#BTC  vs #ETH, a quantitative standpoint.

vs #ETH, a quantitative standpoint.

In terms of risk-ajdusted performance #BTC

In terms of risk-ajdusted performance #BTC  outperformed #ETH so far.

outperformed #ETH so far.

#BTC

#BTC  seems to have also a slightly larger momentum than #ETH.

seems to have also a slightly larger momentum than #ETH.

(thread, 1/n)

vs #ETH, a quantitative standpoint.

vs #ETH, a quantitative standpoint. In terms of risk-ajdusted performance #BTC

In terms of risk-ajdusted performance #BTC  outperformed #ETH so far.

outperformed #ETH so far. #BTC

#BTC  seems to have also a slightly larger momentum than #ETH.

seems to have also a slightly larger momentum than #ETH.(thread, 1/n)

2/n A short introduction.

In finance, the most used metric to measure the risk-adjusted performance is the Sharpe Ratio (SR).

Though, SR has various weaknesses.

In particular it treats the good deviations and the bad deviations in the same way, by putting at the denominator..

In finance, the most used metric to measure the risk-adjusted performance is the Sharpe Ratio (SR).

Though, SR has various weaknesses.

In particular it treats the good deviations and the bad deviations in the same way, by putting at the denominator..

3/n ..the sample standard deviation of returns.

Positive deviations and negative ones are equally bad according to this metric.

Let's consider a long position and two series of 3 returns: -2% 2% 6% and 2% 0% 0%.

The SR of the 2nd series is larger.

Positive deviations and negative ones are equally bad according to this metric.

Let's consider a long position and two series of 3 returns: -2% 2% 6% and 2% 0% 0%.

The SR of the 2nd series is larger.

4/n But the compound return of the 1st series is greater (1.059 vs 1.02).

SR doesn't make much sense imho.

SR doesn't make much sense imho.

5/n A better metric is the Sortino ratio. It replaces the std with the downside risk. So the denominator takes into account only the deviations below a certain minimum acceptable return (MAR).

Usually the MAR is fixed to 0.

Usually the MAR is fixed to 0.

6/n This metric still penalizes large deviations (through the sum of squares), as the SR, but only the negative ones: it doesn't consider the positive deviations as bad, unlike the SR.

My favourite metric though is a "discretized" Omega ratio with MAR=0.

My favourite metric though is a "discretized" Omega ratio with MAR=0.

7/n How the sample Omega Ratio is computed?

In easy terms:

given N returns we take all the returns above 0. We do the sum.

We take all the returns below 0. We do the sum. We take the absolute value of this sum.

The ratio between the former and the latter is the sample OR..

In easy terms:

given N returns we take all the returns above 0. We do the sum.

We take all the returns below 0. We do the sum. We take the absolute value of this sum.

The ratio between the former and the latter is the sample OR..

8/n .. between t1 and tn.

The more the OR is large, the more the risk-adjusted performance, with regard the chosen MAR, is good.

The more the OR is large, the more the risk-adjusted performance, with regard the chosen MAR, is good.

