A few thoughts here on the $INS FY20 results / call

I think it's helpful whilst looking at some of the specifics, to bear in mind three points around the company

1. What it is

2. What it's capable of

3. What it's currently doing

I think it's helpful whilst looking at some of the specifics, to bear in mind three points around the company

1. What it is

2. What it's capable of

3. What it's currently doing

1) What it is can be thought of as a platform built to provide a collection of optionalities that can't be well modelled or guided.

Here's one past option bearing fruit today in 2 ways:

First is this, Apple; translates as Apple Card is working but it's not within $INS' control

Here's one past option bearing fruit today in 2 ways:

First is this, Apple; translates as Apple Card is working but it's not within $INS' control

The quote below show how that optionality keeps paying out in a couple of ways:

My guess is Q2 reference is more Apple, whilst the Q3 reference is General Motors - that was another optionality for $INS having worked with GS on Apple and as GS are hot for credit, there'll be more

My guess is Q2 reference is more Apple, whilst the Q3 reference is General Motors - that was another optionality for $INS having worked with GS on Apple and as GS are hot for credit, there'll be more

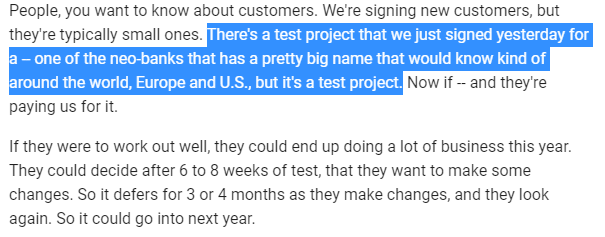

Or a widely-known neobank

The point is that even with their own fully signed clients, such as Apple, it can't be known when they'll pay out; or as with GS getting GM, what they'll do next for INS

But these 3 are how that started. It may (or may not) happen here but.. patience

The point is that even with their own fully signed clients, such as Apple, it can't be known when they'll pay out; or as with GS getting GM, what they'll do next for INS

But these 3 are how that started. It may (or may not) happen here but.. patience

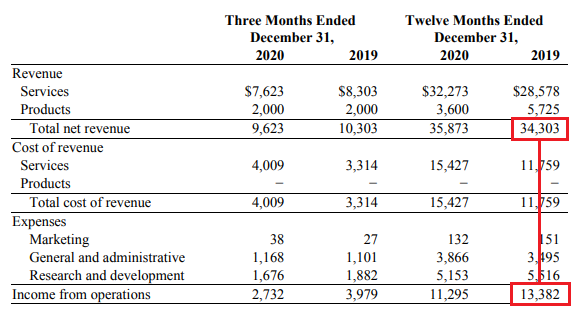

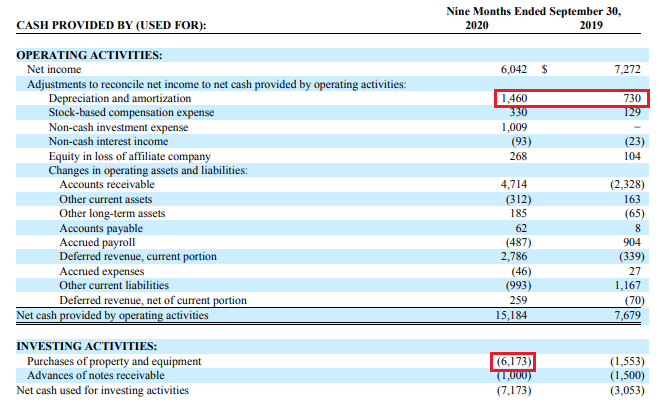

Now, I don't mean "investing" in the common sense of the term: where expenses are out of control and twice the revenues mean twice the money torched; I mean investing in the sense that the company here is capacity constrained so if to get margins like that on 3x the revenue..

..you have to spend now and suffer the losses before anything hits the top line - and these things take time.

Why is the market sad? Probably because the whole thing is confusing and can't be easily modelled or guided: number didn't get bigger = do not like.

Why is the market sad? Probably because the whole thing is confusing and can't be easily modelled or guided: number didn't get bigger = do not like.

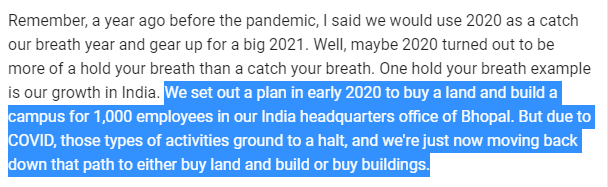

Why am I sad? Because the huge capacity expansion could've been even bigger and sooner were it not for covid.

Money today is worth more than money tomorrow, certainly - but this is also a time of instant gratification and reward for empty revenues; there's nothing here to change what INS was, is or will be; clients take time, capacity takes time and whilst still small, it doesn't model

Transcripts from non-earnings calls explain the time taken to win customers and their permanence. It's simply the nature of the business, as is all this. It's what building a durable franchise looks like. This works but in the meantime it won't look like others and needs patience

Read on Twitter

Read on Twitter