Is 2021 the year for Twitter renaissance ?

I think $TWTR can correct trajectory and can 2x its market cap.

But there's strings attached.

Read on in this thread

I think $TWTR can correct trajectory and can 2x its market cap.

But there's strings attached.

Read on in this thread

// Past Narrative Issues & comparisons //

Twitter had a hard time setting the narrative right for itself.

Twitter had a hard time setting the narrative right for itself.

That's because the financial (ad-driven revenue) and statistical (DAUs/MAUs) comparison is always with Facebook, which is irrelevant at 1/10th the users.

The problem is the same for any "sub-billion" social platform driven by ads.

The problem is the same for any "sub-billion" social platform driven by ads.

// Past Narrative Issues - Management and strategy //

Twitter's management has a history of regularly surprising / scaring investors.

The bumpy ride with @jack left a weird taste in many mouths.

Twitter's management has a history of regularly surprising / scaring investors.

The bumpy ride with @jack left a weird taste in many mouths.

The company's acquisitions have been at best controversial until they started getting really smart this year (Revue, Breaker, Squad).

// The Renaissance and its drivers //

Good news is, Twitter will experience a renaissance because it's positioned to be a centerpiece of the booming creator economy.

Good news is, Twitter will experience a renaissance because it's positioned to be a centerpiece of the booming creator economy.

Some tailwinds :

→ Audio formats are heavily promoted via Twitter, Linkedin being a distant second

→ Unbundling journalism has created a vibrant brain trust that generates crazy engagement

→ Gen-Z creators have flocked to Twitter and harnessed the science of distributing

→ Audio formats are heavily promoted via Twitter, Linkedin being a distant second

→ Unbundling journalism has created a vibrant brain trust that generates crazy engagement

→ Gen-Z creators have flocked to Twitter and harnessed the science of distributing

// The renaissance and drivers (cont'd) //

As @Packym said, "Twitter thinks it's facebook but it's Linkedin"

In startup wonderland, it's become a powerful networking & recruiting tool but captures few of value.

As a result from all of this, user growth rebounds +29% in Q3

As @Packym said, "Twitter thinks it's facebook but it's Linkedin"

In startup wonderland, it's become a powerful networking & recruiting tool but captures few of value.

As a result from all of this, user growth rebounds +29% in Q3

// The distribution opportunity //

Beyond ad revenue, Twitter is extremely well-positionned to be a high-margin (>95%+) "Distribution As A Service" Business

Beyond ad revenue, Twitter is extremely well-positionned to be a high-margin (>95%+) "Distribution As A Service" Business

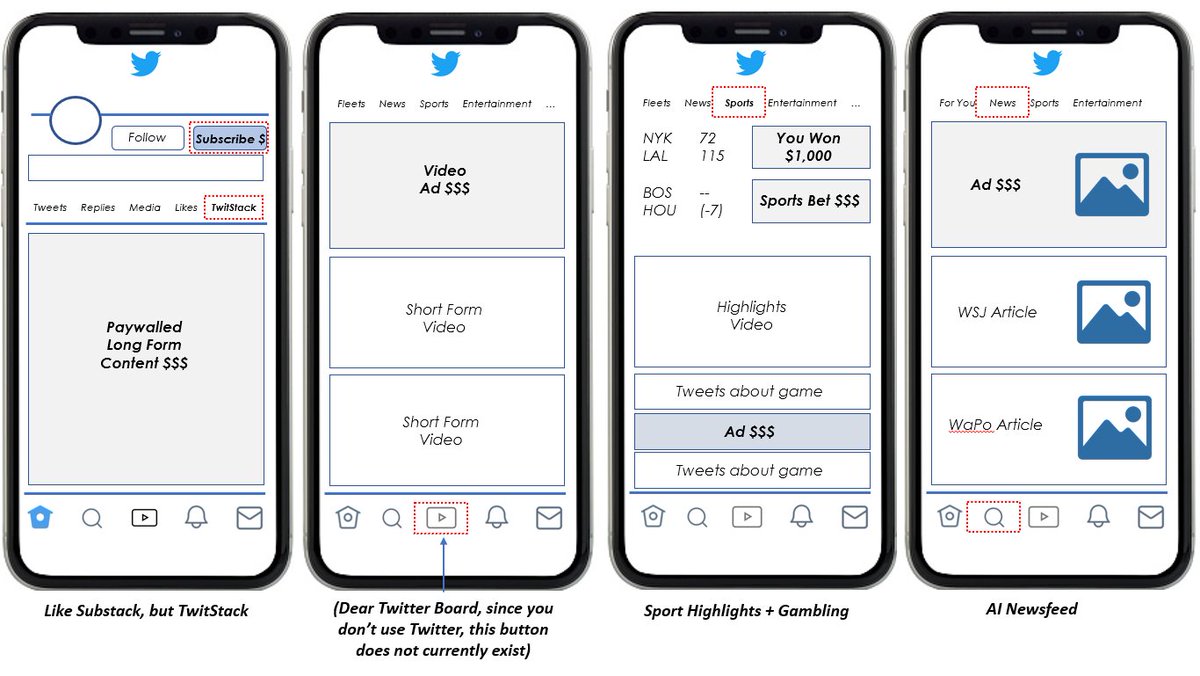

That is, if they seize the right opportunities to selectively aggregate or build creators tools into the platform.

