We have published GDP, an estimate of total output in the UK economy, for December 2020. This also means we have the overall position for Q4 and 2020 as a whole. A thread.

The economy returned to growth in December after shrinking in November, with output in December up 1.2%. The relaxation in restrictions in large parts of the country obviously helped here. (1/n)

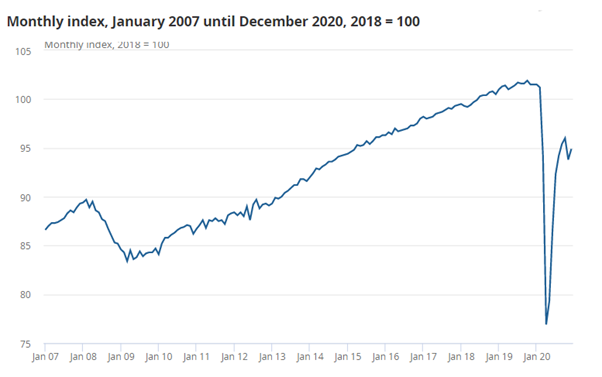

Despite strong growth through the second half of 2020, the economy at the end of December was still 6.3% per cent smaller than in February, before the pandemic. (2/n)

We also saw growth in Quarter 4 as a whole compared with Quarter 3 (quarterly growth of 1%). This followed growth in the third quarter and falls in both first and second quarters of 2020. (3/n)

Some other countries – such as France and Italy – saw their economies shrink again in the fourth quarter. So the UK performed relatively well. But we need to be careful with international comparisons at the moment. (4/n)

https://www.ons.gov.uk/economy/grossdomesticproductgdp/articles/internationalcomparisonsofgdpduringthecoronaviruscovid19pandemic/2021-02-01

https://www.ons.gov.uk/economy/grossdomesticproductgdp/articles/internationalcomparisonsofgdpduringthecoronaviruscovid19pandemic/2021-02-01

Looking at 2020 as a whole, GDP was nearly 10 per cent below the 2019 level. This is by far the annual fall in GDP we have seen – more than double the biggest annual fall. (5/n)

(Note the calendar year growth rates measure the total or average GDP in 2020 compared to the total or average GDP in 2019. This means they are more backward looking compared to measuring December or Quarter 4 GDP compared to a year ago.) (6/n)

When we look beneath the surface there are a couple of notable trends. (7/n)

Firstly, as the year went on some sectors/industries that were badly affected during the spring restrictions bounced back despite the toughening restrictions through the autumn. (8/n)

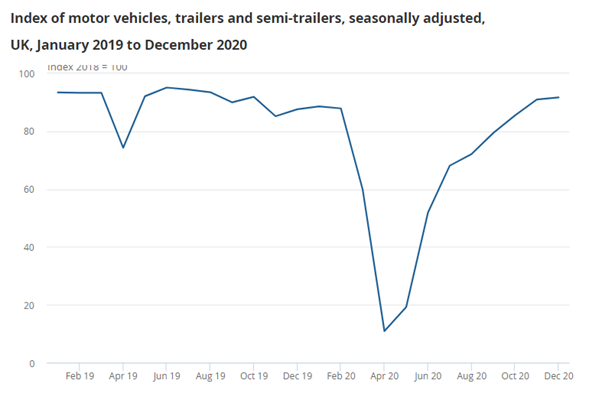

Both manufacturing and construction saw strong growth in the last few months of 2020. In December car manufacturing etc. exceeded its February 2020 level. (9/n)

This is likely due to businesses adapting their operations to allow for social distancing and putting in place other measures to prevent the spread of the virus. Economies adapt to changing circumstances, but that can involve costs. (10/n)

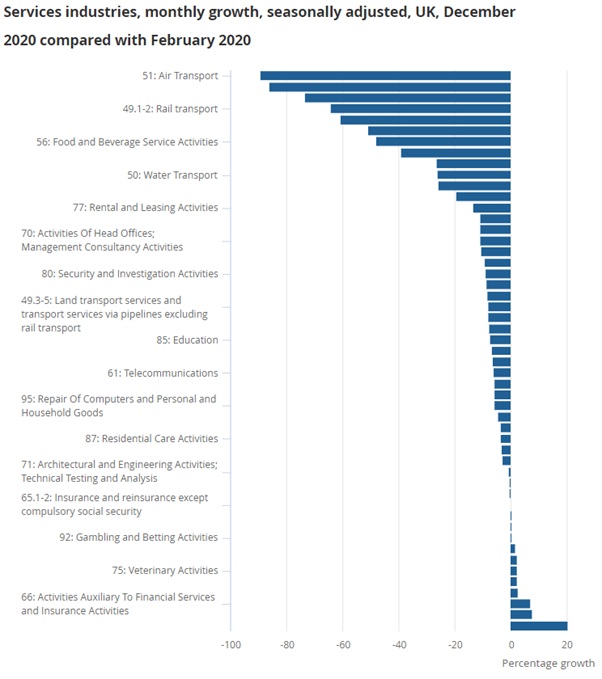

Secondly, and unsurprisingly, there is a lot of variation between industries. Hospitality and parts of transport remain severely depressed while postal and courier firms are doing much better. You see a similar spread in manufacturing too. (11/n)

Two further points. (12/n)

The picture on stockpiling in the run up to the end of the transition period is unclear. The trade data shows a pattern of imports consistent with some stockpiling e.g. car parts and medicines. But data from businesses suggest overall there was no big build up of stocks. (13/n)

There are a number of challenges in measuring stockpiling. 2020 was such an unusual year meaning that normal seasonal stockpiling patterns might have been distorted. There was also some disruption at the UK border in December too. So difficult to draw firm conclusions. (14/n)

Finally, what about the prospects for the start of 2021? We won’t have GDP data for January until next month, but the early indicators are consistent with a worsening economic position. Card spending is down & businesses report weaker turnover. (15/n)

https://www.ons.gov.uk/releases/coronavirusandthelatestindicatorsfortheukeconomyandsociety11february2021

https://www.ons.gov.uk/releases/coronavirusandthelatestindicatorsfortheukeconomyandsociety11february2021

All of today’s data can be found here (ENDS)

https://www.ons.gov.uk/economy/grossdomesticproductgdp/bulletins/gdpmonthlyestimateuk/december2020

https://www.ons.gov.uk/economy/grossdomesticproductgdp/bulletins/gdpfirstquarterlyestimateuk/octobertodecember2020

https://www.ons.gov.uk/economy/grossdomesticproductgdp/bulletins/gdpmonthlyestimateuk/december2020

https://www.ons.gov.uk/economy/grossdomesticproductgdp/bulletins/gdpfirstquarterlyestimateuk/octobertodecember2020

Read on Twitter

Read on Twitter