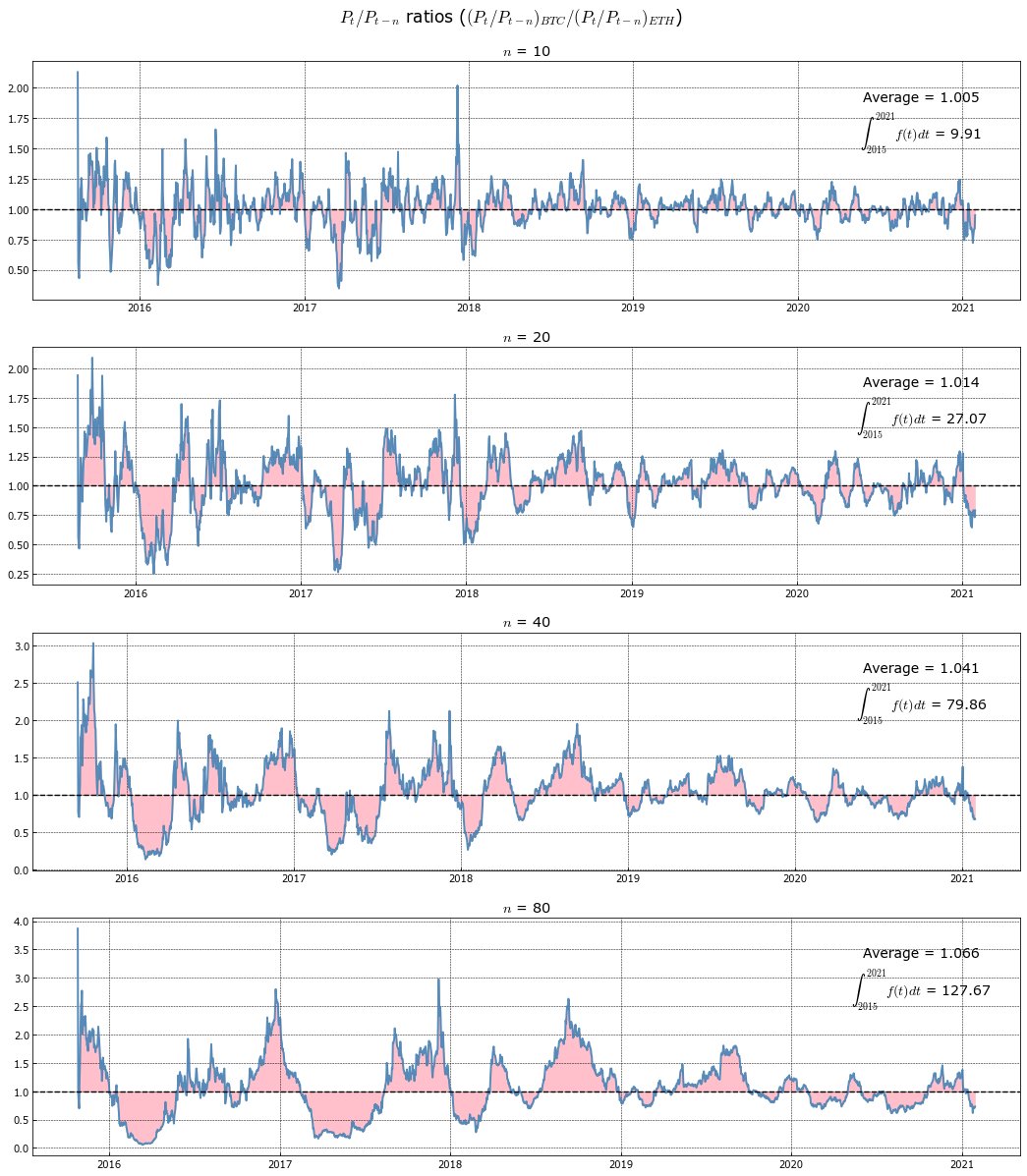

9/n Let's start with the first chart:

We computed the N-day rolling Omega ratio of BTC and that of ETH, then we computed the ratio of these 2 Omega ratios (the OR factor).

We computed the N-day rolling Omega ratio of BTC and that of ETH, then we computed the ratio of these 2 Omega ratios (the OR factor).

10/n The interpretion is quite simple: when the line is above 1 it means that the risk adjusted performance of BTC was better than that of ETH, for the previous N-days.

According to this metric BTC outperformed ETH, regardless the choice of the rolling window (i.e, N).

According to this metric BTC outperformed ETH, regardless the choice of the rolling window (i.e, N).

11/n This is especially true for N = 20.

For each choice of N we computed the sample mean and the integral from 2015 to 2021.

The line indeed can be considered an ex-post deterministic function of the time.

For each choice of N we computed the sample mean and the integral from 2015 to 2021.

The line indeed can be considered an ex-post deterministic function of the time.

12/n The sample mean tells us the BTC's outperformance on a single rolling-period, while the integral tells us the BTC's outperformance for the whole period (i.e., the cumulative edge of BTC compared to ETH).

13/n

QUESTION: Would you invest in BTC or in ETH if you hadn't any other specific information (i.e. unconditionally)?

ANSWER: Based only on this chart you should favor BTC.

QUESTION: Would you invest in BTC or in ETH if you hadn't any other specific information (i.e. unconditionally)?

ANSWER: Based only on this chart you should favor BTC.

14/n What about momentum?

As indicator I used a simple statistic: CurrentPrice / PreviousPrice,

where PreviousPrice could refer to the price of 10-20-40-80 days before.

We compute this metric both for BTC and for ETH, for every day.

Then we compute the ratio of the 2 metrics.

As indicator I used a simple statistic: CurrentPrice / PreviousPrice,

where PreviousPrice could refer to the price of 10-20-40-80 days before.

We compute this metric both for BTC and for ETH, for every day.

Then we compute the ratio of the 2 metrics.

15/n This ratio answers to the following question:

let's say that today BTC has doubled its price compared to 80 days ago.

So CurrentPrice / PreviousPrice(80) = 2

What about ETH?

If the current price of ETH is less than 2 times the price it had 80 days ago, it means that BTC..

let's say that today BTC has doubled its price compared to 80 days ago.

So CurrentPrice / PreviousPrice(80) = 2

What about ETH?

If the current price of ETH is less than 2 times the price it had 80 days ago, it means that BTC..

16/n .. experienced more momentum than ETH.

Otherwise ETH experienced more momentum than BTC.

The ratio of the two metrics represents the BTC "acceleration edge" compared to ETH.

As you can see, BTC seems to have more momentum in the short-mid period, but..

Otherwise ETH experienced more momentum than BTC.

The ratio of the two metrics represents the BTC "acceleration edge" compared to ETH.

As you can see, BTC seems to have more momentum in the short-mid period, but..

17/n .. not in a significant way, expect maybe for N = 80.

QUESTION: Conditionally to the hyphotesis that we are in a bull cycle, would you invest in BTC or ETH?

ANSWER: Based on this chart, and given the results of the previous Omega ratio factor chart, you should favor BTC.

QUESTION: Conditionally to the hyphotesis that we are in a bull cycle, would you invest in BTC or ETH?

ANSWER: Based on this chart, and given the results of the previous Omega ratio factor chart, you should favor BTC.

18/18 N.B. this is only a quantitative inquiry.

Price action, especially regarding the crypto space, is heavely influenced by many other factors that should be taken into consideration to try to answer the question: will BTC outperform ETH in the next future?

Price action, especially regarding the crypto space, is heavely influenced by many other factors that should be taken into consideration to try to answer the question: will BTC outperform ETH in the next future?

Read on Twitter

Read on Twitter