Some thoughts on Impermanent Loss (IL) and APY

TLDR: it is my opinion that current APY for most projects more than compensate for IL

TLDR: it is my opinion that current APY for most projects more than compensate for IL

An asset pair has a certain annualised volatility

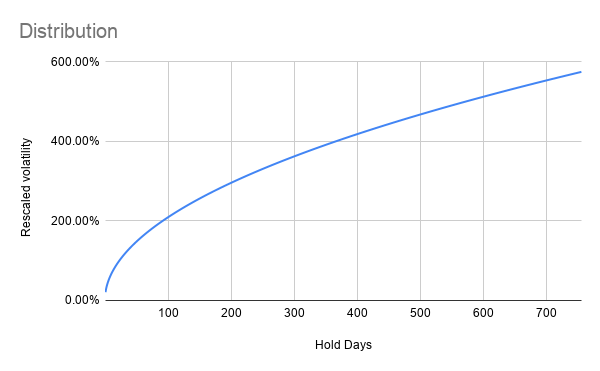

At any given holding period the volatility can be rescaled using

Annual_Vol * sqrt(d/365)

Where d is number of holding days

And it looks like this for an asset with 400% annualised vol

At any given holding period the volatility can be rescaled using

Annual_Vol * sqrt(d/365)

Where d is number of holding days

And it looks like this for an asset with 400% annualised vol

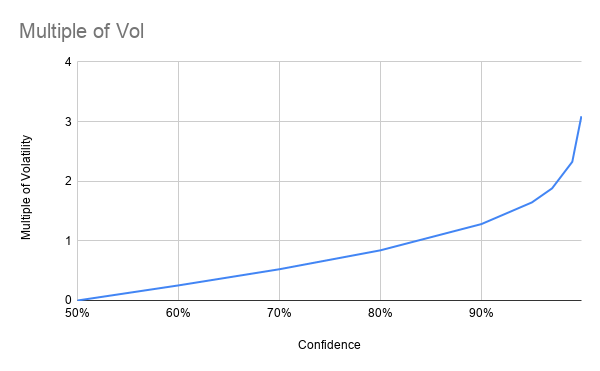

If you know the volatility of a random variable and assume a normal distribution (I know prices are not but does not change things significantly), you can estimate it's max move at a certain confidence interval

And this is a multiple of the vol

And it looks like this

And this is a multiple of the vol

And it looks like this

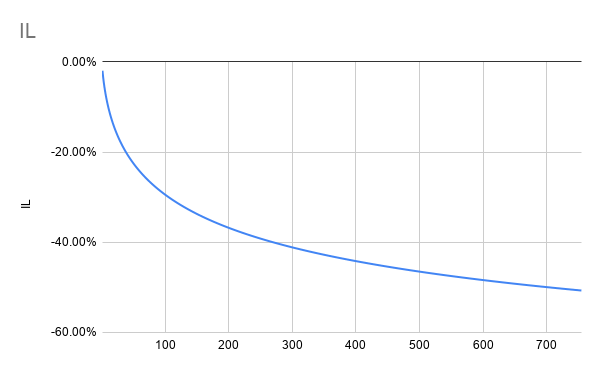

Finally you can calculate expected Impermanent Loss if you know the ratio of the price of 2 assets

divergence_loss = 2 * sqrt(price_ratio) / (1+price_ratio) - 1

see for example https://pintail.medium.com/uniswap-a-good-deal-for-liquidity-providers-104c0b6816f2

divergence_loss = 2 * sqrt(price_ratio) / (1+price_ratio) - 1

see for example https://pintail.medium.com/uniswap-a-good-deal-for-liquidity-providers-104c0b6816f2

So if you assume:

- a volatility

- a confidence

For example:

- 400%

- 99%

You can get a line that tells you the IL for any given holding time that would be true in 99% of possible scenarios

And it looks like this

- a volatility

- a confidence

For example:

- 400%

- 99%

You can get a line that tells you the IL for any given holding time that would be true in 99% of possible scenarios

And it looks like this

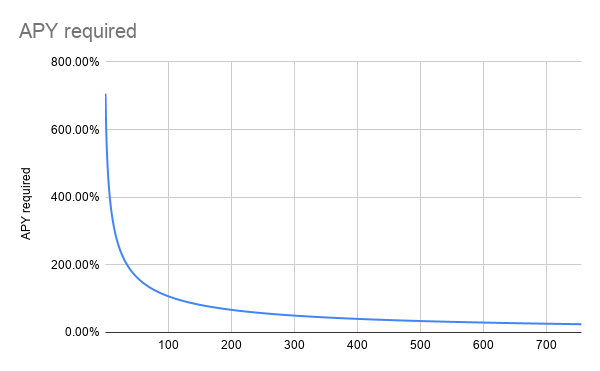

Finally, given a possible IL you can calculate what would be the APY that would make you whole

So with this APY and if the vol is lower than assumed you have at least 99% of probability of not losing money. And this can be calculated for every possible holding time

So with this APY and if the vol is lower than assumed you have at least 99% of probability of not losing money. And this can be calculated for every possible holding time

So even a token that has a vol against ETH of 400% (which basically means it can double in 4 days...) would require sub 200% if LP for at least 36 days

This does no include the transaction fees that accrue to the LP which must be very high for a token with such a high vol

This does no include the transaction fees that accrue to the LP which must be very high for a token with such a high vol

Read on Twitter

Read on Twitter