This additional value can be monetized through direct transaction fees, light premium subscription fees

This additional value can be monetized through direct transaction fees, light premium subscription fees

The metamorphosis is already underway :

@revue's acquisition in January hints to a transformational effort towards a creator-first platform https://blog.twitter.com/en_us/topics/company/2021/making-twitter-a-better-home-for-writers.html

@revue's acquisition in January hints to a transformational effort towards a creator-first platform https://blog.twitter.com/en_us/topics/company/2021/making-twitter-a-better-home-for-writers.html

About audio:

Today, most of @joinclubhouse promotion happens on here, yet Twitter sees none of that value.

Today, most of @joinclubhouse promotion happens on here, yet Twitter sees none of that value.

Here's a super good thread on how Twitter Product head @kayvz is launching an all-out offensive on the product side to counter Clubhouse before it's too late. https://twitter.com/compound248/status/1359617418574848001?s=20

// Caveats and existential threats //

→ About the product and its incentives:

When Twitter announced @revue acquisition, Substack CEO @hamishmckenzie made an interesting point.

→ About the product and its incentives:

When Twitter announced @revue acquisition, Substack CEO @hamishmckenzie made an interesting point.

Selling Substack to Twitter was never on the table, because it would be giving away the killer feature of Substack: a calm, distraction free reading space.

By default and despite the fact that Twitter is an amazing place to connect to new ideas & people, the feed is designed to suck every drop of attention you can give.

The vertical integration play aligns creator and shareholder incentives (more $$ for both), but "passive" users' attention is still the adjustment variable here.

→ About (de)centralization and free speech:

Twitter has found itself amidst a pretty hectic turmoil as it deplatformed @realdonaldtrump for good

It set a precedent that got the 45th banned everywhere else after the Capitol events.

Twitter has found itself amidst a pretty hectic turmoil as it deplatformed @realdonaldtrump for good

It set a precedent that got the 45th banned everywhere else after the Capitol events.

If they don't want this to happen again, here's IMO where it's headed from here :

→ An independent organization regulates who bans who and sets rules for appeals

→ Each platform builds its own policy and doesn't bend it for exceptions or emergency situations

→ An independent organization regulates who bans who and sets rules for appeals

→ Each platform builds its own policy and doesn't bend it for exceptions or emergency situations

This narrative hints to the problem of social media platforms being vectors of centralization.

This represents an existential threat as many weak signals point that users want more decentralization.

The mistrust in institutions is close to the tipping point.

This represents an existential threat as many weak signals point that users want more decentralization.

The mistrust in institutions is close to the tipping point.

As a CEO, @jack has anticipated this and launched a research initiative called Blue Sky.

Blue Sky is essentially striving to build a decentralized standard for the platform, where Twitter would only be the client of an infrastructure it doesn't control. https://www.theverge.com/2021/1/21/22242718/twitter-bluesky-decentralized-social-media-team-project-update

Blue Sky is essentially striving to build a decentralized standard for the platform, where Twitter would only be the client of an infrastructure it doesn't control. https://www.theverge.com/2021/1/21/22242718/twitter-bluesky-decentralized-social-media-team-project-update

// Conclusion //

If Twitter wants to succeed, it has to reposition as a subscription or fee-based product AND invent a more decentralized standard.

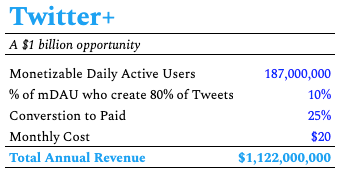

Quick math: Twitter has 187 millon monetizable DAUs. To surpass its 2019 revenue ($3.3bn), it'd need to generate $17 per user

If Twitter wants to succeed, it has to reposition as a subscription or fee-based product AND invent a more decentralized standard.

Quick math: Twitter has 187 millon monetizable DAUs. To surpass its 2019 revenue ($3.3bn), it'd need to generate $17 per user

If you imagine a netflix-like price point at $8/mo for "premium" subscription with a 30% adoption rate, you get to about $5.3bn revenue.

In this equation, a subscription product surpasses FY 2019 revenue at 18% adoption.

Not unimaginable, right ? & not counting fee-based rev.

In this equation, a subscription product surpasses FY 2019 revenue at 18% adoption.

Not unimaginable, right ? & not counting fee-based rev.

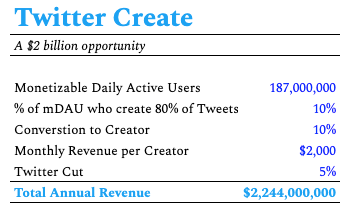

Here are some advanced estimates put together by @packym (him again!) on what a verification product (Twitter +) and a creator bundle (Twitter Create) could generate.

Those are even more conservative than mine: barely 6.5m paying users or 3% of mDAUs to break even !

Those are even more conservative than mine: barely 6.5m paying users or 3% of mDAUs to break even !

I think Twitter looks attractive right now.

$TWTR is undervalued relative to its peers, especially Snapchat (trading at 12x revenue vs. 38x).

(obv, not investment advice) https://www.bvp.com/bvp-nasdaq-emerging-cloud-index

$TWTR is undervalued relative to its peers, especially Snapchat (trading at 12x revenue vs. 38x).

(obv, not investment advice) https://www.bvp.com/bvp-nasdaq-emerging-cloud-index

Read on Twitter

Read on Twitter