor incomes, not the level of labor utilization.

There may be an inflationary limit on the speed of progress, but not on the final destination

There may be an inflationary limit on the speed of progress, but not on the final destination

Regardless of when we see persistent wage & price pressures emerge, the Fed must be willing take a generous and dynamic approach when revising their estimates of maximum employment, more so than in the previous cycle. A robust recovery requires nothing less. /end

Read on Twitter

Read on Twitter